Yes! You can use AI to fill out Form SSA-10, Application for Widow's or Widower's Insurance Benefits

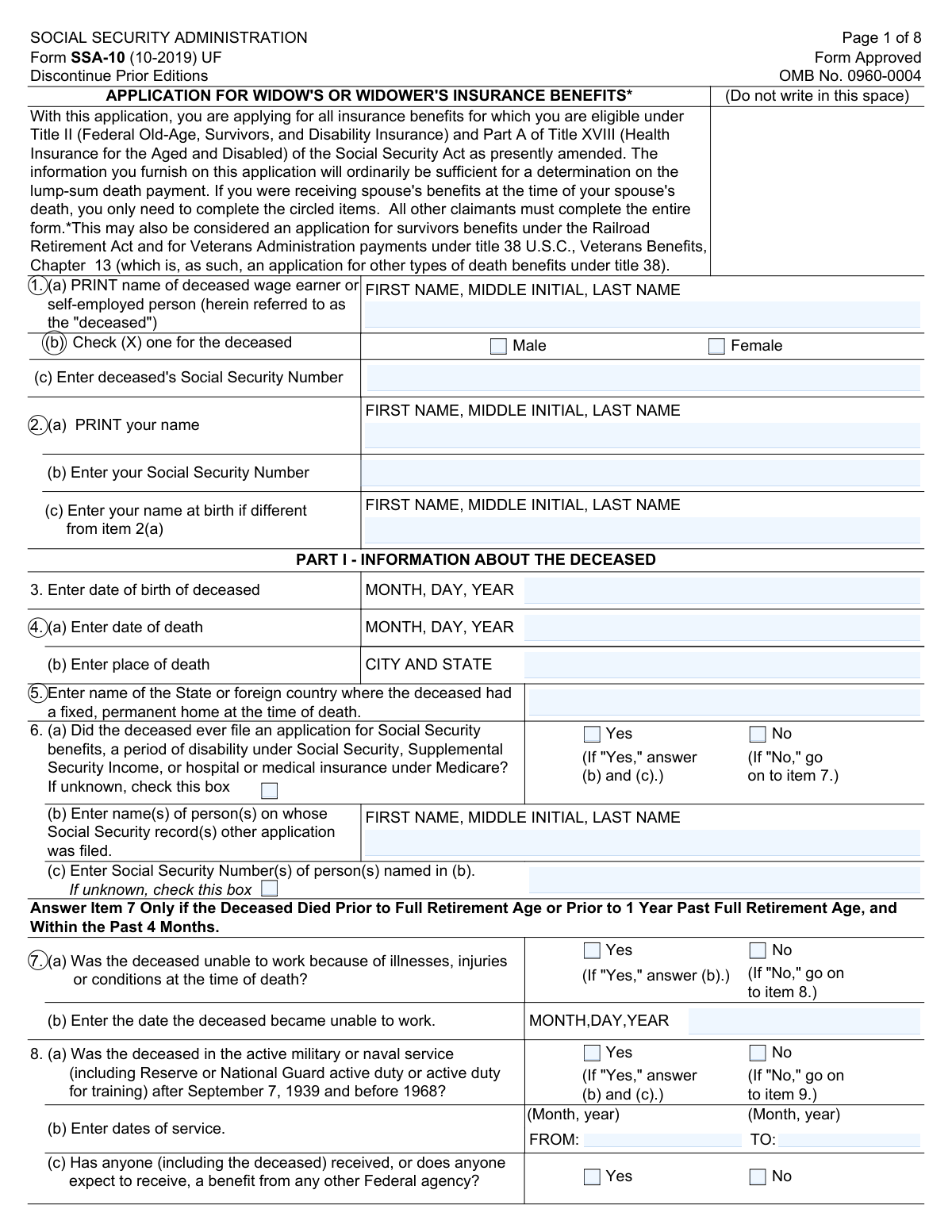

Form SSA-10 is an application used to claim widow's or widower's insurance benefits under the Social Security Act. It is important for individuals who have lost a spouse and may be eligible for survivors benefits, ensuring financial support as provided by law.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out SSA-10 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form SSA-10, Application for Widow's or Widower's Insurance Benefits |

| Form issued by: | Social Security Administration |

| Number of fields: | 217 |

| Number of pages: | 8 |

| Version: | 2019 |

| Filled form examples: | Form SSA-10 Examples |

| Language: | English |

| Categories: | insurance forms, financial forms, benefit forms, SSA forms, insurance application forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out SSA-10 Online for Free in 2026

Are you looking to fill out a SSA-10 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your SSA-10 form in just 37 seconds or less.

Follow these steps to fill out your SSA-10 form online using Instafill.ai:

- 1 Visit instafill.ai site and select SSA-10

- 2 Enter deceased's personal details

- 3 Provide your personal information

- 4 Detail your marriage(s) to the deceased

- 5 Include information on military service

- 6 Report work and earnings details

- 7 Sign and date the form electronically

- 8 Check for accuracy and submit form

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable SSA-10 Form?

Speed

Complete your SSA-10 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 SSA-10 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form SSA-10

The Form SSA-10 is used to apply for Widow's or Widower's Insurance Benefits under the Social Security Administration.

The Form SSA-10 should be completed by an individual who has recently lost a spouse and wishes to apply for survivor benefits under the Social Security Administration.

The Form SSA-10 requires information about the deceased person, including their name, Social Security number, date of birth, and date of death. It also requires information about the applicant, including their name, Social Security number, and date of birth.

There is no specific deadline for submitting the Form SSA-10, but it is recommended that applicants submit the form as soon as possible after the death of their spouse to ensure that benefits are paid in a timely manner.

No, the Form SSA-10 cannot be filed online. It must be completed and mailed to the Social Security Administration.

After the Form SSA-10 is submitted, the Social Security Administration will review the application and determine eligibility for benefits. If the application is approved, benefits will be paid beginning with the month of application or the month following the month of application, depending on the applicant's age and work history.

If the applicant is not yet 60 years old, they may still be eligible for benefits, but their benefits will be reduced if they earn more than the exempt amount in a given year. The exempt amount changes annually and can be found in the 'How Work Affects Your Benefits' publication.

If the applicant is already receiving Social Security benefits, they should report the death of their spouse to the Social Security Administration and complete the Form SSA-10 to apply for survivor benefits.

Non-citizens may be eligible for survivor benefits under certain circumstances. They should contact the Social Security Administration for more information.

If the applicant has remarried before age 60, they may still be eligible for survivor benefits based on their deceased spouse's record, but their benefits may be reduced if they earn more than the exempt amount in a given year. If they remarry after age 60, they may be eligible for benefits based on their own record or their new spouse's record, depending on which is higher.

If you are disabled, you may be eligible for disability benefits based on your own record or your deceased spouse's record, depending on which is higher. To determine your eligibility and apply for benefits, please contact the Social Security Administration at 1-800-772-1213 for assistance.

If the deceased person was a railroad worker, you may be eligible for benefits under the Railroad Retirement Board. To determine your eligibility and apply for benefits, please contact the Railroad Retirement Board at their toll-free number, 1-800-RRB-1154.

If the deceased person was a veteran, you may be eligible for benefits under the Department of Veterans Affairs. To determine your eligibility and apply for benefits, please contact the Department of Veterans Affairs at 1-800-827-1000.

If you have any questions about the Form SSA-10 or the application process, please contact the Social Security Administration at 1-800-772-1213 for assistance.

Compliance SSA-10

Validation Checks by Instafill.ai

1

Ensures that all required fields are accurately completed with either the requested information or 'N/A' if not applicable.

The validation process ensures that all mandatory fields on Form SSA-10 are filled out correctly. It checks for the presence of the requested information in each required field and allows for the entry of 'N/A' in fields that are not applicable to the applicant's situation. This ensures that the form is complete and can be processed without delays. The validation also flags any missing information, prompting the user to provide it before submission.

2

Confirms that black or blue ink is used if the form is filled out by hand.

When Form SSA-10 is completed manually, the validation confirms that all handwritten entries are made using black or blue ink. This is in accordance with the guidelines set by the Social Security Administration, which require these ink colors to ensure legibility and to facilitate the scanning and archiving of documents. The validation check helps prevent the use of other ink colors that might not be accepted and could lead to the rejection of the application.

3

Verifies that the 'REMARKS' section is utilized for any overflow information, or a separate sheet is attached if additional space is needed.

The validation process verifies that any additional information that does not fit within the standard fields of Form SSA-10 is included in the 'REMARKS' section. If the 'REMARKS' section is insufficient, it ensures that a separate sheet is attached to the form. This check is crucial for maintaining the organization of information and ensuring that all pertinent details are considered during the processing of the application.

4

Checks that the form is signed and dated in the designated areas.

The validation ensures that Form SSA-10 is signed and dated by the applicant in the designated areas. A signature is a critical component of the application, as it certifies that the information provided is accurate and truthful. The date is also important as it indicates when the application was completed. This check helps to authenticate the document and is a necessary step for the form to be considered valid and ready for processing.

5

Confirms that contact information is provided for any necessary follow-up communication by the SSA.

The validation confirms that the applicant has provided up-to-date contact information on Form SSA-10. This includes a current address, phone number, and, if available, an email address. Providing accurate contact information is essential for the Social Security Administration to communicate with the applicant regarding the status of the application, request additional information if needed, or clarify any details. This check ensures that the SSA can efficiently follow up with the applicant without unnecessary delays.

6

Witness Signature Verification

Ensures that if the application is signed by mark (X), two witnesses have signed and provided their full addresses. The software checks for the presence of two distinct signatures in the designated witness sections. It also verifies that each witness has included a full address, ensuring that all necessary witness information is complete and accurate.

7

Submission Office Verification

Verifies that the form is submitted to the correct local Social Security office or as otherwise directed by the SSA. The software cross-references the submission address with the official SSA office locations to confirm accuracy. It alerts the user if the form is addressed to an incorrect or outdated office, guiding them to the proper submission point.

8

Applicant's Record Copy Check

Checks for the presence of a copy of the completed form retained for the applicant's records. The software prompts the user to confirm that a copy has been made before final submission. It emphasizes the importance of keeping a personal record for future reference and potential SSA inquiries.

9

Numerical Information Formatting Check

Confirms that all numerical information, such as Social Security numbers and dates, is formatted correctly. The software scans each numerical field to ensure compliance with standard formatting rules, such as the correct number of digits for Social Security numbers and the proper date format (MM/DD/YYYY). It flags any discrepancies for user correction.

10

Instructions Compliance Check

Ensures that the instructions for each section of the form are followed as specified. The software reviews the entered data against the SSA's guidelines for each section. It highlights any deviations from the instructions and provides guidance on how to correct the information to comply with SSA requirements.

11

Verifies that the form is free of any erasures or corrections that could cause processing delays.

The AI ensures that Form SSA-10 is thoroughly reviewed for any erasures or corrections. It verifies that the information provided is clear and unaltered to prevent any potential processing delays that could arise from such issues. The AI cross-references each field to ensure consistency and clarity in the data entered. If any erasures or corrections are detected, the AI flags these for review and correction by the applicant.

12

Checks that any attached sheets for additional information are properly labeled with the applicant's name and Social Security number.

The AI checks for the presence of any additional sheets attached to Form SSA-10. It confirms that these sheets are properly labeled with the applicant's full name and Social Security number to ensure they are not misplaced or mismatched during processing. The AI also ensures that the additional information is relevant and corresponds to the questions on the form. If labeling is missing or incorrect, the AI prompts the user to make the necessary adjustments.

13

Confirms that the form is the most current version as provided by the SSA.

The AI confirms that the version of Form SSA-10 being filled out is the most current and up-to-date as provided by the Social Security Administration (SSA). It checks the form against the latest version available from the SSA to ensure compliance with current regulations and requirements. The AI alerts the applicant if an outdated form is detected and provides guidance on where to find the latest version.

14

Ensures that the applicant has not left any contradictory information throughout the form.

The AI ensures that all information provided by the applicant on Form SSA-10 is consistent and non-contradictory. It cross-verifies data across different sections to detect any discrepancies. The AI analyzes the responses to ensure logical coherence and flags any contradictory statements for the applicant to review and correct. This helps maintain the integrity of the application and aids in smooth processing.

15

Verifies that the applicant has access to the SSA contact information for any questions or assistance needed.

The AI verifies that the applicant has easy access to the SSA contact information for any questions or assistance they may need while completing Form SSA-10. It ensures that the contact details are readily available and visible during the form-filling process. The AI can provide the SSA contact information if it is not already present, ensuring the applicant can reach out for help if necessary.

Common Mistakes in Completing SSA-10

Failure to sign and date the Form SSA-10 application may result in processing delays or even rejection of the application. To avoid this mistake, ensure that all applicants have signed and dated the form in the designated areas and that the date is clearly written. It is also recommended to keep a copy of the signed and dated form for personal records.

Incorrect or incomplete contact information can cause significant delays in the processing of the application or even result in the denial of benefits. Applicants should double-check that they have provided their full name, mailing address, phone number, and email address, if applicable. It is also recommended to keep this information up-to-date throughout the application process and during the receipt of benefits.

The Form SSA-10 requires the signatures of witnesses for mark signatures in certain sections. Failure to obtain these signatures may result in processing delays or even rejection of the application. Applicants should ensure that they have obtained the required signatures from witnesses and that the witnesses have signed and dated the form in the designated areas. It is also recommended to provide the witnesses with a copy of the instructions for signing and dating the form to ensure accuracy.

Leaving sections incomplete or unanswered on the Form SSA-10 can cause processing delays or even result in the denial of benefits. Applicants should carefully review the instructions and ensure that all required information is provided in the designated areas. It is also recommended to double-check that all sections are completed and signed before submitting the application.

Using ink other than black or blue for handwritten responses on the Form SSA-10 may result in processing delays or even rejection of the application. Applicants should ensure that they use only black or blue ink for handwritten responses to avoid any potential issues during processing. It is also recommended to use a pen with a fine tip to ensure that the handwriting is clear and legible.

Applicants for Form SSA-10 may erroneously write 'N/A' instead of supplying the necessary information. This mistake can lead to processing delays or even denial of the application. To avoid this, carefully read the instructions and provide all required information, even if it seems irrelevant or redundant. If an item does not apply to the applicant, indicate 'Not Applicable' only after making sure that the instruction explicitly states so.

Form SSA-10 may necessitate the submission of additional sheets to provide comprehensive information. Applicants who overlook this requirement risk having their applications returned for completion. To prevent this, meticulously review the instructions and gather all necessary documents before submitting the application. If additional sheets are required, attach them to the application as instructed.

An incomplete or illegible application can lead to processing delays or even denial. Applicants for Form SSA-10 should ensure that all sections are filled out completely and legibly. Double-check that all required information is provided and that all fields are clear and easy to read. If necessary, use black ink and print clearly to ensure that the information is easily understood.

Form SSA-10 contains various sections with specific instructions. Applicants may misinterpret these instructions, leading to incorrect or incomplete information. To avoid this, carefully read and follow the instructions for each section. If any instructions are unclear, contact the Social Security Administration for clarification before submitting the application.

Providing inaccurate or inconsistent information can lead to processing delays or even denial of the application. Applicants for Form SSA-10 should ensure that all information provided is accurate and consistent throughout the application. Double-check all entries for accuracy and consistency, and make any necessary corrections before submitting the application.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out SSA-10 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills ssa-10 forms, ensuring each field is accurate.