Form 8613, Return of Excise Tax Completed Form Examples and Samples

Explore our detailed example of Form 8613: Annual Return of Excise Tax. This guide walks you through the correct process of filling out this IRS form, including taxpayer details, tax year, and excise tax calculation. Ideal for financial entities needing precise guidance on excise tax reporting.

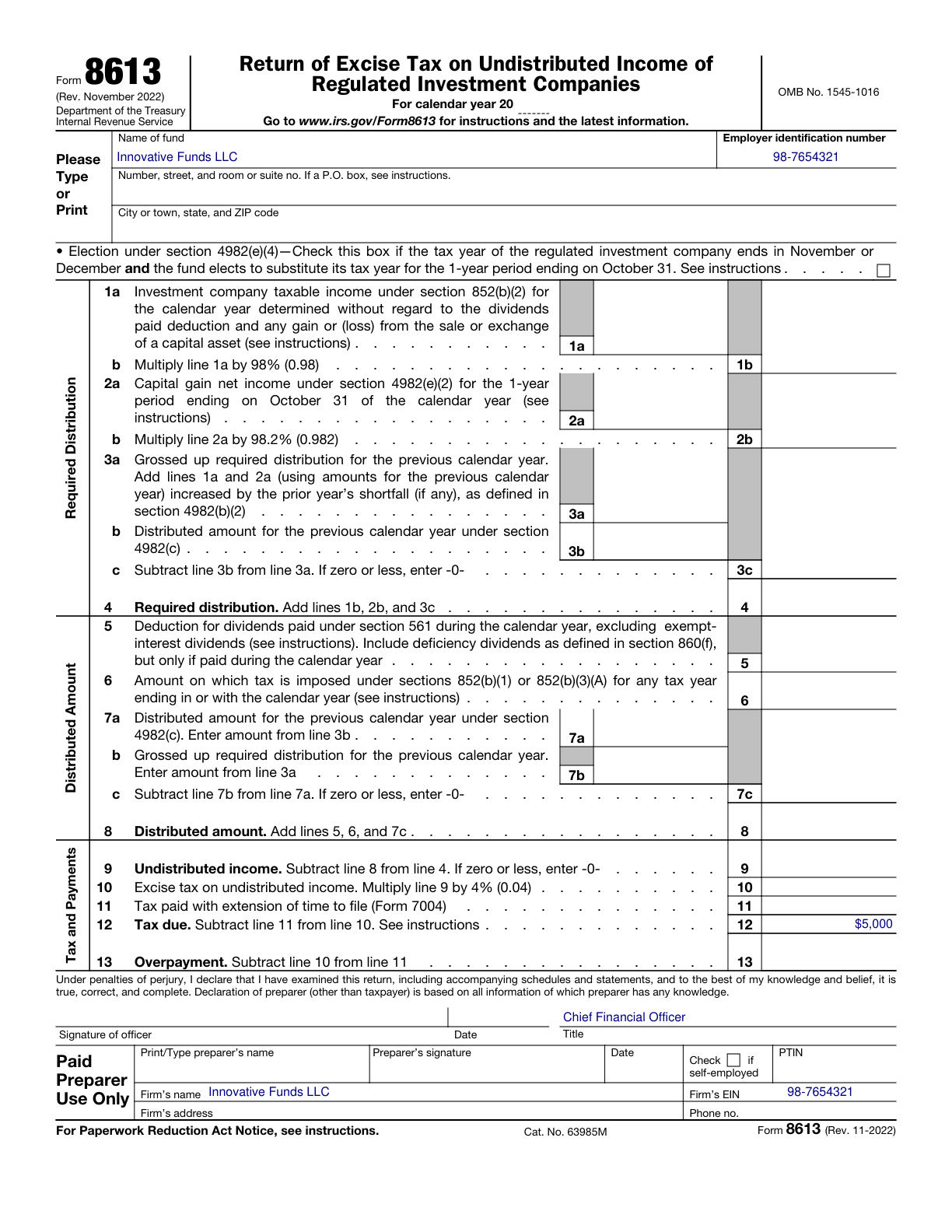

Form 8613 Example – Annual Return of Excise Tax

How this form was filled:

This example demonstrates how to accurately fill out Form 8613 for reporting the annual return of excise tax. It includes specific details such as taxpayer information, tax year, and total excise tax amount calculated for the year.

Information used to fill out the document:

- Taxpayer Name: Innovative Funds LLC

- Taxpayer Identification Number (TIN): 98-7654321

- Tax Year: 2025

- Total Excise Tax Amount: $5,000

- Filing Date: 04/30/2025

- Signature: Jane Smith

- Title: Chief Financial Officer

What this filled form sample shows:

- Accurate completion of taxpayer identification and taxpayer name

- Calculation of total excise tax amount to be reported

- Appropriate signature and title provided for representation

- Details filled within the specified tax year

Form specifications and details:

| Use Case: | Annual return reporting of excise tax for a financial entity |

| Form Type: | IRS Form 8613 |

| Purpose: | To report and pay annual excise taxes |