Form 911, Request for Taxpayer Advocate Service Assistance Completed Form Examples and Samples

Explore a detailed example of Form 911, Request for Taxpayer Advocate Service Assistance. This filled form provides guidance for taxpayers experiencing issues such as delayed tax refunds. Learn how to correctly complete the form with all required personal, contact, and problem description details to seek assistance.

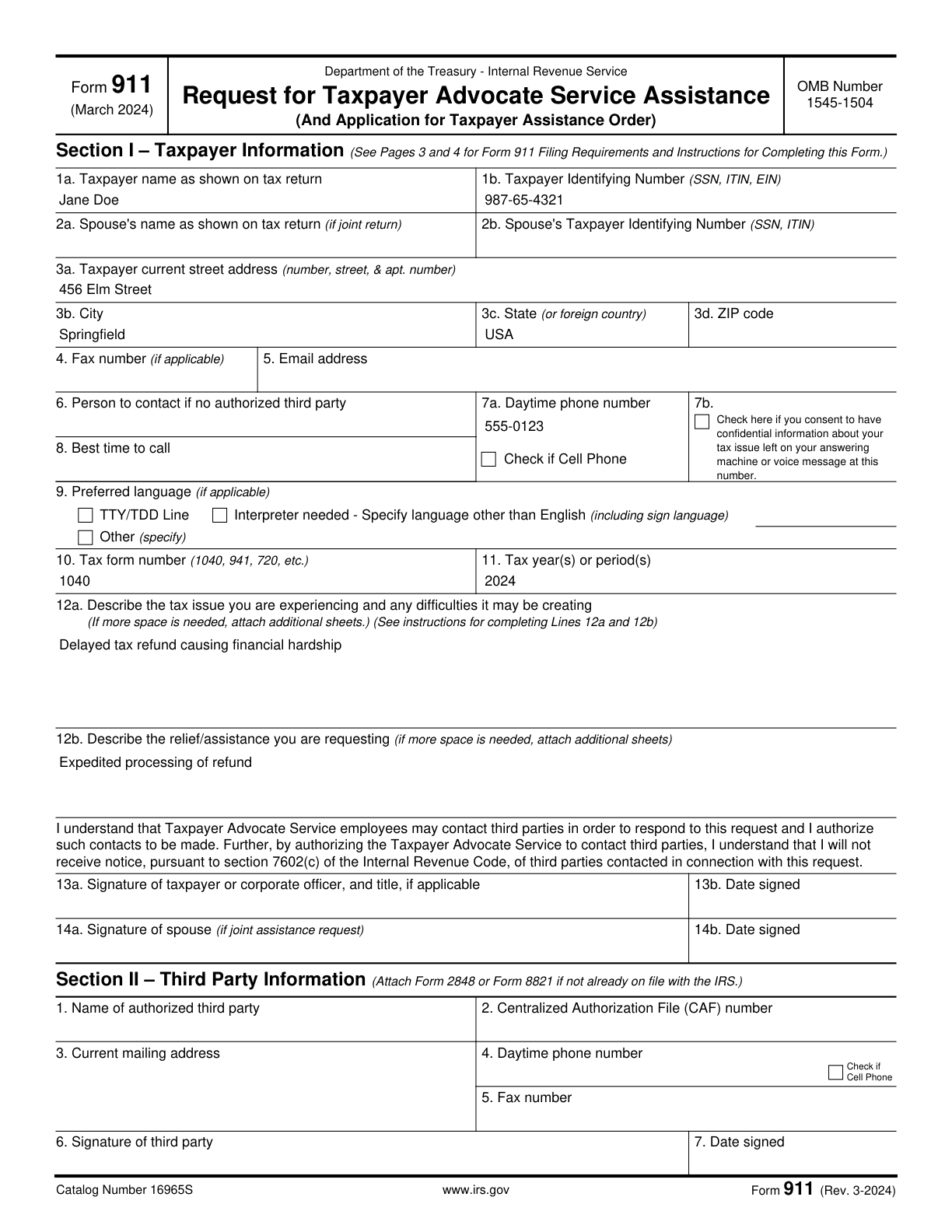

Form 911 Example – Request for Taxpayer Advocate Service Assistance

How this form was filled:

This example showcases the process of filling out Form 911 for requesting assistance from the Taxpayer Advocate Service. It includes all necessary taxpayer information, a detailed explanation of the issue and hardship faced, and a request for specific relief.

Information used to fill out the document:

- Taxpayer's Name: Jane Doe

- Taxpayer Identification Number (TIN): 987-65-4321

- Type of Tax: Individual Income Tax

- Form Number or Year: 1040, 2024

- Contact Information: 456 Elm Street, Springfield, USA, Phone: 555-0123

- Description of Problem: Delayed tax refund causing financial hardship

- Relief Requested: Expedited processing of refund

- Date: 03/12/2025

- Signature: Jane Doe

What this filled form sample shows:

- Complete taxpayer information including TIN and contact details

- Detailed description of the problem leading to hardship

- Clear specification of relief requested

- Correctly formatted signature and date for submission

Form specifications and details:

| Use Case: | Requesting assistance due to delayed tax refund |

| Tax Year: | 2024 |

| Tax Form: | 1040 |