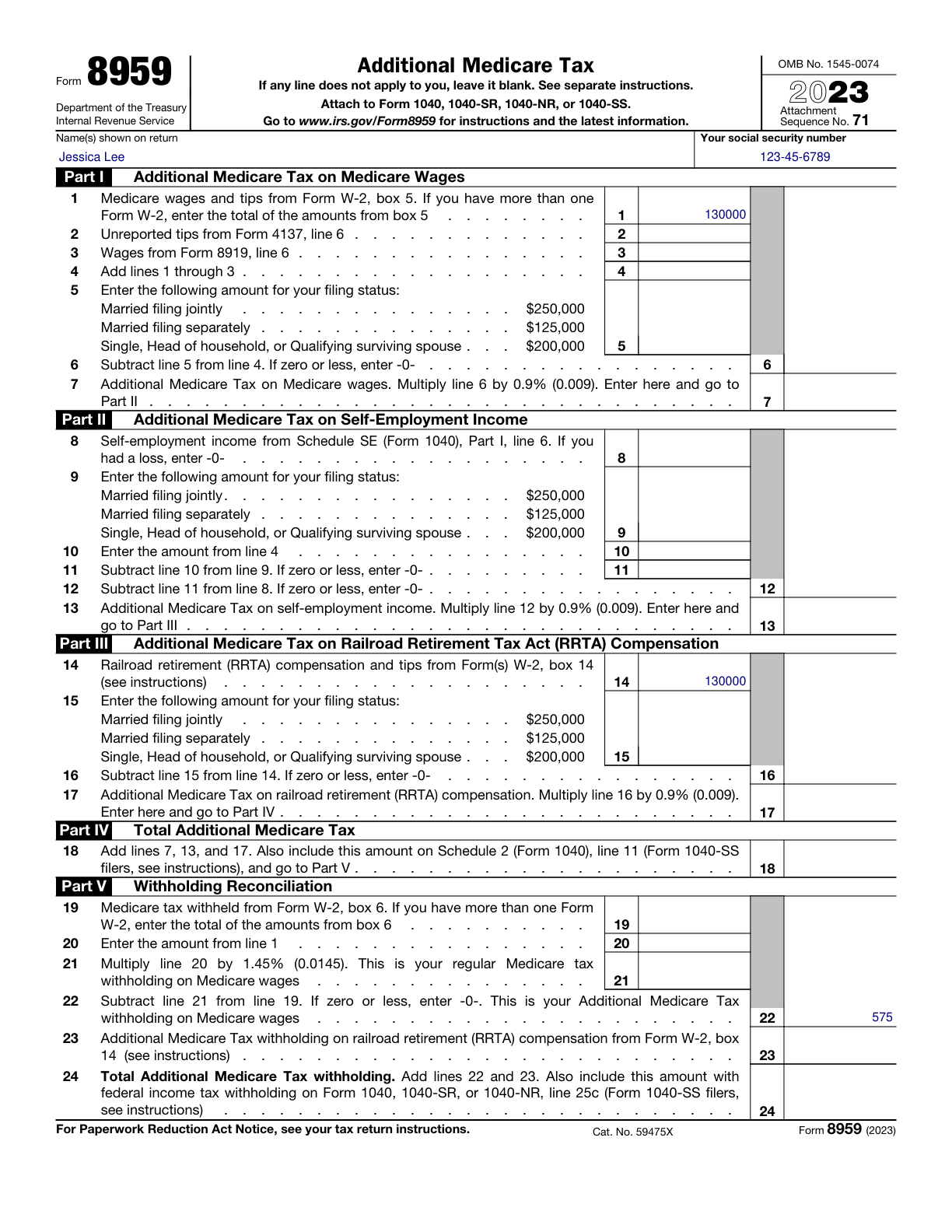

Form 8959, Additional Medicare Tax Completed Form Examples and Samples

Explore a detailed example of Form 8959, designed for high-income earners needing to calculate Additional Medicare Tax. This filled form highlights critical aspects, including adjusted gross income and wage thresholds, to aid in accurate tax reporting and compliance.

Form 8959 Example – Additional Medicare Tax for High-Income Earners

How this form was filled:

This example illustrates the completion of Form 8959 for a high-income individual who has to pay the Additional Medicare Tax. It includes adjusted gross income, wages subject to the tax, and the computation of the tax amount owed.

Information used to fill out the document:

- Taxpayer's Name: Jessica Lee

- Social Security Number: 123-45-6789

- Filing Status: Married filing jointly

- Adjusted Gross Income: 275000

- Wages Before Withholding: 130000

- Medicare Wages: 130000

- Threshold Amount for Filing Status: 250000

- Additional Medicare Tax Owed: 575

What this filled form sample shows:

- Thorough calculation of Additional Medicare Tax for high-income earners

- Demonstrates proper reporting of Medicare wages and tax computation

- Correct application of threshold amounts for married filing jointly

Form specifications and details:

| Use Case: | High-income individual needing to file Form 8959 |

| Applicable Tax Year: | 2025 |

| Filing Deadline: | April 15, 2026 |