Form 8919, Uncollected Social Security and Medicare Tax Completed Form Examples and Samples

Discover a comprehensive example of Form 8919 filled by a freelance graphic designer to report uncollected Social Security and Medicare taxes due to misclassification. This detailed guide includes key entries such as Correcting Entity’s EIN and total wages, providing clarity for individuals in similar situations.

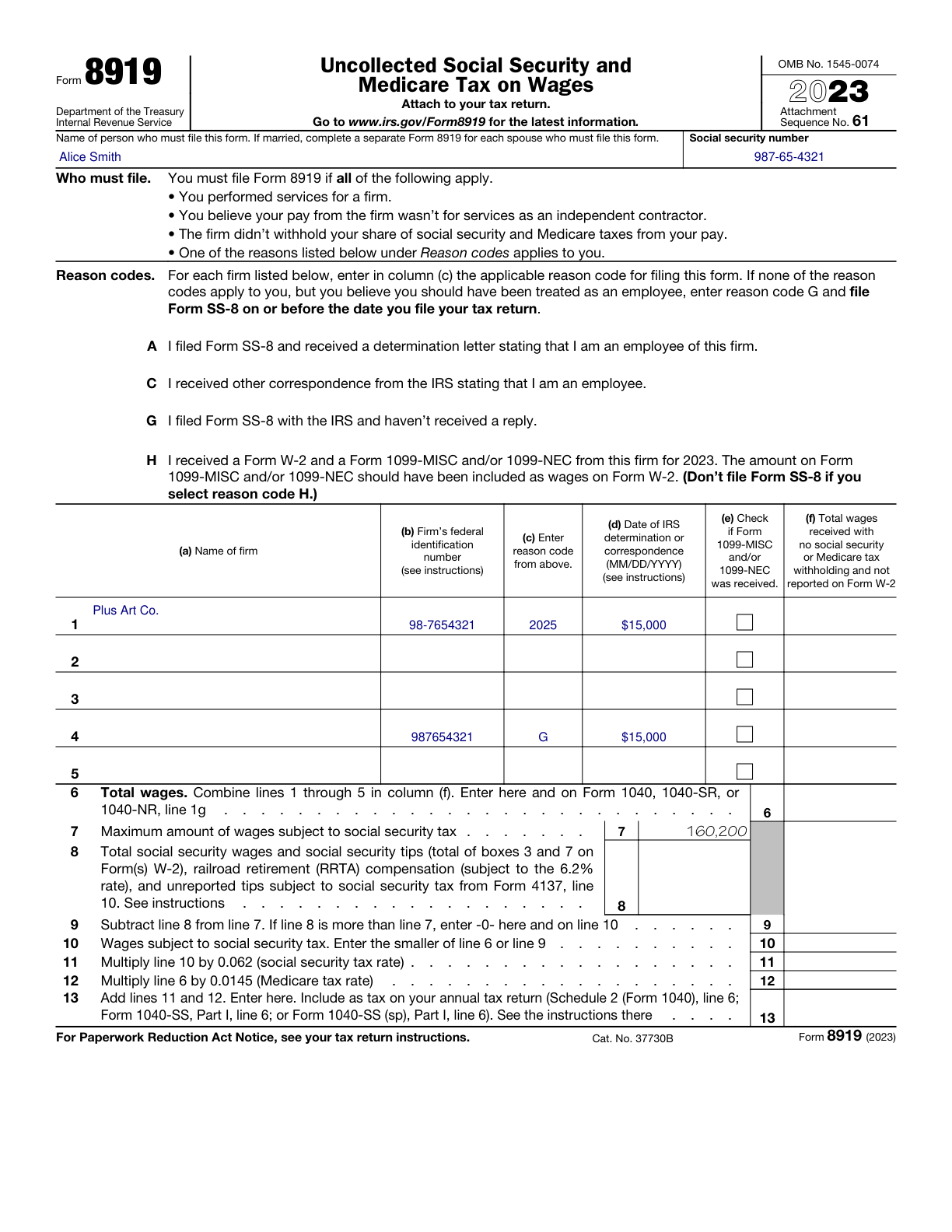

Form 8919 Example – Freelance Graphic Designer

How this form was filled:

This example demonstrates how a freelance graphic designer who was incorrectly classified as an independent contractor can fill out Form 8919 to report uncollected Social Security and Medicare taxes. Key entries include the Correcting Entity’s EIN, total wages, and specific codes for misclassification.

Information used to fill out the document:

- Taxpayer Name: Alice Smith

- Social Security Number: 987-65-4321

- Correcting Entity Employer Identification Number (EIN): 98-7654321

- Total Wages: $15,000

- Reason Code: G

- Correcting Entity Name: Plus Art Co.

- Year: 2025

- Signature: Alice Smith

- Date: 03/20/2025

What this filled form sample shows:

- Accurately filled wages and EIN fields

- Appropriate reason codes for error in classification

- Properly documented signature and date

- Clear example for freelancers or independent contractors

Form specifications and details:

| Use Case: | Freelancer misclassified as independent contractor |