Yes! You can use AI to fill out Form CMS-855O, Medicare Enrollment Application

Form CMS-855O is a Medicare Enrollment Application for eligible ordering and certifying physicians and professionals. This form is essential for those who wish to order or certify items and services for Medicare beneficiaries, ensuring they are recognized and reimbursed appropriately by Medicare.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out CMS-855O using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form CMS-855O, Medicare Enrollment Application |

| Form issued by: | Centers for Medicare & Medicaid Services |

| Number of fields: | 174 |

| Number of pages: | 11 |

| Version: | 09/23 |

| Filled form examples: | Form CMS-855O Examples |

| Language: | English |

| Categories: | CAR forms, CMS forms, enrollment forms, L.A. Care forms, enrollment application forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out CMS-855O Online for Free in 2026

Are you looking to fill out a CMS-855O form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your CMS-855O form in just 37 seconds or less.

Follow these steps to fill out your CMS-855O form online using Instafill.ai:

- 1 Visit instafill.ai site and select CMS-855O.

- 2 Enter your personal and professional information.

- 3 Provide your National Provider Identifier (NPI).

- 4 Complete all required sections accurately.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable CMS-855O Form?

Speed

Complete your CMS-855O in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 CMS-855O form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form CMS-855O

The Medicare Enrollment Application (CMS-855O) is used to apply for enrollment in the Medicare program for providers and suppliers. It allows the Centers for Medicare & Medicaid Services (CMS) to establish and maintain accurate information about the provider or supplier in the Medicare Provider Enrollment, Chain and Ownership System (PECOS).

Any individual or organization that wants to provide services or supplies covered under the Medicare program must submit this application. This includes doctors, nurses, clinics, hospitals, home health agencies, durable medical equipment suppliers, and other types of healthcare providers and suppliers.

The application requires basic information about the applicant, such as name, address, and taxpayer identification number (TIN). It also requires information about the services or supplies the applicant intends to provide, as well as any affiliations or relationships with other providers or organizations. Applicants may also be required to provide supporting documentation, such as proof of citizenship or alien status, and licensure or certification information.

A Provider Transaction Access Number (PTAN) is a unique identifier assigned by CMS to allow electronic billing and processing of Medicare claims. A National Provider Identifier (NPI) is a unique 10-digit identification number issued by the National Plan and Provider Enumeration System (NPPES) for use in administrative and financial transactions involving healthcare providers and suppliers. While a PTAN is specific to Medicare, an NPI can be used for various healthcare transactions, including Medicare, Medicaid, and private insurance.

You can obtain an NPI by registering online through the National Provider Portal at nppeas.cms.hhs.gov. The registration process requires creating an account, providing basic information about yourself or your organization, and agreeing to the terms and conditions. Once your registration is complete, you can generate your NPI and print a copy for your records. You can also contact the NPPES Customer Service Center at 1-800-465-3203 for assistance with obtaining an NPI.

To enroll in Medicare solely to order or certify items or services for Medicare beneficiaries, you must complete the Medicare Enrollment Application (CMS-40B). This is also known as a durable medical equipment (DME) supplier enrollment application. You will need to provide all required documentation and information, including a valid Taxpayer Identification Number (TIN), National Provider Identifier (NPI), and business information. Once your application is processed and approved, you will be able to order and certify items or services for Medicare beneficiaries. It is important to note that you cannot bill Medicare for these items or services under your own provider number.

An active license refers to a healthcare professional or supplier who is authorized to provide healthcare services or sell medical supplies directly to patients. An active certification, on the other hand, refers to a healthcare professional or supplier who is authorized to order, certify, or provide certain items or services for Medicare beneficiaries. For example, a durable medical equipment supplier may have an active certification to order and certify power wheelchairs, but they may also have an active license to sell and service other types of medical equipment. It is important to understand the difference between the two, as they serve different purposes in the Medicare enrollment process.

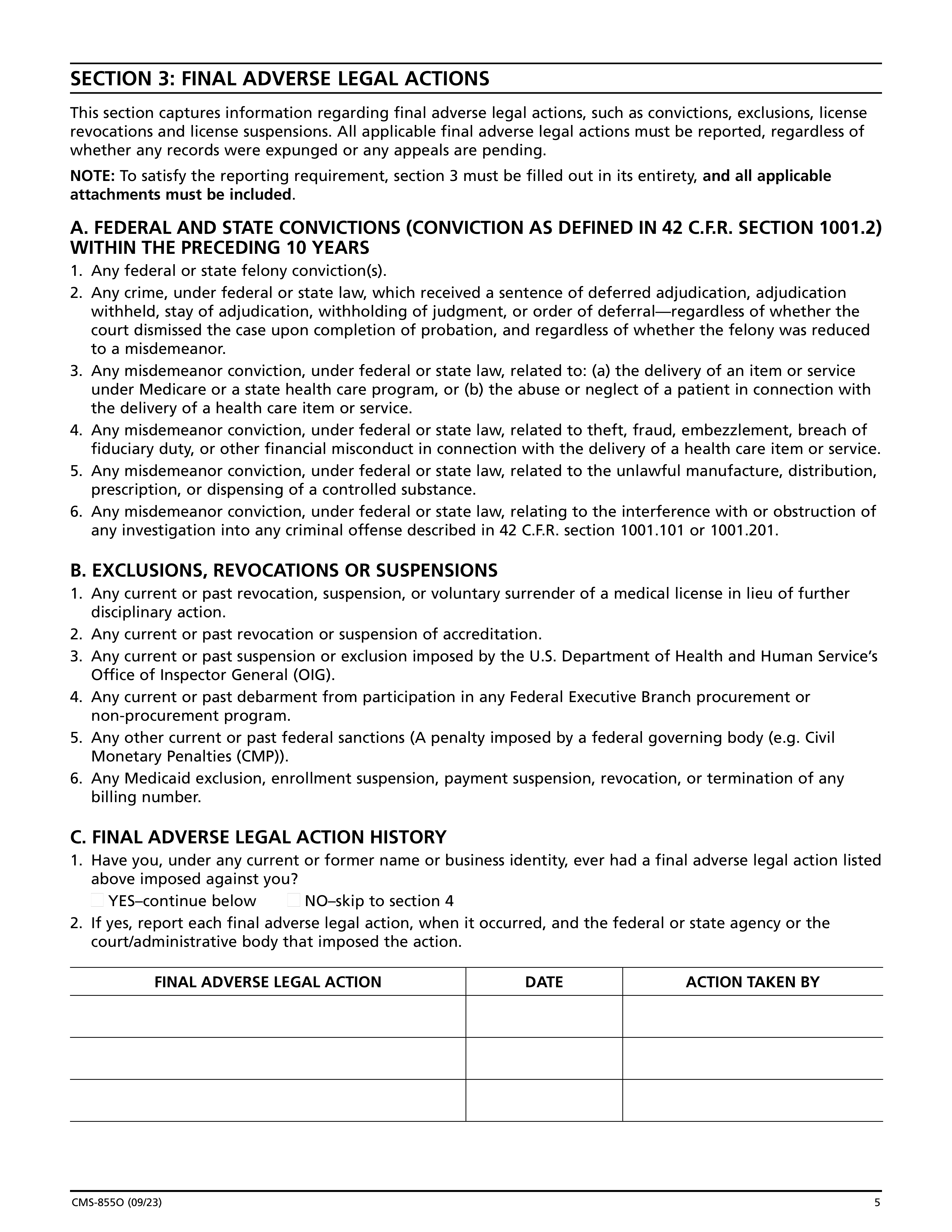

If you have had any final adverse legal actions, such as malpractice judgments or settlements, you must report them on the Medicare Enrollment Application. You will be asked to provide details about the legal action, including the date, the amount paid, and the nature of the action. It is important to report all final adverse legal actions, as failure to do so can result in denial or revocation of your Medicare enrollment. If you are unsure about what constitutes a final adverse legal action, you should contact the Medicare Administrative Contractor (MAC) for your state for clarification.

Falsifying information on the Medicare Enrollment Application is a serious offense. Penalties for falsifying information can include denial or revocation of your Medicare enrollment, as well as civil or criminal penalties. Civil penalties can include fines up to $11,000 per false claim, and criminal penalties can include fines and imprisonment. It is important to provide accurate and complete information on your application to avoid any potential penalties.

The length of time it takes to complete the Medicare Enrollment Application varies depending on the complexity of your application and the completeness of the information you provide. CMS estimates that it takes between 30 and 60 days to process a standard application. However, if additional information is required, the processing time may be longer. It is important to provide all required documentation and information upfront to avoid delays in the application process.

The Medicare Administrative Contractor (MAC) is responsible for processing Medicare enrollment applications and maintaining the Medicare provider enrollment records. They review the application to ensure that the applicant meets the Medicare enrollment requirements and that all necessary documentation is provided. Once approved, the MAC assigns a National Provider Identifier (NPI) and a Medicare billing number to the provider or supplier.

A correspondence mailing address is the address to which Medicare and other third-party payers will send correspondence, such as notices, payment remittances, and other important documents. A contact person is an individual who can be reached for questions or clarifications regarding the enrollment application or billing issues. The contact person does not need to be the billing or responsible party, but they must be authorized to speak on behalf of the applicant or organization.

Failure to report changes to your Medicare enrollment information in a timely manner can result in incorrect or delayed processing of claims, denial of claims, or even termination of your Medicare enrollment. It is important to report any changes to your contact information, practice location, or other relevant information as soon as possible to avoid any potential issues.

To withdraw your Medicare enrollment for billing purposes only, you must submit a written request to the Medicare Administrative Contractor (MAC) that processed your enrollment application. The request should include your name, NPI number, and reason for the withdrawal. Once your request is processed, you will no longer be able to submit claims for Medicare services, but you will still be able to order and certify Medicare benefits for your patients.

A federal conviction is a criminal offense that has been committed and prosecuted under federal law. A state conviction, on the other hand, is a criminal offense that has been committed and prosecuted under state law. A misdemeanor conviction is a criminal offense that is less serious than a felony and is typically punishable by a fine, probation, or a term of imprisonment of one year or less. In the context of Medicare enrollment, certain types of convictions, including felonies and misdemeanors, can disqualify an individual from enrolling or continuing to participate in the Medicare program.

An exclusion, revocation, or suspension refers to actions taken against an individual or entity that prevents them from participating in Medicare, Medicaid, or other Federal health care programs. These actions are typically taken when there is evidence of past or present program violations. A debarment, on the other hand, is a more severe action that prohibits an individual or entity from contracting or participating in any Federal program or receiving Federal financial assistance. Debarment is usually imposed for more serious or repeated violations.

A civil monetary penalty (CMP) is a financial penalty imposed by a Federal agency for violating a Federal regulation or statute. It is a civil action, meaning it is not a criminal penalty, but it is intended to compensate the government for damages and to deter future violations. A civil penalty, on the other hand, is a financial penalty imposed in a civil court action for breaching a contract or violating a statute or regulation. Civil penalties can be imposed for a variety of reasons, including noncompliance with regulations, fraud, or other violations.

A criminal penalty is a penalty imposed by a court as a result of a criminal conviction. Criminal penalties can include fines, imprisonment, probation, and community service. A civil penalty, on the other hand, is a financial penalty imposed in a civil action, such as a lawsuit, for breaching a contract or violating a statute or regulation. Civil penalties are intended to compensate the injured party and to deter future violations, but they do not result in a criminal record.

Common law fraud refers to a deliberate misrepresentation of a material fact made with the intent to deceive and induce another party to take action or relinquish a right. Money paid by mistake, on the other hand, refers to a payment made unintentionally or due to an error. For example, if a provider submits a claim for a service that was not actually provided, that would be an example of common law fraud. If a provider accidentally submits a claim for the wrong amount, that would be an example of money paid by mistake.

A false or fraudulent claim refers to a claim for payment or reimbursement that is knowingly and intentionally false or misrepresentative. This can include submitting a claim for a service that was not provided, or submitting a claim for a higher amount than was actually incurred. A false or fraudulent statement or representation, on the other hand, refers to any false or misrepresentative statement or representation made in connection with a claim, regardless of whether the claim itself is false or fraudulent. For example, providing false information on a claim form, such as a false diagnosis code, would be considered a false or fraudulent statement or representation.

A false or fictitious statement or representation refers to providing incorrect or misleading information orally or in writing during the enrollment process. This could include providing false information about one's identity, citizenship status, or eligibility for Medicare. On the other hand, a false writing or document refers to submitting a document that contains false or misleading information, such as a falsified tax document or a Social Security card. Both false statements and false documents are considered material misrepresentations and are grounds for denial of enrollment or termination of Medicare benefits.

Compliance CMS-855O

Validation Checks by Instafill.ai

1

Typed Information Check

Ensures that all information provided on the Medicare Enrollment Application is typed, as handwritten entries may lead to the form being returned. This check is crucial to maintain the legibility and accuracy of the information, which is essential for the processing of the application. It also helps in avoiding any potential delays that may arise from the need to clarify illegible handwriting. The AI software systematically scans each field to confirm that the text appears to be typed and not handwritten.

2

Copy Retention Check

Confirms that a copy of the completed Medicare Enrollment Application (CMS-855O) is retained for the applicant's personal records. This validation is important for reference and future proof of submission. The AI software reminds the user to save a copy and can assist in generating a duplicate if necessary. It also checks that the copy includes all the pages of the application, ensuring that the entire document is preserved.

3

Correct Mailing Address Verification

Verifies that the completed application is mailed to the correct Medicare Administrative Contractor (MAC) address as listed on the CMS website. This check is vital to ensure that the application reaches the appropriate destination without any delays. The AI software cross-references the provided mailing address with the official MAC addresses to confirm accuracy. It also alerts the user if there is a discrepancy or if the address has been updated.

4

Section 1A Completion Check

Checks that the appropriate box in Section 1A of the Medicare Enrollment Application is selected, and that subsequent sections are completed as indicated. This step is essential to guide the application through the correct processing channel. The AI software reviews the selections made in Section 1A and ensures that they are consistent with the information provided in the rest of the application. It also prompts the user to complete any sections that are indicated as mandatory based on the initial selection.

5

Section 1B Enrollment Reason Verification

Confirms that one reason for enrolling is chosen from either Group 1 or Group 2 in Section 1B of the application. This validation ensures that the applicant's intent for enrolling is clearly stated and falls within the accepted categories. The AI software checks that exactly one reason is selected and that it is not contradictory to other information provided in the application. It also validates that the selection is made from the correct group as per the application guidelines.

6

Verifies that full legal name, date of birth, gender, Social Security Number, Medicare Identification Number (PTAN), National Provider Identifier (NPI), and any existing debt to CMS are accurately provided in Section 2A.

The AI ensures that the applicant's full legal name matches the name on their legal documents. It verifies that the date of birth is in the correct format and reflects the applicant's actual age. The gender field is checked for consistency with the legal name and other gender-specific information. The Social Security Number is validated for its unique 9-digit format. The AI confirms the accuracy of the Medicare Identification Number (PTAN) and the National Provider Identifier (NPI), and checks for any reported existing debt to CMS, ensuring all information is complete and accurate in Section 2A.

7

Ensures that the name of the medical or professional school and year of graduation are correctly entered in Section 2B.

The AI cross-references the name of the medical or professional school with a database of recognized institutions to ensure validity. It also checks that the year of graduation is entered and falls within a plausible range considering the applicant's date of birth and typical education timelines. The AI ensures that the format of the year is correct, typically a four-digit number, and that it is consistent with the applicant's professional history and credentials in Section 2B.

8

Confirms that active license and certification details, including numbers, effective dates, states where issued, and certifying entities, are provided in Section 2C.

The AI validates that all license and certification numbers adhere to the appropriate alphanumeric formats and are not left blank. It checks that effective dates are provided and are in the correct date format, ensuring they are current and have not expired. The AI confirms that the states where the licenses were issued are correctly identified by their standard abbreviations. It also verifies that the names of the certifying entities are provided and are recognized organizations within the medical field in Section 2C.

9

Checks for the reporting of any federal or state convictions, exclusions, revocations, suspensions, or other legal actions in Section 3.

The AI reviews Section 3 for completeness, ensuring that any federal or state legal issues such as convictions, exclusions, revocations, suspensions, or other actions are fully disclosed. It checks that the details of such legal matters, if any, are described with specificity, including dates, nature of the action, and the authority involved. The AI verifies that if there are no such legal matters, the section is marked appropriately to indicate no history of legal issues. It also ensures that the information provided is consistent with public legal records.

10

Verifies that the primary physician specialty is correctly checked from the list provided in Section 4A.

The AI scans the list of specialties provided in Section 4A and ensures that one, and only one, primary physician specialty is selected. It checks that the selected specialty is appropriate based on the applicant's education and certification details provided in previous sections. The AI verifies that the specialty is marked clearly and is one of the recognized specialties listed in the form. It also ensures that the selection is consistent with the applicant's professional practice and history.

11

Confirms that the appropriate box for eligible professional or other non-physician specialty type is checked in Section 4B.

The AI ensures that in Section 4B of the Medicare Enrollment Application, the correct box is selected to indicate whether the applicant is an eligible professional or falls under another non-physician specialty type. It checks for the presence of a selection and validates that it aligns with the information provided elsewhere in the application. This step is crucial for correctly identifying the applicant's professional category, which may affect the processing of the application.

12

Ensures that the correspondence address information provided in Section 5 is complete and accurate.

The AI meticulously reviews the correspondence address details provided in Section 5 of the application. It verifies that all required fields, such as street address, city, state, and ZIP code, are filled out completely and that the information is consistent with postal service standards. The AI also cross-references this information with external databases when possible to confirm its accuracy, ensuring that all future correspondence reaches the applicant without delay.

13

Verifies that optional contact person information in Section 6 is provided for someone who can be reached if there are questions during the application process.

In Section 6, the AI checks for the inclusion of an optional contact person's information. It verifies that the contact details are complete, including the name, phone number, and email address, if provided. The AI understands the importance of having a reliable point of contact for any queries or clarifications that may arise during the application review process, and thus it ensures that this information is readily available and valid.

14

Checks that the penalties for falsifying information on the application are reviewed as stated in Section 7.

The AI examines Section 7 to confirm that the applicant has acknowledged the penalties associated with providing false information on the Medicare Enrollment Application. It checks for any indication that this section has been reviewed by the applicant, such as an initial or checkmark. This validation is essential to ensure the applicant's understanding and acceptance of the legal implications of their declarations.

15

Confirms that the certification statement in Section 8 is read, and the application is signed and dated by the individual practitioner applying.

The AI ensures that the certification statement in Section 8 is not only read but also properly executed with the applicant's signature and the date. It checks for the presence of a signature that matches the name of the individual practitioner applying and verifies that the date is current and valid. This step is critical for the application's authenticity and serves as a formal attestation of the information provided by the applicant.

Common Mistakes in Completing CMS-855O

Applicants may overlook or incorrectly identify the reason for submitting the Medicare Enrollment Application. This section is crucial as it determines the processing time and eligibility for Medicare benefits. To avoid this mistake, carefully review the available options and select the one that applies to your situation. If uncertain, consult with a healthcare professional or Medicare representative for clarification.

Handwritten information may be difficult to read, leading to potential errors during processing. Applicants may find it more convenient to write out their responses instead of typing them. However, this can result in delays or even rejection of the application. To prevent this mistake, make use of the provided typing areas in Section 1 and Section 2 to ensure clear and legible responses.

Applicants may overlook the importance of retaining a copy of the completed Medicare Enrollment Application for their personal records. This copy serves as proof of submission and can be useful for future reference. To avoid this mistake, make sure to keep a copy of the completed form in a safe and accessible location.

Applicants may inadvertently misreport or omit essential personal information when completing the Medicare Enrollment Application. This can lead to processing delays or even denial of benefits. To prevent this mistake, double-check all personal information provided in Section 2 against your official documents to ensure accuracy.

Applicants may unintentionally enter incorrect educational information when completing the Medicare Enrollment Application. This can impact their eligibility for certain Medicare benefits. To avoid this mistake, double-check all educational information provided in Section 2 against your official records to ensure accuracy.

Failure to report any legal actions taken against you in this section may result in denial or termination of your Medicare enrollment. It is crucial to provide accurate and complete information to avoid potential consequences. To ensure reporting of all relevant information, carefully review your criminal history and consult with legal counsel if necessary. Provide all required details, including the nature of the offense, the jurisdiction, and the disposition of the case.

Selecting an incorrect primary specialty may lead to misclassification and potential complications in the billing process. It is essential to choose the correct specialty that best represents the services you will be providing to Medicare beneficiaries. Double-check the specialty codes listed in the instructions or consult with the Medicare Administrative Contractor (MAC) to confirm your selection.

Providing an incomplete or incorrect correspondence address may delay the processing of your Medicare enrollment application. It is essential to provide a valid and complete address where Medicare can send important correspondence and notifications. Ensure the address is accurate and up-to-date to avoid any potential delays.

Incomplete or incorrect contact person information may cause complications in the billing process or delay the processing of your Medicare enrollment application. It is essential to provide accurate and complete contact information for the designated contact person. Double-check all fields for accuracy and ensure all required information is provided.

Signing the application on behalf of someone else or failing to sign it may result in denial or delay of your Medicare enrollment. It is essential to sign the application yourself and ensure all required signatures are obtained. Review the instructions carefully to understand the signing requirements and ensure all necessary signatures are obtained and documented.

During the Medicare Enrollment Application process, it is crucial to ensure that the application is sent to the correct MAC address. Each MAC covers specific jurisdictions, and sending the application to an incorrect MAC may result in processing delays or even rejection. To avoid this mistake, double-check the MAC jurisdiction covering your area before mailing the application. You can find the MAC information on the Centers for Medicare & Medicaid Services (CMS) website or by contacting the CMS help line.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out CMS-855O with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills cms-855o forms, ensuring each field is accurate.