Yes! You can use AI to fill out In Forma Pauperis Affidavit/Petition (AOPC 622A) – Pennsylvania Magisterial District Court

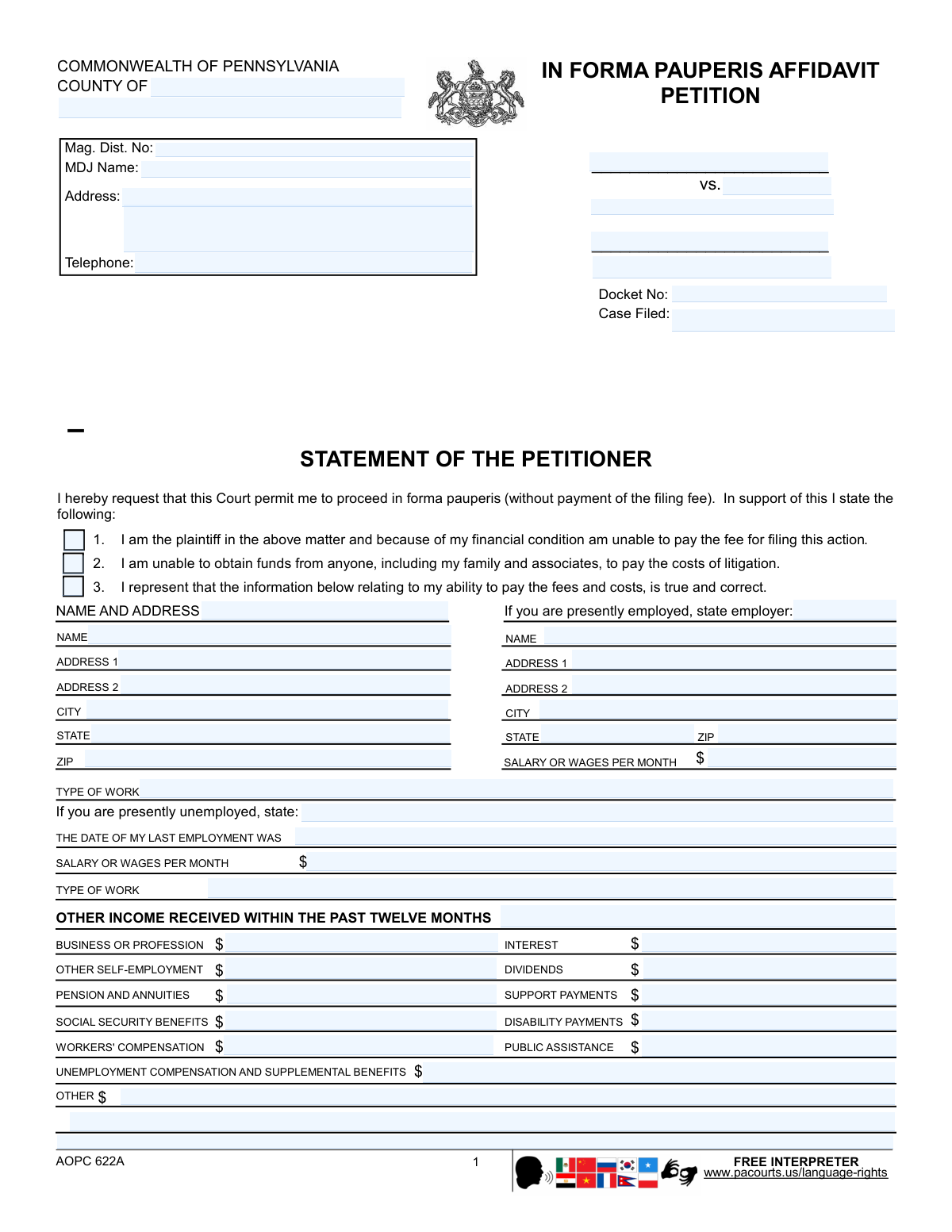

The In Forma Pauperis Affidavit/Petition (AOPC 622A) is a sworn request to proceed in a Pennsylvania Magisterial District Court without paying filing fees due to financial hardship. The petitioner provides employment, income, assets, debts, and dependents information so the court can determine eligibility for a fee waiver. It also imposes a continuing duty to notify the court if financial circumstances improve and warns that false statements may be penalized under 18 Pa. C.S. § 4904.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out AOPC 622A (IFP Petition) using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | In Forma Pauperis Affidavit/Petition (AOPC 622A) – Pennsylvania Magisterial District Court |

| Number of pages: | 7 |

| Filled form examples: | Form AOPC 622A (IFP Petition) Examples |

| Language: | English |

| Categories: | court forms, financial forms, District court forms, UK court forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out AOPC 622A (IFP Petition) Online for Free in 2026

Are you looking to fill out a AOPC 622A (IFP PETITION) form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your AOPC 622A (IFP PETITION) form in just 37 seconds or less.

Follow these steps to fill out your AOPC 622A (IFP PETITION) form online using Instafill.ai:

- 1 Enter the court and case identifiers (County, Magisterial District number, MDJ name/contact info, party names, docket number, and case filed date if known).

- 2 Complete the petitioner statement section confirming inability to pay and inability to obtain funds from others, then review the verification language for accuracy.

- 3 Provide employment details (current employer and wages) or, if unemployed, last employment date, prior work type, and prior monthly wages.

- 4 List all other income received in the past 12 months (e.g., public assistance, Social Security, unemployment, disability, support payments, interest/dividends) and any household contributions from spouse/children/parents/others.

- 5 Disclose assets and property owned (cash, bank accounts, certificates of deposit, real estate, vehicles) and list debts/obligations (rent, mortgage, loans, other obligations).

- 6 Identify all persons dependent on you for support (names/relationships and ages of minor children), then sign and date the petition and provide spouse name if requested.

- 7 Certify compliance with Pennsylvania’s Case Records Public Access Policy regarding confidential information, then submit the form to the Magisterial District Judge for review and decision.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable AOPC 622A (IFP Petition) Form?

Speed

Complete your AOPC 622A (IFP Petition) in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 AOPC 622A (IFP Petition) form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form AOPC 622A (IFP Petition)

An IFP Affidavit/Petition asks the court to let you proceed without paying filing fees because you cannot afford them. You must provide financial information under oath so the judge can decide whether to waive costs.

You should file it if you are the plaintiff/petitioner starting a case (or filing something that requires a fee) and you cannot pay the filing costs. The form is used in Pennsylvania courts and is reviewed by a judge (often a Magisterial District Judge for MDJ matters).

Not necessarily—IFP typically waives or postpones filing fees, but other costs (like transcript fees or service costs) may still apply depending on the case. The form also states you must tell the court if your finances improve and you become able to pay.

You’ll need your employment status, monthly wages, employer information (if employed), and details about other income received in the past 12 months (such as Social Security, unemployment, disability, public assistance, support payments, interest/dividends). You’ll also list property, cash/bank accounts, vehicles, and debts/obligations.

If you are unemployed, provide the date of your last employment and the type of work and wages you had at that time. If you have any other income (benefits, assistance, support, etc.), list it in the “Other income received within the past twelve months” section.

Yes, the form asks for “Other contributions to household support,” including spouse employment and contributions from children, parents, or others. The court considers household resources when deciding whether you can afford fees.

The petition includes a verification that your statements are true and warns that false statements may be penalized under 18 Pa. C.S. § 4904 (unsworn falsification to authorities). Missing or inaccurate information can also delay a decision or lead to denial.

It is your certification that you are filing confidential information (like certain identifiers) the way Pennsylvania’s public access rules require—separately or in a protected manner. If you are unsure what is confidential, ask the filing office before submitting.

The Civil Cover Sheet is an administrative form used by the court to categorize and track civil cases. Under Pa.R.C.P. 205.5, it must be filed when commencing most civil actions, and the prothonotary generally will not accept a new filing without a completed cover sheet.

Yes—Rule 205.5 lists exceptions such as Protection From Abuse, support, custody/visitation, divorce/annulment, and other domestic relations matters. Some counties with approved electronic filing systems may also be exempt from the cover sheet requirement.

Check the ONE category that best describes your primary claim (the main reason you are suing). If you have multiple claims, select the most important one and use “Other” lines if needed to describe it.

A “Complaint” starts the case with your written claims; a “Writ of Summons” starts the case without the full complaint (you file the complaint later); a “Petition” starts certain matters that proceed by petition rather than complaint. If you are unsure which applies, check what document you are filing to open the case.

It is used to appeal a criminal order from the Court of Common Pleas of Northampton County to the Pennsylvania Supreme, Superior, or Commonwealth Court (as applicable). The form states the date of the order being appealed and requires an attached copy of the docket entry showing the order.

The checklist includes appellate court and clerk filing fees (listed as $90.25 and $50.00 on the form), a copy of the Request for Transcript, any required transcript deposit check, proof of service on required recipients, and the referenced docket entry. The form also states it must be filed in duplicate.

You must serve all parties in the trial court, the trial judge(s), the official court reporter(s), and the trial court’s District Court Administrator, using a method permitted by Pa.R.A.P. 906. The Proof of Service must list the names/addresses and explain how service was made.

Compliance AOPC 622A (IFP Petition)

Validation Checks by Instafill.ai

1

Court/Jurisdiction Header Completeness (County, Magisterial District, MDJ details)

Validates that the in forma pauperis (IFP) petition includes the required court-identifying fields such as County, Magisterial District Number, MDJ Name, court Address, and Telephone. These fields are necessary to route the filing to the correct magisterial district and to ensure the court can contact the filer if issues arise. If any of these are missing or malformed, the submission should be flagged as incomplete and prevented from filing until corrected.

2

Party Caption Presence and Non-Blank Names (Plaintiff vs. Defendant)

Checks that the caption contains two parties (the “___ vs. ___” lines) and that each party name is not blank or placeholder text (e.g., only underscores). Correct party identification is essential for docketing, service, and avoiding misfiled cases. If either party is missing, the system should reject the submission or require correction before acceptance.

3

Docket/Case Identifier Format Validation (Docket No., Case No., OTN #)

Validates that any provided Docket No., Case No., and OTN # follow expected formatting rules (e.g., not empty, not all underscores, and matching local patterns if configured). These identifiers link the filing to the correct case and are critical for appellate processing and transcript requests. If the identifier is missing where required or fails format checks, the filing should be routed to manual review or blocked depending on the form type.

4

Date Field Validation (Case Filed, Order Date, Last Employment Date, Signature Dates)

Ensures all dates are valid calendar dates and captured in an acceptable format (e.g., MM/DD/YYYY or a configured court standard), including “Case Filed,” the appealed order date (day/month/year), last employment date, and dated signatures. Date accuracy is required to calculate deadlines (especially for appeals) and to assess financial recency for IFP eligibility. If a date is invalid, in the future where not allowed, or incomplete (missing month/year), the system should prompt for correction and prevent final submission.

5

Employment Status Logical Consistency (Employed vs. Unemployed Sections)

Checks that the petitioner does not simultaneously complete mutually exclusive sections in a contradictory way (e.g., providing a current employer while also stating they are presently unemployed without explanation). The IFP determination depends on a coherent financial picture, and conflicting employment information undermines reliability. If inconsistency is detected, the system should require the filer to clarify status and either complete the employed section or the unemployed section appropriately.

6

Income Amount Format and Range Validation (Monthly wages and other income lines)

Validates that all monetary fields (salary/wages per month and each “other income received within the past twelve months” line) are numeric currency values with at most two decimal places and non-negative amounts. This prevents calculation errors and ensures the court can evaluate eligibility consistently. If any amount contains non-numeric characters (other than currency symbols/commas) or is negative, the system should reject the entry and request correction.

7

Household Contribution Consistency (Spouse employed vs. spouse income fields)

If “MY SPOUSE IS EMPLOYED” is indicated, validates that spouse name, spouse employer, type of work, and spouse salary/wages per month are provided; if not employed, spouse income fields should be blank or explicitly zero as allowed by policy. Household income is a key factor in IFP determinations, and missing spouse details can materially change eligibility. If spouse employment is marked but required spouse fields are missing, the submission should be flagged as incomplete.

8

Asset and Debt Currency Validation (Property owned and obligations)

Checks that asset values (cash, savings, checking, certificates of deposit, real estate value, vehicle cost) and debt/obligation amounts (mortgage, rent, loans/other) are valid non-negative currency amounts. Accurate assets and liabilities are required to assess ability to pay fees and to detect obvious omissions. If any asset/debt field is malformed or contains text instead of numbers, the system should require correction or route to manual review.

9

Motor Vehicle Details Completeness (Make, Year, Cost, Amount Owed)

When a motor vehicle is listed, validates that make and year are present and that year is a plausible 4-digit year (e.g., 1900–current year+1), with cost and amount owed provided as currency. Vehicle ownership can affect IFP eligibility and must be described consistently. If a vehicle is indicated but year/cost/owed are missing or invalid, the system should prompt for completion.

10

Dependents Section Integrity (Names, relationships, and minor ages)

Validates that each dependent entry includes a name and relationship, and that ages of minor children (if any) are provided as whole numbers within a reasonable range (e.g., 0–17). Dependents affect household financial obligations and are relevant to IFP determinations. If dependents are listed without required details or minor ages are missing/invalid, the submission should be flagged for correction.

11

Required Signatures and Verification Statements Present (IFP and appellate forms)

Ensures the petitioner/appellant has signed where required (e.g., “Signature of Petitioner” on IFP; signature on Notice of Appeal, Request for Transcript, and Proof of Service) and that the verification/certification statements are not omitted. Signatures and verifications establish accountability and are often mandatory for acceptance. If any required signature is missing, the system should prevent submission as legally incomplete.

12

Attorney vs. Pro Se Consistency (Cover sheet and appellate attorney fields)

Checks that the filer either provides attorney information (name, address, phone, Supreme Court No.) or explicitly indicates pro se status where the form provides that option, and that the two are not contradictory. This is important for service, contact, and compliance with attorney identification requirements. If pro se is checked but attorney fields are populated (or vice versa without explanation), the system should require the filer to resolve the inconsistency.

13

Telephone Number Format Validation (Court and filer contact numbers)

Validates that telephone numbers provided (court telephone, filer/attorney telephone) match an acceptable pattern (e.g., 10-digit US number with optional separators and optional extension). Reliable contact information is necessary for deficiency notices and scheduling. If a phone number is present but invalid (too short/long or contains letters), the system should prompt for correction; if required by local rules, block submission until fixed.

14

Notice of Appeal Court Selection and Order Identification Completeness

Ensures the Notice of Appeal specifies who is appealing (Commonwealth or Defendant), identifies the appellate court selection (Supreme/Superior/Commonwealth), and includes the appealed order date (day/month/year). These elements are essential to determine jurisdiction and timeliness and to process the appeal correctly. If the appellate court is not selected or the order date is missing, the system should reject the filing as incomplete.

15

Transcript Request Completeness and Payment/Estimate Consistency

Validates that the Request for Transcript identifies the proceeding (trial/hearing regarding what) and the hearing date, and enforces logical consistency among transcript options (e.g., if “no verbatim record” is checked, page count/cost fields should not be required; if an estimate is provided, total estimated cost should equal pages × cost per page within rounding tolerance). This prevents delays and billing disputes and ensures the court reporter can act on the request. If required details are missing or the estimate math is inconsistent, the system should require correction or route to manual review.

16

Proof of Service Minimum Content Validation (served parties and method)

Checks that the Proof of Service includes a service date, identifies the persons served (names and addresses/phone where requested), and states the manner of service consistent with Pa.R.A.P. 906 requirements. Proper service is a prerequisite for appellate processing and avoids later procedural dismissal. If the proof of service lacks recipients or method, the system should flag the submission as deficient and prevent final acceptance until completed.

Common Mistakes in Completing AOPC 622A (IFP Petition)

People often skip these fields because they don’t know where to find the numbers or assume the court will fill them in. Missing or mismatched identifiers can cause the filing to be rejected, misfiled, or delayed because staff cannot reliably match the paperwork to the correct case. Always copy the County, Magisterial District number, docket/case number, and (for criminal appeals) the OTN exactly as shown on prior court notices or the docket sheet.

Filers frequently put their own name in the wrong place in the caption or check the wrong party designation on the Notice of Appeal. This happens because the forms mix civil and criminal contexts and the caption format is unfamiliar to self-represented litigants. The consequence can be an incorrect appeal notice or a petition that does not match the underlying case, leading to rejection or the need to refile. Use the caption exactly as it appears on the court’s docket and confirm whether you are the Plaintiff/Appellant, Defendant, or the Commonwealth before completing the form.

A very common error is listing only wages and leaving all other income lines blank (Social Security, unemployment, disability, support payments, public assistance, cash contributions, etc.). People do this because they think “income” means only a paycheck or they are unsure whether irregular payments count. Underreporting can result in denial of IFP status or later sanctions if the court believes the affidavit is inaccurate. Avoid this by entering $0 where applicable and including all income received within the past 12 months, even if intermittent.

Applicants often fill in “type of work” and “salary” but omit the employer name/address, or if unemployed, they forget to provide the date of last employment and prior wages. This happens because the form presents both employed and unemployed sections and people don’t realize one of them must be completed fully. Missing employment history can cause the court to question eligibility and delay review. Complete the employed section fully if currently working; otherwise complete the unemployment section with last employment date, type of work, and prior monthly wages.

Many filers leave the property/debts section blank, especially for vehicles, bank accounts, real estate, loans, rent, and mortgages, or they list an item but omit “cost” and “amount owed.” This usually happens because people assume IFP is based only on income, or they don’t have exact figures handy. The court evaluates ability to pay using both assets and obligations, so incomplete entries can lead to denial or requests for additional documentation. Gather approximate current balances and amounts owed and enter $0 where you have none; include vehicle year/make and any loan balance.

Filers frequently skip spouse income/contributions, contributions from children/parents, and the list of dependents and their relationships/ages. This happens because people are unsure whether household members “count” or they worry about sharing others’ information. The court uses household support and dependents to assess financial hardship, so missing data can distort the analysis and delay a decision. Provide spouse/household contribution amounts (or $0), and list all dependents with relationship and ages of minor children as requested.

A common rejection reason is an unsigned IFP affidavit, an undated verification, or forgetting to sign the Notice of Appeal/Transcript Request/Proof of Service. People miss this because signatures appear in multiple places and the forms span several pages. Unsigned filings may be treated as defective, causing delays or dismissal, and the IFP affidavit specifically warns about penalties for false statements. Before filing, check every page that has a signature line, date line, and verification/certification paragraph and complete them all.

On the Notice of Appeal, filers often forget to include the attached docket entry, proof of service, transcript request, or the required filing fees/checks—or they make checks payable to the wrong entity. This happens because the attachments list is long and includes multiple payees and amounts. Missing attachments can result in the appeal being rejected or not perfected, risking loss of appellate rights. Use the checklist exactly: include the referenced docket entry, proof of service, transcript request, and ensure checks match the stated amounts and payees (or file a properly completed IFP request if seeking fee waiver).

People commonly serve only the opposing party and forget the trial judge(s), court reporter(s), and District Court Administrator, or they fail to state the manner of service and full addresses/phone numbers. This occurs because service rules are technical and the form requires multiple recipients under Pa.R.A.P. 906. Defective service can delay the appeal, trigger court orders to cure, or jeopardize compliance with appellate rules. Avoid this by listing every required recipient, providing complete contact information, and clearly stating how and when each was served (e.g., first-class mail, hand delivery, e-service if permitted).

Filers often request “the transcript” without identifying the specific hearing/trial and date, or they fail to include the reporter’s page estimate, per-page cost, total estimate, and deposit check information when required. This happens because they don’t know which proceeding is relevant for the appeal or they haven’t contacted the court reporter. The consequence is delay in transcript preparation, missed appellate deadlines, or an incomplete record on appeal. Identify the exact proceeding and date, contact the official court reporter(s) promptly for estimates, and include the required deposit/check details or indicate the appropriate checkbox if no verbatim record exists.

On the Civil Cover Sheet, filers frequently check more than one primary case category or choose a category that doesn’t match the complaint (e.g., selecting “Contract” when it’s actually “Tort” or “Real Property”). This happens because the categories are broad and the form instructs you to pick only the ONE primary case. Misclassification can affect routing, case management, arbitration assignment, and processing time. Read the complaint’s main legal theory and select a single best-fitting category; if “Other” is used, write a clear, specific description.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out AOPC 622A (IFP Petition) with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills in-forma-pauperis-affidavitpetition-aopc-622a-penn forms, ensuring each field is accurate.