Form 3911, Taxpayer Statement Regarding Refund Completed Form Examples and Samples

Explore our detailed example of Form 3911, Taxpayer Statement Regarding Refund, which demonstrates how to fill out the form to inquire about a missing tax refund. This sample includes taxpayer details, refund issue documentation, and signature requirements to ensure accurate form completion.

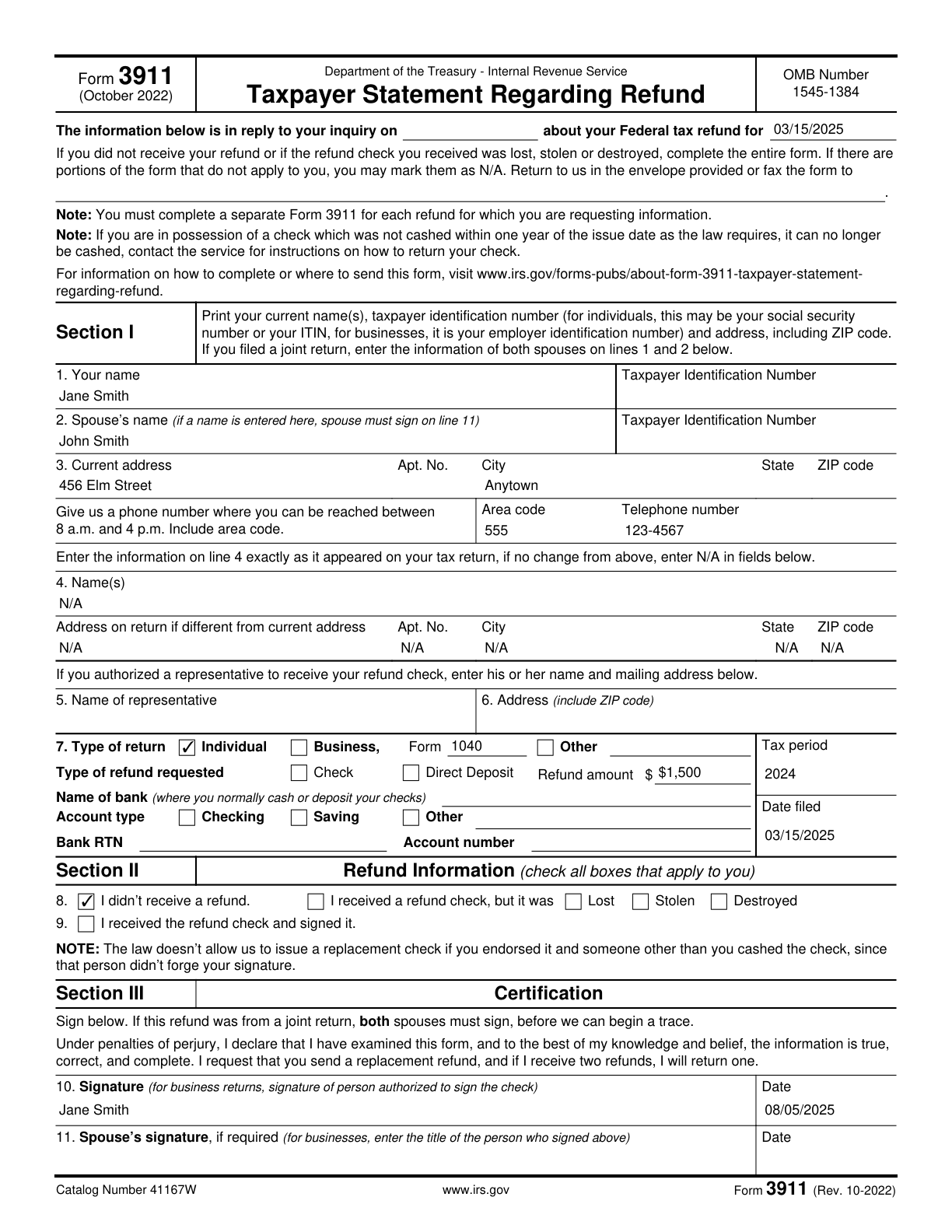

Form 3911 Example – Taxpayer Statement Regarding Refund

How this form was filled:

This example demonstrates how to fill out Form 3911 to inquire about a missing tax refund. The taxpayer details, issue description, and action taken are properly documented, along with the necessary signature and date.

Information used to fill out the document:

- Taxpayer Name: Jane Smith

- Spouse's Name: John Smith

- Current Address: 456 Elm Street, Anytown, USA

- Tax Year: 2024

- Form Filed: 1040

- Refund Amount Expected: $1,500

- Date Filed: 03/15/2025

- Contact Number: 555-123-4567

- Refund Inquiry Type: Not received

- Explanation of Issue: Return filed on 03/15/2025 but refund still not received as of 08/01/2025.

- Signature: Jane Smith

- Date: 08/05/2025

What this filled form sample shows:

- Complete details of taxpayer name and address

- Accurately filled tax year and form filed information

- Clear issue description with specific refund inquiry type

- Properly formatted signature and date fields

Form specifications and details:

| Use Case: | Inquiry about a missing tax refund |

| Form Purpose: | To address issues regarding tax refunds that have not been received |