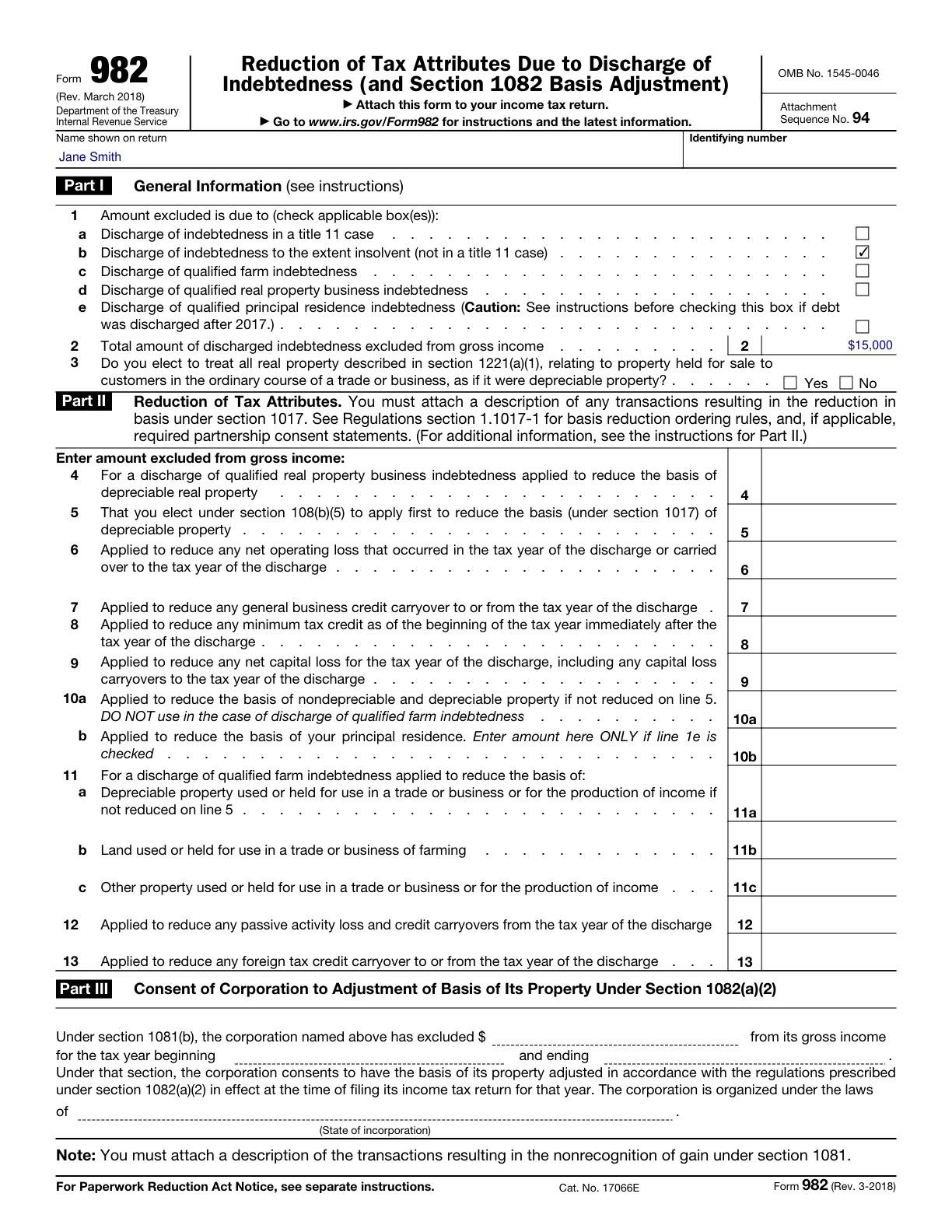

Form 982, Reduction of Tax Attributes Completed Form Examples and Samples

Explore a comprehensive example of Form 982, Reduction of Tax Attributes, demonstrating how to accurately complete the form in cases of debt discharge due to insolvency. This example provides a detailed breakdown of insolvency amounts, discharged debts, and necessary tax attribute adjustments.

Form 982 Example – Discharge of Indebtedness

How this form was filled:

This example demonstrates how to complete Form 982 when debt is discharged due to insolvency. The taxpayer indicates the exclusion from gross income and adjusts tax attributes accordingly.

Information used to fill out the document:

- Taxpayer Name: Jane Smith

- Tax Year: 2025

- Insolvency Amount: $20,000

- Amount of Discharged Debt: $15,000

- Reduction Type: Insolvency

- Date of Discharge: 01/15/2025

- Instructions Followed: Section 108(a)(1)(B)

What this filled form sample shows:

- Accurate detailing of insolvency amount and discharged debt

- Correct application of tax codes relevant to insolvency

- Complete specification of tax attributes adjustments

- Clear identification of the reduction type and discharge date

Form specifications and details:

| Use Case: | Debt discharged due to insolvency |

| Related Tax Code: | Section 108(a)(1)(B) |

| Applicable Tax Year: | 2025 |