Form SSA-1042S, Social Security Benefit Statement Completed Form Examples and Samples

View clear, filled-out examples of Form SSA-1042S, the Social Security Benefit Statement for non-resident aliens. Our samples help you understand how to read your statement, including gross benefits, repayments, and federal tax withheld.

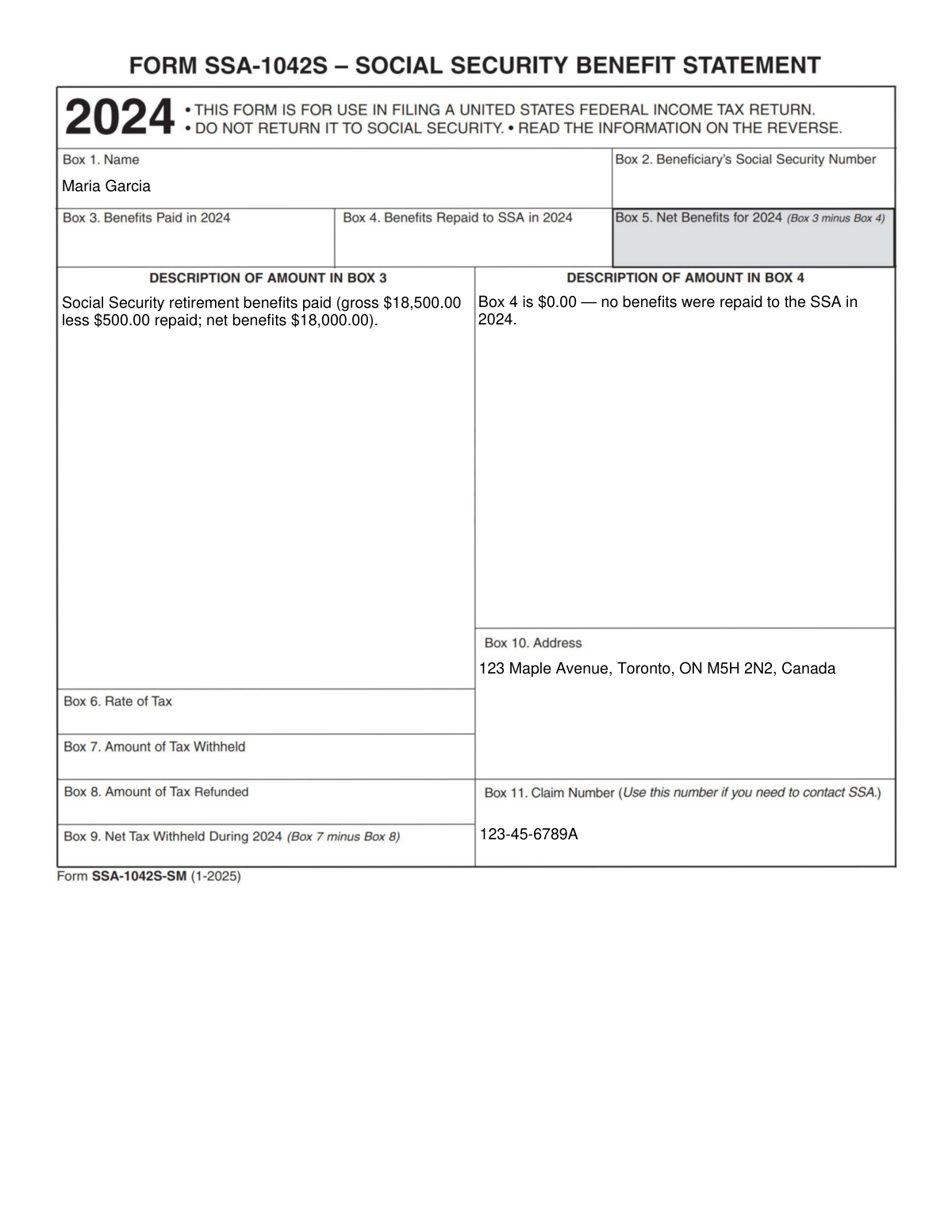

Form SSA-1042S Example – Non-Resident Alien with Treaty Benefits

How this form was filled:

This is a sample Form SSA-1042S for a Canadian resident receiving U.S. Social Security benefits for the 2025 tax year. It shows the total gross benefits, a repayment made during the year, and the resulting net benefits. Importantly, it reflects $0 in U.S. federal income tax withheld, a common scenario for residents of countries with a tax treaty with the United States, like Canada.

Information used to fill out the document:

- Recipient's Name: Maria Garcia

- Recipient's Address: 123 Maple Avenue, Toronto, ON M5H 2N2, Canada

- Social Security Claim Number: 123-45-6789A

- Tax Year: 2025

- Gross Benefits Paid (Box 2): $18,500.00

- Benefits Repaid (Box 3a): $500.00

- Net Benefits for 2025 (Box 3b): $18,000.00

- U.S. Federal Income Tax Withheld (Box 4): $0.00

- Description of Benefits (Box 5): Social Security Retirement Benefits

What this filled form sample shows:

- Clearly shows the **annual gross and net benefits** paid to the non-resident alien.

- Illustrates a case with **$0 federal tax withheld**, demonstrating the effect of a tax treaty.

- Includes the recipient's foreign address and unique Social Security claim number.

- Specifies the correct **tax year (2025)** for a statement issued in early 2026.

Form specifications and details:

| Form Number: | SSA-1042S |

| Form Name: | Social Security Benefit Statement |

| Use Case: | Non-resident alien (Canadian resident) receiving retirement benefits with a tax treaty exemption. |

| Issued By: | Social Security Administration (SSA) |

| Purpose: | Reports Social Security benefits paid to non-resident aliens for U.S. tax purposes. |

Created: January 29, 2026 07:31 AM