Yes! You can use AI to fill out Form SSA-4-BK, Application for Child's Insurance Benefits

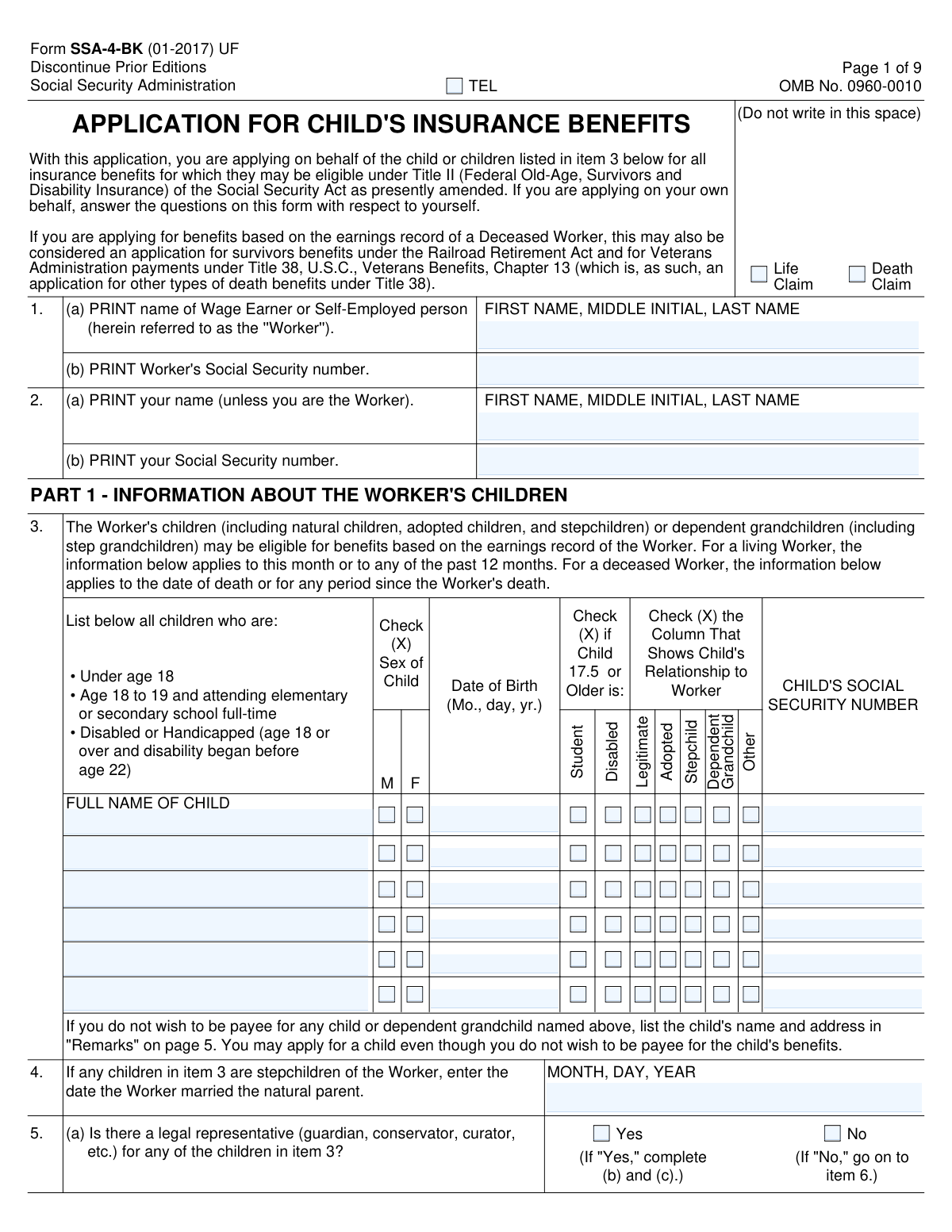

Form SSA-4-BK, also known as the Application for Child's Insurance Benefits, is a document used to apply for Social Security benefits on behalf of children or dependent grandchildren of retired, disabled, or deceased workers. It is important to ensure that eligible dependents receive the financial support they are entitled to under the Social Security Act.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out SSA-4-BK using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form SSA-4-BK, Application for Child's Insurance Benefits |

| Form issued by: | Social Security Administration |

| Number of fields: | 276 |

| Number of pages: | 9 |

| Version: | 2017 |

| Language: | English |

| Categories: | insurance forms, benefit forms, SSA forms, insurance application forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out SSA-4-BK Online for Free in 2026

Are you looking to fill out a SSA-4-BK form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your SSA-4-BK form in just 37 seconds or less.

Follow these steps to fill out your SSA-4-BK form online using Instafill.ai:

- 1 Visit instafill.ai and select SSA-4-BK

- 2 Enter worker's information

- 3 Add child or children's details

- 4 Provide earnings information

- 5 Complete deceased worker's section if applicable

- 6 Sign and date the form electronically

- 7 Check for accuracy and submit the form

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable SSA-4-BK Form?

Speed

Complete your SSA-4-BK in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 SSA-4-BK form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form SSA-4-BK

The worker's name, Social Security number, and whether they are living or deceased should be provided on the Form SSA-4-BK.

The Form SSA-4-BK is used to apply for child's insurance benefits under Title II of the Social Security Act based on the earnings record of a living or deceased worker.

An individual can file for child's insurance benefits using the Form SSA-4-BK if they are applying on behalf of a child or children who may be eligible for benefits based on the earnings record of a living or deceased worker.

Information about the children, including their name, sex, date of birth, relationship to the worker, and Social Security number (if known), must be provided on the Form SSA-4-BK.

The earnings information section on the Form SSA-4-BK is used to report the earnings of children who may have earned more than the exempt amount in the current or previous years.

There is no deadline to file the Form SSA-4-BK, but it's recommended to apply as soon as possible after the child turns 16 or becomes disabled.

If the worker is deceased, the person filing the application must provide proof of the worker's death, such as a death certificate, and their own relationship to the deceased worker.

Through the Form SSA-4-BK, children may be eligible to receive survivor benefits if the worker is deceased, or disability benefits if the worker is living but unable to work due to a disability.

Legal representatives, such as guardians or conservators, may be required to provide information about the circumstances that led to their appointment and their contact information on the Form SSA-4-BK. This information is necessary for the Social Security Administration to establish the representative's authority to act on behalf of the child.

If a child's earnings are expected to exceed the exempt amount in the current or upcoming year, the expected earnings and months in which the child did not earn more than the exempt amount must be reported on the Form SSA-4-BK. The exempt amount for 2023 is $14,640. If a child's earnings exceed this amount, they may be subject to taxes on their Social Security benefits. Reporting this information will help ensure accurate benefit calculations.

It is important to report any changes, such as address, citizenship or immigration status, work changes, custody changes, or disability status, as soon as possible to avoid overpayments and possible monetary penalties. Reporting changes in a timely manner will help ensure that the Social Security Administration has accurate information to process the application and make any necessary adjustments to ongoing benefits.

The Social Security Administration is responsible for determining eligibility for monthly benefits or insurance coverage and authorizing payments to the children of retired, disabled, or deceased workers. The Form SSA-4-BK is used to apply for benefits for a child under the age of 18, or under the age of 19 if they are still in school full-time. The Social Security Administration uses the information provided on the form to establish the child's eligibility and calculate any potential benefits.

If the worker had wages or self-employment income covered under Social Security in all years from 1978 through the year of death, no additional information is required to be reported on the Form SSA-4-BK. The Social Security Administration already has a record of the worker's earnings history and can use this information to determine the child's eligibility for benefits.

The Privacy Act Statement and Paperwork Reduction Act Statement on the Form SSA-4-BK are important notices that provide information about the collection, use, and disclosure of your personal information, as well as the estimated time required to complete the form. The Social Security Administration is required by law to obtain your consent before collecting and using your personal information for these purposes. By signing the form, you are acknowledging that you have read and understand these statements.

If the worker had wages or self-employment income covered under Social Security in some, but not all, years from 1978 through the year of death, it is important to report this information accurately on the Form SSA-4-BK. The Social Security Administration uses this information to determine the worker's eligibility for survivor benefits and the amount of those benefits. If the worker did not have wages or self-employment income covered under Social Security in some years, those years must be reported on the form as best as possible. This may include using tax records, bank statements, or other documentation to estimate the worker's earnings for those years.

The Centers for Medicare & Medicaid Services (CMS) play a role in the Form SSA-4-BK application process because they may share information with the Social Security Administration for the purpose of administering Medicare benefits. Specifically, the Social Security Administration may use Medicare information to determine if an individual is eligible for Medicare-conditional survivor benefits or if they are eligible for Medicare Part A or Part B premiums based on the worker's earnings record. It is important to provide accurate and complete information on both the Form SSA-4-BK and any related Medicare forms to ensure that all benefits are calculated correctly.

Compliance SSA-4-BK

Validation Checks by Instafill.ai

1

Ensures that the Worker's first name, middle initial, and last name are correctly entered in Part 1, Section 1a.

The AI ensures that the Worker's personal details are accurately captured in the form. It checks for correct spelling and proper placement of the first name, middle initial, and last name in the designated fields of Part 1, Section 1a. The AI cross-references this information with official documents to prevent any discrepancies. It also alerts the user if any field is left blank or contains invalid characters.

2

Confirms that the Worker's Social Security number is accurately entered in Part 1, Section 1b.

The AI confirms the accuracy of the Social Security number provided for the Worker. It validates the format and sequence of the nine-digit number entered in Part 1, Section 1b. The AI uses checksum algorithms to ensure the number is valid and cross-checks it against government databases when possible. It also highlights any missing or extra digits to ensure compliance with Social Security number standards.

3

Verifies that the applicant's first name, middle initial, and last name are correctly entered in Part 1, Section 2a, if not the Worker.

The AI verifies the applicant's name details when the applicant is not the Worker. It ensures that the first name, middle initial, and last name are correctly entered in Part 1, Section 2a. The AI checks for proper capitalization, spelling, and that each part of the name is placed in the correct field. It also prompts the user to correct any errors or fill in any missing information.

4

Checks that the applicant's Social Security number is accurately entered in Part 1, Section 2b.

The AI checks the Social Security number provided for the applicant. It ensures that the number entered in Part 1, Section 2b adheres to the correct format and contains exactly nine digits. The AI employs validation techniques to detect any anomalies or incorrect entries and requests corrections if necessary. It also prevents the submission of the form with an incomplete or improperly formatted Social Security number.

5

Confirms that all children's information is listed, including sex, date of birth, student status, disability status, relationship to the Worker, and Social Security numbers in Part 1, Section 3.

The AI confirms that all required information for each child is fully listed in Part 1, Section 3. It checks for the inclusion of sex, date of birth, student status, disability status, relationship to the Worker, and Social Security numbers. The AI ensures that each field is completed accurately and that the information provided is consistent with legal documentation. It also validates the format of dates and Social Security numbers, and flags any missing or inconsistent data for review.

6

Verifies that the date the Worker married the natural parent is entered for any stepchildren listed in Part 1, Section 4.

The system ensures that the application includes the specific date on which the worker married the natural parent of any stepchildren, as required in Part 1, Section 4 of Form SSA-4-BK. This validation is crucial for establishing the stepchild's eligibility for insurance benefits. If this date is missing or incorrectly formatted, the system flags the entry for review or correction. This check is essential to prevent processing delays and to support the accurate determination of benefits.

7

Checks for the presence of legal representative details for any child in Part 1, Section 5.

The system checks for the complete and accurate entry of legal representative details for any child listed in Part 1, Section 5 of Form SSA-4-BK. It verifies that all required fields, such as the representative's name, address, and relationship to the child, are filled out. This information is vital for ensuring that there is a responsible party for the child's interests and for proper communication. The system alerts if any of this critical information is missing or incomplete.

8

Confirms the applicant's parental status as the natural or adoptive parent in Part 1, Section 6.

The system confirms that the applicant has indicated their parental status as either the natural or adoptive parent in Part 1, Section 6 of the form. This confirmation is necessary to establish the legal relationship between the applicant and the child, which is a key factor in the child's eligibility for insurance benefits. The system ensures that this section is not left blank and that the information provided is consistent with other sections of the application.

9

Verifies adoption information for any children adopted by someone other than the Worker in Part 1, Section 7.

The system verifies that adoption information is provided for any children who were adopted by someone other than the worker, as required in Part 1, Section 7 of Form SSA-4-BK. It checks for the inclusion of the adoption date and the details of the adoptive parent(s). This verification is essential to confirm the child's eligibility for benefits and to ensure that the application is in compliance with legal requirements. The system flags any discrepancies or omissions in this section for further action.

10

Ensures that household information is complete, indicating if all children live with the applicant or providing details for those who do not in Part 1, Section 8.

The system ensures that household information is thoroughly completed in Part 1, Section 8 of the form. It checks whether the application clearly indicates if all children reside with the applicant or, if not, that it provides detailed information about the living arrangements of those who live elsewhere. This information is critical for assessing the correct benefit amounts and for understanding the family dynamic. The system alerts the user to any incomplete or inconsistent information regarding household composition.

11

Checks marital status details for any child who has ever been married in Part 1, Section 9.

The system ensures that the marital status details for any child who has ever been married are accurately captured in Part 1, Section 9 of Form SSA-4-BK. It checks for completeness and consistency in the information provided, such as the date of marriage, the name of the spouse, and whether the marriage is still in effect. The system also validates that the marital status is appropriately selected and that all necessary fields related to marital history are filled out correctly.

12

Confirms if prior applications for benefits have been filed on behalf of any child listed in Part 1, Section 10.

The system confirms whether any prior applications for benefits have been filed on behalf of the children listed in Part 1, Section 10 of the form. It cross-references the provided information with existing records to ensure there are no discrepancies or duplicate applications. The system also checks that the section is completed with either a 'Yes' or 'No' response and that details of any previous applications are provided if applicable.

13

Ensures that all required information about the deceased Worker is provided in Part II, Sections 18-29, if applicable.

The system ensures that all required information about the deceased worker is thoroughly provided in Part II, Sections 18-29 of Form SSA-4-BK. It verifies the accuracy of the worker's Social Security number, name, date of death, and other personal details. The system also checks for the completeness of the employment history, the worker's earnings, and any other relevant information that is necessary to process the child's insurance benefits application.

14

Verifies that the application is signed and dated by the applicant, with a telephone number and mailing address provided.

The system verifies that Form SSA-4-BK is properly signed and dated by the applicant in the designated section. It checks that the signature is present and that the date of signing is recent and valid. Additionally, the system ensures that contact details, such as a telephone number and mailing address, are provided, enabling effective communication with the applicant for any follow-up or clarification needed.

15

Checks that the direct deposit information is complete, including routing transit number, account number, and account type, or if enrollment in Direct Express or refusal of direct deposit is indicated.

The system checks that the direct deposit information section is complete with all necessary details, including the bank's routing transit number, the applicant's account number, and the type of account (checking or savings). It also verifies whether the applicant has indicated enrollment in Direct Express or has explicitly refused direct deposit. The system ensures that the financial information provided is valid and formatted correctly to prevent any issues with benefit payments.

16

Witness Signature Validation for Mark (X)

Ensures that if the applicant signs the Form SSA-4-BK, Application for Child's Insurance Benefits, with a mark (X) instead of a traditional signature, there are two witnesses who have provided their signatures to validate the mark. Confirms that these witnesses have included their full addresses alongside their signatures, as required by the form's instructions. Verifies the presence of these witness signatures and addresses in the designated areas of the form to maintain its legality and authenticity. Checks for completeness and legibility of the witness information to prevent any potential issues during the processing of the application.

Common Mistakes in Completing SSA-4-BK

One of the most common errors made when filling out the Form SSA-4-BK is the failure to use the required ink color. The form instructions state that answers must be written in black or blue ink to ensure proper processing. Using other ink colors may result in illegible responses, causing delays or even denial of the application. To avoid this mistake, make sure to have a pen with black or blue ink readily available before beginning to fill out the form.

Another frequent error is writing information in spaces specifically marked as 'Do not write in this space.' These areas are intended for form processing purposes and should be left blank. Failing to adhere to these instructions may lead to processing errors or even rejection of the application. To prevent this mistake, carefully read and follow the instructions on the form, ensuring that all required information is entered only in the designated spaces.

Providing incorrect or incomplete Worker's information is a common mistake that can significantly delay or even deny the application process. The form requires specific details about the worker, including their Social Security Number, name, and mailing address. Ensuring that this information is accurate and complete is crucial to the successful processing of the application. Double-checking all entered information against official documents and taking the time to carefully read and follow the instructions can help prevent this mistake.

Similar to the Worker's information, providing incorrect or incomplete Applicant's information can lead to processing errors or even denial of the application. The form requires detailed information about the applicant, including their name, Social Security Number, and mailing address. Double-checking all entered information against official documents and taking the time to carefully read and follow the instructions can help prevent this mistake and ensure the application is processed efficiently.

Another common mistake is failing to provide complete and accurate information about the children for whom insurance benefits are being applied. This may include omitting a child's name, date of birth, or Social Security Number. Ensuring that all required information is entered correctly and completely is essential for the successful processing of the application. Double-checking all entered information against official documents and taking the time to carefully read and follow the instructions can help prevent this mistake and ensure that all eligible children are included in the application.

When completing the Form SSA-4-BK, applicants may inadvertently provide incorrect date information for their stepchildren. It is essential to double-check the birthdates and ensure they are accurately recorded to avoid potential delays or denials in the application process. To prevent this mistake, carefully review the provided dates and consult relevant documents, such as birth certificates, to confirm their accuracy.

Another common mistake on the Form SSA-4-BK is incorrectly reporting parental status or adoption information. Applicants must ensure they accurately indicate their relationship to the child, as well as provide any necessary adoption information. Failure to do so may result in processing delays or denials. To avoid this mistake, carefully read the instructions and consult any relevant documents, such as birth certificates or adoption decrees, to ensure all information is reported accurately.

Applicants may also overlook indicating whether all children listed on the form live with them. This information is crucial for determining eligibility for certain benefits. To prevent this mistake, carefully review the instructions and ensure all children's living arrangements are accurately reported. If some children do not live with the applicant, provide their current address and contact information.

Applicants may inadvertently report the incorrect marital status of their children on the Form SSA-4-BK. It is essential to ensure all children's marital statuses are accurately reported, as this information may impact their eligibility for certain benefits. To avoid this mistake, carefully review the instructions and consult any relevant documents, such as marriage certificates or divorce decrees, to confirm the marital status of each child.

Lastly, applicants may overlook indicating if anyone listed on the form has previously filed an application for Social Security benefits. This information is necessary for the Social Security Administration to process the application correctly. To prevent this mistake, carefully review the instructions and ensure all required information is accurately reported. If someone has previously applied, provide their application number and the date the application was filed.

One of the most critical mistakes in filling out Form SSA-4-BK is neglecting to provide complete and accurate information about the deceased. This may include incorrect or missing Social Security numbers, names, or dates of birth. Such errors can significantly delay the processing of your application and may even result in its denial. To avoid this mistake, double-check all the information you provide about the deceased against their original documents or records. If you're unsure about any details, contact the Social Security Administration for clarification.

Another common mistake is forgetting to sign and date the Form SSA-4-BK. This oversight can cause significant delays in processing your application, as the Social Security Administration cannot proceed without your signature. To prevent this mistake, make sure you sign and date the form as soon as you complete it. If you're unable to sign the form in person due to illness or disability, you may be able to designate someone else to sign on your behalf. Consult the instructions provided with the form for details.

Failing to provide complete Direct Deposit Information is another common mistake when filling out Form SSA-4-BK. This may include incorrect or missing routing numbers, account numbers, or financial institution names. Incomplete Direct Deposit Information can cause significant delays in processing your application and may even result in its denial. To avoid this mistake, double-check all the information you provide about your Direct Deposit account against your bank statement or other records. If you're unsure about any details, contact your bank for clarification.

If you're unable to sign the Form SSA-4-BK in person, you'll need to provide the information of a witness who can sign on your behalf. Failing to provide correct Witness information can cause significant delays in processing your application. To avoid this mistake, make sure you provide the full name, address, and Social Security number of your witness. If your witness is unable to provide their Social Security number, you may be able to provide other identifying information instead. Consult the instructions provided with the form for details.

Another common mistake is neglecting to review the Privacy Act Statement and Paperwork Reduction Act Statement on the Form SSA-4-BK. These statements explain how the Social Security Administration will use the information you provide and the time required to complete the form. Failing to review these statements can result in misunderstandings about how your information will be used or delays in processing your application. To avoid this mistake, read both statements carefully before signing and dating the form.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out SSA-4-BK with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills ssa-4 forms, ensuring each field is accurate.