Yes! You can use AI to fill out Form 4562 (2025), Depreciation and Amortization (Including Information on Listed Property)

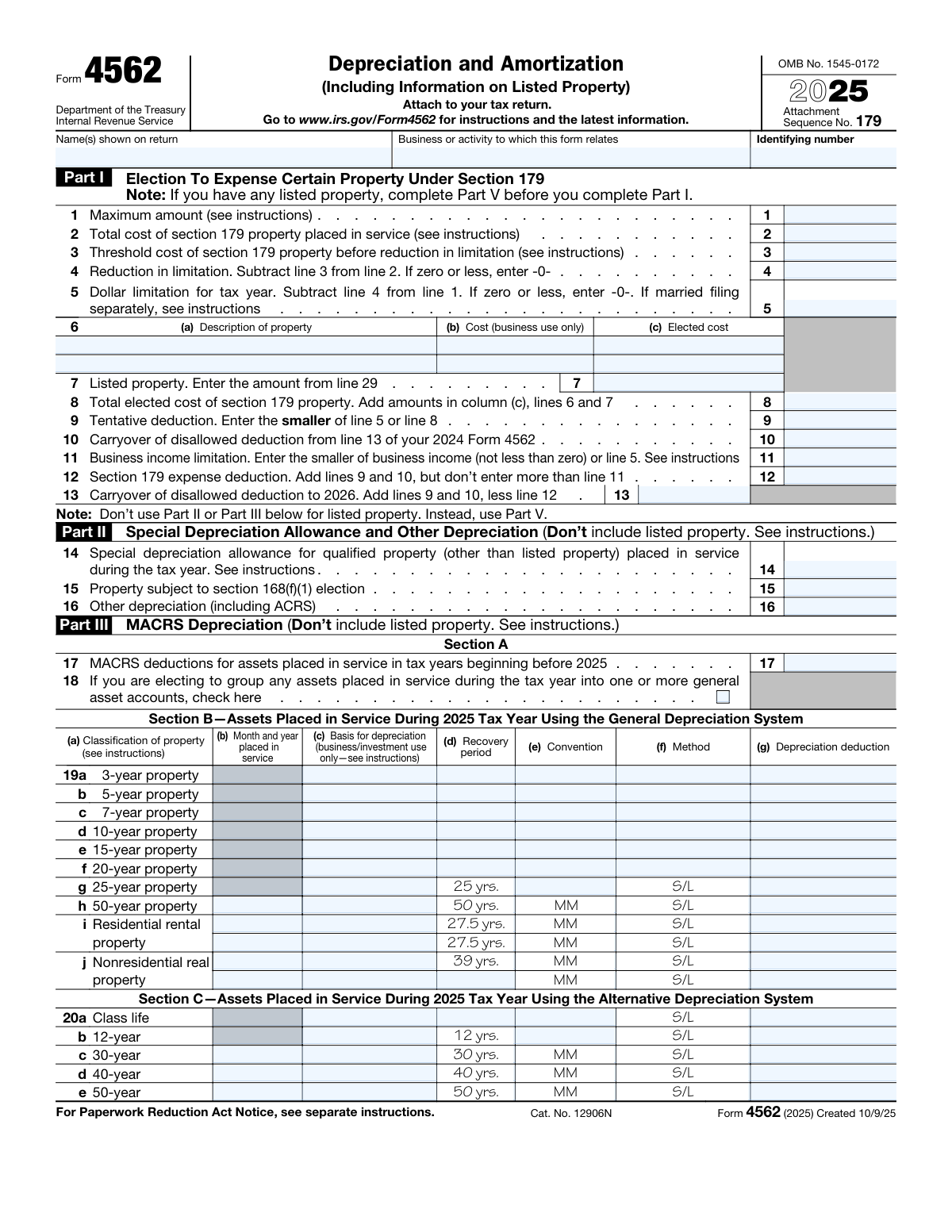

IRS Form 4562 is the federal tax form used to report depreciation and amortization for business or investment property, including the Section 179 election to expense qualifying property and depreciation under MACRS. It also includes special rules and reporting for “listed property” such as passenger vehicles and other assets subject to substantiation and business-use limitations. The form is important because it determines the amount and timing of deductions that reduce taxable income and supports compliance with IRS documentation requirements. It is filed as an attachment to your tax return and summarizes deductions that flow to the appropriate lines of your return.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 4562 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 4562 (2025), Depreciation and Amortization (Including Information on Listed Property) |

| Number of pages: | 3 |

| Filled form examples: | Form Form 4562 Examples |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 4562 Online for Free in 2026

Are you looking to fill out a FORM 4562 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 4562 form in just 37 seconds or less.

Follow these steps to fill out your FORM 4562 form online using Instafill.ai:

- 1 Enter taxpayer and activity information (name(s) as shown on return, business/activity, and identifying number) and gather asset records (purchase dates, placed-in-service dates, cost/basis, business-use %, and prior-year depreciation).

- 2 Complete Part V first if you have listed property (e.g., vehicles): answer substantiation questions, enter vehicle/asset details, compute business-use percentages, and calculate listed-property depreciation and any Section 179 elected cost for listed property.

- 3 Fill out Part I to elect Section 179 expensing: enter total qualifying Section 179 property placed in service, apply the annual limit and phaseout threshold, list property descriptions and costs, include listed-property Section 179 from Part V, and compute any carryover limits based on business income.

- 4 Complete Part II for special depreciation allowance (bonus depreciation) and other depreciation items that are not listed property, including any property subject to special elections or other depreciation methods.

- 5 Complete Part III for MACRS depreciation: report prior-year MACRS (Section A), then enter 2025 placed-in-service assets by class life/recovery period under the General Depreciation System (Section B) or Alternative Depreciation System (Section C) and compute the depreciation deduction.

- 6 Complete Part VI for amortization: list amortizable costs, start dates, code sections, amortization periods, and calculate current-year amortization, including amounts that began in prior years.

- 7 Finish Part IV summary: total all depreciation, Section 179, bonus depreciation, listed-property depreciation, and amortization amounts, then transfer the total to the appropriate line(s) on your tax return and attach Form 4562 to the return.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 4562 Form?

Speed

Complete your Form 4562 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 4562 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 4562

Form 4562 is used to claim depreciation and amortization deductions, including Section 179 expensing and certain special depreciation allowances. It also includes required reporting for “listed property” such as vehicles.

You generally file Form 4562 if you are claiming a depreciation deduction, a Section 179 deduction, a special depreciation allowance, or amortization. You also file it if you are reporting listed property (for example, business vehicles) for depreciation or Section 179.

Yes—Form 4562 is attached to your tax return. The form directs you to www.irs.gov/Form4562 for instructions and the latest information.

You’ll need details for each asset, such as the date placed in service, cost/basis, business-use percentage (if not 100%), and the depreciation method/recovery period. For vehicles and other listed property, you should also have mileage logs or other usage records.

Section 179 is an election to expense (deduct immediately) the cost of qualifying property instead of depreciating it over time. It is reported in Part I, including the property description and elected cost on line 6 (and line 7 for listed property).

Listed property (like vehicles) has special rules and limits, and the Section 179 amount for listed property is calculated in Part V first. The total elected Section 179 cost for listed property flows from Part V, line 29 to Part I, line 7.

Listed property includes automobiles and certain other vehicles, certain aircraft, and property used for entertainment, recreation, or amusement. These items are reported in Part V because they require additional substantiation and business-use tracking.

The note in Part V says that for any vehicle using the standard mileage rate or deducting lease expense, you complete only line 24a and 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. You generally do not complete the full depreciation columns for that vehicle.

This refers to records that substantiate business use, such as mileage logs, calendars, trip sheets, receipts, or similar documentation. Line 24b asks whether the evidence is written, which is typically expected for vehicle substantiation.

Non-listed property depreciation is generally reported in Part II (special depreciation allowance and other depreciation) and Part III (MACRS depreciation). The form notes not to use Parts II or III for listed property; listed property goes in Part V.

Assets placed in service during the 2025 tax year are entered in Part III, Section B (General Depreciation System) or Section C (Alternative Depreciation System), depending on which system applies. You’ll provide the classification, placed-in-service date, basis, recovery period, convention, method, and the depreciation deduction.

GDS (Part III, Section B) is the standard MACRS system with typical recovery periods and methods. ADS (Part III, Section C) generally uses longer lives and straight-line methods and is required in certain situations or when elected.

Part IV, line 22 totals the Section 179 deduction (line 12), depreciation amounts from Parts II and III, and listed property depreciation (line 21). You enter that total on the appropriate line(s) of your tax return, and partnerships/S corporations should follow the instructions referenced on the form.

Part I includes a business income limitation on line 11, and your allowed Section 179 deduction is limited to that amount on line 12. Any disallowed amount is carried over to the next year and shown on line 13 (carryover to 2026).

Amortization is reported in Part VI. You list the description of costs, the date amortization begins, the amortizable amount, the applicable code section, the amortization period/percentage, and the amortization for the year, then total it on line 44.

Compliance Form 4562

Validation Checks by Instafill.ai

1

Tax year consistency (Form 4562 must be for 2025)

Validates that the submission is for Form 4562 (2025) and that all date fields (placed-in-service dates, amortization begin dates) fall within or appropriately relate to the 2025 tax year. This prevents mixing data from the wrong tax year, which can misstate depreciation/amortization and carryovers. If the tax year is not 2025 or dates clearly conflict (e.g., all assets placed in service in 2024 but reported as 2025-only sections), the system should block submission or require correction/override with explanation.

2

Header identity completeness (Name(s), business/activity, identifying number)

Checks that the taxpayer name(s) shown on return, the business or activity to which the form relates, and the identifying number are present and non-blank. These fields are required to associate the depreciation schedule with the correct return and entity. If any are missing, the form should be rejected as incomplete because the IRS matching and internal record linkage can fail.

3

Identifying number format validation (SSN/EIN)

Validates that the identifying number matches an allowed format: SSN (9 digits, optionally formatted XXX-XX-XXXX) or EIN (9 digits, optionally formatted XX-XXXXXXX). This reduces downstream e-file rejections and prevents transposition/length errors. If the value contains invalid characters, wrong length, or impossible patterns (e.g., all zeros), the system should flag an error and require correction.

4

Section 179 line arithmetic integrity (Lines 1–5)

Verifies the internal math for Section 179 limitation: line 4 must equal line 2 minus line 3 (or be entered as 0 if zero/less), and line 5 must equal line 1 minus line 4 (or 0 if zero/less). This ensures the statutory limitation is computed correctly before applying elected costs. If calculations do not reconcile, the system should prevent filing or auto-recompute and require user confirmation of corrected values.

5

Section 179 property detail completeness (Line 6 columns a–c)

Ensures that each Section 179 asset listed on line 6 includes a description (6a), a numeric cost (6b), and a numeric elected cost (6c). This is necessary to substantiate the election and to support the totals on line 8. If any row is partially filled (e.g., elected cost without description), the system should require completion or removal of the row.

6

Section 179 elected cost constraints (Line 6c and Line 7/29)

Validates that elected cost for each asset (line 6c) is not negative and does not exceed the corresponding business-use cost (line 6b). Also validates that line 7 equals the amount from line 29 (listed property elected 179 cost) and is not entered independently. If elected costs exceed allowable amounts or line 7 does not match line 29, the system should error because the election would be overstated and inconsistent across parts.

7

Section 179 totals and limitation checks (Lines 8–13)

Checks that line 8 equals the sum of elected costs (line 6c plus line 7), line 9 equals the smaller of line 5 or line 8, and line 12 does not exceed line 11 (business income limitation). It also validates carryover logic: line 13 must equal (line 9 + line 10 − line 12) and cannot be negative. If any of these relationships fail, the system should flag the specific line(s) and require correction to avoid disallowed deductions or incorrect carryovers.

8

Listed property evidence questions required (Lines 24a–24b)

Requires a Yes/No response for line 24a (evidence to support business use) and, if 24a is 'Yes', requires a Yes/No response for 24b (whether evidence is written). These questions are critical for substantiation of listed property deductions and can affect audit risk and eligibility. If 24a is blank or 24b is blank when required, the system should mark the listed property section as incomplete and block submission.

9

Aircraft ownership/lease/charter selection validation (Line 24c)

Validates that line 24c selections are consistent: at least one of Own/Lease/Charter must be checked if the taxpayer indicates they have an aircraft-related listed property entry, and none should be checked if no aircraft is involved. This prevents contradictory reporting and helps ensure the correct substantiation rules are applied. If aircraft is listed in Section A but 24c is blank, the system should require a selection; if 24c is checked but no aircraft is listed, the system should prompt for confirmation or correction.

10

Listed property row-level field validation (Part V Section A columns a–i)

For each listed property item, validates required fields and formats: type/description (a) non-empty, date placed in service (b) is a valid date, business-use percentage (c) is numeric between 0 and 100, and cost/basis fields (d/e) are non-negative currency amounts. It also checks that basis for depreciation (e) does not exceed cost or other basis (d) and is consistent with business-use percentage where applicable. If any row violates these constraints, the system should flag the row and prevent totals (lines 28/29) from being accepted.

11

Listed property >50% vs ≤50% business use classification consistency (Lines 25–27)

Ensures that assets reported as 'used more than 50% in a qualified business use' are placed on line 26 and have business-use percentage strictly greater than 50%, while assets on line 27 have business-use percentage 50% or less. This classification affects depreciation method eligibility and special depreciation allowance treatment. If an asset’s percentage conflicts with the line it is reported on, the system should require reclassification or correction before computing depreciation.

12

Vehicle mileage reconciliation and nonnegative checks (Part V Section B lines 30–33)

Validates that for each vehicle column, lines 30 (business), 31 (commuting), and 32 (other personal) are nonnegative integers and that line 33 equals the sum of lines 30–32. This prevents impossible mileage reporting and supports the business-use percentage substantiation. If line 33 does not reconcile or any mileage is negative/non-numeric, the system should error and require correction.

13

Vehicle availability/owner-use logic checks (Part V Section B lines 34–36)

Requires Yes/No answers for lines 34–36 for each vehicle when Section B is applicable, and checks for logical consistency (e.g., if vehicle was available for personal use off-duty hours = 'No', but commuting miles > 0, prompt for review). These answers affect whether personal use is present and whether additional substantiation is needed. If responses are missing or contradictory to mileage entries, the system should flag the vehicle for correction or explanation.

14

Employer-provided vehicle exception gating (Part V Section C vs Section B completion)

Validates the rule stated on the form: if any of lines 37–41 is answered 'Yes' for covered employee vehicles, Section B should not be completed for those vehicles; conversely, if all are 'No', Section B is required for vehicles used by more-than-5% owners/related persons. This prevents incomplete or duplicative reporting and ensures the correct substantiation pathway is followed. If Section C indicates an exception but Section B is still filled (or required Section B is missing), the system should prompt to remove/complete the appropriate section.

15

Amortization schedule completeness and date/amount validation (Part VI lines 42–44)

For each amortization entry, checks that description (42a) is present, amortization begin date (42b) is a valid date, amortizable amount (42c) is nonnegative, code section (42d) is provided in an acceptable format (e.g., '197', '167', '195'), and amortization period/percentage (42e) is valid and positive. It also validates that total amortization (line 44) equals the sum of column (f) amounts and that line 43 is used only for costs that began before 2025. If any required field is missing or totals do not reconcile, the system should block submission to avoid incorrect amortization deductions.

Common Mistakes in Completing Form 4562

Many filers jump straight to Part I to claim a Section 179 deduction and miss the note that listed property must be handled in Part V first. This often leads to incorrect Section 179 amounts on line 7/8 and mismatched totals in Part IV. To avoid this, identify any listed property (autos, certain vehicles, aircraft, entertainment property) up front and complete Part V through line 29 before finishing Part I.

A common misunderstanding is to depreciate vehicles and other listed property in Part II (special depreciation/other) or Part III (MACRS) because those sections look like the “main” depreciation areas. The form explicitly says not to use Parts II or III for listed property, and doing so can cause double-counting or incorrect limitations (especially for passenger autos). To avoid this, route all listed property depreciation and any related Section 179 election through Part V and then carry totals to lines 21, 7, and 22 as instructed.

Filers frequently enter the full cost of an asset on line 6(b) or Part III column (c) even when the asset is partly personal-use. This overstates depreciation/Section 179 and can trigger disallowance, recapture, or audit issues. Always compute and enter the business/investment-use portion only (e.g., cost × business-use %) and keep the personal portion out of the depreciable basis.

In Part V, column (c) is often left blank, entered as a decimal when the form expects a percentage, or calculated using the wrong mileage totals. This can misclassify property as “more than 50%” vs “50% or less,” changing the allowed method and eligibility for special depreciation/Section 179. To avoid this, reconcile business, commuting, and personal miles in Section B (lines 30–33) and ensure the percentage in column (c) matches those totals.

People often skip the “evidence” questions or check “Yes” without having written records, assuming it’s informational only. Inconsistent answers can undermine the credibility of the deduction and increase audit risk, especially for vehicles. To avoid this, answer 24a and 24b accurately and maintain contemporaneous logs (mileage, dates, business purpose) and written documentation if you indicate it exists.

Sole proprietors and more-than-5% owners frequently omit Section B (lines 30–36) even though it’s required unless an exception applies. Missing mileage and availability-for-personal-use answers can lead to disallowed vehicle depreciation and Section 179. To avoid this, complete Section B for each applicable vehicle and only rely on Section C exceptions when you truly meet the stated requirements.

A very common error is counting commuting miles in line 30 (business miles) or excluding them entirely so totals don’t reconcile. This inflates business-use percentage and can improperly increase depreciation, Section 179, or special depreciation. To avoid this, report commuting miles on line 31, other personal miles on line 32, and ensure line 33 equals the sum of lines 30–32 for each vehicle.

Filers often take the full tentative Section 179 amount (line 9 plus carryover) without limiting it to business income on line 11. This can create an overstated deduction and a mismatch with the required carryover calculation on line 13. To avoid this, compute business income per the instructions, enter the smaller of that amount or line 5 on line 11, and cap line 12 accordingly while carrying the remainder to line 13.

People frequently forget to bring in the prior-year disallowed Section 179 carryover (line 10) or they compute the new carryover (line 13) incorrectly. This can cause lost deductions (if omitted) or excess deductions (if overstated), both of which may require amended returns. To avoid this, pull line 13 from the prior-year Form 4562 into line 10 and carefully compute line 13 as (line 9 + line 10 − line 12).

A frequent data-entry issue is using the purchase date instead of the placed-in-service date, or leaving the month/year blank in Part III column (b) and Part V column (b). The placed-in-service date affects convention, recovery timing, and whether the asset belongs in the current tax year at all. To avoid this, use the date the asset was first ready and available for business use, and enter the correct month and year exactly as requested.

Filers often guess at the property class (e.g., 5-year vs 7-year), use the wrong convention, or mix GDS/ADS without realizing the impact. This leads to incorrect depreciation deductions in Part III columns (d)–(g) and can cascade into an incorrect total on line 22. To avoid this, confirm the asset’s class life and required system (GDS vs ADS) from the instructions, then ensure the recovery period, convention, and method are consistent with that classification.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 4562 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-4562-2025-depreciation-and-amortization-inclu forms, ensuring each field is accurate.