Yes! You can use AI to fill out In Forma Pauperis Affidavit Petition (AOPC 622A) — Pennsylvania Magisterial District Court

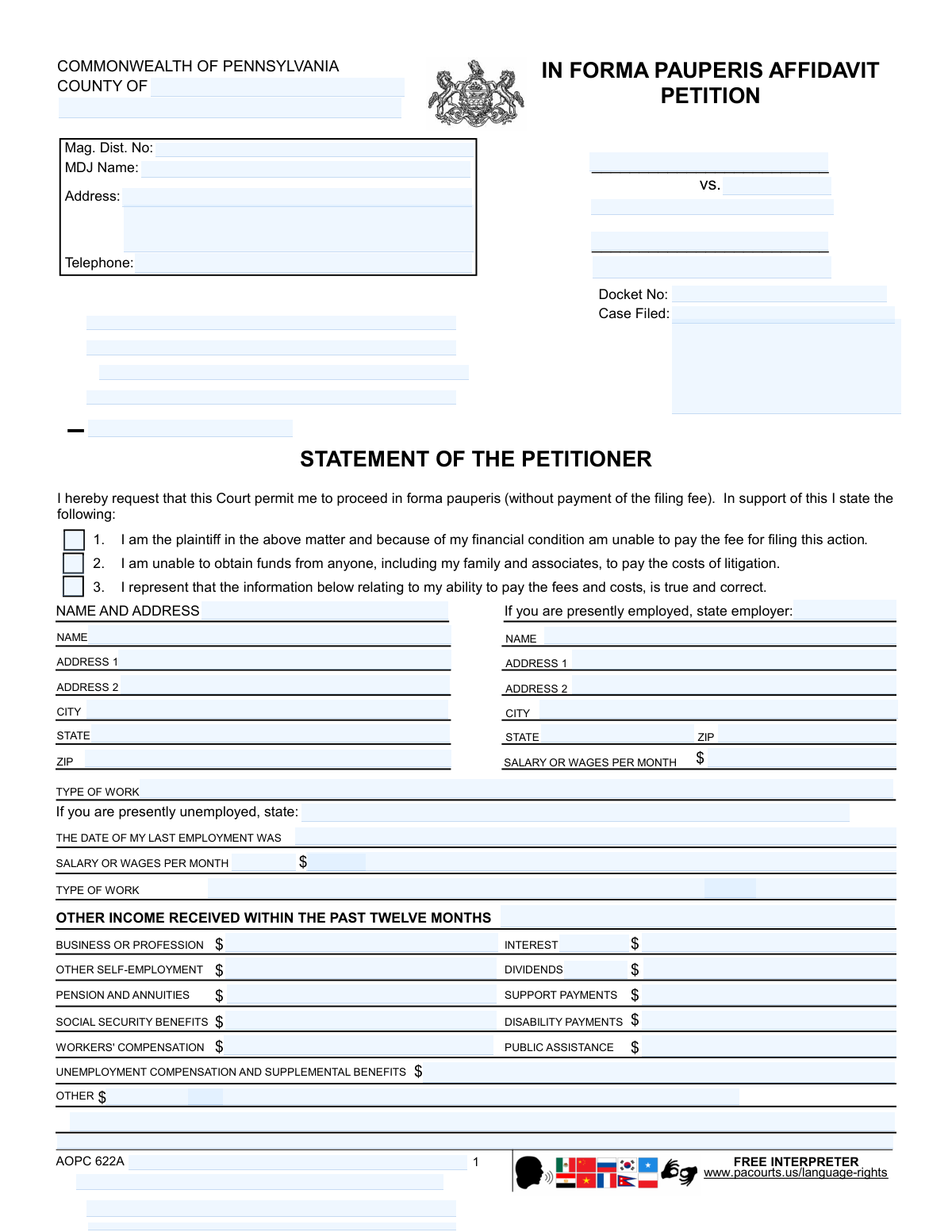

The In Forma Pauperis Affidavit Petition (AOPC 622A) is a Pennsylvania court form that allows a plaintiff/petitioner to request permission to proceed without paying filing fees due to financial hardship. It requires sworn disclosures about employment, income sources, household contributions, property, debts, and dependents so the judge can determine eligibility for a fee waiver. The petitioner also agrees to update the court if finances improve and acknowledges penalties for false statements under Pennsylvania law. This form is important because it can provide access to the courts when a person cannot afford the costs to start or continue a case.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out AOPC 622A (IFP Petition) using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | In Forma Pauperis Affidavit Petition (AOPC 622A) — Pennsylvania Magisterial District Court |

| Number of pages: | 7 |

| Language: | English |

| Categories: | court forms, District court forms, UK court forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out AOPC 622A (IFP Petition) Online for Free in 2026

Are you looking to fill out a AOPC 622A (IFP PETITION) form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your AOPC 622A (IFP PETITION) form in just 37 seconds or less.

Follow these steps to fill out your AOPC 622A (IFP PETITION) form online using Instafill.ai:

- 1 Enter the case caption and court details (county, magisterial district number, MDJ name/address/phone, parties, docket number, and filing date if known).

- 2 Complete your personal information section (name and address) and provide current employment details (type of work, monthly wages, employer name and address) or unemployment details (last employment date and prior wages/type of work).

- 3 List all other income received in the past 12 months (e.g., self-employment, public assistance, Social Security, unemployment, disability, support, interest/dividends, and any other sources) with amounts.

- 4 Provide household support information (spouse employment and wages, spouse name/employer, and contributions from children/parents/others).

- 5 Disclose assets and property owned (cash, checking/savings, CDs, real estate, vehicles with year/make, cost and amount owed, and any stocks/bonds) and list debts/obligations (rent, mortgage, loans, and other liabilities).

- 6 List all persons dependent on you for support (names, relationships, and ages of minor children) and review the continuing duty to report improved finances.

- 7 Sign and date the verification and confidentiality certification, then submit the petition to the appropriate court/MDJ for review and judge action (seal/date as applicable).

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable AOPC 622A (IFP Petition) Form?

Speed

Complete your AOPC 622A (IFP Petition) in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 AOPC 622A (IFP Petition) form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form AOPC 622A (IFP Petition)

An IFP Petition asks the court to let you proceed “in forma pauperis,” meaning you can file your case without paying the filing fee because you cannot afford it. You must provide truthful financial information to support the request.

The form states it is for the plaintiff/petitioner who is starting the action and cannot pay the filing costs. If you are not the party initiating the case, ask the court whether IFP is available for your situation.

Yes. The form asks for “Other Contributions to Household Support,” including spouse employment and contributions from children, parents, and others, because the court considers your overall household resources.

Complete the “presently unemployed” section by listing the date of your last employment, your prior type of work, and your prior monthly wages. Also fill out any “Other income received within the past twelve months” that applies.

You should report all income listed on the form that applies to you, such as Social Security, unemployment, workers’ compensation, public assistance, disability payments, support payments, pension/annuities, dividends/interest, self-employment, and “other” income.

The form asks you to list assets like cash, checking/savings, certificates of deposit, real estate (including your home), vehicles (make/year/cost/amount owed), and investments (stocks/bonds). It also asks for obligations such as rent, mortgage, loans, and other debts.

It means if your financial situation improves after filing (for example, you get a job or receive money), you must notify the court because you may then be able to pay some or all costs.

Yes. The form warns that false statements are subject to penalties under 18 Pa. C.S. § 4904 (unsworn falsification to authorities), so you should answer completely and accurately.

It is your certification that you are filing confidential information and documents in the required way, separate from non-confidential filings, under Pennsylvania’s public access rules. If you are unsure what is confidential, ask the court office before filing.

It is used to appeal a criminal court order from the Court of Common Pleas of Northampton County to the Pennsylvania Supreme, Superior, or Commonwealth Court (as applicable). The form requires the date of the order and an attached copy of the docket entry showing the order was entered.

The checklist includes: the appellate court filing fee check ($90.25), a $50.00 check payable to the Clerk of Judicial Records–Criminal Division, a copy of the Request for Transcript, any required transcript deposit check, proof of service on required recipients, and the referenced docket entry.

After a Notice of Appeal is filed, this form requests the official court reporter to prepare and file the transcript under Pa.R.A.P. 1922. It also allows you to indicate if there is no verbatim record or if the transcript is already lodged of record.

The form allows you to record the estimated number of pages, cost per page, and total estimated cost as provided by the court reporter. If a deposit is required to start transcription, you attach a check payable to the Court Reporter(s) for the required deposit(s).

Proof of Service is your written certification that you served the Notice of Appeal, Request for Transcript, and Proof of Service on the required recipients. The form references Pa.R.A.P. 906, which requires service on all parties in the trial court, the trial judge(s), the official court reporter(s), and the trial court’s District Court Administrator.

The Civil Cover Sheet is an administrative form required at the commencement of most civil actions filed with the prothonotary (e.g., complaint, writ of summons, petition). The notice states the prothonotary will not accept a filing that commences an action without a completed cover sheet, except for certain excluded case types (like custody, support, divorce, and Protection from Abuse).

Compliance AOPC 622A (IFP Petition)

Validation Checks by Instafill.ai

1

Validates Court/Jurisdiction Identifiers Are Present and Properly Formatted (County, Magisterial District No., MDJ Name)

Checks that the County, Magisterial District Number (Mag. Dist. No.), and MDJ Name fields are completed when the In Forma Pauperis (IFP) petition is filed in a Magisterial District Court context. Validates that the Magisterial District Number follows the expected Pennsylvania MDJ format (commonly a numeric pattern such as ##-#-##) and that the county is a recognized Pennsylvania county name. If missing or malformed, the submission should be rejected or routed for clerk review because the court cannot properly docket or assign the filing.

2

Ensures Case/Docket Identifiers Are Complete and Consistent Across Forms (Docket No., Case No., OTN #)

Verifies that required case identifiers are provided for the specific filing type: Docket No. for MDJ filings, and Case No. and OTN # for criminal Common Pleas appeal/transcript/service forms. Also checks that the same Case No./OTN # values match across the Notice of Appeal, Request for Transcript, and Proof of Service when submitted as a packet. If identifiers are missing or inconsistent, the system should block submission or flag it because documents may be misfiled to the wrong case.

3

Validates Party Caption Completeness (Plaintiff vs. Defendant / Commonwealth vs. Defendant)

Checks that the caption contains both parties (e.g., plaintiff and defendant for civil/MDJ matters, or Commonwealth of Pennsylvania vs. Defendant for criminal matters) and that the defendant name is not blank. Ensures the party role selection on the Notice of Appeal (Commonwealth/Defendant) is explicitly indicated and consistent with the caption. If incomplete, the filing should fail validation because the court cannot determine who is appealing or who the adverse party is for service and docketing.

4

Validates Required Signatures and Signature Blocks Are Present (Petitioner/Attorney)

Confirms that the IFP petition includes the petitioner’s signature and date, and that the Notice of Appeal, Request for Transcript, and Proof of Service include the filer’s signature (typically attorney or self-represented party). Also validates that the “Attorney for” field is completed when an attorney is indicated, or that the pro se indicator is used where applicable. If signatures are missing, the submission should be rejected because unsworn/unsigned filings may be legally ineffective.

5

Validates Date Fields for Correct Format and Logical Timing (Case Filed, Order Date, Last Employment Date, Service Date)

Checks that all dates are in an acceptable format (e.g., MM/DD/YYYY or a clearly parseable date) and are not impossible (e.g., 02/30/2026). Applies logical rules: the order date being appealed should not be in the future; the Proof of Service date should not precede the Notice of Appeal date; last employment date should not be after today. If invalid, the system should prompt correction because date errors can affect timeliness, jurisdiction, and compliance with appellate rules.

6

Validates Telephone Number Format for Court and Filer Contact Fields

Ensures telephone numbers (MDJ telephone, attorney/filer telephone) contain a valid 10-digit US number (optionally with country code +1) and acceptable punctuation. Prevents entry of non-numeric placeholders or too-short/too-long values. If validation fails, the system should require correction because courts rely on accurate contact information for notices, scheduling, and deficiency communications.

7

Ensures Employment Status Branching Is Completed (Employed vs. Unemployed Sections)

Checks that the filer provides either current employment details (employer name/address, type of work, monthly wages) or, if unemployed, the last employment date plus prior monthly wages and type of work. Prevents partially completed entries across both branches (e.g., claiming unemployed but providing a current employer) unless explicitly supported by the form logic. If incomplete or contradictory, the submission should be flagged because the court cannot assess indigency without a coherent employment picture.

8

Validates Monetary Fields Are Numeric, Non-Negative, and Currency-Formatted (Income, Assets, Debts, Costs)

Ensures all dollar amount fields (monthly wages, other income categories, cash/savings/checking, debts/obligations, transcript cost estimates, check amounts) are valid numbers, non-negative, and within reasonable bounds (e.g., not exceeding system maximums). Also enforces consistent currency formatting (two decimals allowed) and disallows text like “N/A” in numeric fields (use blank/zero per rules). If invalid, the system should block submission because financial calculations and eligibility determinations depend on clean numeric data.

9

Checks Financial Completeness for IFP Determination (Income, Assets, Debts, Dependents)

Validates that the IFP affidavit includes enough financial information to evaluate inability to pay: at minimum, monthly income (or explicit zero), assets (or explicit zero), debts/obligations (or explicit zero), and number of dependents (or explicit none). Requires that if any “Other” income/contribution is entered, a description is provided where the form implies a label. If key sections are blank, the system should mark the filing deficient because the court may deny IFP for insufficient information.

10

Validates Spouse/Household Contribution Logic (Spouse Employed, Spouse Name/Employer, Contribution Amounts)

If “MY SPOUSE IS EMPLOYED” is indicated or spouse contribution amounts are entered, checks that spouse name, employer, type of work, and spouse monthly wages are provided. If spouse fields are blank, ensures spouse-related contribution fields are empty or explicitly zero to avoid ambiguity. If inconsistent, the system should require correction because household resources are relevant to indigency determinations.

11

Validates Dependent Information Consistency (Names/Relationships/Ages of Minor Children)

Checks that when dependents are listed, each dependent entry includes a name and relationship, and that minor children have ages provided (numeric and plausible, e.g., 0–17). Also ensures the number of dependents is consistent with the number of dependent rows completed (if a count is captured by the system). If validation fails, the submission should be flagged because dependents materially affect financial hardship analysis.

12

Validates Notice of Appeal Court Selection and Order Information (Supreme/Superior/Commonwealth Court; Order Date)

Ensures exactly one appellate court is selected (Supreme, Superior, or Commonwealth) and that the appealed order date fields (day, month, year) are completed. Prevents multiple selections or none, and requires an attached docket entry copy as referenced by the form. If missing, the system should reject or mark deficient because the appeal cannot be routed or evaluated for timeliness without the correct court and order information.

13

Validates Attachment/Payment Checklist Consistency for Notice of Appeal Packet

When the filer checks items in the attachments list (e.g., check numbers, transcript request, proof of service, docket entry), validates that corresponding fields are completed (e.g., check number present if a check is indicated) and that uploaded documents match the checked items. If IFP is being requested in lieu of fees, ensures fee checks are not simultaneously asserted as included unless explicitly allowed. If inconsistent, the system should stop submission or request clarification to prevent incomplete packets and fee processing errors.

14

Validates Request for Transcript Details and Cost Arithmetic (Pages, Cost/Page, Total Estimated Cost, Deposit Check)

If the transcript cost certification is selected, checks that approximate pages and cost per page are numeric and that the total estimated cost equals pages × cost per page within a small rounding tolerance. If a deposit check is indicated as attached, requires a check number and (if captured) a deposit amount greater than zero. If validation fails, the system should flag it because incorrect estimates and missing deposits can delay transcript preparation and appellate deadlines.

15

Validates Proof of Service Completeness (Persons Served, Methods, Addresses/Phones, Rule 906 Coverage)

Requires that the Proof of Service section includes the names of all required recipients (all parties in trial court, trial judge(s), court reporter(s), and District Court Administrator) and the manner of service for each (e.g., mail, personal service, electronic where permitted). Validates that each listed recipient has sufficient contact information (address and/or phone as requested by the form) and that the service date is present. If incomplete, the system should mark the filing deficient because improper service can result in dismissal or delays in the appeal.

16

Validates Civil Cover Sheet Selections (Primary Case Category, Commencement Type, Damages/Class Action/MDJ Appeal, Dollar Amount Range)

Ensures exactly one PRIMARY CASE category is selected and that any “Other” category includes a text description. Validates that one commencement type (Complaint/Writ of Summons/Petition/etc.) is selected and that Yes/No questions (money damages, class action, MDJ appeal) are not left blank. If dollar amount requested is provided, checks that the arbitration-limits selection is made and is logically consistent with the amount (if the county’s arbitration threshold is configured); otherwise the cover sheet should be rejected because the prothonotary may not accept an action without a completed cover sheet.

Common Mistakes in Completing AOPC 622A (IFP Petition)

People often focus on the financial section and forget the top caption fields like County, Magisterial District No., MDJ Name, Docket No., Case Filed, Case No., and OTN #. Missing or inconsistent identifiers can cause the filing to be rejected, misfiled, or delayed because the clerk cannot match the paperwork to the correct case. Always copy these numbers exactly from the court notice/docket and ensure the same case identifiers appear consistently across the IFP petition, notice of appeal, transcript request, and proof of service.

This packet includes both civil-style captions (plaintiff vs. defendant) and criminal appeal captions (Commonwealth of Pennsylvania vs. Defendant), which leads many filers to put their own name in the wrong place. Incorrect captions can create confusion about who is filing and may result in the document being docketed incorrectly or returned for correction. Use the exact caption from the underlying case and double-check that the “Notice of Appeal” line correctly identifies whether the appellant is the Commonwealth or the Defendant.

Applicants frequently fill in both the “presently employed” and “presently unemployed” areas, or they leave key items blank such as employer name/address, type of work, last employment date, and monthly wages. This happens because the form layout is repetitive and easy to misread. Incomplete employment details can lead the court to question eligibility and request additional documentation, delaying a decision; only complete the section that applies and provide full employer contact information and accurate monthly amounts.

The form asks for “SALARY OR WAGES PER MONTH” and lists “OTHER INCOME RECEIVED WITHIN THE PAST TWELVE MONTHS,” which many people mistakenly report as weekly or annual figures, or they mix gross and take-home pay. This can make the affidavit internally inconsistent and may be treated as inaccurate or misleading. Convert all wages to a monthly figure, keep the same basis (gross or net) throughout, and clearly total or explain any irregular income (e.g., seasonal work).

Filers often overlook categories like unemployment compensation, disability payments, public assistance, support payments, pensions/annuities, interest/dividends, or self-employment income because they assume only wages count. Missing income sources can result in denial of IFP status or later sanctions if the court believes information was withheld. Review each listed category and enter “0” where applicable rather than leaving blanks, and include brief notes for intermittent benefits or one-time payments.

The form requests spouse employment and “OTHER CONTRIBUTIONS TO HOUSEHOLD SUPPORT” (children, parents, other persons), plus a list of dependents and ages of minor children. People commonly skip this because they think only their personal income matters, or they are unsure how to count shared household support. Courts often consider household resources when evaluating ability to pay, so leaving this incomplete can trigger follow-up or denial; list all regular contributors, approximate monthly amounts, and all dependents with relationships and ages.

Applicants frequently omit cash on hand, checking/savings balances, certificates of deposit, vehicle information (make/year/cost/amount owed), or real estate because they believe IFP is only about income. Missing asset information can undermine credibility and lead to denial or a requirement to pay partial fees. Provide current approximate balances, include jointly owned property, and for vehicles/real estate include both estimated value/cost and the amount still owed.

People often list only one major bill (like rent) and forget other recurring obligations such as car loans, credit cards, medical debt, child support arrears, or other loans, or they write vague entries like “bills.” Incomplete debt information can distort the court’s view of disposable income and may cause an incorrect eligibility decision. Itemize major monthly obligations and outstanding balances where requested, and use the “OTHER” lines to specify the creditor/type of debt.

These forms require dated signatures (petitioner/appellant) and include verification statements warning about penalties under 18 Pa. C.S. § 4904. Filers sometimes sign but forget to date, or they leave the signature line blank on one of the duplicate copies. Undated/unsigned filings are commonly rejected or treated as not properly verified; sign and date every form where indicated and ensure both copies (when filing in duplicate) are signed.

The Notice of Appeal checklist requires specific attachments (docket entry, proof of service, transcript request) and separate payments (e.g., $90.25 payable to the Appellate Court and $50.00 payable to Clerk of Judicial Records–Criminal Division), plus any transcript deposit. People often include one check instead of two, omit check numbers/amounts, or make checks payable to the wrong entity, which delays processing or results in rejection. Follow the checklist exactly, confirm current fees with the clerk, and label each check and attachment to match the form’s boxes.

On the Request for Transcript, filers frequently fail to identify which hearing/trial is being transcribed, omit the date, or do not address the checkboxes about whether a verbatim record exists or whether the transcript is already lodged. This can prevent the court reporter from starting work and can jeopardize appellate deadlines. Specify the exact proceeding and date, contact the court reporter for page estimates and deposit requirements, and attach the required deposit check if applicable.

Pa.R.A.P. 906 requires service on all parties in the trial court, the trial judge(s), the official court reporter(s), and the District Court Administrator, but filers often serve only the prosecutor/defense or only one office. They also commonly omit the manner of service (mail/hand/e-service), addresses, and phone numbers, making the certification incomplete. An inadequate proof of service can lead to procedural defects and delays; list every required recipient with full contact details and clearly state the service method and date.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out AOPC 622A (IFP Petition) with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills in-forma-pauperis-affidavit-petition-aopc-622a-pen forms, ensuring each field is accurate.