Yes! You can use AI to fill out Form 5884-A, Employee Retention Credit

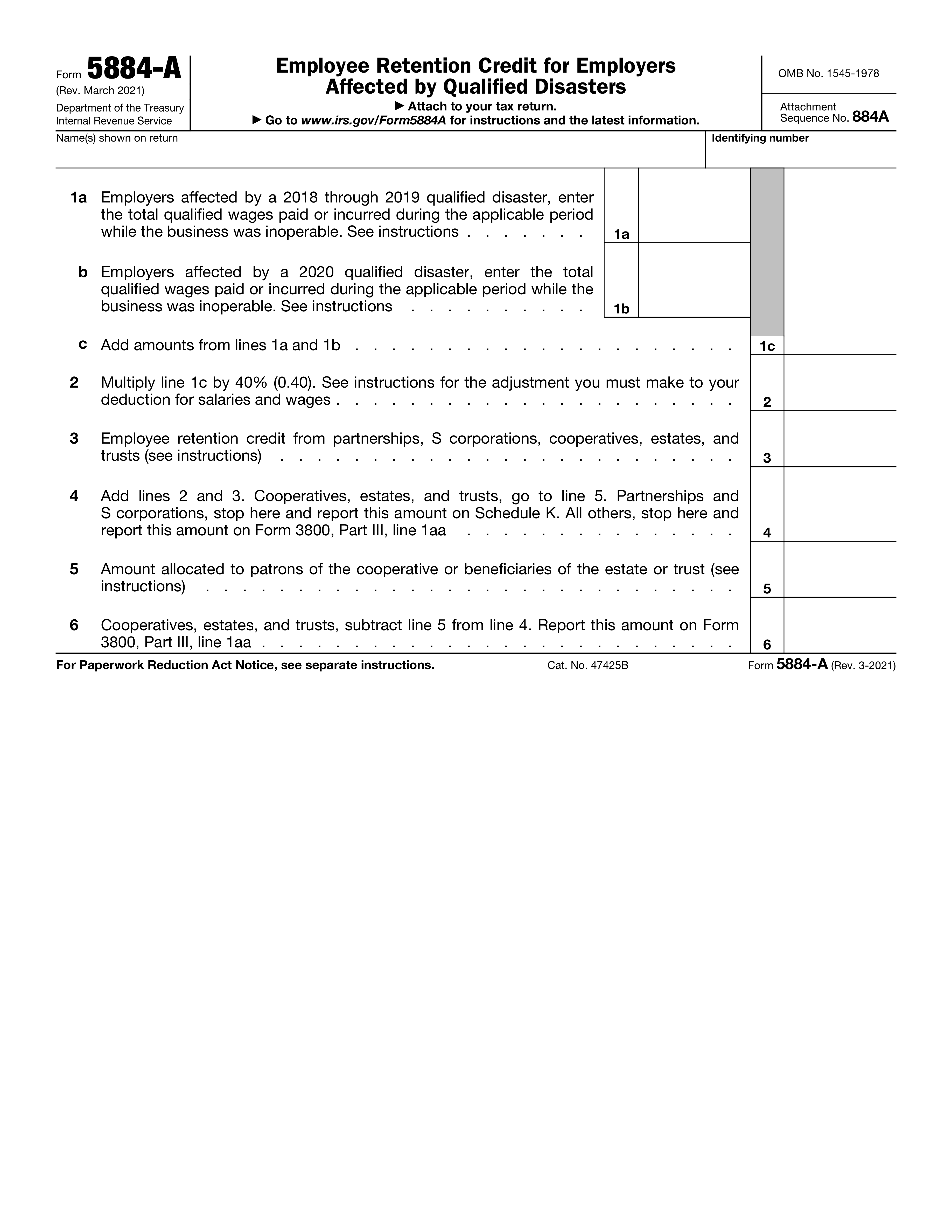

Form 5884-A, Employee Retention Credit, is used by employers affected by qualified disasters to claim a credit for wages paid during the period of inoperability. This form is essential for businesses to recover some of their lost income due to disasters.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 5884-A using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 5884-A, Employee Retention Credit |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 10 |

| Number of pages: | 1 |

| Version: | 2021 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i5884a.pdf |

| Filled form examples: | Form Form 5884-A Examples |

| Language: | English |

| Categories: | employee forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 5884-A Online for Free in 2026

Are you looking to fill out a FORM 5884-A form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 5884-A form in just 37 seconds or less.

Follow these steps to fill out your FORM 5884-A form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 5884-A.

- 2 Enter name(s) shown on return.

- 3 Fill in identifying number and qualified wages.

- 4 Calculate total qualified wages and credits.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 5884-A Form?

Speed

Complete your Form 5884-A in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 5884-A form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 5884-A

Form 5884-A, Employer's Application for Disaster Relief Provisions, is a form used by eligible employers to apply for various disaster relief provisions, including the Employee Retention Credit (ERC) for Qualified Disasters. Employers who have experienced a qualified disaster and have had their operations suspended or experienced a significant decline in gross receipts may be eligible for these provisions.

Form 5884-A should be filed along with the employer's quarterly employment tax return, Form 941, for the quarter in which the qualified disaster occurred. If the employer is required to file on a monthly basis, the form should be filed with Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Adjusted Employer's Annual Federal Tax Return (Form 940), as applicable. The form can be filed electronically or by mail to the address listed on the form instructions.

The Employee Retention Credit (ERC) is a refundable tax credit designed to encourage employers to keep employees on their payroll during periods of significant disruption or closure due to a qualified disaster. The credit is equal to 70% of qualified wages paid to eligible employees, up to $10,000 per employee per quarter. This translates to a maximum credit of $7,000 per employee per quarter. Eligible wages include those paid for hours not worked due to the disaster, as well as those paid for hours worked during the disaster period. The credit is calculated on a per-employee basis, and the total credit amount is determined by multiplying the percentage of credit (70%) by the total qualified wages paid to each eligible employee.

Employers who have experienced a qualified disaster and have had their operations fully or partially suspended, or have experienced a significant decline in gross receipts, may be eligible for the Employee Retention Credit for Qualified Disasters. Eligibility is determined on a case-by-case basis, and employers should refer to the instructions for Form 5884-A and the IRS website for the most current information on eligibility requirements.

Qualified wages are wages paid to eligible employees during the period that the employer's operations were fully or partially suspended due to a qualified disaster, or during a period in which the employer experienced a significant decline in gross receipts. Wages paid for hours not worked due to the disaster, as well as wages paid for hours worked during the disaster period, may be considered qualified wages. The wages must be paid or incurred during the calendar quarter in which the employer files its application for disaster relief provisions, or in the preceding or following quarter. Employers should refer to the instructions for Form 5884-A and the IRS website for the most current information on determining qualified wages.

The total qualified wages for 2018 through 2019 disasters are calculated by adding line 1 (total qualified wages paid to employees) of Form 941, Employer's Quarterly Federal Tax Return, for the quarters in which the disaster occurred. You may also include qualified wages paid for sick and family leave if the leave was taken due to the disaster. The maximum amount of qualified wages for each employee for any calendar quarter is $20,000, and the maximum amount of qualified health plan expenses is $10,000.

The total qualified wages for 2020 disasters are calculated by adding line 5 (total qualified wages, including allocable qualified health plan expenses, for all employees) of Form 941, Employer's Quarterly Federal Tax Return, for the quarters in which the disaster occurred. The maximum amount of qualified wages for each employee for any calendar quarter is $10,000, and the maximum amount of qualified health plan expenses is $10,000.

The adjustment for the deduction for salaries and wages is made by subtracting the total qualified wages from the total wages paid to employees in the affected quarters. This adjustment is reported on Form 941, line 11, and is carried forward to Form 1040, Schedule 1, line 11. This adjustment is also used to determine the Employer's Share of Social Security Tax on wages paid to employees in the affected quarters.

The amount from lines 2 and 3 (total qualified wages and total qualified health plan expenses) are added together to determine the total amount of qualified wages and qualified health plan expenses for the affected quarters. This total amount is reported on line 4 of the form.

Cooperatives, estates, and trusts should report the total amount on line 4 (total qualified wages and qualified health plan expenses) on their respective income tax returns. Cooperatives should report this amount on Form 1120, U.S. Corporation Income Tax Return, line 11. Estates and trusts should report this amount on Form 1041, U.S. Income Tax Return for Estates and Trusts, line 11.

Partnerships and S corporations should report the total qualified disaster relief wages (QWRW) paid to their employees on line 4a of Form 941, Employer's Quarterly Federal Tax Return. They will then subtract this amount from their total wages, tips, and other compensation paid to their employees during the quarter, and report the difference on line 1a of Form 941. The partnership or S corporation will also report the total QWRW paid to each employee on Form W-2, Box 14, with the code 'Q'.

All other taxpayers, including self-employed individuals, should report the total qualified disaster relief wages (QWRW) paid to their employees on line 4a of Form 941. They will then subtract this amount from their total wages, tips, and other compensation paid to their employees during the quarter, and report the difference on line 1a of Form 941. The employer will also report the total QWRW paid to each employee on Form W-2, Box 14, with the code 'Q'.

Line 5 is used by cooperatives, estates, and trusts to report the total qualified disaster relief wages (QWRW) paid to their patrons or beneficiaries. This amount is reported on Form 1042-S, Form 1042, or Form 1120-S, as applicable.

The amount allocated to patrons or beneficiaries is calculated by subtracting the total wages, tips, and other compensation paid to all employees (other than the patron or beneficiary) from the total wages, tips, and other compensation paid to all employees during the quarter. The result is the amount of qualified disaster relief wages paid to the patron or beneficiary.

Cooperatives, estates, and trusts should report the total qualified disaster relief wages (QWRW) paid to their patrons or beneficiaries on Form 3800, Part III, line 1aa. This amount is reported in Box 11 of Form 1042-S, Form 1042, or Form 1120-S, as applicable.

The Paperwork Reduction Act (PRA) notice is included in Form 5884-A to comply with the requirements of the Paperwork Reduction Act of 1995. The PRA aims to minimize the reporting burden on taxpayers by reducing the need to provide the same information to multiple government agencies. The notice includes the OMB control number and expiration date of the form, which helps ensure that the information collected is necessary and efficient.

The instructions for completing Form 5884-A, along with other related forms and publications, can be found on the IRS website (www.irs.gov). You can search for Form 5884-A using the Form Finder tool or by visiting the Disaster-Related Tax Topics page. The IRS website is updated regularly to reflect any changes to the form or its instructions. It is recommended that you check the website frequently for the latest information to ensure that you are using the most current version of the form.

Compliance Form 5884-A

Validation Checks by Instafill.ai

1

Form Revision Check for 2018 or Later

Ensures that the form being used is the March 2021 revision of Form 5884-A for tax years beginning in 2018 or later. This check is crucial as it verifies the form's version is current and applicable for the specified tax years, preventing the use of outdated forms that may contain incorrect information or calculations. It also ensures compliance with the IRS's requirements for the Employee Retention Credit for Qualified Disasters.

2

Form Revision Check for Pre-2018

Confirms that for tax years prior to 2018, the appropriate prior revisions of the form are used. This validation is important to maintain accuracy in filing, as different tax years may have different rules and calculations. It helps to avoid processing delays or errors that could arise from using an incorrect form version for a specific tax year.

3

Qualified Wages Limit Check

Verifies that the total qualified wages entered on lines 1a and 1b do not exceed $6,000 for each qualified employee. This check is essential to ensure that the credit claimed does not surpass the allowable limit per employee, as stipulated by the IRS. It maintains the integrity of the tax filing by preventing overstatement of the credit.

4

Deduction Reduction Check

Checks that the deduction for salaries and wages is reduced by the amount on line 2. This validation ensures that the taxpayer does not double-dip by claiming both a full deduction for salaries and wages and the full Employee Retention Credit. It aligns the tax filing with IRS regulations that require the deduction to be reduced by the amount of the credit claimed.

5

Costs Capitalization Reduction Check

Ensures that any costs capitalized are reduced by the credit amount attributable to these costs. This check is important to prevent the taxpayer from claiming a credit on costs that have been capitalized, which would result in an incorrect calculation of taxable income. It ensures that the credit is accurately reflected in the taxpayer's financial statements and tax returns.

6

Confirms the total employee retention credits from Schedule K-1 or Form 1099-PATR are accurately entered on line 3.

The validation process ensures that the total employee retention credits reported on Schedule K-1 or Form 1099-PATR are correctly transcribed to line 3 of the Employee Retention Credit for Qualified Disasters form. It cross-references the amounts from the supporting documents to confirm accuracy. Any discrepancies are flagged for review to prevent errors in the credit calculation. This check is crucial for maintaining the integrity of the tax return and ensuring compliance with tax laws.

7

Verifies that cooperatives allocate any excess credit to patrons and calculate the unused amount of the credit allocated to patrons on line 5.

This validation check verifies that cooperatives properly allocate any excess employee retention credit to their patrons. It ensures that the calculation of the unused amount of the credit, which is allocated to patrons, is accurately reflected on line 5 of the form. The check helps maintain compliance with the specific tax provisions applicable to cooperatives and their patrons. It also ensures that the cooperative's tax obligations are met accurately.

8

Ensures that estates and trusts allocate the credit between the estate or trust and the beneficiaries on line 5.

The validation process ensures that for estates and trusts, the employee retention credit is appropriately allocated between the estate or trust itself and the beneficiaries. This allocation is confirmed to be accurately reported on line 5 of the form. The check is designed to uphold the tax rules governing estates and trusts, ensuring that the credit is distributed according to legal requirements and that the form reflects the correct allocation.

9

Includes any Form 5884-A credit from passive activities disallowed for prior years and carried forward to this year on line 5.

This validation check includes verifying that any credit from Form 5884-A related to passive activities, which was disallowed in prior years and is being carried forward to the current year, is accurately included on line 5. It ensures that the carryforward of disallowed credits is in compliance with tax regulations and that the form accurately reflects the taxpayer's entitlements. This check is essential for the correct application of carryforward provisions.

10

Confirms that all members of a controlled group of corporations or businesses under common control are treated as a single employer.

The validation process confirms that all members of a controlled group of corporations, or businesses under common control, are treated as a single employer for the purposes of the Employee Retention Credit for Qualified Disasters form. This check is crucial for ensuring that the credit is applied consistently across the group and that no entity within the group exceeds the credit limitations or duplicates claims. It upholds the integrity of the credit calculation across related entities.

11

Proportionate Share Verification

Ensures that the Employee Retention Credit claimed is accurately based on the proportionate share of qualified wages that contribute to the group's overall credit. It verifies that a detailed statement is attached to the form, outlining the calculation method used to determine the share. This check is crucial to maintain compliance with tax credit regulations and to prevent any discrepancies that may arise from incorrect allocation of wages.

12

Paperwork Reduction Act Compliance

Checks that the form complies with the Paperwork Reduction Act Notice by estimating the time required for recordkeeping, learning about the law or the form, and preparing and sending the form. This validation ensures that the burden on the taxpayer is not excessive and that the form meets federal requirements for information collection and reporting.

13

Record Retention Requirement

Ensures that all records pertaining to the Employee Retention Credit for Qualified Disasters form are retained as mandated by law. This includes documentation of qualified wages, credit calculations, and any other relevant information. The validation confirms that the taxpayer is prepared for any future audits or inquiries regarding the credit claimed.

14

Confidentiality of Information

Confirms that the information provided on the form is kept confidential, in accordance with section 6103 of the Internal Revenue Code. This validation protects sensitive taxpayer information from unauthorized disclosure, maintaining the privacy and security of the data submitted.

15

Form Simplification Suggestions

Verifies that any suggestions for simplifying the Employee Retention Credit for Qualified Disasters form are submitted as indicated in the instructions accompanying the tax return with which this form is filed. This check encourages continuous improvement of the form's usability and clarity, facilitating a better experience for all taxpayers.

Common Mistakes in Completing Form 5884-A

When filling out the Employee Retention Credit for Qualified Disasters form, it is essential to enter the correct amount of qualified wages for each eligible employee on lines 1a and 1b. The total amount should not exceed $6,000 per employee per quarter. Entering more significant amounts may result in an overstatement of the credit, leading to potential penalties and incorrect tax reporting. To avoid this mistake, double-check the wages paid to each employee and ensure they do not exceed the allowable limit.

Another common mistake is neglecting to reduce deductions for salaries and wages by the amount entered on line 2. This reduction is necessary to avoid double-counting the wages when calculating the total income. To prevent this error, make sure to subtract the amount entered on line 2 from the total wages reported on the income statement or tax return.

Cooperatives and estates or trusts may be eligible for excess credits, which need to be allocated to patrons or beneficiaries, respectively. Failing to make these allocations on line 5 may result in incorrect reporting and potential penalties. To avoid this mistake, carefully review the instructions for line 5 and ensure that all required allocations are made accurately.

Attaching a statement showing the allocation of the credit for controlled groups or businesses under common control is mandatory. Failing to do so may result in the rejection of the form or incorrect processing of the credit. To prevent this mistake, ensure that all required statements are attached to the form before submitting it to the appropriate tax authority.

Lastly, it is crucial to retain all required records related to the form, including wage records, tax records, and any supporting documentation. Failing to do so may result in difficulties during audits or future tax filings. To avoid this mistake, establish a record-keeping system and ensure that all necessary documents are stored securely and easily accessible.

Taxpayers may inadvertently use an older version of Form 5884-A to claim the Employee Retention Credit for Qualified Disasters, which could result in incorrect calculations or denial of the credit. To avoid this mistake, ensure that the latest version of Form 5884-A is used and that it corresponds to the appropriate tax year. The IRS website provides the most up-to-date forms and instructions. Additionally, taxpayers should double-check the form instructions and deadlines to ensure timely filing.

Taxpayers who receive the Employee Retention Credit from a partnership, S corporation, cooperative, estate, or trust, may overlook reporting the credit directly on their Form 3800 for other taxpayers. Failure to report the credit could result in underreported income or missed opportunities for tax savings. To prevent this mistake, taxpayers should carefully review the instructions for Form 3800 and ensure that they report all relevant credits, including those received from pass-through entities or other sources. Additionally, maintaining accurate records of all income and credits is essential for proper reporting and potential future audits.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 5884-A with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 5884-a forms, ensuring each field is accurate.