Form 433-F (Rev. 7-2024), Collection Information Statement Completed Form Examples and Samples

Explore comprehensive examples and samples of a completed IRS Form 433-F (Rev. 7-2024), Collection Information Statement. Our detailed guides illustrate how to accurately fill out the form for various financial situations, helping you prepare for discussions with the IRS.

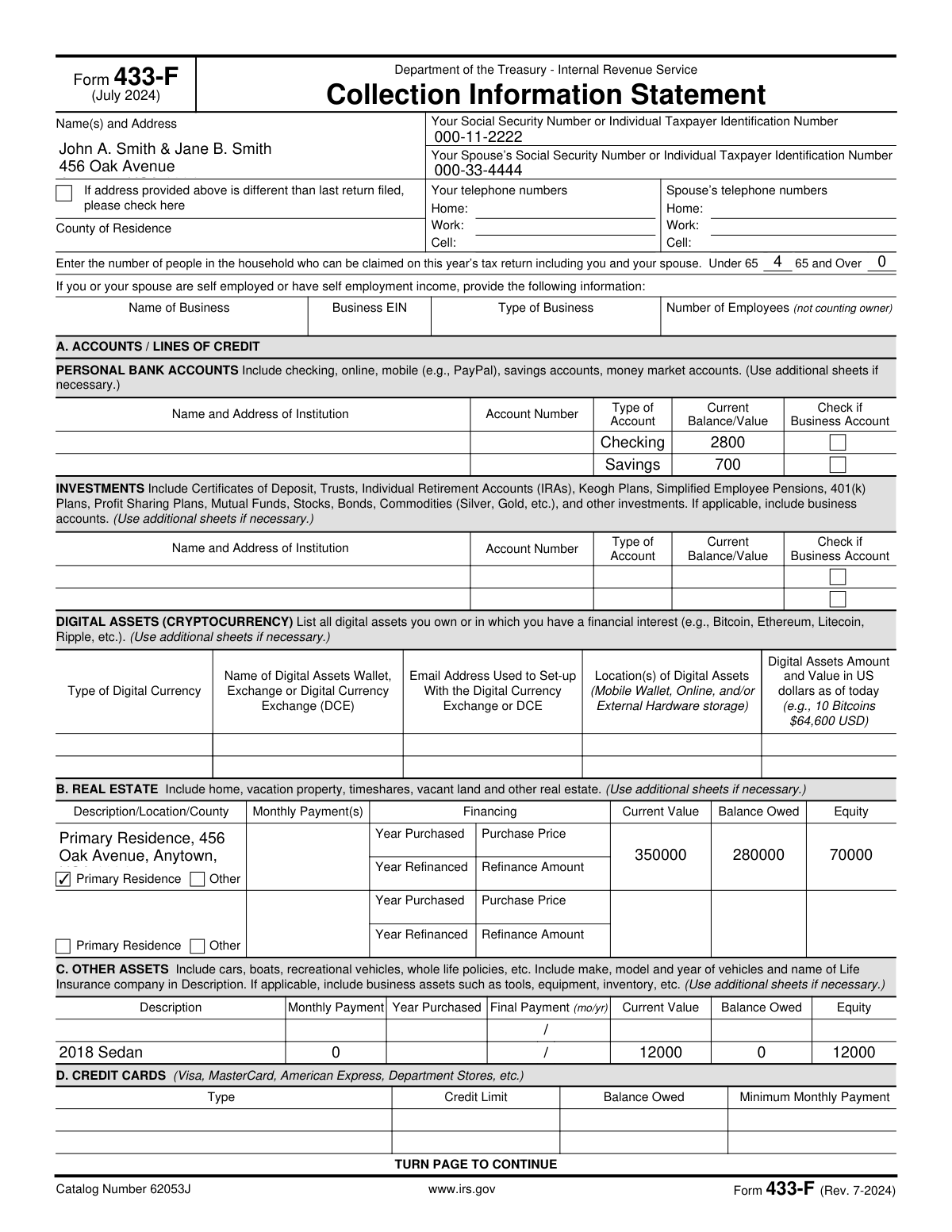

Form 433-F (Rev. 7-2024) Example: Married Couple with Dependents

How this form was filled:

This sample Form 433-F is filled out for a married couple, John and Jane Smith, who have two dependents. It details their joint income from two jobs, their primary residence with a mortgage, two vehicles (one with a loan), and their monthly living expenses. This example illustrates how to provide a complete financial picture to the IRS when seeking a collection alternative.

Information used to fill out the document:

- Taxpayer Name: John A. Smith

- Taxpayer SSN: 000-11-2222

- Spouse Name: Jane B. Smith

- Spouse SSN: 000-33-4444

- Address: 456 Oak Avenue, Anytown, USA 12345

- Dependents: 2 Children (Ages 8 and 12)

- Taxpayer's Employer: Reliable Auto Repair

- Spouse's Employer: Anytown School District

- Total Monthly Gross Income: $6,500

- Total Monthly Net Income: $5,150

- Total Monthly Living Expenses: $4,950

- Primary Residence Fair Market Value: $350,000

- Mortgage Balance: $280,000

- Vehicle 1 (2022 SUV) Value: $25,000

- Vehicle 1 Loan Balance: $15,000

- Vehicle 2 (2018 Sedan) Value: $12,000

- Vehicle 2 Loan Balance: $0

- Bank Account (Checking) Balance: $2,800

- Bank Account (Savings) Balance: $700

- Credit Card Debt: $8,500

- Signature Date: 01/15/2026

What this filled form sample shows:

- Demonstrates how a married couple filing jointly reports their combined financial information.

- Includes common assets like a primary residence and vehicles, showing how to list fair market value and outstanding loan balances.

- Provides a realistic breakdown of monthly household income and living expenses for a family with dependents.

- Accurately completed with taxpayer, spouse, and dependent information required for IRS collection evaluation.

Form specifications and details:

| Form Name: | Form 433-F (Rev. 7-2024), Collection Information Statement |

| Use Case: | Married couple with two dependents providing financial information to the IRS to arrange a payment plan for back taxes. |

Created: February 11, 2026 07:40 PM