Yes! You can use AI to fill out Form 8910, Alternative Motor Vehicle Credit

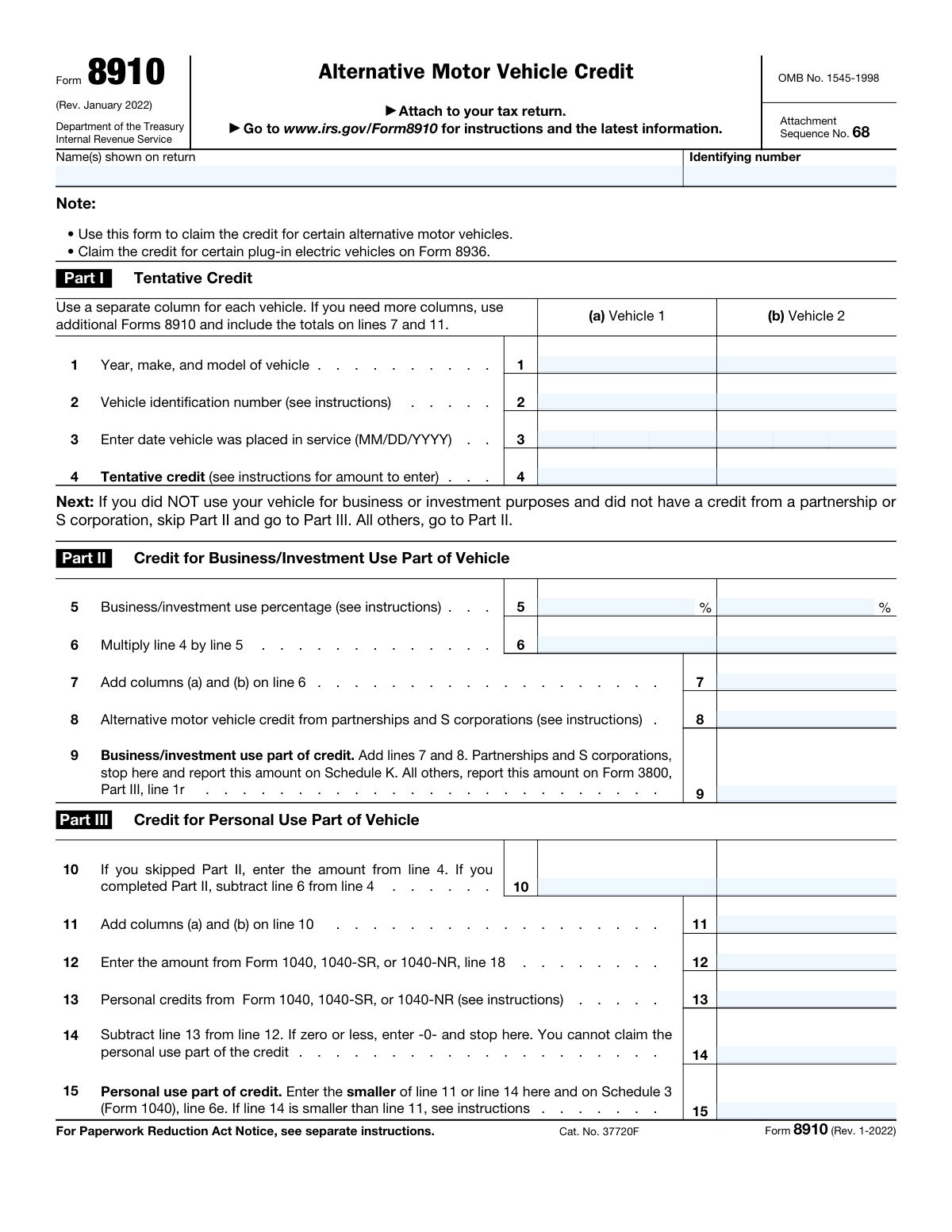

Form 8910, Alternative Motor Vehicle Credit, is used to claim a credit for certain alternative motor vehicles. This form is important for taxpayers who have purchased eligible vehicles, as it allows them to reduce their tax liability by claiming the appropriate credits.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 8910 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 8910, Alternative Motor Vehicle Credit |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 28 |

| Number of pages: | 1 |

| Version: | 2022 |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i8910.pdf |

| Filled form examples: | Form Form 8910 Examples |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 8910 Online for Free in 2026

Are you looking to fill out a FORM 8910 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 8910 form in just 37 seconds or less.

Follow these steps to fill out your FORM 8910 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 8910.

- 2 Enter your name and identifying number.

- 3 Provide vehicle details and tentative credit.

- 4 Complete business/investment use section if applicable.

- 5 Fill out personal use part of the credit.

- 6 Sign and date the form electronically.

- 7 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 8910 Form?

Speed

Complete your Form 8910 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 8910 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 8910

Form 8910, Alternative Motor Vehicle Credit, is used to calculate and claim a credit for the cost of purchasing, leasing, or placing in service certain alternative motor vehicles or their components. These vehicles include qualified fuel cell motor vehicles, qualified hybrid vehicles, qualified plug-in electric vehicles, and qualified alternative fuel vehicle refueling property.

Individuals, estates, and trusts who have purchased, leased, or placed in service a qualified alternative motor vehicle or qualified alternative fuel vehicle refueling property during the tax year should file Form 8910 to calculate and claim the credit.

Part I of Form 8910 requires the taxpayer to provide information about each qualified alternative motor vehicle or qualified alternative fuel vehicle refueling property, including the vehicle identification number (VIN), the date of acquisition, the cost or lease price, and the type of vehicle or property. The taxpayer must also indicate whether the vehicle is a new or used vehicle and whether it is a passenger automobile or light truck.

The tentative credit for each vehicle is calculated using the applicable percentage and the cost or lease price of the vehicle. The applicable percentage depends on the type of vehicle and the taxpayer's taxable income. The instructions for Form 8910 provide tables to help taxpayers determine the applicable percentage. The tentative credit is then reduced by any qualified plug-in electric vehicle credit or qualified fuel cell motor vehicle credit the taxpayer may be eligible for.

If you used your qualified alternative motor vehicle for business or investment purposes, you must complete Part II of Form 8910 to figure the business use percentage and the business use credit. If you received a credit from a partnership or S corporation for the same vehicle, you must subtract that credit from the total credit you figure on Form 8910.

To calculate the credit for business or investment use in Part II of Form 8910, you need to follow these steps:

1. Determine the total amount of qualified fuel costs for the tax year. Qualified fuel costs include the cost of alternative fuel and the cost of the transportation of the alternative fuel to the point where it is first used, sold, or otherwise disposed of in a trade or business or in an activity held for the production of income.

2. Determine the percentage of the total amount of qualified fuel costs that is attributable to business or investment use.

3. Multiply the total amount of qualified fuel costs by the percentage of business or investment use.

4. Enter the result on line 1 of Part II.

5. Multiply line 1 by the alternative motor vehicle credit rate for the tax year.

6. Enter the result on line 2.

7. Subtract line 3 from line 2 to find the credit for business or investment use.

If you are not required to complete Part II of Form 8910, you should still complete Part III to claim the credit for personal use of an alternative motor vehicle. If you are not required to complete Part II because you did not have any qualified fuel costs for business or investment use during the tax year, you should enter a zero on line 1 of Part II and sign the form.

To calculate the credit for personal use in Part III of Form 8910, you need to follow these steps:

1. Determine the total amount of qualified fuel costs for personal use during the tax year. Qualified fuel costs include the cost of alternative fuel and the cost of the transportation of the alternative fuel to the point where it is first used in a personal vehicle.

2. Multiply the total amount of qualified fuel costs for personal use by the alternative motor vehicle credit rate for the tax year.

3. Enter the result on line 1 of Part III.

4. Subtract any qualified fuel costs for business or investment use (from Part II) from the total qualified fuel costs for personal use.

5. Multiply the result from step 4 by the alternative motor vehicle credit rate for the tax year.

6. Enter the result on line 2 of Part III.

7. Subtract line 1 from line 6 to find the credit for personal use.

To complete Part III of Form 8910, you need to provide the following information:

1. Your name, address, and social security number or taxpayer identification number.

2. The total amount of qualified fuel costs for personal use during the tax year.

3. The alternative motor vehicle credit rate for the tax year.

4. The total amount of qualified fuel costs for business or investment use during the tax year (if applicable).

Lines 10 and 11 in Part III of Form 8910 serve different purposes.

Line 10 is used to calculate the total amount of qualified fuel costs for personal use during the tax year. This amount is multiplied by the alternative motor vehicle credit rate to determine the credit for personal use (line 2).

Line 11 is used to calculate the alternative fuel mixture percentage for the tax year. This percentage is used to determine the amount of qualified fuel costs for business or investment use that can be subtracted from the total qualified fuel costs for personal use to find the net qualified fuel costs for personal use (line 6).

The Alternative Motor Vehicle Credit allows taxpayers to claim a credit for the purchase of certain alternative fuel vehicles or for the installation of alternative fuel vehicle refueling equipment. The personal credits that can be subtracted from line 12 in Part III include the Qualified Plug-in Electric Drive Motor Vehicle Credit, the Alternative Fuel Vehicle Refueling Property Credit, and the Alternative Fuel Mixture Excise Tax Credit. Taxpayers should refer to the instructions for Form 8910 and the IRS Publication 596 for more information on these credits.

If the personal use part of the Alternative Motor Vehicle Credit is less than the total credit, taxpayers should report the excess amount as a business credit on Form 4562, Part II. The instructions for Form 8910 provide more details on how to calculate and report the business credit.

The Alternative Motor Vehicle Credit from Form 8910 is reported on Form 1040, line 43, or Form 1041, line 15, as other credits. Taxpayers should refer to the instructions for their specific tax form for more information on reporting the credit.

The Paperwork Reduction Act (PRA) Notice on Form 8910 is a statement from the Internal Revenue Service (IRS) that the collection of information on the form is necessary for the IRS to administer and enforce the Internal Revenue Code. The notice includes the estimated time required to complete the form and the estimated burden on taxpayers. Taxpayers are encouraged to read the instructions for Form 8910 carefully to ensure they provide all required information.

Yes, taxpayers can file Form 8910 electronically using IRS-approved software or through the IRS Free File program. Taxpayers should refer to the instructions for Form 8910 and the IRS website for more information on electronic filing options.

The OMB (Office of Management and Budget) No. for Form 8910, Alternative Motor Vehicle Credit, is 1120-2714.

The latest instructions and information for Form 8910, Alternative Motor Vehicle Credit, can be found on the IRS (Internal Revenue Service) website. You can visit the IRS website at www.irs.gov and search for Form 8910 in the Forms library. Alternatively, you can call the IRS Business and Specialty Tax Line at 1-800-829-4933 for assistance.

To claim the credit for certain plug-in electric vehicles, you should use Form 8910, Alternative Motor Vehicle Credit. This form is used to calculate and claim the credit for qualified plug-in electric vehicles, including passenger vehicles and light trucks. Make sure to follow the instructions carefully and provide all required information to ensure the accurate calculation and claim of the credit.

Compliance Form 8910

Validation Checks by Instafill.ai

1

Ensures the Vehicle Identification Number (VIN) entered on Line 2 is a valid 17-character alphanumeric string.

This validation check ensures that the VIN provided on Line 2 adheres to the standard format, which is a 17-character alphanumeric string. It confirms that all characters are either letters or numbers, without any special symbols or spaces. The check also verifies that the VIN does not contain any illegal characters that are not used in VINs, such as 'I', 'O', or 'Q'. Additionally, it validates that the VIN length is exactly 17 characters, as required for proper identification of the vehicle.

2

Confirms that the tentative credit amount entered on Line 4 matches the manufacturer's or domestic distributor's certification to the IRS.

This validation check confirms that the amount of tentative credit claimed on Line 4 is consistent with the certification provided by the vehicle's manufacturer or domestic distributor to the IRS. It ensures that the credit amount does not exceed the certified limit and matches the figures authorized for the specific make and model of the alternative motor vehicle. The check also verifies the accuracy of the credit calculation against the current IRS guidelines and approved amounts.

3

Verifies the percentage of business/investment use entered on Line 5 is calculated correctly based on the miles driven for business purposes versus total miles driven.

This validation check verifies that the percentage of business or investment use claimed on Line 5 is accurately calculated. It ensures that the calculation is based on the actual miles driven for business or investment purposes in comparison to the total miles driven by the vehicle. The check also confirms that the percentage is represented as a decimal fraction of one and does not exceed 100%, which would be logically incorrect.

4

Checks that any alternative motor vehicle credits reported from a partnership or S corporation on Line 8 are accurately totaled from Schedule K-1.

This validation check ensures that any alternative motor vehicle credits reported on Line 8, which originate from a partnership or S corporation, are accurately summed up from the information provided on Schedule K-1. It confirms that the total credit amount claimed is the aggregate of the individual credits reported on the K-1 forms. The check also verifies that the credits are applicable for the tax year in question and have been correctly transferred to the main form.

5

Validates the total of other credits entered on Line 13 against the sum from Schedule 3 (Form 1040) lines 1 through 4, 6d, and 6I; and Form 5695, line 30.

This validation check validates that the total of other credits entered on Line 13 is in agreement with the sum of the credits reported on Schedule 3 (Form 1040) lines 1 through 4, 6d, and 6I, as well as Form 5695, line 30. It ensures that there are no discrepancies between the credits claimed on different parts of the tax return and that the total on Line 13 accurately reflects the sum of these individual credit amounts. The check also confirms that the credits are eligible for the current tax year and have been properly documented.

6

Qualified Fuel Cell Vehicle Confirmation

The system confirms that the vehicle in question is indeed a qualified fuel cell vehicle, which is a prerequisite for eligibility for the Alternative Motor Vehicle Credit. It cross-references the vehicle's make, model, and year against the list of qualified fuel cell vehicles provided by the IRS. This ensures that the credit is not erroneously claimed for a vehicle that does not meet the necessary environmental and efficiency standards set forth by the government.

7

Vehicle Placement and Purchase Year Verification

The system verifies that the vehicle was placed in service during the tax year for which the credit is being claimed. Additionally, it checks that the vehicle was purchased in 2021 if the credit is being claimed after its expiration date. This step is crucial to prevent the claiming of credits for vehicles that were not in service within the specified timeframe, thereby upholding the integrity of the tax credit system.

8

Taxpayer Ownership and Usage Check

The system ensures that the taxpayer claiming the Alternative Motor Vehicle Credit is the actual owner of the vehicle. It also confirms that the vehicle is used primarily within the United States, aligning with the credit's stipulations. This check is important to prevent fraudulent claims by individuals who do not own the vehicle or are using it predominantly outside of the U.S., which would disqualify them from receiving the credit.

9

Seller to Tax-Exempt Organization Verification

The system checks if the taxpayer is the seller of the vehicle to a tax-exempt organization, governmental unit, or foreign person/entity. It also verifies whether the tentative credit has been properly disclosed to the purchaser. This validation is essential to ensure transparency and proper tax credit allocation, as the credit may not be claimed by the seller in such transactions.

10

Basis Reduction by Credit Amount Verification

The system verifies that the basis of the vehicle has been appropriately reduced by the amount of the Alternative Motor Vehicle Credit claimed, if applicable. This step is necessary to ensure that the taxpayer's records accurately reflect the reduced basis, which affects depreciation and any future calculations related to the sale or exchange of the vehicle.

11

No Carryback or Forward of Unused Personal Credit

Ensures that there is no attempt to carry back or forward any unused personal portion of the Alternative Motor Vehicle Credit due to tax liability limits as indicated on Line 15 of the form. This validation check is crucial to comply with the regulations that stipulate the credit must be used in the year the vehicle is placed in service and cannot be deferred to future tax years or applied to past tax liabilities.

12

Recapture of Credit Compliance

Checks for any required recapture of the credit if the vehicle for which the Alternative Motor Vehicle Credit was claimed no longer qualifies under the specified conditions. This validation is important to ensure that the credit is only maintained for vehicles that continue to meet the eligibility criteria throughout the required period.

13

Recordkeeping for Future Administration

Ensures all necessary records related to the Alternative Motor Vehicle Credit form and its instructions are kept for potential future administration of Internal Revenue laws. This validation check is essential for maintaining proper documentation that may be required for audits, reviews, or other legal purposes.

14

Acknowledgement of Time Estimates

Validates that the estimated time for recordkeeping, learning about the form, and preparing/sending the Alternative Motor Vehicle Credit form is acknowledged and adhered to by the taxpayer. This check ensures that the taxpayer is aware of the time commitment involved and has allocated sufficient resources to comply with these requirements.

15

Current Information and Legislative Changes Review

Confirms that the most current information has been reviewed from the official IRS website for the Alternative Motor Vehicle Credit (IRS.gov/Form8910) and any legislative changes that may affect the form have been considered. This validation ensures that the form is completed with the most up-to-date guidance and takes into account any recent changes in the law.

Common Mistakes in Completing Form 8910

The Vehicle Identification Number (VIN) is a unique code assigned to every motor vehicle. It is essential to enter the correct and complete VIN on Line 2 of the Alternative Motor Vehicle Credit form. Failing to do so may result in incorrect calculations of your credit. To avoid this mistake, ensure you have the correct VIN before filling out the form. You can find the VIN on the vehicle's registration or insurance documents or on the vehicle itself, usually located near the windshield or the driver's side door. Double-check the VIN before submitting the form to prevent any errors.

Line 4 of the Alternative Motor Vehicle Credit form requires you to enter the tentative credit amount from the manufacturer or domestic distributor. This amount is crucial for calculating the actual credit you can claim. Neglecting to enter this information may result in an incorrect credit calculation. To avoid this mistake, ensure you have the necessary information from the manufacturer or domestic distributor before filling out the form. You can find this information on the Certificate of Origin or the invoice from the dealer. Double-check the information before submitting the form to prevent any errors.

Line 5 of the Alternative Motor Vehicle Credit form requires you to calculate the percentage of business or investment use of the vehicle. This percentage is essential for determining the amount of credit you can claim. Neglecting to calculate this percentage may result in an incorrect credit calculation. To avoid this mistake, ensure you have accurate records of the total miles driven for business or investment purposes and the total miles driven for personal use. Use the provided formula on the form to calculate the percentage and double-check your work before submitting the form to prevent any errors.

Line 13 of the Alternative Motor Vehicle Credit form requires you to enter the total of credits from Schedule 3 and Form 5695. This total is crucial for determining the total alternative motor vehicle credit you can claim. Entering an incorrect total may result in an incorrect credit calculation. To avoid this mistake, ensure you have accurate records of all the credits claimed on Schedule 3 and Form 5695. Double-check the totals before submitting the form to prevent any errors.

Line 8 of the Alternative Motor Vehicle Credit form requires you to report any alternative motor vehicle credits received from a partnership or S corporation. Failing to report these credits may result in an incorrect credit calculation. To avoid this mistake, ensure you have accurate records of any alternative motor vehicle credits received from a partnership or S corporation. Report these credits on Line 8 and double-check the information before submitting the form to prevent any errors.

Taxpayers may overlook the fact that they have lost any unused personal credit carryforward when calculating the Alternative Motor Vehicle Credit. This oversight can lead to an incorrect credit amount being claimed. To avoid this mistake, taxpayers should carefully review their previous tax returns and account for any unused personal credit when filling out this form.

Proper documentation and record-keeping are essential when claiming the Alternative Motor Vehicle Credit. Taxpayers may overlook the importance of keeping records related to the purchase, ownership, and disposal of qualifying vehicles. This can lead to errors or discrepancies when calculating the credit. To prevent this mistake, taxpayers should keep detailed records of all transactions related to the qualifying vehicles and refer to the form instructions regularly.

Taxpayers may mistakenly believe they can still claim the Alternative Motor Vehicle Credit for a vehicle that was placed in service after the credit expiration date. This can result in an incorrect credit amount being claimed or even disqualification of the credit. To avoid this mistake, taxpayers should familiarize themselves with the credit expiration dates and ensure that all qualifying vehicles are placed in service before these dates.

Taxpayers may mistakenly claim the Alternative Motor Vehicle Credit for a vehicle that does not meet the qualifications for a fuel cell vehicle. This can result in an incorrect credit amount being claimed or even disqualification of the credit. To prevent this mistake, taxpayers should carefully review the form instructions and ensure that the vehicle meets all the necessary qualifications for the credit.

Taxpayers may overlook the requirement to report the sale of a qualifying vehicle to a tax-exempt organization, governmental unit, or foreign person/entity. This can result in an incorrect credit amount being claimed or even disqualification of the credit. To prevent this mistake, taxpayers should familiarize themselves with the reporting requirements and ensure that all necessary reports are filed.

One of the most common mistakes made when filling out the Alternative Motor Vehicle Credit form is failing to adjust the basis of the vehicle by the amount of the credit claimed. The basis of the vehicle is the cost or other basis in the vehicle before applying the credit. By not making this adjustment, the taxpayer may overstate their basis in the vehicle and potentially underreport their taxable income. To avoid this mistake, it is recommended to carefully review the instructions on the form and make the necessary adjustment to the basis of the vehicle before calculating the credit. Additionally, keeping accurate records of the purchase price, sales price, and any relevant improvements or adjustments made to the vehicle can help ensure the correct basis is used.

Another mistake made when filling out the Alternative Motor Vehicle Credit form is failing to recapture part or all of the credit when the vehicle no longer qualifies. The credit is only allowed for vehicles that are used for business purposes over 50% of the time. If the vehicle is no longer used for business purposes or the percentage of business use falls below 50%, the taxpayer must recapture the previously claimed credit. Failure to do so can result in underreported income and potential penalties. To avoid this mistake, it is recommended to carefully review the instructions on the form and keep accurate records of the percentage of business use for each vehicle. Additionally, if a vehicle is sold, traded, or no longer used for business purposes, the taxpayer should calculate and report any necessary recapture of previously claimed credits on their tax return.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 8910 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 8910 forms, ensuring each field is accurate.