Form 4562 (2025), Depreciation and Amortization (Including Information on Listed Property) Completed Form Examples and Samples

Explore comprehensive, filled-out examples of IRS Form 4562 for the 2025 tax year. Our samples clearly illustrate how to report Depreciation and Amortization, including Section 179 deductions, MACRS, and information on listed property for small businesses.

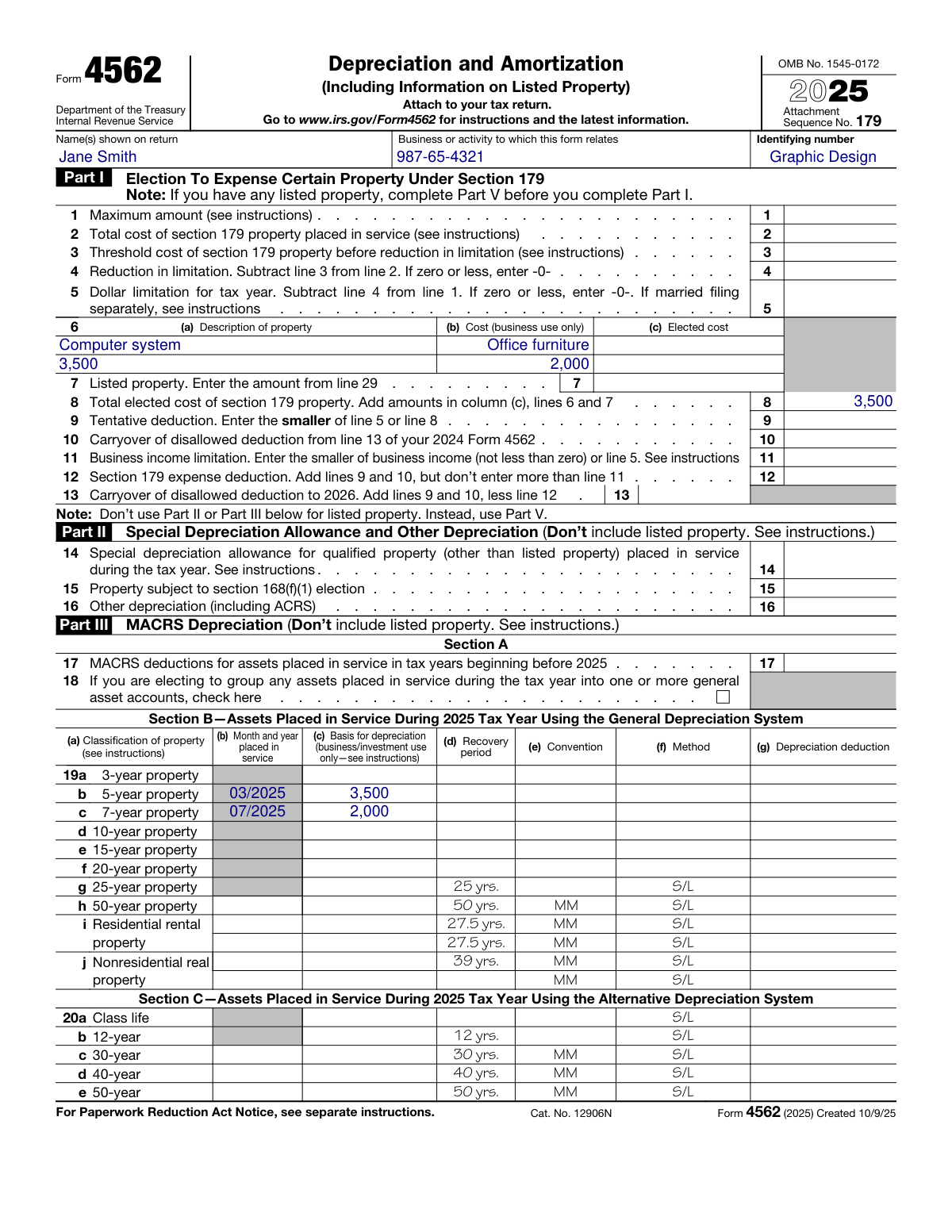

Form 4562 (2025) Example – Small Business Asset Depreciation

How this form was filled:

This example shows a sole proprietor claiming a Section 179 deduction for a computer, calculating MACRS depreciation for new office furniture, and reporting depreciation for a vehicle used for business more than 50% of the time. The form is filled out based on assets placed in service during the 2025 tax year.

Information used to fill out the document:

- Taxpayer Name: Jane Smith

- Business/Activity: Graphic Design Services

- Identifying Number (SSN): 987-65-4321

- Computer System Cost: $3,500

- Computer Placed in Service Date: March 15, 2025

- Office Furniture Cost: $2,000

- Office Furniture Placed in Service Date: July 1, 2025

- Section 179 Election: $3,500 (for the computer)

- Vehicle Cost: $30,000

- Vehicle Placed in Service Date: January 1, 2025

- Vehicle Business Use Percentage: 80%

- Total Business Miles: 8,000 miles

- Total Miles Driven: 10,000 miles

What this filled form sample shows:

- Demonstrates claiming the Section 179 deduction for a qualifying asset (computer) in Part I.

- Calculates standard MACRS depreciation for 7-year property (office furniture) in Part III.

- Shows how to report depreciation and usage information for listed property (a vehicle) in Part V.

- Includes proper reporting of the business use percentage required for listed property.

- Provides a complete summary of depreciation from all parts on line 22.

Form specifications and details:

| Form: | Form 4562 |

| Year: | 2025 |

| Title: | Depreciation and Amortization (Including Information on Listed Property) |

| Use Case: | Sole proprietor claiming depreciation on new equipment and a business vehicle. |

Created: February 03, 2026 07:47 PM