Form 5884-A, Employee Retention Credit Completed Form Examples and Samples

Explore a completed example of Form 5884-A used by a mid-sized retail business to claim Employee Retention Credit due to COVID-19 impacts. This example includes essential business details, credit calculation, and authoritative signature, offering a practical guide for filing correctly.

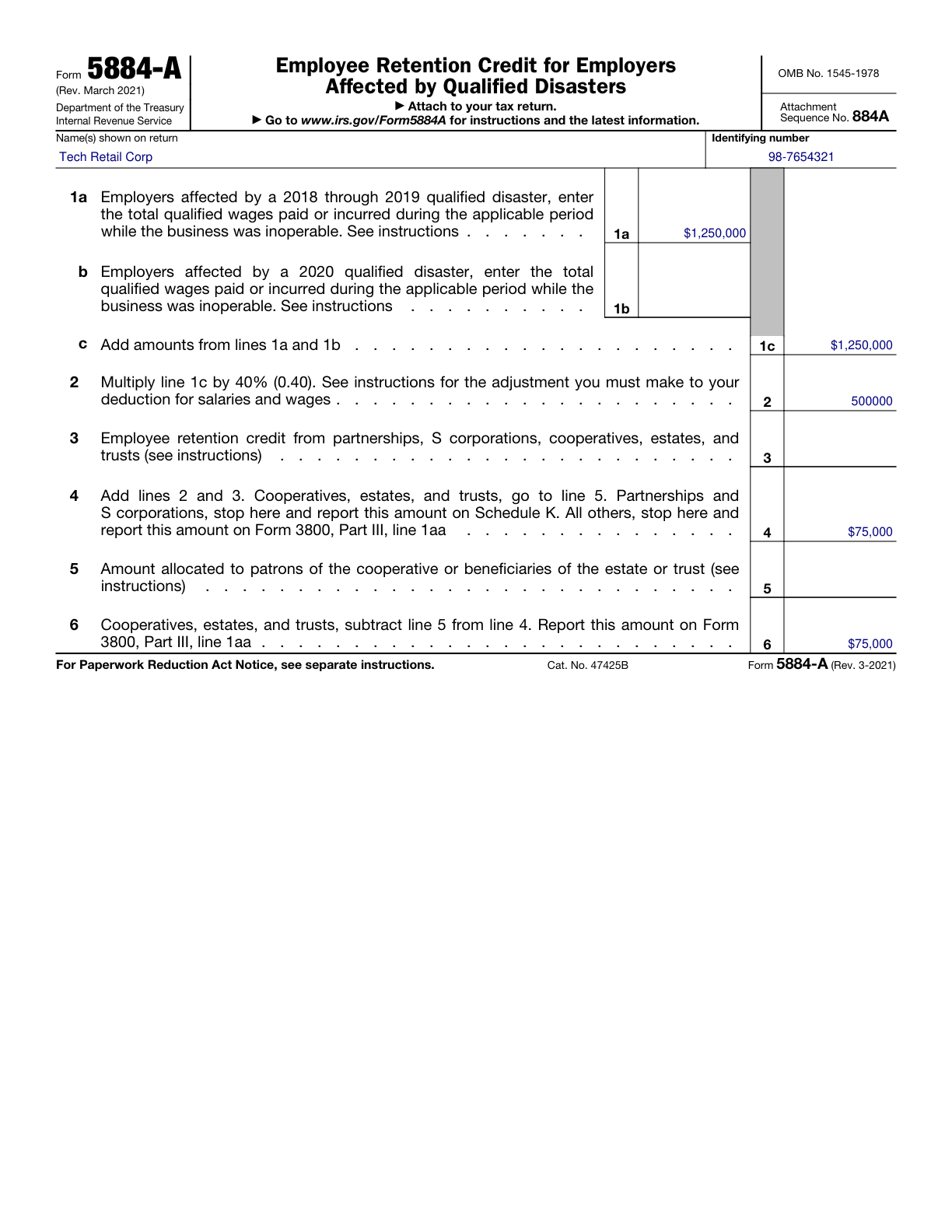

Form 5884-A Example – Employee Retention Credit

How this form was filled:

This example demonstrates how a mid-sized retail company fills out Form 5884-A to claim Employee Retention Credit due to COVID-19 impacts. It contains essential business information, credit calculation, and authoritative signature.

Information used to fill out the document:

- Business Name: Tech Retail Corp

- Employer Identification Number (EIN): 98-7654321

- Business Address: 456 Innovation Avenue, New York, NY, 10001

- Total Number of Employees: 150

- Qualified Wages Paid: $1,250,000

- Credit Calculation: $75,000

- COVID-19 Impact Description: Significant decline in gross receipts

- Authorized Signature: Jane Smith

- Date Signed: 03/10/2025

What this filled form sample shows:

- Complete business information and employer identification

- Detailed calculation of qualified wages and resultant credit

- Explanation of COVID-19 impact on business operations

- Properly formatted signature and date

- Useful for mid-sized businesses in the retail sector

Form specifications and details:

| Use Case: | Mid-sized retail business claiming Employee Retention Credit |

| Filing Requirement: | COVID-19 related impacts on business |