California Form 568 (2024), Limited Liability Company Return of Income Completed Form Examples and Samples

Explore detailed examples and samples of a completed California Form 568 (2024), the Limited Liability Company Return of Income. Our filled-out 2024 Form 568 guides illustrate how to report income, calculate the annual tax and LLC fee for various business scenarios.

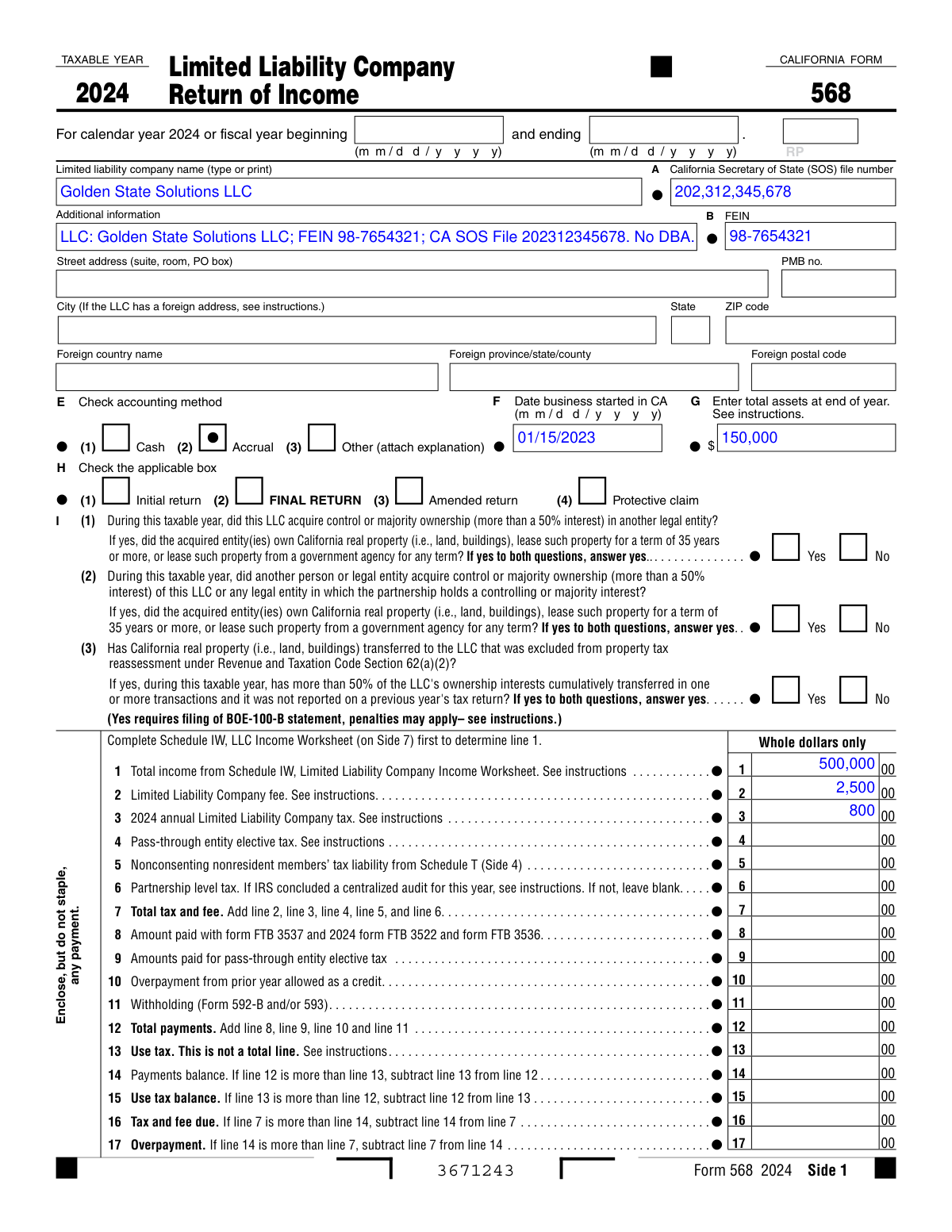

California Form 568 (2024) Example – Multi-Member LLC

How this form was filled:

This is a sample of a completed California Form 568 for a multi-member LLC operating a consulting business. This example highlights the calculation of the annual tax, the LLC fee based on total income, and the reporting of income, deductions, and member information for the 2024 tax year.

Information used to fill out the document:

- LLC Name: Golden State Solutions LLC

- FEIN: 98-7654321

- California SOS File Number: 202312345678

- Date Business Started in CA: 01/15/2023

- Principal Business Activity: Management Consulting

- Principal Product or Service: Business Strategy Services

- Total California Income (Gross Receipts): $500,000

- Ordinary Business Income: $193,200

- Guaranteed Payments to Members: $100,000

- Annual LLC Tax: $800

- LLC Fee (Based on $500k income): $2,500

- Total Tax and Fee: $3,300

- Number of Members: 2

- Total Assets at End of Year: $150,000

- Accounting Method: Accrual

- Signatory: Alice Chen, Member

- Date Signed: 04/15/2025

What this filled form sample shows:

- Correctly identifies the LLC using its FEIN and California SOS File Number.

- Demonstrates the calculation of the LLC Fee ($2,500) based on total California income ($500,000).

- Includes the mandatory $800 annual LLC tax, separate from the income-based fee.

- Shows reporting of key financial data, including guaranteed payments to members and other business deductions.

- Illustrates a complete return for a common business structure: a multi-member service-based LLC.

Form specifications and details:

| Form Name: | California Form 568 (2024), Limited Liability Company Return of Income |

| Use Case: | Multi-member LLC operating a service-based business in California |

| Tax Year: | 2024 |

| Filing Deadline: | April 15, 2025 |

Created: February 03, 2026 05:09 AM