Fill out financial forms

with AI

Financial forms cover a broad range of official documents used to report income, manage debt, apply for assistance, disclose assets, and meet regulatory requirements. Whether you're dealing with tax obligations, bankruptcy proceedings, loan applications, retirement distributions, or immigration-related financial sponsorships, these forms play a critical role in h

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About financial forms

People turn to financial forms in all kinds of situations: a small business owner applying for an SBA disaster loan after a hurricane, a taxpayer requesting an IRS installment agreement to pay off a balance over time, a surviving spouse filing for Social Security benefits, or a student seeking financial aid for college. Debt relief forms like bankruptcy petitions and financial affidavits are especially common for individuals working through serious financial hardship, while personal financial statements and affidavits of support are frequently required during lending and immigration processes.

With 55 forms in this category spanning everything from IRS filings to international student aid applications, the paperwork can feel overwhelming. Tools like Instafill.ai use AI to help you fill out these forms accurately in under 30 seconds, reducing the risk of mistakes and saving significant time.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

Navigating financial documentation can be overwhelming, whether you are managing tax debt, applying for a business loan, or seeking legal aid. This guide helps you identify the correct form based on your current financial or legal situation.

Tax Debt and IRS Assistance

If you owe federal taxes but cannot pay the full amount immediately, use Form 9465, Installment Agreement Request to propose a monthly payment plan. For those facing significant financial hardship, Form 1127 allows you to request an extension of time to pay, while Form 433-F, Collection Information Statement helps the IRS evaluate your ability to satisfy a debt based on your current assets and expenses. If you have an unresolved issue causing financial difficulty, file Form 911 to request help from the Taxpayer Advocate Service.

Bankruptcy and Debt Relief

Individuals seeking a fresh start through bankruptcy should begin with Form 101, Voluntary Petition for Bankruptcy. To provide the court with a full picture of your finances, you will also need to complete Form 106Sum (Summary of Assets and Liabilities) and Form 107, Statement of Financial Affairs. If you are specifically looking for debt restructuring in Sweden, use the Ansökan om skuldsanering.

Immigration and Financial Sponsorship

Sponsors helping a non-U.S. resident must prove they can provide financial support. Form I-864, Affidavit of Support is the standard requirement for most family-based immigrants. For a simplified version, use Form I-864EZ if you are sponsoring only one person using your own income. For temporary visitors, Form I-134, Declaration of Financial Support is typically required.

Small Business and Professional Licensing

Entrepreneurs seeking funding should look to SBA Form 1919 for 7(a) loans or Form 5 for disaster assistance. Most lenders will also require SBA Form 413, Personal Financial Statement to assess your creditworthiness. For professional licensing, such as in Hawaii, use Form CT-36 for sole proprietor contractor applications.

Legal Aid and Court Fee Waivers

If you cannot afford court costs, look for "In Forma Pauperis" documents. Form AO 240 is used in U.S. District Courts, while specific state forms like the Pennsylvania AOPC 622A serve local jurisdictions. For residents in Australia, the Legal Aid Queensland application form (LAQAPP) is the primary document for seeking subsidized legal help.

Tips for financial forms

When filing multiple documents, such as a tax installment request alongside a collection statement, ensure your reported income and assets are identical. Discrepancies between different forms can lead to processing delays or additional scrutiny from agencies like the IRS or SSA.

Most financial forms require specific data from bank statements, tax returns, and pay stubs. Having these documents ready allows you to provide the exact figures required for sections like liquid assets or monthly expenses without having to guess or estimate.

AI-powered tools like Instafill.ai can complete these complex forms in under 30 seconds with high accuracy. Your sensitive data stays secure during the process, making it a highly efficient way to handle high-stakes paperwork without manual entry errors.

When filling out personal financial statements or bankruptcy petitions, remember to include co-signed loans or pending legal claims. Omitting these contingent liabilities can result in an inaccurate representation of your financial health and may affect your eligibility for loans or aid.

Many financial affidavits and state licensing forms require a formal signature in the presence of a notary public. Review the final page of your form before submission to ensure you haven't missed a required witness or official seal, as an unverified signature can void the entire application.

Financial situations change, and you may need to reference previous filings for future applications or tax audits. Maintain an organized digital folder of every completed form so you can quickly provide updates if your income, assets, or household expenses shift.

Frequently Asked Questions

This category includes a wide range of documents such as IRS tax installment requests, Social Security benefit applications, SBA loan forms, and bankruptcy petitions. You will also find financial affidavits for court cases, declarations of support for immigration purposes, and forms for reporting foreign financial assets.

For individuals filing for bankruptcy, Form 101 is the standard voluntary petition used to initiate the process. Depending on your specific situation, you may also need to file supplemental schedules like Form 106Sum to summarize your assets or Form 107 to disclose your statement of financial affairs.

If you are facing financial difficulty, you can use Form 9465 to request a monthly installment agreement with the IRS. For cases of extreme hardship where you need an extension of time to pay the tax due, Form 1127 may be used to request relief and avoid immediate collection actions.

Form I-864, the Affidavit of Support, is the most common document used by sponsors to demonstrate they have the financial means to support an intending immigrant. For shorter stays or specific visitor visas, Form I-134 (Declaration of Financial Support) is often used to ensure the visitor does not become a public charge.

Yes, many jurisdictions allow you to file 'In Forma Pauperis' using forms like AO 240 or AO 239 if you are experiencing financial constraints. These applications require a detailed summary of your income and expenses so the court can determine if you qualify for a fee waiver or installment plan.

Yes, AI tools like Instafill.ai can fill these forms in under 30 seconds by accurately extracting and placing data from your source documents. This technology helps ensure that complex financial data is entered into the correct fields without the need for manual typing.

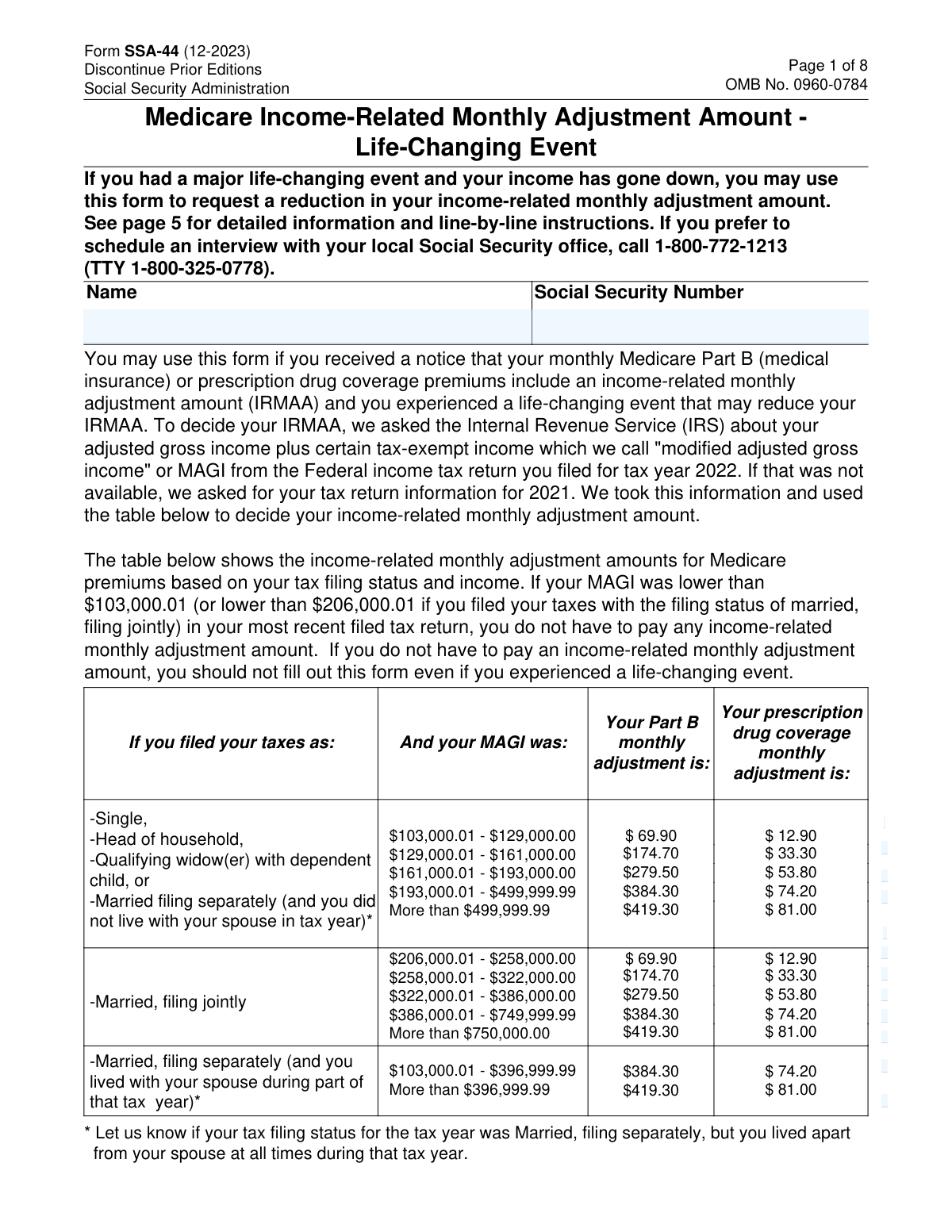

You should use Form SSA-44 if you already receive Medicare and your income has significantly dropped due to a specific event like retirement, marriage, or the loss of income-producing property. For initial claims for retirement or disability benefits, you would instead use the standard applications like Form SSA-1-BK or Form SSA-16.

Small business applicants typically need to provide a Personal Financial Statement (SBA Form 413) and borrower information (SBA Form 1919). These forms help lenders and the Small Business Administration evaluate your creditworthiness, net worth, and eligibility for programs like the 7(a) loan.

While manual completion of detailed financial forms can take hours, using an AI-powered service can reduce that time to less than a minute. These tools automatically map your personal and financial information to the appropriate boxes, significantly speeding up the filing process.

Financial affidavits are legal documents signed under penalty of perjury, meaning false statements can lead to legal penalties or the denial of your application. Providing precise details about your assets and liabilities ensures that court decisions, loan approvals, or benefit assessments are based on your actual financial standing.

U.S. taxpayers with interests in foreign financial accounts or specified assets exceeding certain thresholds may need to file Form 8938 or Form 8966. These forms are essential for compliance with FATCA regulations and help the IRS track international investments and income.

To apply for legal aid, you generally must provide a detailed account of your household income, assets, and the specifics of your legal matter using forms like the LAQAPP or CJA-23. This information is used to determine if you meet the financial eligibility criteria to receive free or subsidized legal representation.

Glossary

- Affidavit of Support

- A legally binding document where a person (sponsor) accepts financial responsibility for another individual, often required for immigration to ensure the person does not require government assistance.

- Public Charge

- A term used by immigration authorities to describe an individual who is likely to become primarily dependent on the government for subsistence, which may impact their eligibility for a visa or green card.

- Installment Agreement

- A formal payment plan that allows a taxpayer or debtor to pay off their total debt over time in smaller, monthly increments rather than as a single lump sum.

- In Forma Pauperis

- A Latin legal term meaning 'as a pauper,' used in court petitions to request that filing fees and legal costs be waived due to the applicant's inability to pay.

- Fiduciary

- A person or organization legally appointed to manage assets or make financial decisions on behalf of another party, such as an estate, trust, or minor.

- Unsecured Claim

- A debt that is not backed by collateral, meaning the creditor has no right to seize specific property if the debtor fails to pay.

- Contingent Liability

- A potential financial obligation that may arise in the future depending on the outcome of an uncertain event, such as a pending lawsuit or a guaranteed loan.

- Undue Hardship

- A legal standard used to describe a situation where paying a debt or meeting a requirement would cause an individual significant and unreasonable financial suffering.