Form 8910, Alternative Motor Vehicle Credit Completed Form Examples and Samples

Explore a comprehensive example of Form 8910, filled to claim the Alternative Motor Vehicle Credit for purchasing a qualified electric vehicle. This detailed walkthrough includes essential taxpayer information, vehicle details, and credit calculations, serving as a valuable reference for accurate form completion.

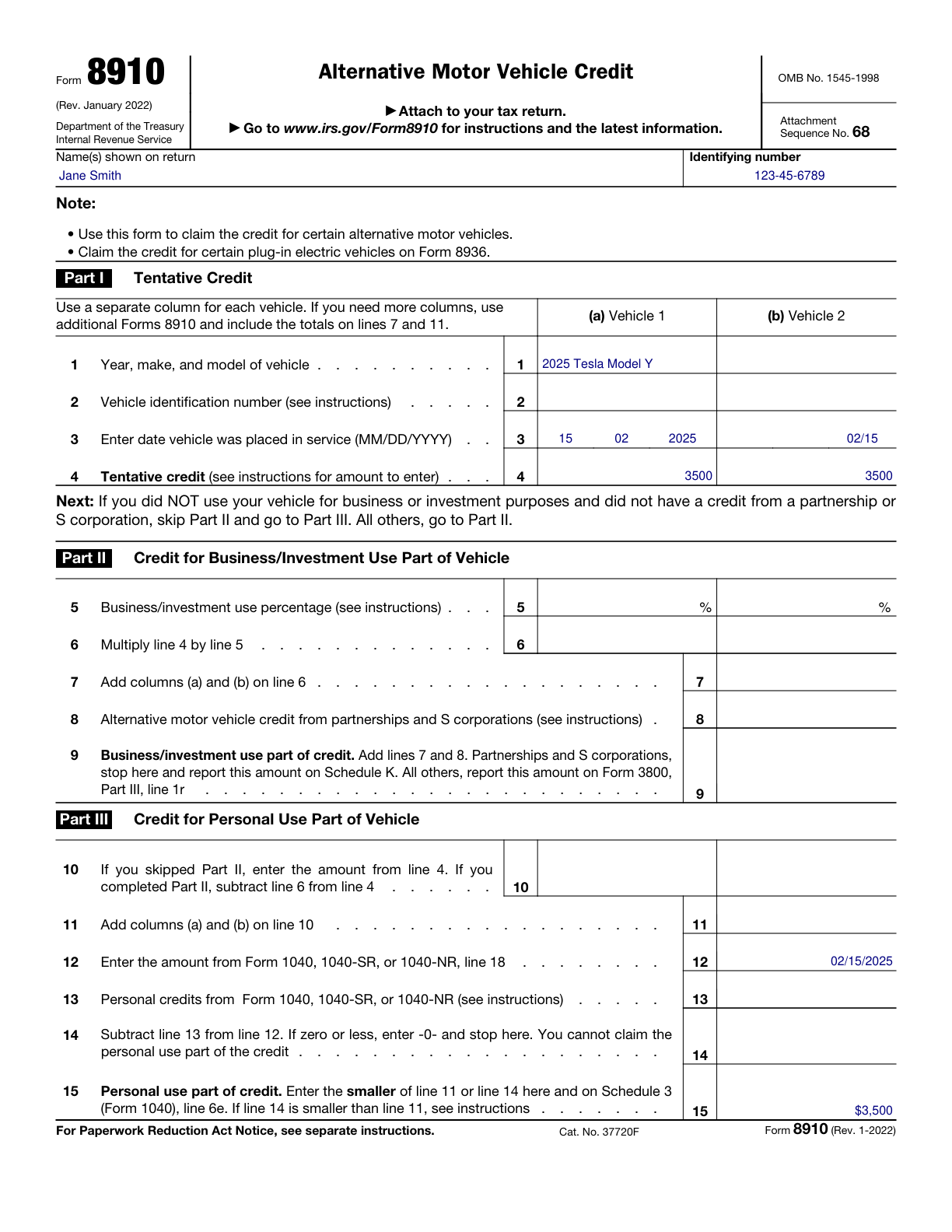

Form 8910 Example – Alternative Motor Vehicle Credit

How this form was filled:

This example showcases a Form 8910 filled out to claim a credit for the purchase of a qualified electric vehicle. The taxpayer's details, vehicle information, and credit calculation are included, showing the proper way to complete the form.

Information used to fill out the document:

- Taxpayer Name: Jane Smith

- Identification Number: 123-45-6789

- Purchase Date: 02/15/2025

- Vehicle Model: Tesla Model Y

- Model Year: 2025

- Credit Amount: $3,500

What this filled form sample shows:

- Accurate depiction of taxpayer information and identification number

- Detailed vehicle purchase date and model details

- Precise calculation of credit amount with all relevant fields filled

- Clear demonstration of eligibility criteria for the credit

Form specifications and details:

| Use Case: | Claiming alternative motor vehicle credit for an electric vehicle purchase |

| Form Year: | 2025 |