Form 7206, Self-Employed Health Ins. Ded. Completed Form Examples and Samples

Explore our detailed example of Form 7206 for Self-Employed Health Insurance Deduction. Learn how a self-employed individual accurately completes this form to deduct health insurance premiums from taxable income.

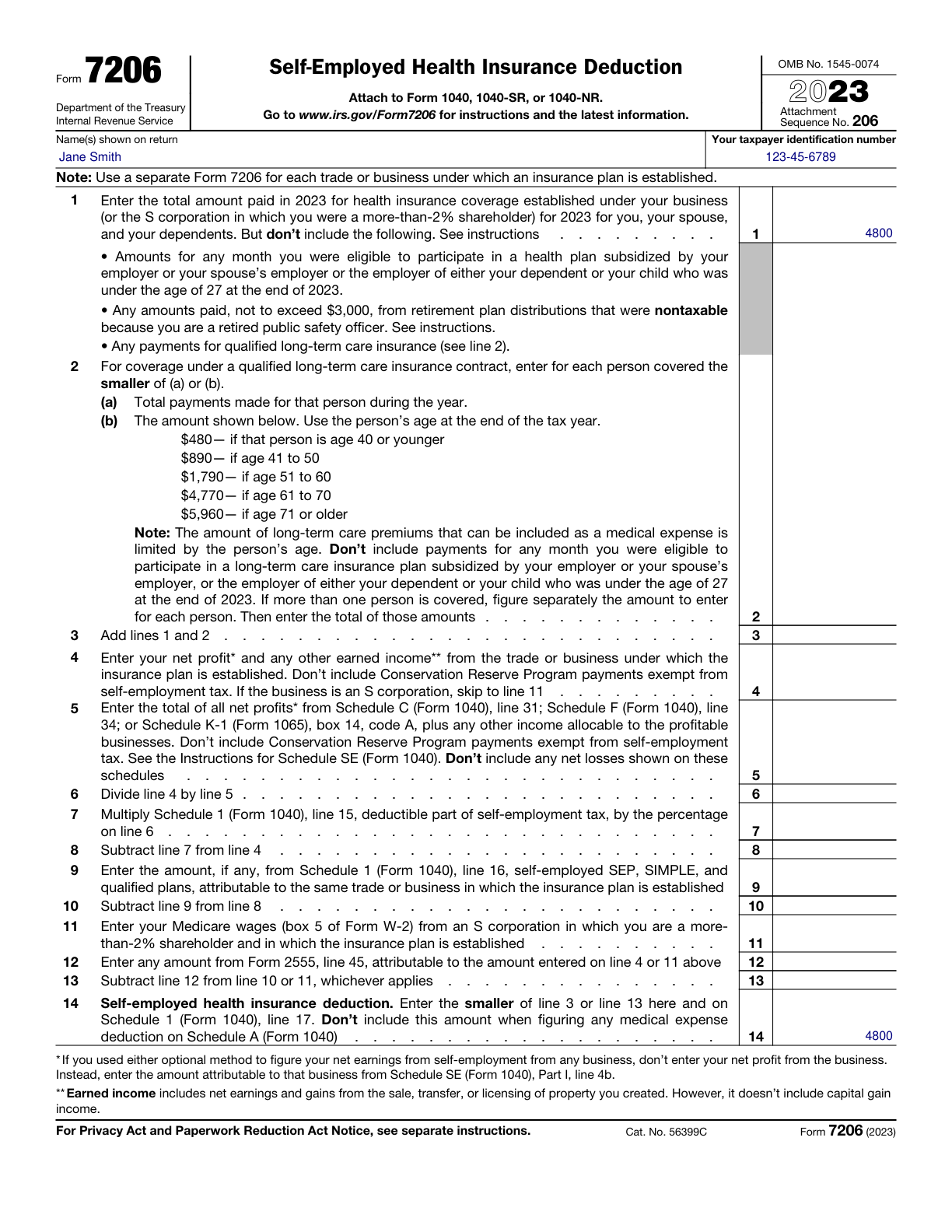

Form 7206 Example – Self-Employed Health Insurance Deduction

How this form was filled:

This example demonstrates how a self-employed individual completes Form 7206 to deduct their health insurance premiums from their taxable income.

Information used to fill out the document:

- Taxpayer Name: Jane Smith

- Occupation: Freelance Graphic Designer

- Business Name: Smith Creations

- Health Insurance Provider: Health Co.

- Premiums Paid: 4800

- Tax Year: 2024

- Social Security Number: 123-45-6789

- Signature: Jane Smith

- Date: 03/15/2025

What this filled form sample shows:

- Illustrates completion of taxpayer information and business name

- Highlights premium payment details for accurate deduction

- Includes health insurance provider for validation

- Properly formatted signature and date

Form specifications and details:

| Use Case: | Self-employed individual claiming health insurance premium deduction |

| Relevant Year: | 2024 Tax Year |

| Deduction Type: | Self-Employed Health Insurance |