Form 1099-SA, Distributions from HSA/MSA Completed Form Examples and Samples

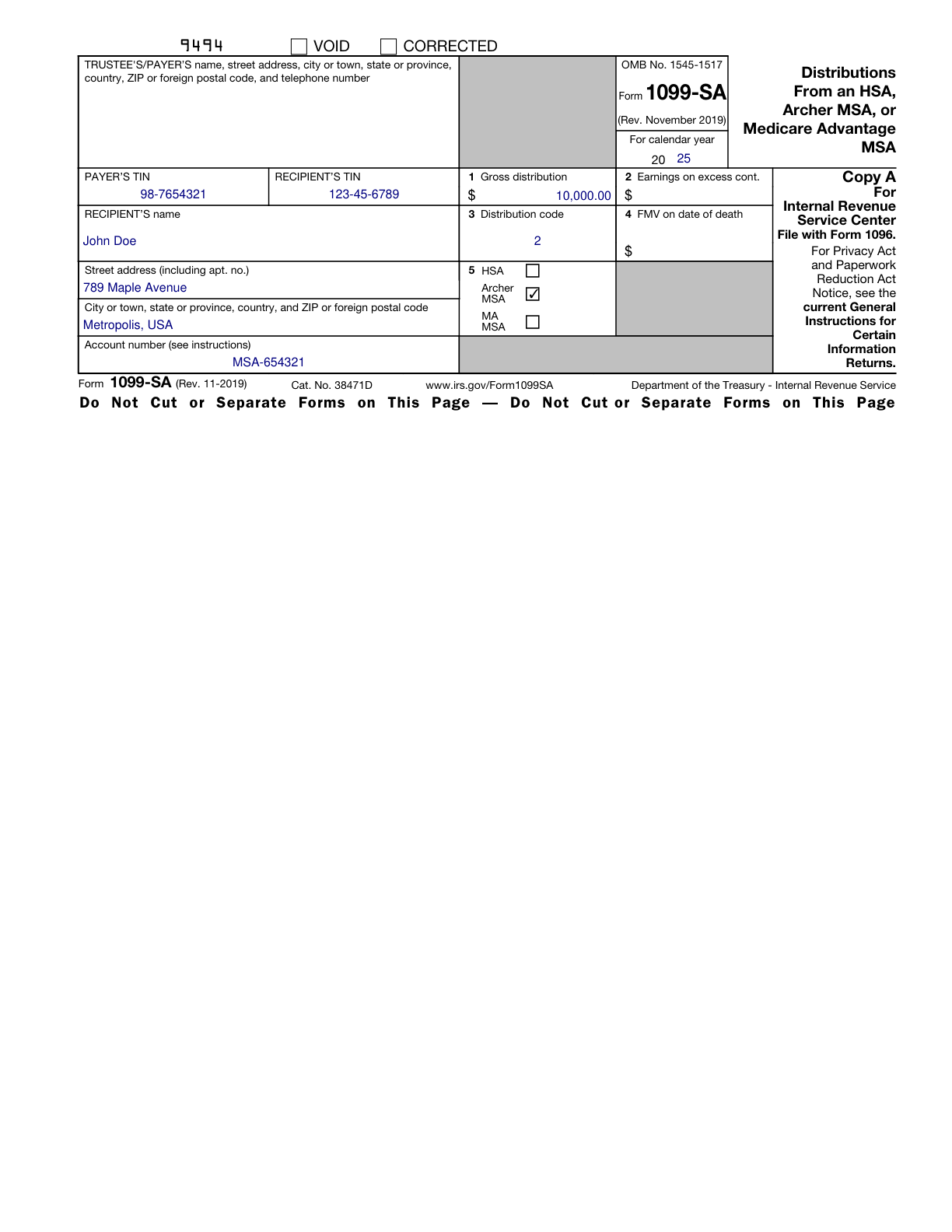

Form 1099-SA Example – HSA Distribution for Medical Expenses

How this form was filled:

This example illustrates a Form 1099-SA completed for a distribution from a Health Savings Account (HSA) to cover qualified medical expenses. Key fields include the recipient's information, total distribution amount, and indication that the distribution is for medical expenses.

Information used to fill out the document:

- Recipient's Name: Jane Smith

- Recipient's TIN: 987-65-4321

- Address: 456 Elm Street, Anytown, USA

- Total Distribution: 3,500.00

- Distribution Code: 1

- Box 5 (Medicare Advantage MSA):

- Payer's TIN: 12-3456789

- Account Number: HSA-123456

- Date of Distribution: 01/30/2025

What this filled form sample shows:

- Recipient information is correctly filled with name, TIN, and address.

- The total distribution amount is accurately listed.

- Appropriate distribution code is used to indicate medical expenses.

- Form includes payer's TIN and account number details.

Form specifications and details:

| Use Case: | HSA distribution for qualified medical expenses |

| Tax Year: | 2025 |

| Form Purpose: | To report distributions from a Health Savings Account. |

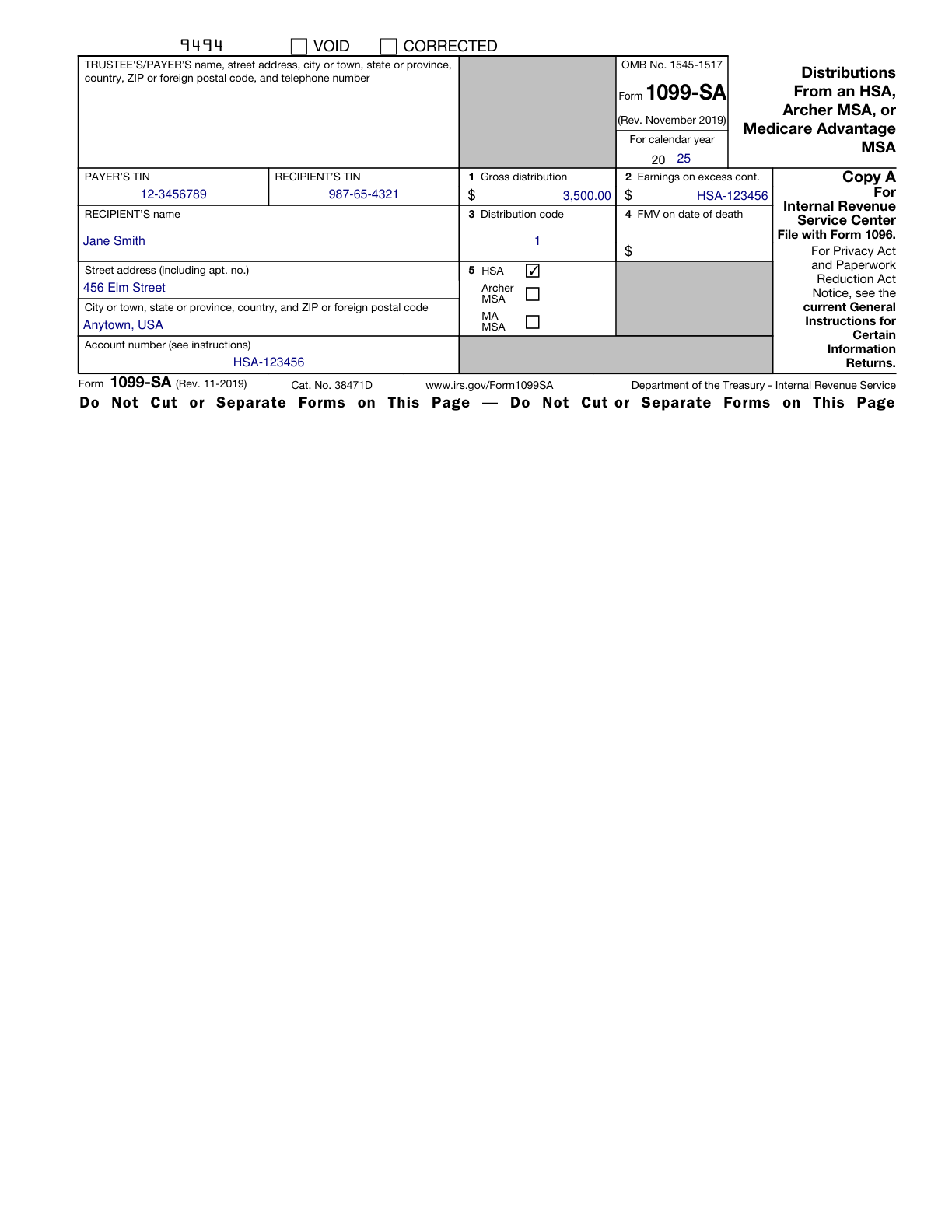

Form 1099-SA Example – MSA Distribution for Retirement

How this form was filled:

This example demonstrates a Form 1099-SA completed for a distribution from a Medical Savings Account (MSA) intended for retirement savings. Important fields include recipient details, total distribution amount, and indication that the distribution is for retirement purposes.

Information used to fill out the document:

- Recipient's Name: John Doe

- Recipient's TIN: 123-45-6789

- Address: 789 Maple Avenue, Metropolis, USA

- Total Distribution: 10,000.00

- Distribution Code: 2

- Box 5 (Medicare Advantage MSA):

- Payer's TIN: 98-7654321

- Account Number: MSA-654321

- Date of Distribution: 02/15/2025

What this filled form sample shows:

- Recipient information includes complete name, TIN, and address.

- The total distribution amount is clearly stated.

- Correct distribution code indicates retirement purposes.

- Details for payer's TIN and account number are provided.

Form specifications and details:

| Use Case: | MSA distribution for retirement purposes |

| Tax Year: | 2025 |

| Form Purpose: | To report distributions from a Medical Savings Account. |