Yes! You can use AI to fill out Form I-134, Declaration of Financial Support

Form I-134, also known as the Declaration of Financial Support, is a document used by individuals in the United States to demonstrate their financial ability to support a non-U.S. resident during their stay. It is often required for visitor visas and is crucial for ensuring that the visitor will not become a public charge.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out I-134 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

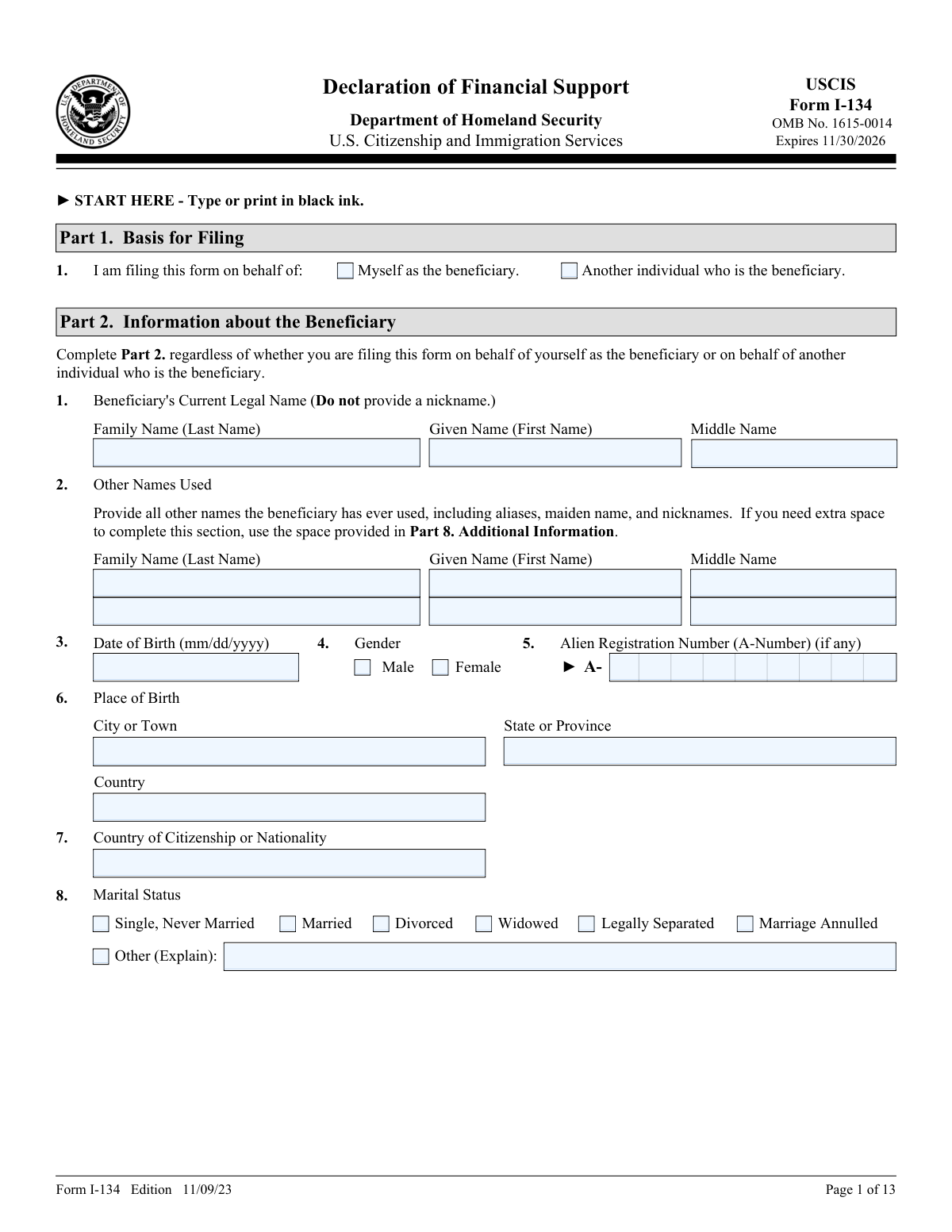

| Form name: | Form I-134, Declaration of Financial Support |

| Form issued by: | Department of Homeland Security |

| Number of fields: | 241 |

| Number of pages: | 10 |

| Version: | 2023 |

| Filled form examples: | Form I-134 Examples |

| Language: | English |

| Categories: | financial forms, financial support forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out I-134 Online for Free in 2026

Are you looking to fill out a I-134 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your I-134 form in just 37 seconds or less.

Follow these steps to fill out your I-134 form online using Instafill.ai:

- 1 Visit instafill.ai site and select I-134

- 2 Enter beneficiary's legal name

- 3 Provide beneficiary's other names used

- 4 Input beneficiary's personal details

- 5 Add financial information and assets

- 6 Complete sponsor's information section

- 7 Sign and date the form electronically

- 8 Check for accuracy and submit form

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable I-134 Form?

Speed

Complete your I-134 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 I-134 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form I-134

Form I-134, Declaration of Financial Support, is a document used by individuals to show that they have sufficient financial resources to support a non-U.S. citizen visiting the United States. This form is provided by the sponsor to demonstrate that the visitor will not become a public charge while in the U.S. It is often used for nonimmigrant visa applications, such as for tourists, students, or fiancé(e)s.

Form I-134 should be filed by a U.S. citizen or lawful permanent resident who intends to support a non-U.S. citizen visiting the United States. The person filing the form is referred to as the 'sponsor' and is responsible for providing financial support to the visitor, or 'beneficiary,' during their stay in the U.S.

The beneficiary is required to provide personal information such as their full name, date of birth, address, nationality, and relationship to the sponsor. Additionally, the beneficiary may need to provide details about their employment, financial situation, and the purpose of their visit to the United States. This information helps to establish their ties to their home country and their financial capability to support themselves, or the extent to which they will rely on the sponsor.

The purpose of Form I-134 is to provide evidence that a visitor to the United States has financial support available from a sponsor, ensuring that the visitor will not become a financial burden on public funds during their stay. It is a declaration by the sponsor that they have the means to support the beneficiary and will do so if necessary.

On Form I-134, the beneficiary typically does not directly provide information about their financial situation; instead, the sponsor fills out the form with details about their own financial resources. However, the beneficiary may supply the sponsor with necessary information about their employment, income, or assets, which the sponsor can include in the form to strengthen the case that the beneficiary will not become a public charge.

The individual agreeing to financially support the beneficiary on Form I-134 must provide the following details: full name, date of birth, address, occupation, citizenship status, relationship to the beneficiary, financial information including income and assets, and a detailed account of their dependents. They must also provide information about their employment and demonstrate their ability to support the beneficiary financially by submitting evidence such as tax returns, bank statements, and employment letters.

Yes, assets can be included as part of the financial support on Form I-134. The sponsor can list various assets such as savings, stocks, bonds, property, and other valuable possessions that can be converted into cash within one year without considerable hardship or financial loss. These assets can help demonstrate the sponsor's financial ability to support the beneficiary.

Yes, it is necessary to provide evidence of assets on Form I-134. The sponsor should provide documentation that verifies the value and ownership of the assets listed. This can include bank statements, property deeds, stock certificates, and other financial documents. The evidence must be convincing enough to assure the authorities that the sponsor has sufficient resources to support the beneficiary.

If the beneficiary or the supporter has income from illegal activities, it could lead to serious legal consequences, including denial of the application, potential investigation, and legal action against the individuals involved. Income from illegal activities is not considered valid for the purposes of Form I-134, and both parties are required to comply with all applicable laws. It is important to disclose all sources of income truthfully and ensure that all financial support is derived from legal means.

If the mailing address and physical address are different on Form I-134, the sponsor should provide both addresses in the appropriate sections of the form. The mailing address should be where the sponsor receives correspondence, while the physical address is the actual location where the sponsor resides. It is important to provide accurate and current information for both addresses to ensure proper communication and processing of the form.

On Form I-134, Declaration of Financial Support, the beneficiary can indicate their anticipated length of stay in the United States in Part 3, under the section 'Information about the Beneficiary.' There is a specific question asking for the intended length of stay. The beneficiary should provide an estimate of the time they plan to spend in the U.S. in terms of days, months, or years.

The role of the interpreter in the completion of Form I-134 is to assist the sponsor (the person completing the form) if they are not comfortable with English. The interpreter must translate the content of the form accurately and completely. If an interpreter is used, they must provide their contact information and sign the form in Part 7, certifying that they have read the form to the sponsor in a language that the sponsor understands and that the sponsor has acknowledged the accuracy of the information provided.

The role of the preparer in the completion of Form I-134 is to assist the sponsor with filling out the form if the sponsor is unable to do so on their own. The preparer could be anyone who completes the form on behalf of the sponsor, other than the sponsor themselves. The preparer must provide their own information in Part 8 of the form, including their name, address, and contact details, and they must also sign and date the form, certifying that they have prepared the form at the request of the sponsor and that the information is complete and accurate to the best of their knowledge.

The individual agreeing to financially support the beneficiary on Form I-134, known as the sponsor, is responsible for providing financial support to the beneficiary during their stay in the United States. This includes ensuring that the beneficiary will not become a public charge by providing for their living expenses, such as housing, food, and medical care. The sponsor must demonstrate the ability to support the beneficiary by providing evidence of income and assets. The sponsor is also responsible for completing the form accurately and truthfully, and for providing any additional documentation required to establish their financial ability to support the beneficiary.

On Form I-134, both the beneficiary and the supporter (sponsor) are required to provide certifications. The sponsor must certify in Part 6 that all the information provided on the form is true and correct to the best of their knowledge and belief. They must also certify that they are willing to financially support the beneficiary and that they understand the obligations this entails. The beneficiary is not required to sign Form I-134, as this form is completed and signed by the sponsor. However, the beneficiary must provide accurate information to the sponsor to ensure the form is filled out correctly and may be required to sign related forms or documents as part of their visa application process.

If additional space is needed to provide information on Form I-134, the supporter should attach a separate sheet of paper with the additional information. The supporter must include their name and Alien Registration Number (A-Number) if applicable, at the top of each sheet, indicate the page number, part number, and item number to which the answer refers, and sign and date each sheet.

Failing to complete Form I-134 in its entirety or not submitting the required documents can result in the form being rejected or denied. This may delay the beneficiary's application process or lead to a determination that the beneficiary does not have sufficient financial support, potentially affecting their eligibility for the immigration benefit they are seeking. It is crucial to provide all requested information and documentation to avoid negative consequences.

The beneficiary or the supporter can authorize the release of information for the administration and enforcement of U.S. immigration laws by signing the Form I-134. By signing the form, they consent to the disclosure of information contained in the form to other entities and persons where necessary for the administration and enforcement of U.S. immigration laws.

The expiration date of the current edition of Form I-134 is typically located in the top right corner of the form. It is important to use the most recent version of the form when submitting it to U.S. Citizenship and Immigration Services (USCIS). Applicants should check the USCIS website or contact USCIS directly to obtain the most current form and expiration date information.

If the beneficiary or the supporter has previously submitted a Form I-134 on behalf of another person, they should disclose this information on the current Form I-134 as required. They must provide details about the previous submission, including the name of the person they supported and the date of the previous submission. This information helps USCIS assess the supporter's financial ability to support additional beneficiaries.

Compliance I-134

Validation Checks by Instafill.ai

1

Ensures that the form edition date is '11/09/23' as per the provided instructions.

The AI ensures that the edition date of Form I-134 is the latest as specified, which is '11/09/23'. It checks the footer of each page for the edition date and confirms that it matches the required version. If the date is incorrect or outdated, the AI flags this for review. This validation is crucial to ensure that the form being filled is accepted by the authorities and has all the current questions and format.

2

Confirms that Part 1, Field 1 is correctly filled indicating who the filing is on behalf of.

The AI confirms that Part 1, Field 1 of Form I-134 is filled out correctly, indicating the person on whose behalf the filing is made. It checks for the appropriate selection or entry that identifies the relationship between the sponsor and the beneficiary. The AI ensures that this field is not left blank and that the information provided is consistent with the rest of the form. This validation is important for establishing the legitimacy of the sponsorship.

3

Verifies that the beneficiary's full legal name is entered in Part 2, Field 1, including family name, given name, and middle name.

The AI verifies that the beneficiary's full legal name is accurately entered in Part 2, Field 1 of Form I-134. It checks for the inclusion of the family name, given name, and middle name, if applicable. The AI ensures that the name matches the beneficiary's legal documents, such as a passport or birth certificate. This validation is essential to avoid any discrepancies that could lead to delays or rejections of the form.

4

Checks that all other names used by the beneficiary, including aliases and maiden names, are provided in Part 2, Field 2.

The AI checks that Part 2, Field 2 of Form I-134 includes all other names used by the beneficiary, such as aliases, maiden names, or any other legal names previously held. It ensures that this field is filled out if applicable, and that it is consistent with the beneficiary's historical records. This validation helps in establishing a complete identity profile for the beneficiary and is important for background checks and verifications.

5

Validates that the beneficiary's date of birth is entered in mm/dd/yyyy format in Part 2, Field 3.

The AI validates that the beneficiary's date of birth is correctly entered in Part 2, Field 3 of Form I-134 in the mm/dd/yyyy format. It checks for the correct sequence and formatting of the date, ensuring that it is not only accurate but also conforms to the required format. The AI also confirms that the date of birth is plausible and corresponds with the age indicated elsewhere on the form. This validation is critical for accurate record-keeping and processing of the form.

6

Confirms that the beneficiary's gender is selected in Part 2, Field 4.

This validation check ensures that a gender option has been selected for the beneficiary in Part 2, Field 4 of Form I-134. It confirms that one of the predefined gender categories is marked, and that the field is not left blank. The check is crucial for the accuracy of the beneficiary's personal information and to prevent any processing delays due to incomplete data. It also helps in maintaining the integrity of the demographic information provided in the form.

7

Ensures that the beneficiary's Alien Registration Number (A-Number), if any, is entered in Part 2, Field 5.

This validation check ensures that the beneficiary's Alien Registration Number (A-Number) is correctly entered in Part 2, Field 5, if applicable. It verifies that the A-Number, when present, is in the correct format and consists of the appropriate number of digits. This check is essential for the identification of the beneficiary within the immigration system. It also aids in the accurate tracking and processing of the beneficiary's file.

8

Verifies the completeness and accuracy of the beneficiary's place of birth in Part 2, Field 6.

This validation check verifies that the beneficiary's place of birth is completely and accurately entered in Part 2, Field 6 of Form I-134. It checks for the inclusion of the city, region, and country, ensuring that the information is consistent with legal documents and other forms of identification. This check is vital for confirming the beneficiary's identity and for any background checks that may be necessary. It also prevents any confusion or errors that could arise from incomplete or incorrect place of birth information.

9

Checks that the beneficiary's country of citizenship or nationality is correctly entered in Part 2, Field 7.

This validation check confirms that the beneficiary's country of citizenship or nationality is correctly entered in Part 2, Field 7 of Form I-134. It ensures that the country name is spelled correctly and matches the official designations used by the U.S. government. This check is important for legal and processing purposes, as it affects the beneficiary's eligibility and the applicable immigration laws. It also assists in the accurate compilation of statistical data for government records.

10

Validates the beneficiary's marital status and details if 'Other' is selected in Part 2, Field 8.

This validation check validates the beneficiary's marital status in Part 2, Field 8 of Form I-134, particularly if the 'Other' option is selected. It ensures that any additional details provided are clear and pertinent to the beneficiary's marital situation. This check is crucial for understanding the beneficiary's family circumstances, which may affect their financial support needs. It also ensures that all necessary information is provided for the adjudication of the form.

11

Ensures that the beneficiary's mailing address is complete and correctly formatted in Part 2, Field 9.

The AI ensures that the beneficiary's mailing address entered in Part 2, Field 9 of Form I-134 is complete, including all necessary components such as street address, city, state, and ZIP code. It checks for correct formatting according to USPS standards, and it flags any missing or incomplete information. The AI also cross-references the address with postal databases to confirm its validity and deliverability.

12

Confirms if the beneficiary's mailing and physical addresses are the same, and if not, ensures the physical address is provided in Part 2, Field 11.

The AI confirms whether the beneficiary's mailing address, provided in Part 2, Field 9, is identical to their physical address. If the addresses differ, the AI ensures that the physical address is fully and accurately provided in Part 2, Field 11. It validates the physical address format and completeness, and it prompts the user to correct any discrepancies or provide missing details.

13

Verifies the beneficiary's anticipated period of stay in the United States, including dates or 'No End Date' if applicable, in Part 2, Field 12.

The AI verifies the beneficiary's anticipated period of stay in the United States as stated in Part 2, Field 12 of Form I-134. It checks for the inclusion of specific start and end dates or the indication of 'No End Date' when applicable. The AI ensures that the dates are in a valid format and are logically consistent, such as the start date being earlier than the end date. It also alerts the user if the period of stay appears to be unusually long or short based on typical visa requirements.

14

Checks for the completeness of the beneficiary's financial information, including income and assets, in Part 2, Field 13 and Field 16.

The AI checks for the completeness and accuracy of the beneficiary's financial information in Part 2, Fields 13 and 16 of Form I-134. It ensures that all required fields related to income, employment, and assets are filled out. The AI also performs calculations to verify that the reported financial figures are consistent and reasonable, and it flags any fields that contain unlikely values or are left blank.

15

Validates that the supporter's full legal name is entered in Part 3, Field 1, including family name, given name, and middle name.

The AI validates that the supporter's full legal name is correctly entered in Part 3, Field 1 of Form I-134. It checks that the family name, given name, and middle name (if applicable) are all provided and spelled correctly. The AI cross-references the name with official identity documents when available to ensure accuracy. It also alerts the user if any part of the name is missing or if it detects unusual characters that are not typically found in legal names.

16

Ensures that the supporter's current mailing address is complete and correctly formatted in Part 3, Field 3.

The AI verifies that the supporter's current mailing address provided in Part 3, Field 3 of Form I-134 is complete, including all necessary components such as street number, street name, apartment or suite number if applicable, city, state, and ZIP code. It ensures that the address is correctly formatted according to USPS standards, which facilitates accurate and timely mail delivery. The AI also checks for any common errors in address entry, such as transposed numbers or misspelled city names. Additionally, the AI cross-references the provided address with official postal service databases to confirm its validity and existence.

Common Mistakes in Completing I-134

Applicants often incorrectly indicate the basis for filing on Form I-134, which can lead to confusion or delays in processing. It is crucial to carefully review the instructions and ensure that the correct basis for filing is selected, as this informs the purpose of the declaration and the nature of the support being provided. Double-check this section before submission to ensure accuracy. If unsure about which option to select, consult the form instructions or seek legal advice.

Omitting the beneficiary's full legal name is a common error on Form I-134. It is essential to provide the complete legal name as it appears on official documents such as passports or birth certificates. This ensures that the beneficiary is correctly identified and avoids potential issues with immigration authorities. Always cross-reference with official documents to verify the accuracy of the name entered on the form.

Applicants sometimes forget to include other names used by the beneficiary, such as maiden names, aliases, or nicknames that have been used in legal documents. This information is critical for accurate identification and background checks. To avoid this mistake, thoroughly review the beneficiary's history and include all names that have been legally recognized. This will help prevent unnecessary delays in the processing of the form.

The date of birth must be entered in the correct format on Form I-134, typically in the MM/DD/YYYY format. Incorrectly formatted dates can lead to misunderstandings or processing errors. Before submitting the form, double-check that the date of birth matches the format specified in the form instructions and that it corresponds to the beneficiary's official birth records. Using a calendar to verify the date can help prevent errors.

Failing to select the beneficiary's gender on Form I-134 is a mistake that can be easily overlooked. The gender field is an important demographic detail that must be accurately completed. Review the form to ensure that the appropriate gender has been selected for the beneficiary. If the form is being filled out electronically, ensure that the selection is properly recorded and appears on the review screen before final submission.

Failing to provide the Alien Registration Number (A-Number) when applicable can lead to processing delays or even the rejection of Form I-134. If the beneficiary has been issued an A-Number, it is crucial to include it in the designated field. To avoid this mistake, double-check all personal identification documents for the A-Number before submitting the form. If an A-Number has not been issued, ensure that the field is left blank as instructed.

The place of birth must be filled out completely, including the city and country of birth. Omitting any part of this information can result in the form being considered incomplete. To prevent this error, review the beneficiary's birth certificate or passport to verify the full place of birth. Ensure that all details are entered accurately and correspond with official documents.

It is mandatory to specify the beneficiary's country of citizenship or nationality on Form I-134. Neglecting to provide this information can cause confusion and delay the adjudication process. To avoid this oversight, confirm the beneficiary's nationality or citizenship status through their passport or national identity documents and record it accurately on the form.

Accurately stating the beneficiary's marital status is essential, as it can affect the evaluation of the declaration of financial support. Incorrect information in this section can lead to misunderstandings regarding the beneficiary's eligibility and requirements. To prevent this mistake, verify the beneficiary's marital status through appropriate legal documents such as a marriage certificate or divorce decree, and ensure the form reflects the current status correctly.

Providing an incomplete or incorrect mailing address for the beneficiary can result in important correspondence being misdirected or lost. This can significantly delay the processing of the form. To circumvent this error, double-check the beneficiary's mailing address for accuracy and completeness, including the street number, city, state, and postal code. It is also advisable to confirm the address with the beneficiary to ensure it is their current and correct mailing location.

Applicants often neglect to specify whether their mailing and physical addresses are identical on Form I-134. It is crucial to check the appropriate box to indicate if both addresses are the same to avoid any confusion or delays in communication. If the addresses differ, ensure that both are provided accurately. Double-checking the addresses before submission can prevent processing delays and ensure that all correspondence reaches the applicant in a timely manner.

A common oversight is the failure to include the beneficiary's physical address when it differs from their mailing address. It is essential to provide complete and accurate information regarding the beneficiary's physical location. This information is necessary for the authorities to have a clear understanding of the beneficiary's living arrangements. To avoid this mistake, carefully review the form to ensure that all address fields are filled out correctly, especially if the beneficiary's physical address is not the same as the mailing address.

Many applicants forget to detail the beneficiary's anticipated period of stay in the United States. This information is critical for immigration officials to assess the nature and duration of the financial support being declared. To prevent this error, applicants should communicate with the beneficiary to determine the expected length of their stay and clearly state this period on the form. Providing a clear and accurate duration helps establish the terms of financial responsibility and support.

Applicants sometimes omit crucial details regarding the beneficiary's financial information and any dependents they may have. It is important to disclose the beneficiary's financial situation and information about dependents to give a complete picture of the financial support required. To avoid this mistake, gather all necessary financial documents and information about dependents in advance, and ensure that every relevant section of the form is completed thoroughly.

While it may be uncomfortable, it is mandatory to disclose any income from illegal activities if applicable. Failure to disclose this information can have serious legal consequences and can affect the credibility of the declaration of financial support. To ensure compliance with legal requirements, review all sources of income carefully and disclose all information as required by the form. Honesty and transparency in this section are crucial for the integrity of the application.

Failing to list the beneficiary's assets and attach supporting evidence can lead to insufficient proof of financial capability. To avoid this mistake, ensure that all of the beneficiary's assets are listed in detail on the form. Additionally, attach bank statements, property documents, or other relevant evidence that substantiate the claims made about the beneficiary's financial resources. This documentation is crucial for establishing the beneficiary's ability to support themselves and can significantly impact the outcome of the application.

Providing an incomplete legal name of the supporter can cause confusion and delays in the processing of Form I-134. It is essential to use the supporter's full legal name as it appears on official documents such as a passport or driver's license. Double-check the spelling and include all parts of the name, including middle names if applicable. This ensures that the form is accurately associated with the supporter's identity and legal records.

Omitting other names used by the supporter, such as maiden names, aliases, or nicknames, can lead to incomplete background checks or misidentification. It is important to disclose all names that the supporter has used legally or informally. This information helps immigration officials to conduct thorough background checks and verify the supporter's identity. To avoid this mistake, review all personal records and include any additional names on the form.

Entering an incomplete or incorrect mailing address for the supporter can result in important correspondence being misdirected or lost. To prevent this, provide the full and accurate mailing address, including street number, name, apartment or suite number, city, state, and ZIP code. Before submitting the form, verify the address against a recent piece of mail or official document to ensure its correctness. Accurate address information is vital for maintaining communication with immigration authorities.

Neglecting to indicate whether the supporter's mailing and physical addresses are the same can lead to ambiguity regarding the supporter's place of residence. If the mailing and physical addresses are identical, clearly mark the appropriate box on the form. If they differ, provide both addresses in their respective fields. Clarifying this information helps immigration officials understand where the supporter resides and where to send official notices.

Applicants often neglect to provide the supporter's physical address when it differs from their mailing address. It is crucial to distinguish between the two addresses, as USCIS requires accurate information for potential contact purposes. To avoid this mistake, double-check the form sections asking for physical and mailing addresses and ensure that both are filled out if they are not the same. This helps ensure that all correspondence reaches the supporter in a timely manner.

Incorrectly entering the supporter's date of birth is a common error that can lead to processing delays. It is important to enter the date in the format specified by the form instructions (usually MM/DD/YYYY). Before submitting the form, verify the date of birth against a government-issued identification document to ensure accuracy. This simple step can prevent unnecessary confusion or requests for evidence from USCIS.

Supporters who have an Alien Registration Number (A-Number) sometimes forget to include it on the form. The A-Number is a critical piece of information used to identify the supporter's immigration records. If the supporter has an A-Number, it should be included in the designated field. Reviewing previous immigration documents or correspondence from USCIS can help locate the A-Number if it is not readily known.

Some supporters may have a USCIS Online Account Number but fail to provide it on the form. This number is used to track online filings and correspondence with USCIS. If the supporter has created an online account with USCIS, the account number should be included on the form. Checking the supporter's online account or previous USCIS notices can help identify the correct number to include.

It is a common oversight to not specify the supporter's current immigration status on the form. This information is essential for USCIS to understand the supporter's eligibility to sponsor. To avoid this mistake, the supporter should carefully review their immigration documents to determine their current status and ensure it is clearly indicated on the form. Accurate and complete information about the supporter's status can expedite the processing of the declaration.

Failing to provide the supporter's employment status and details can lead to insufficient evidence of financial ability to support the beneficiary. It is crucial to clearly state whether the supporter is employed, self-employed, or unemployed, and provide the necessary details such as the employer's name, address, and the nature of the work. This information helps establish the supporter's financial stability and ability to fulfill the declaration of support. To avoid this mistake, carefully review the employment section and ensure all fields are accurately completed with current and correct information.

Leaving out the supporter's financial information and details about dependents can result in an incomplete assessment of the supporter's financial obligations. It is important to disclose all sources of income, including salary, dividends, or other earnings, as well as providing accurate information about any dependents the supporter has. This information is used to determine the supporter's financial capacity to support the beneficiary in addition to their existing obligations. To prevent this error, double-check the financial section and dependents' information to ensure completeness and accuracy.

Failure to disclose income from illegal activities, if any, can have serious legal consequences and affect the credibility of the declaration. While it may seem counterintuitive, U.S. immigration law requires the disclosure of all income sources, legal or illegal. This does not mean that illegal income will be accepted as a means of support, but it must be reported for transparency. To avoid this oversight, ensure that all income, regardless of its legality, is reported on the form. Consult with a legal professional if there are concerns about disclosing such information.

Neglecting to list the supporter's assets and failing to attach evidence can weaken the declaration of financial support. Assets such as real estate, stocks, bonds, and other valuable properties can be considered when evaluating the supporter's financial strength. It is essential to provide a comprehensive list of assets and attach corresponding evidence such as property deeds, stock certificates, or bank statements. To correct this mistake, compile a detailed list of assets and gather the necessary documentation before submitting the form.

Omitting information about financial responsibility for other beneficiaries can lead to an underestimation of the supporter's financial commitments. If the supporter is financially responsible for other individuals, this must be disclosed to accurately assess their ability to support the beneficiary. This includes any previous declarations of support for other beneficiaries. To avoid this error, review any existing financial responsibilities and ensure they are clearly indicated on the form.

The absence of the beneficiary's signature and date on Form I-134 invalidates the declaration of financial support. It is crucial for the beneficiary to review the form thoroughly before submission to ensure that all required fields, including the signature and date sections, are completed. To avoid this mistake, beneficiaries should double-check the form after filling it out and before submitting it. A checklist or a final review step can be helpful in ensuring that no critical sections have been overlooked.

Omitting contact information can lead to delays in processing as it prevents communication between the beneficiary and the authorities. It is essential for the beneficiary to provide accurate and complete contact details, including address, phone number, and email address. To prevent this error, beneficiaries should fill out the form carefully and verify that all contact fields are filled in correctly. It may be beneficial to have another person review the contact information for accuracy before submission.

Failing to specify the nature of the financial support offered to the beneficiary can result in misunderstandings or insufficient evidence of the supporter's commitment. Supporters should clearly outline the type and extent of support being provided, such as monthly monetary assistance, accommodation, or other forms of support. To avoid this mistake, supporters should provide detailed descriptions and, if possible, attach additional documentation that corroborates their commitment to supporting the beneficiary.

When the supporter does not certify their statement on Form I-134, it can lead to questions regarding the authenticity and validity of the information provided. The supporter must read the certification section carefully and ensure that they sign and date the form to confirm the accuracy of the information. To prevent this error, the supporter should review the certification requirements and complete them as instructed. It is also advisable to check the form for any updates or changes to the certification process that may have been implemented since the last time it was completed.

The beneficiary's failure to certify their statement can cause complications in the processing of Form I-134. The certification is a necessary step that confirms the beneficiary's understanding and agreement with the information provided. Beneficiaries should carefully read the certification section and ensure that they complete it as required. To avoid this mistake, beneficiaries should pay close attention to the instructions regarding certification and ensure that they do not skip this critical step before submitting the form.

The absence of the supporter's signature and date on Form I-134 invalidates the declaration of financial support. It is crucial for the supporter to review the completed form before submission to ensure that the signature and date fields are not overlooked. The supporter should be aware that these fields are a mandatory part of the form's completion process. To avoid this mistake, the supporter should double-check the form after filling it out and before sending it to the relevant authorities.

Failing to provide contact information can lead to issues in communication and processing of Form I-134. The supporter must include complete and accurate contact details, including address, phone number, and email if available. This information is essential for the authorities to reach out if there are any questions or additional requirements. Supporters should carefully enter their contact information in the designated sections and verify the details to prevent any errors.

When an interpreter is used, it is mandatory for them to provide their full name and contact information on Form I-134. This information is necessary to validate the interpreter's identity and to facilitate any necessary follow-up communication. Interpreters should ensure that they fill out their section completely and accurately. They should also double-check their entries before finalizing the form to prevent any omissions or errors.

An interpreter's signature and the date are required to confirm that the supporter's information was accurately translated and understood. If an interpreter is used and they forget to sign and date the form, it may lead to processing delays or even the rejection of the form. Interpreters should be reminded to sign and date the form in the appropriate section after they have completed their part of the translation. A final review of the form can help ensure that this important step is not missed.

If a preparer is involved in completing Form I-134, their full name and contact information must be included. This is essential for the authorities to verify the preparer's involvement and to contact them if necessary. Preparers should take care to fill in their information accurately and review the form to ensure that no details have been left out. It is also advisable for preparers to keep a copy of the form for their records in case they need to be contacted in the future.

The absence of a signature and date by the preparer on Form I-134 invalidates the document, as it is a critical requirement for processing. To avoid this oversight, double-check the form before submission to ensure that all required fields are completed. The preparer should sign and date the form in the designated areas to confirm the accuracy and authenticity of the information provided. It is advisable to review the form thoroughly upon completion and before sending it to the relevant authorities.

Incorrect use of the additional information section can lead to misunderstandings or incomplete data being presented. This section is intended for any additional details that cannot be included in the main part of the form due to space constraints. To use this section correctly, clearly indicate the part of the form to which the information relates, and be concise yet thorough in your explanation. Always reference the specific item number or section to which the additional information pertains, ensuring clarity and coherence in your declaration.

Failing to sign and date each additional sheet attached to Form I-134 can result in the rejection of these supplementary documents. Each additional sheet is considered an integral part of the declaration and must be treated with the same level of importance as the primary form. To prevent this mistake, remember to provide a signature and date on each additional sheet, verifying the information contained within. This practice confirms the validity of the entire declaration and supports the authenticity of the additional details provided.

Utilizing an ink color other than black when completing Form I-134 can cause issues during the scanning and processing of the document. To ensure that all information is legible and correctly captured by electronic systems, it is essential to use only black ink. Before filling out the form, verify that the pen being used contains black ink and avoid using colors that may not be recognized by scanning equipment. This will facilitate a smoother processing experience and reduce the likelihood of delays.

The requirement to type or print in black ink is often overlooked, which can lead to processing delays due to illegibility or scanning errors. Black ink provides the highest contrast for clear reproduction and scanning of documents. To comply with this requirement, ensure that all typed or handwritten entries on Form I-134 are completed using black ink only. If printing the form, check printer settings to confirm that black ink is selected. This will help to avoid any unnecessary complications during the review of the form.

Failing to attach all required evidence can result in the rejection or delay of the processing of Form I-134, Declaration of Financial Support. Applicants should carefully review the instructions to ensure they include all necessary documentation, such as proof of income, assets, and the relationship to the beneficiary. It is advisable to create a checklist of required documents before submitting the form and to double-check that each item is included in the submission package. Keeping a copy of all documents for personal records is also recommended.

Submitting Form I-134 to the incorrect USCIS office can lead to significant processing delays. To avoid this mistake, applicants should consult the USCIS website or the form's instructions to determine the correct filing location based on their circumstances. It is important to note that the correct office may vary depending on factors such as the applicant's location or the beneficiary's situation. Applicants should also verify the address periodically, as USCIS office locations and filing procedures may change over time.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out I-134 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills i-134 forms, ensuring each field is accurate.