Form W-10, Dependent Care Provider’s Identification Completed Form Examples and Samples

Explore a detailed example of a completed IRS Form W-10 tailored for in-home child care providers. This guide includes step-by-step instructions for filling out the form with essential details like legal name, business address, and tax identification information.

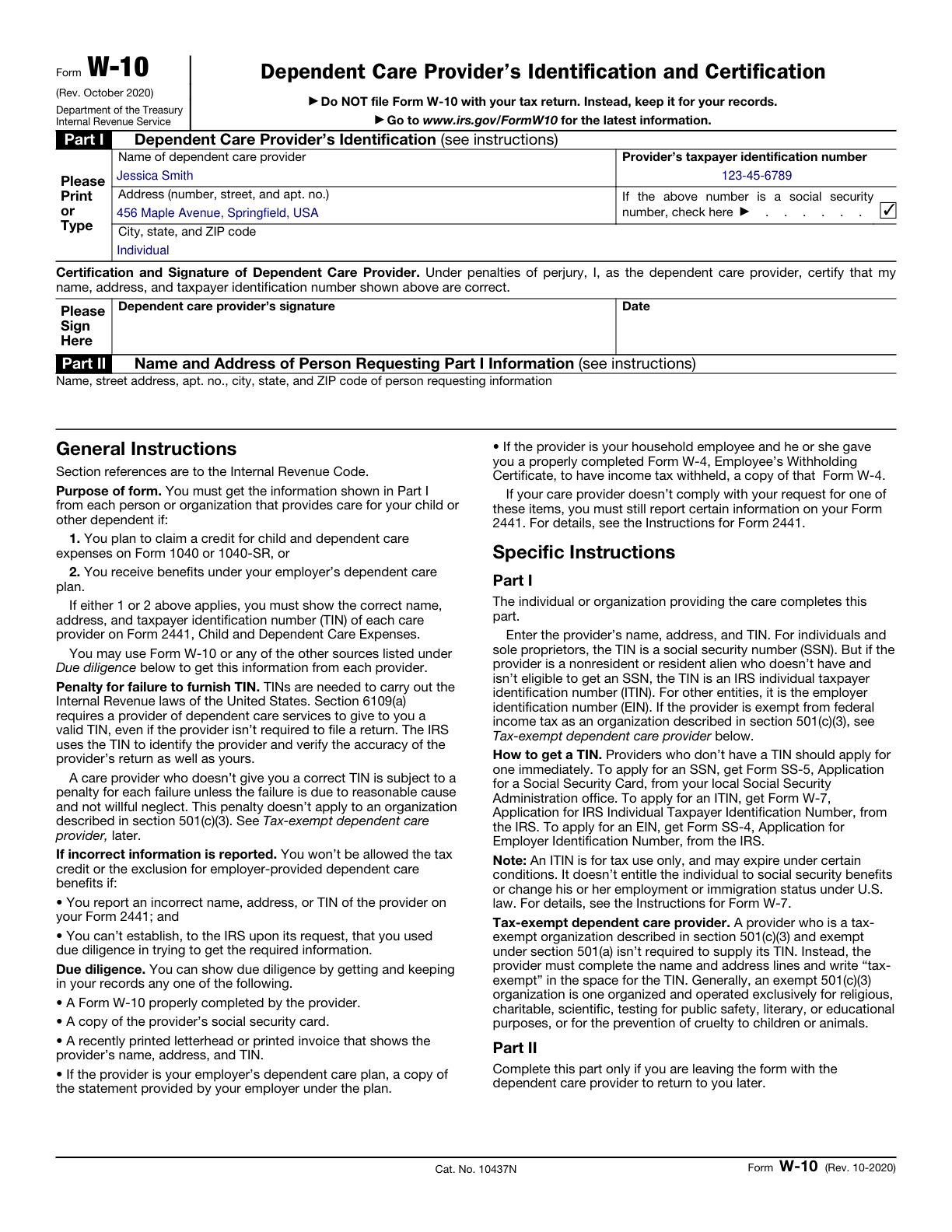

W-10 Example – In-Home Child Care Provider

How this form was filled:

The form displays the provider's details including legal name, business name, address, and tax identification number. The example demonstrates the correct completion of these fields for a provider offering in-home child care services.

Information used to fill out the document:

- Legal Name: Jessica Smith

- Business Name: Jessica's Tiny Tots Care

- Mailing Address: 456 Maple Avenue, Springfield, USA

- Social Security Number (SSN): 123-45-6789

- Provider's Signature: Jessica Smith

- Date: 01/20/2025

What this filled form sample shows:

- Accurate legal name and business name entries

- Proper SSN format

- Correctly filled address for reliable contact

- Properly formatted signature and date

Form specifications and details:

| Use Case: | In-home child care provider |