Form SS-4 (Rev. December 2025), Application for Employer Identification Number Completed Form Examples and Samples

Explore detailed examples and completed samples of IRS Form SS-4 (Rev. December 2025), Application for Employer Identification Number. See how to correctly fill out the SS-4 form for various business types, including S Corporations, LLCs, and sole proprietorships, to successfully apply for your EIN.

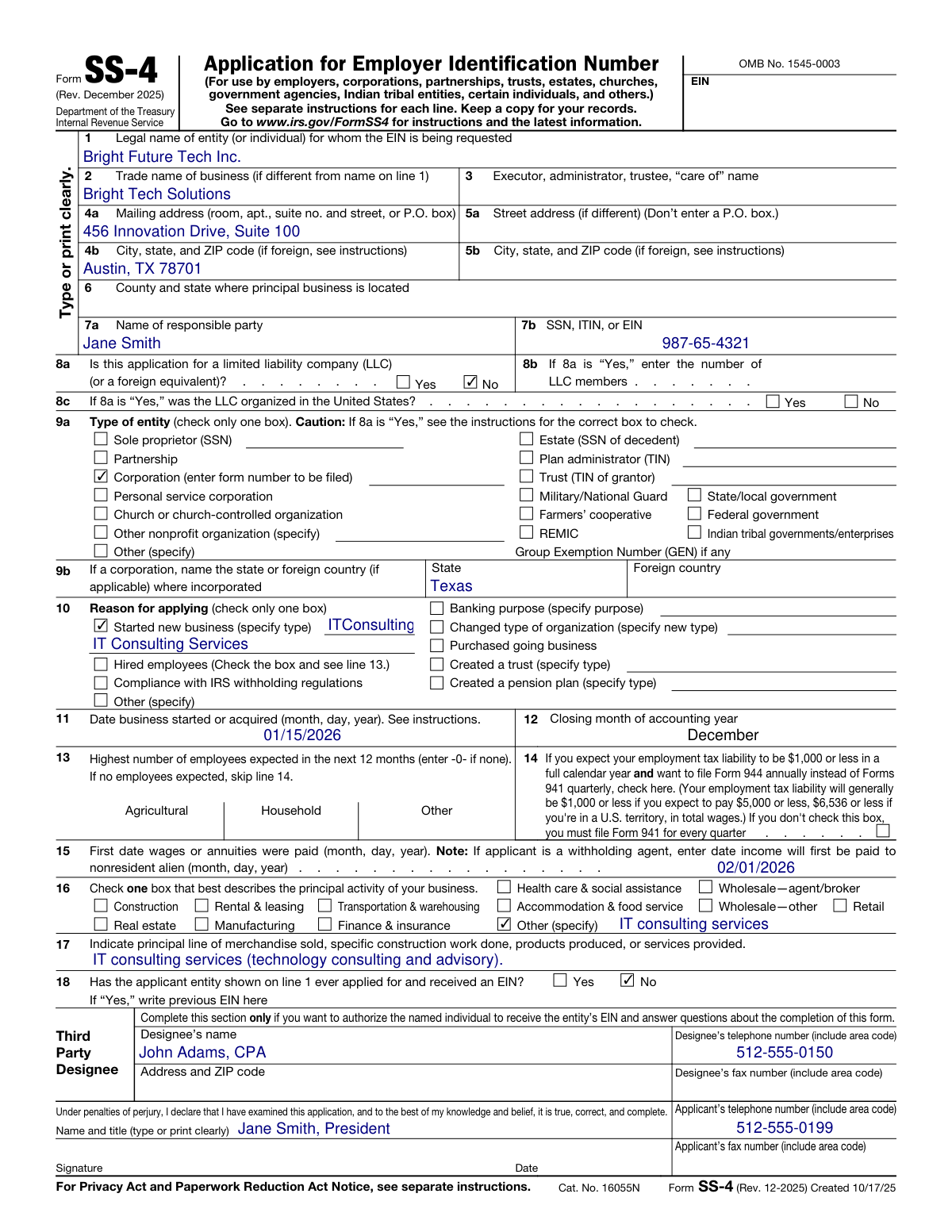

Form SS-4 Example – S Corporation

How this form was filled:

This is an example of a completed Form SS-4 for a newly formed S Corporation. It correctly identifies the legal entity name, specifies the responsible party, and indicates the reason for applying is 'Started new business.' The form also includes expected employee information and a third-party designee.

Information used to fill out the document:

- Legal Name of Entity: Bright Future Tech Inc.

- Trade Name (DBA): Bright Tech Solutions

- Mailing Address: 456 Innovation Drive, Suite 100, Austin, TX 78701

- Responsible Party Name: Jane Smith

- Responsible Party SSN: 987-65-4321

- Entity Type: Corporation (elected to be an S corporation by filing Form 2553)

- State of Incorporation: Texas

- Reason for Applying: Started new business

- Date Business Started: January 15, 2026

- Closing Month of Accounting Year: December

- Highest Number of Employees Expected: 2

- First Date Wages Paid or Annuities Paid: February 1, 2026

- Principal Business Activity: Consulting

- Principal Line of Service: IT Consulting Services

- Has the applicant ever applied for an EIN before?: No

- Applicant Name & Title: Jane Smith, President

- Applicant Phone Number: 512-555-0199

- Third-Party Designee Name: John Adams, CPA

- Designee Phone Number: 512-555-0150

What this filled form sample shows:

- Correctly indicates the entity type as a Corporation with an S Corp election.

- Clearly identifies the Responsible Party as required by the IRS.

- Specifies a valid Reason for Applying ('Started new business').

- Includes projected employee numbers and first wage payment date, critical for payroll tax setup.

- Optionally includes a Third-Party Designee to handle correspondence with the IRS.

Form specifications and details:

| Form Name: | Form SS-4, Application for Employer Identification Number |

| Form Revision: | December 2025 |

| Use Case: | Newly formed S Corporation applying for its first EIN. |

Created: February 02, 2026 10:22 PM