Form 4562, Depreciation and Amortization (Including Information on Listed Property) Completed Form Examples and Samples

Find clear, filled-out examples and samples of IRS Form 4562, Depreciation and Amortization. Our detailed guides illustrate how to correctly report Section 179 deductions, bonus depreciation, and calculate depreciation for listed property like business vehicles.

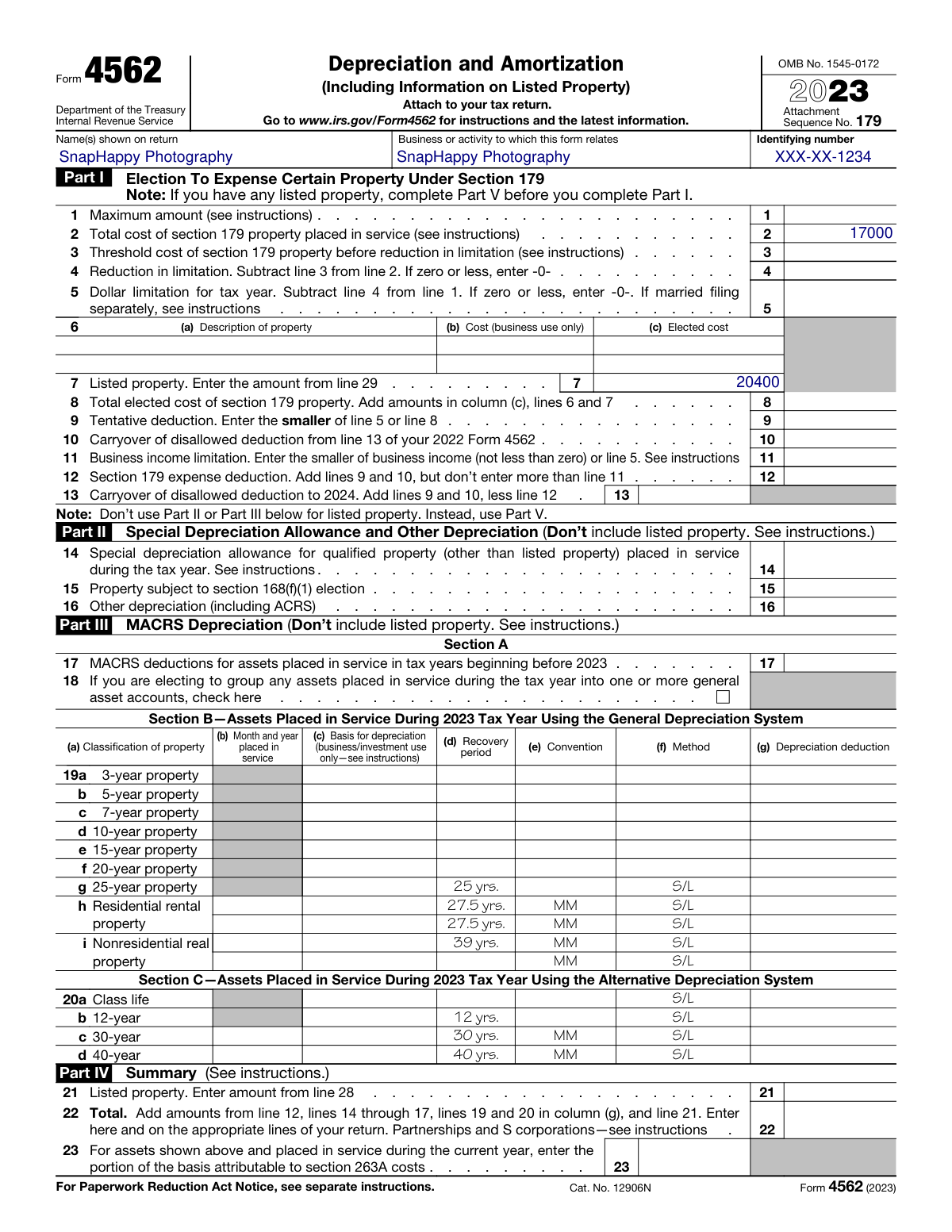

Form 4562 Example – Small Business Asset Purchase

How this form was filled:

This example shows Form 4562 for 'SnapHappy Photography,' a sole proprietorship. It details the Section 179 deduction for new camera and computer equipment, and calculates depreciation for a newly purchased business vehicle, which is treated as listed property.

Information used to fill out the document:

- Business Name: SnapHappy Photography

- Identifying Number: XXX-XX-1234

- Tax Year: 2025

- Asset 1 (Section 179): Camera Equipment

- Asset 1 Cost: $12,000

- Asset 2 (Section 179): Computer System

- Asset 2 Cost: $5,000

- Total Section 179 Deduction: $17,000

- Asset 3 (Listed Property): Light-Duty Truck

- Asset 3 Cost: $45,000

- Asset 3 Purchase Date: July 10, 2025

- Asset 3 Business Use: 90%

- Total Listed Property Deduction (Limited): $20,400

- Total Depreciation Deduction: $37,400

What this filled form sample shows:

- Correctly filled out Part I for Section 179 deduction on new business equipment.

- Demonstration of how to calculate and report depreciation for listed property (a business vehicle) in Part V.

- Application of business use percentage to a vehicle's cost basis.

- Example reflects the application of the first-year depreciation limit for passenger automobiles, including bonus depreciation.

Form specifications and details:

| Use Case: | Sole proprietorship purchasing equipment and a vehicle for business use. |

| Form Version: | 2025 (for tax year ending December 31, 2025) |

| Key Sections Used: | Part I (Section 179 Election) and Part V (Listed Property) |

Created: January 29, 2026 06:30 PM