Yes! You can use AI to fill out Personal Financial Statement (REV 06/2018) – Northwest Federal Credit Union

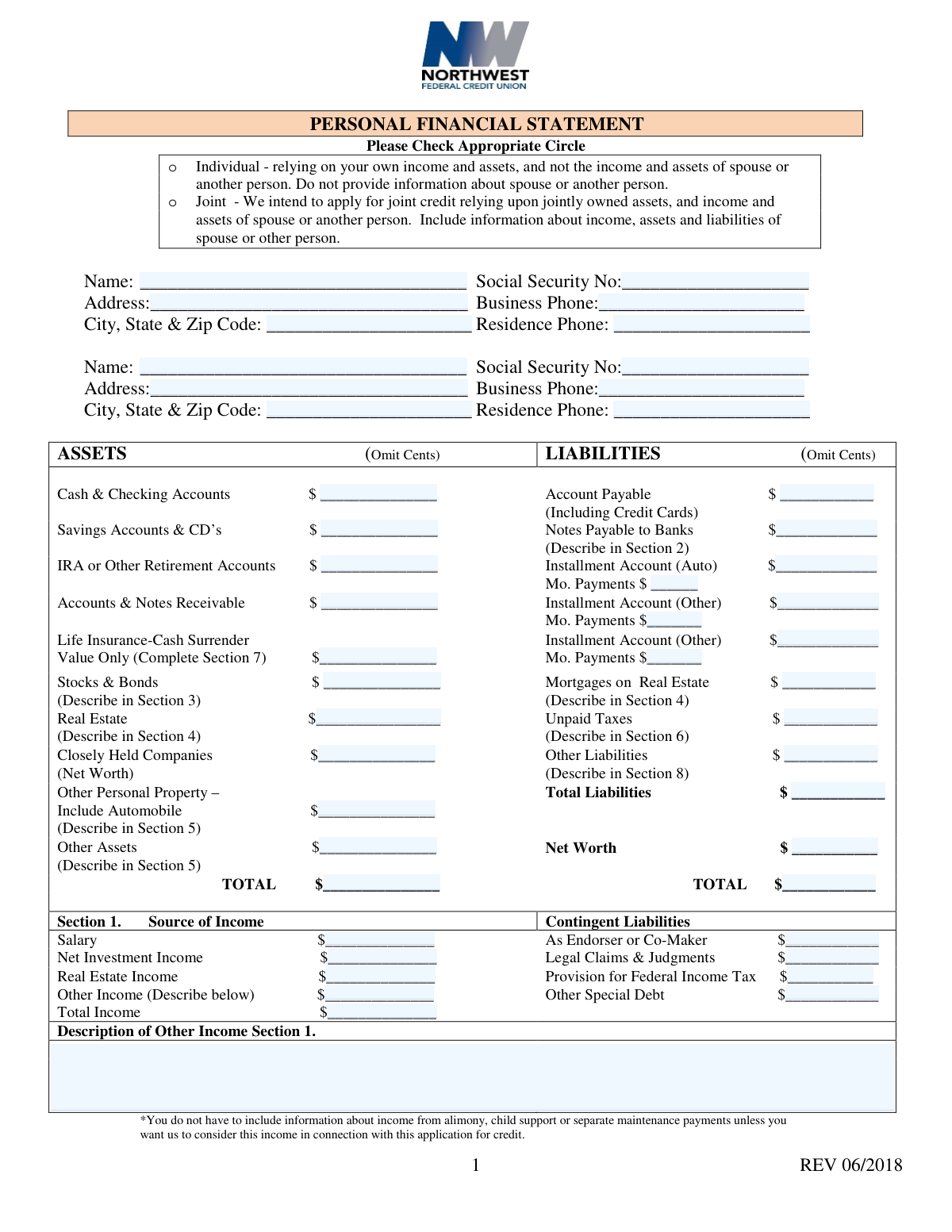

This Personal Financial Statement is a lender-required disclosure form used to summarize an applicant’s (or joint applicants’) complete financial position, including assets, debts, income sources, and contingent liabilities. It supports underwriting by helping the credit union verify net worth, repayment capacity, and overall creditworthiness. The form also includes detailed schedules for real estate, notes payable, investments, unpaid taxes, insurance, and other liabilities, plus legal/credit history questions. Signing authorizes the credit union to verify the information and warns that false statements may lead to prosecution under 18 U.S.C. § 1001.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Personal Financial Statement (REV 06/2018) using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Personal Financial Statement (REV 06/2018) – Northwest Federal Credit Union |

| Number of pages: | 4 |

| Filled form examples: | Form Personal Financial Statement (REV 06/2018) Examples |

| Language: | English |

| Categories: | insurance forms, financial forms, credit union forms, federal forms, PA state forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Personal Financial Statement (REV 06/2018) Online for Free in 2026

Are you looking to fill out a PERSONAL FINANCIAL STATEMENT (REV 06/2018) form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your PERSONAL FINANCIAL STATEMENT (REV 06/2018) form in just 37 seconds or less.

Follow these steps to fill out your PERSONAL FINANCIAL STATEMENT (REV 06/2018) form online using Instafill.ai:

- 1 Select whether you are filing as Individual or Joint, based on whether the credit decision should rely only on your finances or on combined finances with a spouse/other person.

- 2 Enter applicant (and co-applicant, if joint) identifying information: name, Social Security number, address, and phone numbers.

- 3 Complete the main balance sheet by listing total ASSETS and total LIABILITIES (omit cents), then calculate Total Assets, Total Liabilities, and Net Worth.

- 4 Fill out Section 1 for income sources and contingent liabilities, including totals and any description of “Other Income” (only include alimony/child support if you want it considered).

- 5 Provide required detail schedules: Section 2 (notes payable), Section 3 (stocks/bonds), and Section 4 (real estate owned) with supporting information and attachments if needed.

- 6 Complete remaining disclosures: Sections 5–8 (other property/assets, unpaid taxes, life insurance, other liabilities) and Section 9 (bankruptcy, settlements, judgments, pledged assets, lawsuits, disability insurance) with explanations in Comments when applicable.

- 7 Review for accuracy, attach and sign any additional pages, then sign and date the certification/authorization for verification before submitting.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Personal Financial Statement (REV 06/2018) Form?

Speed

Complete your Personal Financial Statement (REV 06/2018) in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Personal Financial Statement (REV 06/2018) form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Personal Financial Statement (REV 06/2018)

This form summarizes your assets, liabilities, income, and other financial details. It is used by Northwest Federal Credit Union to evaluate your creditworthiness for obtaining a loan or guaranteeing a loan.

Choose “Individual” if you are relying only on your own income and assets and not using a spouse’s or another person’s finances. Choose “Joint” if you are applying for joint credit and want the credit union to consider jointly owned assets and the other person’s income, assets, and liabilities.

No. The form instructs you not to provide information about your spouse or another person if you are applying as an individual relying only on your own income and assets.

No. The form says to “Omit Cents,” so round amounts to whole dollars.

You must provide name, Social Security number, address, city/state/ZIP, and business and residence phone numbers. If filing jointly, provide the same information for the second person as well.

List the total current balances for each category. For Savings/CDs and retirement accounts (IRA or other), include the combined value of all accounts you own in that category.

List each loan/credit obligation separately with the creditor name, original date and amount, present balance, interest rate, monthly payment, maturity date, and collateral/security. If you need more space, attach additional pages and sign them as instructed.

Provide the number of shares/face value or ownership percentage, the issuer/company name, ticker symbol (if applicable), market value, and indicate whether the security is pledged. Use signed attachments if you have many holdings.

List each parcel separately and use an attachment if you have more than the provided columns (Property A–C). Each attachment must be identified as part of the statement and signed.

It asks for your total monthly housing payment including Principal, Interest, Taxes, and Insurance (PITI), plus any condominium or townhouse fees. Enter the full monthly amount for each property.

List automobiles and other personal property in the “Other Personal Property – Include Automobile” line and describe details in Section 5. If any item is pledged as security, include the lien holder, lien amount, payment terms, and whether it is delinquent.

No. The form states you do not have to include income from alimony, child support, or separate maintenance unless you want the credit union to consider it for this credit application.

These are potential obligations that may become debts, such as being an endorser/co-maker, legal claims and judgments, or other special debt. Enter the amounts that could become payable if the contingency occurs.

Provide an explanation in the “Comments” section. Include enough detail for the credit union to understand what happened and the current status.

Yes—each applicant must sign and date the form. By signing, you authorize Northwest Federal Credit Union (or its designee) to verify the information and you certify the statements are true; false statements may have legal consequences under 18 U.S.C. 1001.

Compliance Personal Financial Statement (REV 06/2018)

Validation Checks by Instafill.ai

1

Application Type Selection (Individual vs Joint) is Exactly One Choice

Validates that the applicant selected exactly one option: Individual or Joint, and did not leave both unselected or select both. This is critical because it determines whether spouse/other person information must be included and relied upon for underwriting. If validation fails, the submission should be rejected or routed back for correction because downstream completeness rules depend on this choice.

2

Applicant Identity Fields Present and Non-Placeholder

Ensures the primary applicant’s Name, Address, City/State/Zip, and Social Security Number fields are completed and not left blank or filled with placeholders (e.g., underscores only). These fields are required to identify the borrower and support credit and identity verification. If missing or placeholder-only, the form should be flagged as incomplete and not accepted for processing.

3

Joint Applicant Section Required Only When Joint is Selected

Checks that the second person’s Name/SSN/Address/Phones are provided when Joint is selected, and are omitted (or explicitly marked N/A) when Individual is selected. This prevents collecting unnecessary personal data in Individual applications and ensures required co-borrower data is present for Joint credit. If Joint is selected and the second applicant section is incomplete, the submission should fail validation.

4

Social Security Number Format and Basic Validity

Validates that each SSN is 9 digits (allowing common formatting like XXX-XX-XXXX) and is not an obviously invalid value (e.g., all zeros, 123-45-6789, or repeated digits). SSNs are used for credit pulls and identity checks, and malformed values cause verification failures. If invalid, the system should block submission and request correction.

5

Phone Number Format Validation (Business and Residence)

Ensures business and residence phone numbers, if provided, conform to a valid phone format (e.g., 10 digits with optional separators and optional country code) and are not alphabetic or too short. Reliable contact information is necessary for follow-up and verification. If a phone number is present but invalid, the field should be rejected and the user prompted to correct it; if required by policy, missing phones should also trigger an error.

6

City/State/ZIP Code Format and Consistency

Validates that the ZIP code is 5 digits (or ZIP+4) and that State is a valid US state/territory abbreviation when the form is US-based. This improves address standardization and reduces downstream mailing/verification issues. If the ZIP/state format is invalid, the submission should be flagged for correction before acceptance.

7

Monetary Fields Are Whole Dollars, Non-Negative, and Numeric

Checks that all currency fields marked '(Omit Cents)' contain numeric whole-dollar amounts only (no cents, no letters), and are not negative. This includes assets, liabilities, income, contingent liabilities, and monthly payment fields. If any monetary field contains invalid characters, decimals, or negative values, the system should reject the entry and require correction to prevent calculation and underwriting errors.

8

Assets Total Equals Sum of Asset Line Items

Validates that the 'TOTAL' under ASSETS equals the sum of the listed asset categories (cash/checking, savings/CDs, retirement, receivables, life insurance cash value, stocks/bonds, real estate, closely held companies, other personal property, other assets). Accurate totals are essential for net worth and ratio calculations. If the total does not match (within a defined tolerance, typically $0 since cents are omitted), the form should be flagged and the applicant required to correct totals or line items.

9

Liabilities Total Equals Sum of Liability Line Items

Validates that the 'Total Liabilities' equals the sum of accounts payable, notes payable to banks, installment accounts (auto/other), mortgages, unpaid taxes, and other liabilities. This ensures the debt picture is complete and prevents incorrect net worth calculations. If the total does not reconcile, the submission should be rejected or routed for correction.

10

Net Worth Calculation Consistency (Assets - Liabilities)

Checks that Net Worth equals Total Assets minus Total Liabilities and that the displayed net worth is consistent with the provided totals. Net worth is a key underwriting metric and must be mathematically correct. If inconsistent, the system should flag the discrepancy and require correction before proceeding.

11

Income Total Equals Sum of Income Components

Validates that 'Total Income' equals the sum of Salary, Net Investment Income, Real Estate Income, and Other Income. This prevents misstatements and ensures consistent debt-to-income and cash flow analysis. If the total does not match the components, the form should be flagged and the applicant prompted to correct either the total or the line items.

12

Other Income Description Required When Other Income Amount > 0

Ensures that if 'Other Income' has a positive amount, the 'Description of Other Income' field is completed with a meaningful description (not blank or 'N/A'). This is important for underwriting to assess stability and eligibility of income sources (and to respect the note about alimony/child support being optional unless considered). If missing, the submission should fail validation or be routed for follow-up.

13

Installment Monthly Payment Required When Installment Balance > 0

Checks that for each installment account line where a balance is entered (Auto or Other), the corresponding 'Mo. Payments' field is also provided and numeric. Monthly payment amounts are required for debt service calculations and affordability analysis. If a balance exists without a monthly payment, the system should flag the entry as incomplete.

14

Section 2 Notes Payable Detail Required When Notes Payable to Banks > 0

Validates that if the summary liability 'Notes Payable to Banks' is greater than $0, at least one row in Section 2 is completed with creditor name and key terms (original date/amount, present balance, interest rate, monthly payment, maturity date, collateral). This ensures the summarized liability is supported by itemized details for verification. If the summary amount is non-zero but Section 2 is blank, the submission should be rejected or marked incomplete.

15

Section 4 Real Estate Detail Required When Real Estate or Mortgages > 0

Ensures that if 'Real Estate' assets or 'Mortgages on Real Estate' liabilities are greater than $0, Section 4 includes at least one property with address and key financial fields (date purchased, original cost, present market value, mortgage holder, mortgage balance, monthly payment). Real estate values and mortgage obligations must be traceable to specific properties for underwriting and collateral evaluation. If amounts are present without property details, the form should fail validation.

16

Yes/No Questions Require a Single Answer and Comments When Any 'Yes'

Validates that each Section 9 question has exactly one response (Yes or No) and that if any are answered 'Yes' (bankruptcy, settled debts, judgments, pledged assets not shown, lawsuits), the Comments section contains an explanation. These disclosures are material to credit risk and legal review, and missing explanations create compliance and underwriting gaps. If a Yes is selected without comments, the submission should be flagged for mandatory follow-up before acceptance.

Common Mistakes in Completing Personal Financial Statement (REV 06/2018)

People often skip the circle selection or choose “Joint” without realizing it requires including the spouse/other person’s income, assets, and liabilities throughout the statement. This creates inconsistencies (e.g., joint application checked but only one person’s data provided) and can delay underwriting or trigger follow-up requests. To avoid this, decide whether credit is based solely on one person or on combined finances, then complete all sections consistently with that choice.

On joint credit requests, applicants frequently provide only the primary borrower’s name and contact details and leave the second set of fields empty. This can prevent the lender from pulling credit, verifying identity, or properly evaluating combined repayment capacity. If applying jointly, complete the second applicant’s name, SSN, address, and phone numbers, and ensure the rest of the form reflects both parties’ finances.

Many people enter values like “$1,234.56” or mix formats (some with cents, some without), even though the form explicitly says to omit cents. This can cause calculation errors, rounding inconsistencies, and extra clarification requests. Use whole-dollar amounts only (e.g., 1235), and keep formatting consistent across all asset, liability, and income fields.

A very common issue is that Total Assets, Total Liabilities, and Net Worth are left blank or don’t reconcile with the amounts listed above. Underwriters often re-calculate and will pause the file if totals don’t tie out, especially when the discrepancy is material. Add each category carefully, confirm Total Assets minus Total Liabilities equals Net Worth, and re-check after any edits.

Applicants frequently lump all debts into one line (often “Accounts Payable”) or place loans in the wrong category, such as listing credit cards as “Notes Payable to Banks.” Misclassification makes it harder to assess debt structure, required payments, and collateral, which can lead to follow-up questions or incorrect debt-to-income calculations. Separate revolving credit (credit cards) from bank notes/lines and from installment loans, and include monthly payments where requested.

People often enter a lump-sum figure for items like Notes Payable, Stocks & Bonds, Real Estate, Unpaid Taxes, or Other Liabilities but leave the corresponding detail sections blank. This prevents verification of balances, terms, collateral, and ownership, and can stall approval. If you enter an amount in the summary, complete the matching section (or attach a signed, clearly labeled schedule) with the requested specifics.

In Section 4, applicants commonly provide property values but omit mortgage holder names, account numbers, balances, and the full monthly payment (PITI and condo/TH fees). Missing these details makes it difficult to validate liens and calculate cash flow and obligations, especially for rental properties. For each parcel, fill every line you can: purchase date, cost, market value, lender, account number, balance, and full monthly payment; include rental income if applicable.

Applicants often enter a single number for IRA/retirement or closely held companies without indicating whether it’s current market value, vested amount, or net worth, and without supporting detail. This can lead to overstated assets or assets that can’t be counted due to restrictions, which affects credit decisions. Use current statements or a reasonable valuation method, specify ownership percentage for businesses, and be prepared to attach documentation if requested.

A frequent mistake is listing the policy face value as an asset, even though the form asks for “Cash Surrender Value Only” and requires Section 7 details. This can materially overstate assets and create credibility issues during verification. Report only the cash surrender value in the asset summary, and in Section 7 provide insurer name, beneficiaries, face amount, and cash surrender value.

Applicants often check “No” to bankruptcy, judgments, lawsuits, or secured debts, but elsewhere list unpaid taxes, legal claims, or “other liabilities,” creating contradictions. Inconsistencies can trigger additional documentation requests or concerns about accuracy. Answer Section 9 carefully, and if any item is “Yes,” provide a clear explanation in Comments (dates, amounts, status, and resolution plan).

The form states this income is optional to disclose unless the applicant wants it considered, but people either include it without context or omit it and later rely on it verbally. This can cause underwriting confusion and may change qualifying income calculations. Decide upfront whether you want this income considered; if yes, list it clearly under Other Income with a description and be ready to document it.

When applicants add extra pages for loans, securities, or properties, they often forget to label them as part of the statement, tie them to the correct section, or sign them as required. Unlabeled/unsigned attachments may be rejected, forcing resubmission and delaying processing. Mark each attachment with the section number (e.g., “Section 2 – Notes Payable”), include the applicant name(s), and sign/initial as instructed.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Personal Financial Statement (REV 06/2018) with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills personal-financial-statement-rev-062018-northwest forms, ensuring each field is accurate.