Form 2438, Undistributed Capital Gains Tax Return Completed Form Examples and Samples

Discover detailed examples and step-by-step guides for completing Form 2438, Undistributed Capital Gains Tax Return, for both Real Estate Investment Trusts (REITs) and Regulated Investment Companies (RICs). Find sample filled forms, illustrating how to calculate undistributed capital gains and applicable taxes accurately.

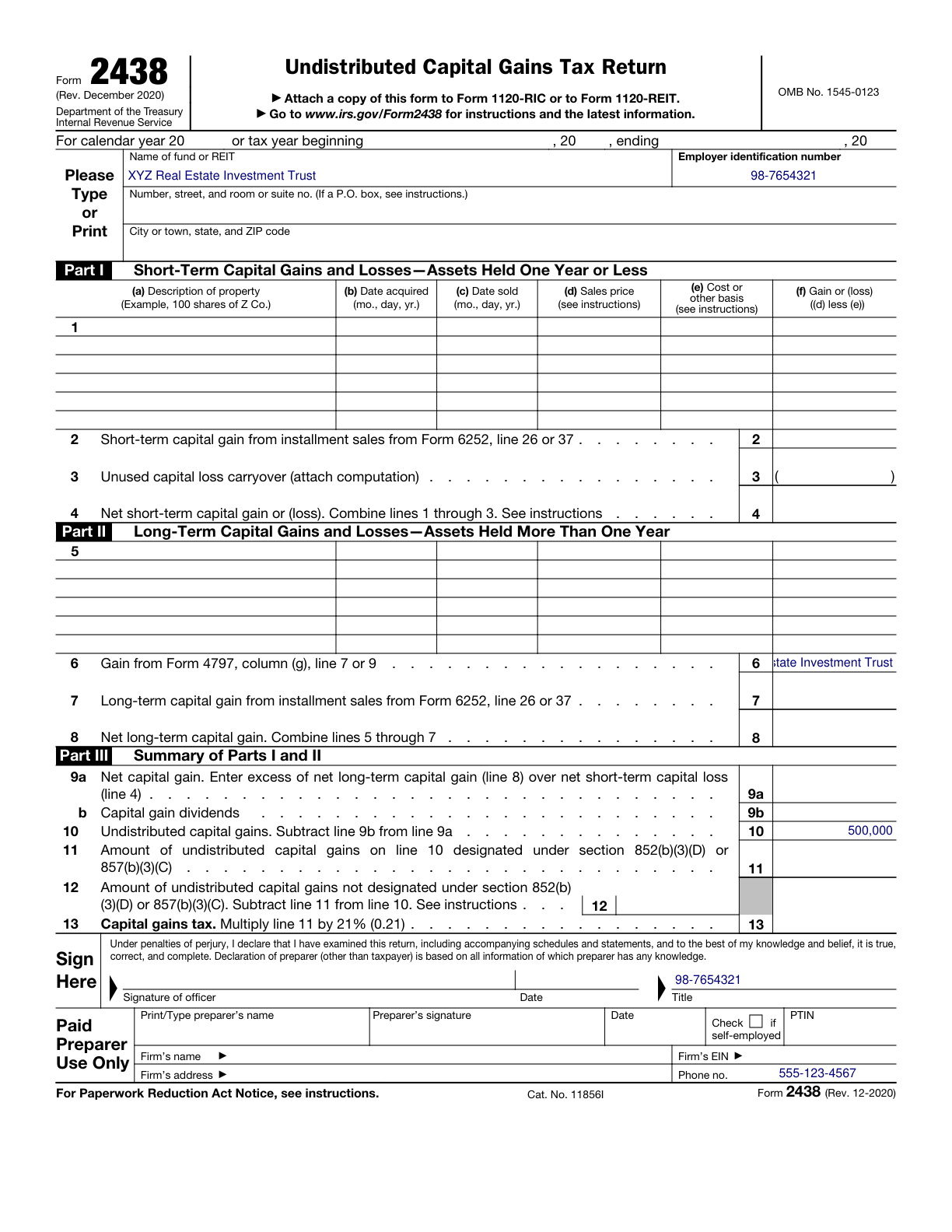

Form 2438 Example – Real Estate Investment Trust (REIT)

How this form was filled:

This example illustrates how a Real Estate Investment Trust (REIT) should correctly complete Form 2438. The sample includes details such as undistributed capital gains, applicable taxes, and all necessary identification information.

Information used to fill out the document:

- Entity Name: XYZ Real Estate Investment Trust

- Employer Identification Number (EIN): 98-7654321

- Tax Year: 2025

- Undistributed Capital Gains: 500,000

- Tax Rate: 21%

- Tax Due: 105,000

- Contact Name: Jane Smith

- Contact Phone Number: 555-123-4567

- Filing Date: 03/15/2025

What this filled form sample shows:

- Shows a comprehensive example for Real Estate Investment Trust (REIT) completing Form 2438

- Includes accurate calculation of undistributed capital gains and applicable taxes

- Properly filled Entity Name and EIN

- Illustrates the section for contact information and filing date

Form specifications and details:

| Use Case: | Real Estate Investment Trust (REIT) |

| Form Purpose: | Reporting of undistributed capital gains |

| Filing Requirement: | Annual |

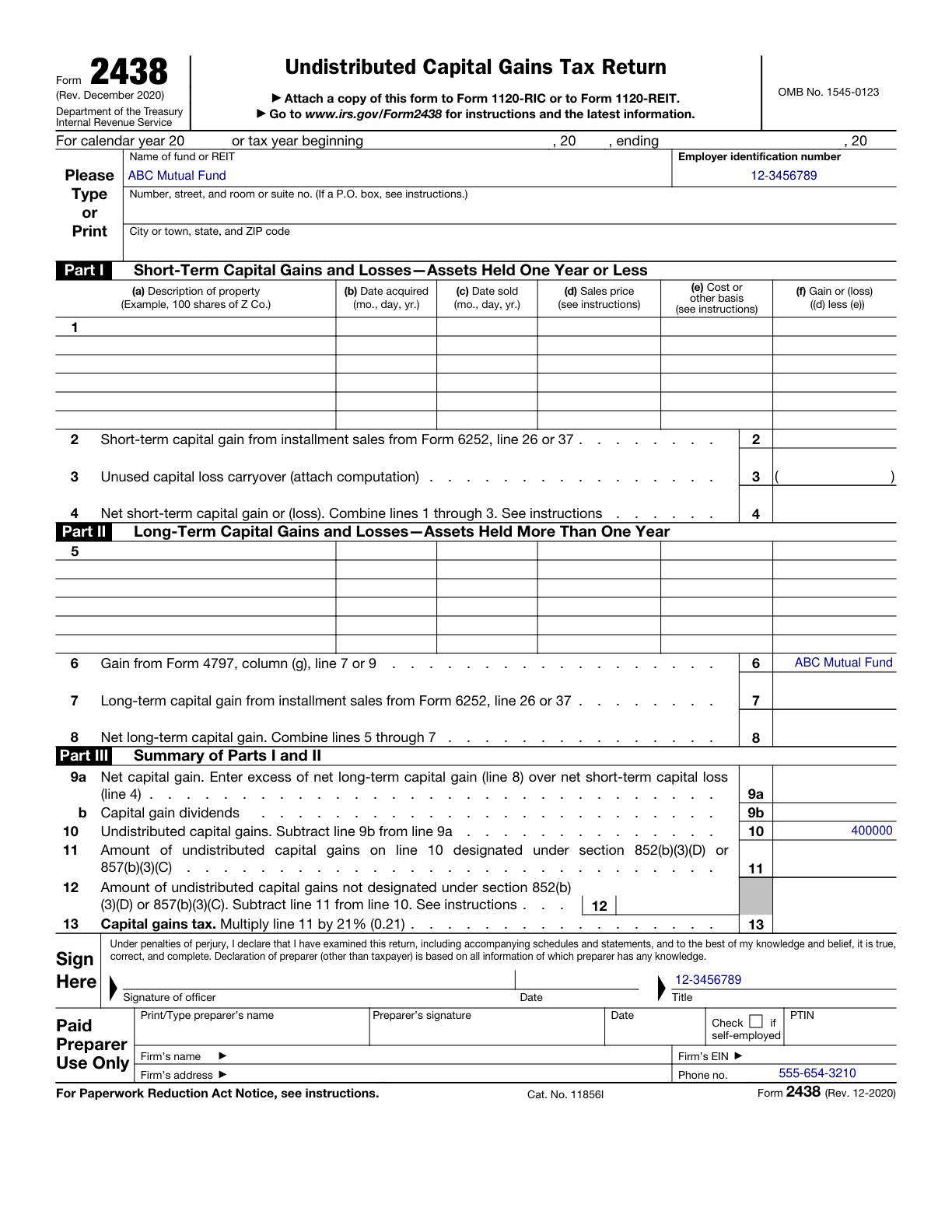

Form 2438 Example – Regulated Investment Company (RIC)

How this form was filled:

This example provides a detailed walkthrough for a Regulated Investment Company (RIC) in completing Form 2438, covering specifics such as undistributed capital gains, applicable tax calculations, and company details.

Information used to fill out the document:

- Entity Name: ABC Mutual Fund

- Employer Identification Number (EIN): 12-3456789

- Tax Year: 2025

- Undistributed Capital Gains: 400,000

- Tax Rate: 21%

- Tax Due: 84,000

- Contact Name: John Doe

- Contact Phone Number: 555-654-3210

- Filing Date: 02/20/2025

What this filled form sample shows:

- Provides a detailed example for Regulated Investment Company (RIC) completing Form 2438

- Includes calculation of undistributed capital gains and applicable taxes

- Accurately filled Entity Name and EIN with a fictional example

- Shows the proper contact information and filing date

Form specifications and details:

| Use Case: | Regulated Investment Company (RIC) |

| Form Purpose: | Reporting of undistributed capital gains |

| Filing Requirement: | Annual |