Form 1127, Application for Extension of Time for Payment of Tax Due to Undue Hardship Completed Form Examples and Samples

Explore examples of completed Form 1127, showcasing applications for an extension of time to pay taxes due to undue hardship. These samples provide detailed insights into filling the form for situations like unexpected medical expenses and business losses, helping taxpayers understand the necessary steps and requirements.

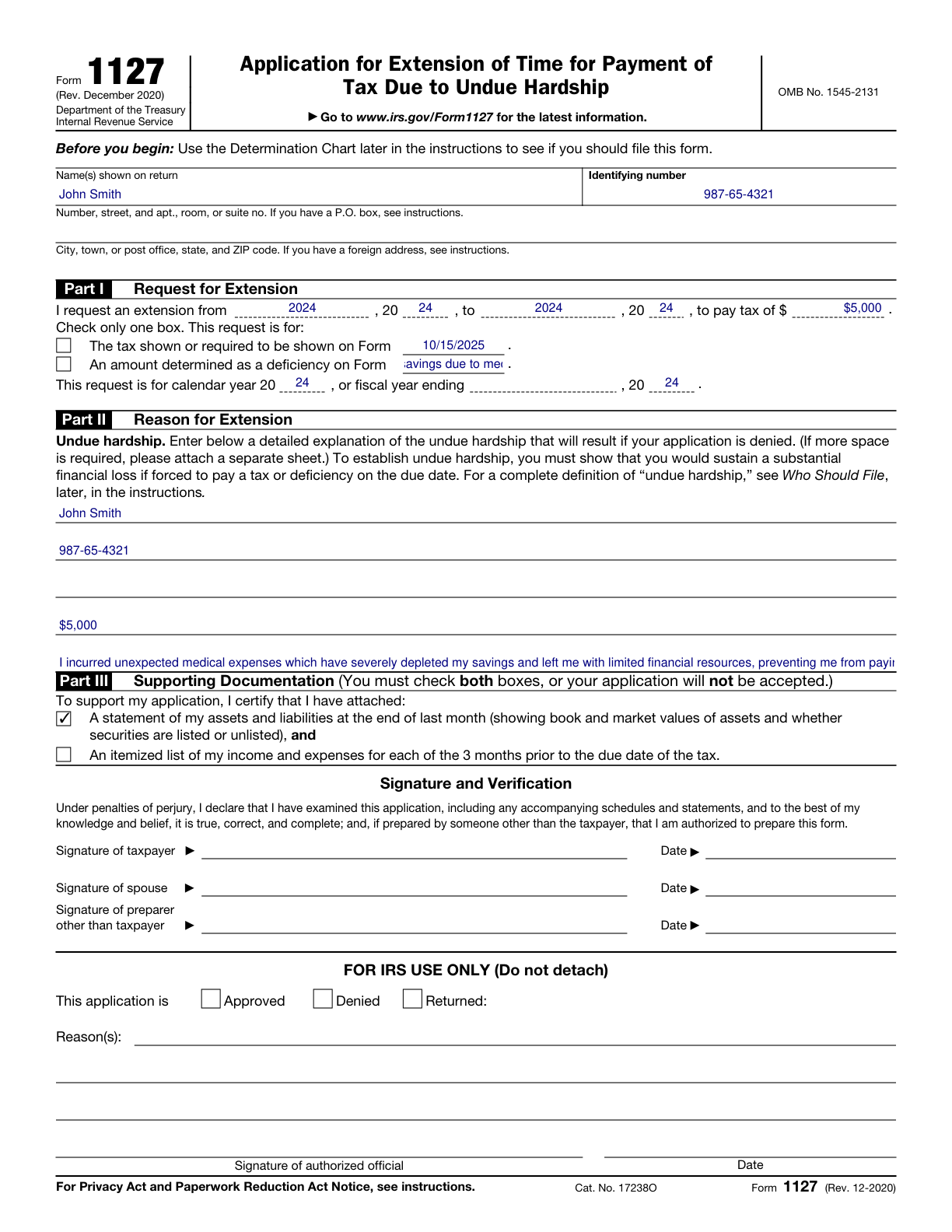

Form 1127 Example – Extension Due to Undue Hardship

How this form was filled:

This example demonstrates the completion of Form 1127, where John Smith applies for an extension of time to pay his 2024 income tax due to unexpected medical expenses. Details include his explanation of undue hardship, requested payment extension date, and declaration of financial status.

Information used to fill out the document:

- Taxpayer Name: John Smith

- Social Security Number: 987-65-4321

- Address: 456 Elm Street, Rivertown, USA

- Tax Year: 2024

- Tax Due Date: 04/15/2025

- Amount of Tax Due: $5,000

- Reason for Extension: Unexpected medical expenses

- Requested Payment Extension Date: 10/15/2025

- Current Financial Position: Limited savings due to medical bills

- Signature: John Smith

- Date: 03/25/2025

What this filled form sample shows:

- Detailed explanation of undue hardship due to unexpected medical expenses.

- Accurate financial position declaration reflecting impact on ability to pay.

- Clear requested payment extension date matching IRS requirements.

- Appropriate signature and date marking completion of form.

Form specifications and details:

| Use Case: | Tax payment extension due to undue hardship caused by significant medical expenses. |

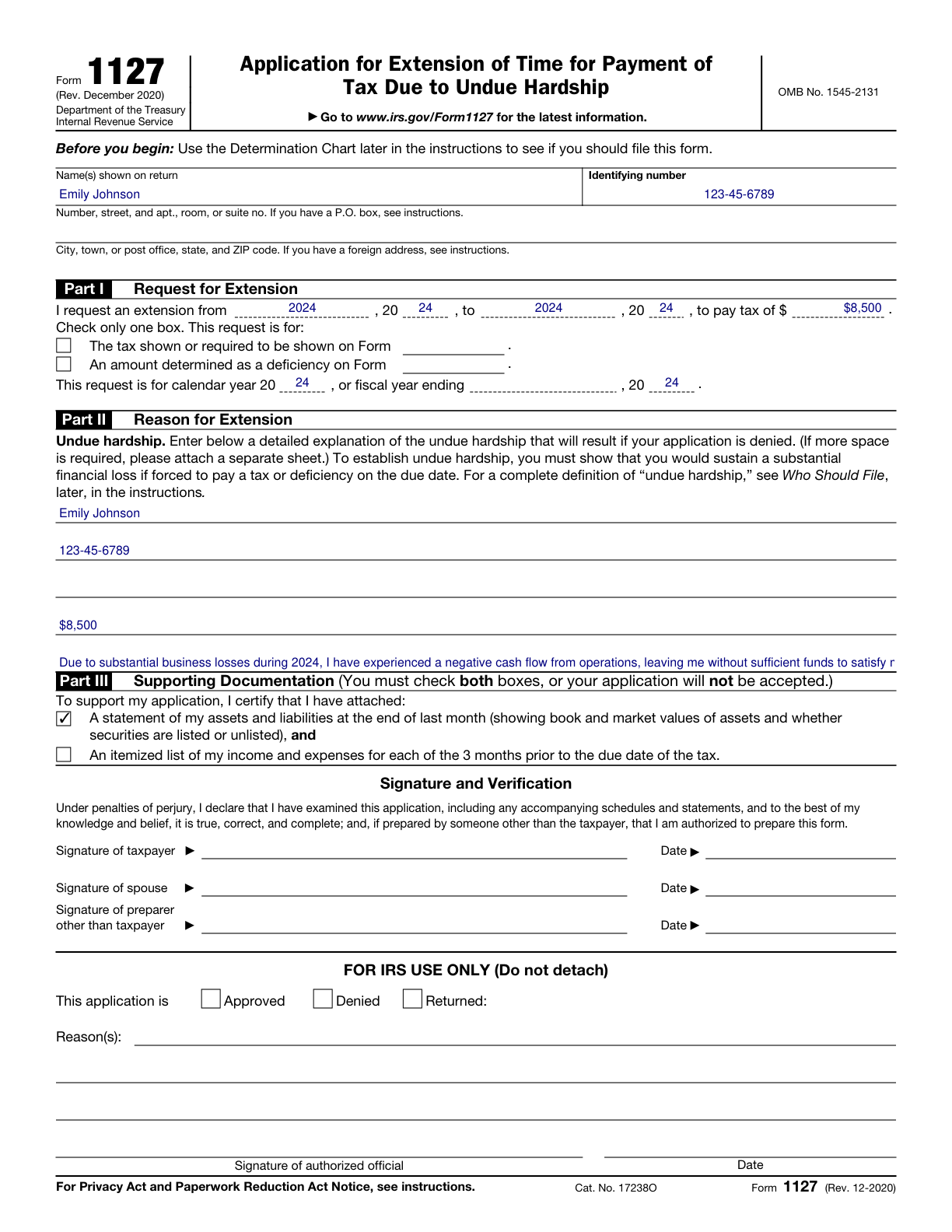

Form 1127 Example – Extension for Business Losses

How this form was filled:

This example showcases the completion of Form 1127, where Emily Johnson seeks an extension of time to pay her 2024 income tax following significant business losses. It includes her explanation of undue hardship, the requested extension date, and financial statements.

Information used to fill out the document:

- Taxpayer Name: Emily Johnson

- Social Security Number: 123-45-6789

- Address: 789 Pine Road, Oakville, USA

- Tax Year: 2024

- Tax Due Date: 04/15/2025

- Amount of Tax Due: $8,500

- Reason for Extension: Significant business losses

- Requested Payment Extension Date: 10/15/2025

- Current Financial Position: Negative cash flow from business operations

- Signature: Emily Johnson

- Date: 03/30/2025

What this filled form sample shows:

- Comprehensive explanation of undue hardship due to significant business losses.

- Detailed financial statement depicting the inability to meet tax obligations.

- Clearly stated requested payment extension date aligning with IRS guidelines.

- Proper signature and date indicating form completion.

Form specifications and details:

| Use Case: | Tax payment extension due to business operational losses. |