Yes! You can use AI to fill out Form 5, SBA Disaster Loan Application

Form SBA Form 5 is the application for a Small Business Administration disaster loan. It is crucial for businesses affected by declared disasters to fill out this form to secure financial assistance for recovery.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out SBA Form 5 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 5, SBA Disaster Loan Application |

| Form issued by: | U.S. Small Business Administration |

| Number of fields: | 207 |

| Number of pages: | 22 |

| Version: | 2023 |

| Filled form examples: | Form SBA Form 5 Examples |

| Language: | English |

| Categories: | financial forms, loan application forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out SBA Form 5 Online for Free in 2026

Are you looking to fill out a SBA FORM 5 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your SBA FORM 5 form in just 37 seconds or less.

Follow these steps to fill out your SBA FORM 5 form online using Instafill.ai:

- 1 Visit instafill.ai site and select SBA Form 5.

- 2 Enter your business name and disaster details.

- 3 Provide insurance and financial information.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable SBA Form 5 Form?

Speed

Complete your SBA Form 5 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 SBA Form 5 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form SBA Form 5

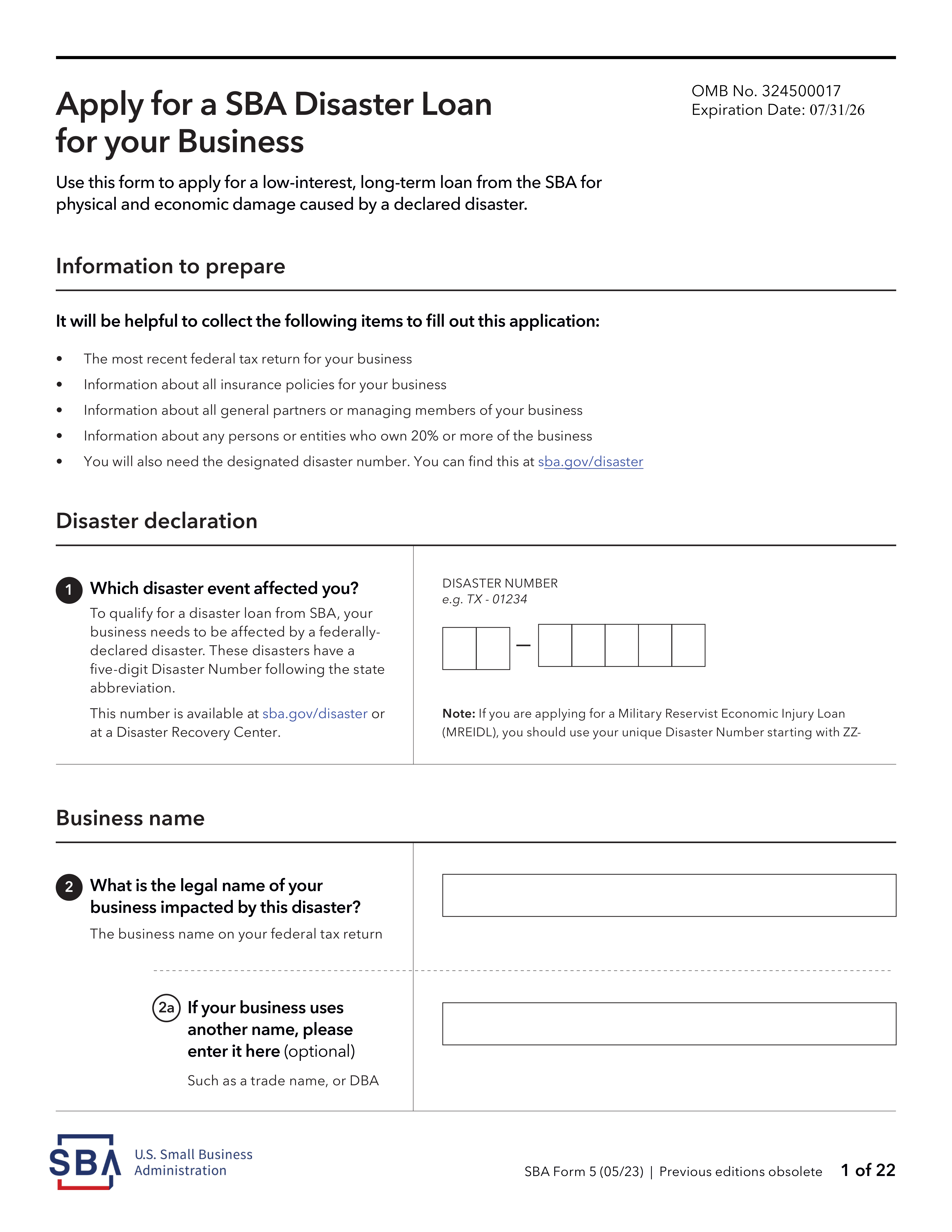

To apply for an SBA Disaster Loan, your business must have been affected by a federally-declared disaster. Please provide the disaster number associated with the event.

Provide the exact legal name of your business as it appears on your most recent federal tax return.

Please provide the address of the business location that experienced physical damage or economic injury from the disaster. Ensure the address is within the declared disaster area.

Select all the items that apply to your business. If your business has had a loss of capital, please select 'Loss of capital'.

Please provide your Employer Identification Number (EIN) or Social Security Number if you are a sole proprietorship or independent contractor.

The six-digit NAICS (North American Industry Classification System) code is required to describe the primary industry activity of your business. You can find this code by conducting a search on the U.S. Small Business Administration (SBA) website or other business registration databases. It may also be listed as a 'Business Activity Code' or 'Business Code Number' on your tax filings.

You should report the number of employees you had at the time of the disaster event. This includes all full-time and part-time employees, as well as yourself.

Yes, having hazard insurance is a requirement for the SBA Disaster Loan Application. If you have insurance, you will need to provide the name of the insurance company, policy number, and the amount you have received from the insurance company, if any.

You should report the percentage of ownership you have in the business. This percentage represents the proportion of the business that you personally own and control.

Yes, if you have an additional phone number that can be used to contact you, please provide it on the application. This will help ensure that the SBA can reach you with any important updates or information regarding your loan application.

Designate a primary point of contact for your loan application. This person should have the authority to make decisions and sign legal documentation on behalf of your business.

Check 'Yes' if you agree to conduct business with the U.S. Small Business Administration using Electronic Communications and using an electronic signature instead of a written signature.

Check the expiration date at the top of the form to determine the deadline for submitting your application.

Gather the required documents, including the Request for Transcript of Tax Returns (IRS Form 4506C), complete copies of the most recent federal income tax returns, and a Personal Financial Statement (SBA Form 413).

Compliance SBA Form 5

Validation Checks by Instafill.ai

1

Disaster Number Format

Ensures that the Disaster Number is correctly formatted, adhering to the specific pattern that includes the state abbreviation followed by a hyphen and a five-digit number. For example, 'TX-01234' would be a valid format. This check is crucial to ensure that the application is associated with the correct disaster event and to maintain consistency across all applications.

2

Business Name and DBA Verification

Confirms that the legal business name provided on the SBA Disaster Loan Application matches exactly with the name on the federal tax return. Additionally, it verifies that any Doing Business As (DBA) or trade name is properly entered in section 2a of the form. This validation is essential to prevent discrepancies and to ensure that the business is correctly identified in all related documentation.

3

Business Location Address Verification

Verifies that the address(es) of the affected business location(s) are complete and accurately entered on the form. This check includes confirmation of whether the space is owned or leased by the business. Accurate location information is vital for assessing the impact of the disaster and for any potential inspections or correspondence.

4

Damaged or Destroyed Items and Military Reservist Employee Information

Checks that all damaged or destroyed items are selected on the form and ensures that the name and Social Security Number of any affected Military Reservist employee are included if applicable. This information is necessary for a thorough evaluation of the claim and to provide support for employees who are reservists.

5

Federal Tax ID and Business Structure Verification

Confirms that the Federal Tax ID (EIN or SSN) provided is valid and cross-references the North American Industry Classification System (NAICS) code to ensure its correctness. Additionally, it checks that the business structure indicated on the application matches the most recent federal tax return. This validation is critical for legal and tax purposes.

6

Verifies the number of employees at the time of the disaster event is indicated

This validation check ensures that the application accurately reflects the number of employees at the time of the disaster event. It verifies that this field is not left blank and that the input is a valid numerical value. This information is crucial for assessing the impact of the disaster on the business and determining the appropriate level of assistance.

7

Ensures all insurance policies are detailed with the insurance company name, policy number, and any received amounts from claims

This validation check confirms that all relevant insurance policies are thoroughly detailed in the application. It ensures that the insurance company name, policy number, and any amounts received from claims are provided. This information is essential for understanding the applicant's insurance coverage and for avoiding duplication of benefits.

8

Confirms the full legal name, date of birth, Social Security Number, email, phone number, percentage of ownership, and other relevant details for each owner with 20% or more ownership

This validation check is designed to confirm that all required personal details for each owner with 20% or more ownership are fully provided. It checks for the presence of the full legal name, date of birth, Social Security Number, email, phone number, and percentage of ownership, among other relevant details. Accurate and complete owner information is vital for background checks and loan processing.

9

Checks for complete responses to all questions regarding criminal background, delinquencies, and federal contract issues

This validation check scrutinizes the application to ensure that all questions related to the applicant's criminal background, any delinquencies, and issues with federal contracts are answered completely. It helps in identifying any potential red flags that might affect the eligibility for the disaster loan. Full disclosure is necessary for compliance with federal regulations.

10

Verifies the primary point of contact information is complete and an alternative address for correspondence is provided if necessary

This validation check ensures that the primary point of contact information is fully detailed, including name, phone number, and email address. It also verifies that an alternative address for correspondence is provided if necessary. Reliable contact information is crucial for effective communication throughout the loan application process.

11

Confirms if a paid agent was used, their full name, company, address, and fee for services are provided.

The AI ensures that if a paid agent was involved in the preparation of the SBA Disaster Loan Application, all required details about the agent are accurately captured. This includes confirming the presence of the agent's full name, the name of the company they represent, their full address, and the fee charged for their services. The AI cross-references this information with the provided data to ensure completeness and accuracy. If any of these details are missing or incomplete, the AI flags the section for review and correction.

12

Ensures the E-SIGN Disclosure and Consent section is completed indicating consent to electronic signatures and communications.

The AI verifies that the E-SIGN Disclosure and Consent section of the SBA Disaster Loan Application is fully completed. This validation check is crucial as it confirms the applicant's consent to use electronic signatures and receive communications electronically. The AI checks for an affirmative indication of consent and ensures that all necessary fields in this section are filled out. If the consent is not properly indicated, the AI highlights this as a critical error that needs to be addressed before proceeding.

13

Verifies the signature, title, and date are present on the consent and signature section, along with the business name and date.

The AI meticulously scans the consent and signature section of the SBA Disaster Loan Application to ensure that the signature of the authorized individual is present and legible. It also confirms that the individual's title and the date of signing are provided, alongside the correct business name. The AI checks the date for validity and relevance to the application period. Any discrepancies or omissions in this section are flagged for immediate attention to maintain the integrity of the application process.

14

Checks that all additional information about the form is reviewed, especially the filing requirements for all applications and for non-profit organizations.

The AI conducts a thorough review of all additional information provided in the SBA Disaster Loan Application. It pays special attention to the filing requirements, ensuring that they are met for all applications, including those submitted by non-profit organizations. The AI assesses whether all necessary documentation and supplementary information are included as per the guidelines. It flags any missing or incomplete sections that could potentially delay the processing of the application.

15

Confirms that all information provided throughout the form is accurate and truthful to avoid legal consequences.

The AI is programmed to confirm the accuracy and truthfulness of all information provided in the SBA Disaster Loan Application. It cross-verifies the data against known databases and checks for consistency throughout the form. The AI understands the legal implications of submitting false information and therefore highlights any potential inaccuracies or inconsistencies for further investigation. This safeguard helps to prevent fraudulent applications and ensures compliance with legal standards.

Common Mistakes in Completing SBA Form 5

Applicants may enter an incorrect or incomplete Disaster Number, which can delay or even deny the application process. The Disaster Number is essential as it identifies the specific disaster declaration for the business location. To avoid this mistake, applicants should double-check the Disaster Number provided on the declaration or verification letter from the Federal Emergency Management Agency (FEMA) or Small Business Administration (SBA).

Another common mistake is not providing the legal name of the business as it appears on the federal tax return. This discrepancy can lead to processing delays or even denial of the application. To ensure accuracy, applicants should verify their business name with their tax records and enter it exactly as it appears on those documents. Additionally, they should ensure that all business entities listed on the application have the same legal name.

Applicants may fail to indicate the complete and accurate addresses of all affected business locations. This mistake can lead to delays in processing or even denial of the application. To avoid this, applicants should double-check all addresses listed on the application, including street addresses, city, state, and zip codes. They should also include any additional information, such as suite or unit numbers, that may be necessary to identify the specific business location.

Providing inaccurate or incomplete information about what is damaged can lead to underestimation of losses and potential denial of the application. Applicants should ensure that they provide detailed descriptions of the damages, including the extent and cause of the damage, as well as any supporting documentation, such as photographs or invoices. They should also be sure to include all damaged property, even if it is located off-site or is not directly related to the primary business operations.

Applicants may misreport their Federal Tax ID or NAICS code, which can lead to processing delays or even denial of the application. The Federal Tax ID is essential for identifying the business and its tax records, while the NAICS code is used to determine the business category and eligibility for the loan. To avoid this mistake, applicants should double-check their Federal Tax ID and NAICS code with their tax records and enter them exactly as they appear on those documents. They should also ensure that they select the most accurate NAICS code based on their primary business activities.

Applicants may overlook the importance of providing complete and accurate insurance information on the SBA Disaster Loan Application. This can lead to delays or even denial of the loan. To avoid this mistake, applicants should ensure they have all necessary insurance policies and documents ready before filling out the form. They should double-check the information they provide for accuracy and completeness. If they are unsure about any aspect of their insurance coverage, they should consult with their insurance provider or a qualified professional.

Another common mistake is failing to include all required information about the business owners on the SBA Disaster Loan Application. This can include their full legal names, Social Security Numbers, and percentage of business ownership. Incomplete or inaccurate information about business owners can cause delays or even denial of the loan. To avoid this mistake, applicants should ensure they have all necessary information about their business owners readily available before starting the application process. They should double-check the information they provide for accuracy and completeness.

Applicants may be tempted to misrepresent their criminal background or delinquencies on the SBA Disaster Loan Application. However, this can lead to serious consequences, including denial of the loan or even criminal charges. To avoid this mistake, applicants should answer all questions about their criminal background and delinquencies truthfully and completely. They should consult with a qualified professional if they are unsure about how to answer any specific question.

Providing incorrect or incomplete contact information for the primary point of contact on the SBA Disaster Loan Application can cause delays or even denial of the loan. Applicants should ensure they provide accurate and complete contact information, including a valid email address and phone number. They should double-check the information they provide for accuracy and completeness.

Applicants may overlook the importance of signing the SBA Disaster Loan Application or may provide an incorrect signature. This can cause delays or even denial of the loan. To avoid this mistake, applicants should ensure they sign the application and provide a valid signature. They should double-check the signature they provide for accuracy.

The SBA Disaster Loan Application form requires applicants to review and understand various filing requirements and statements mandated by laws and executive orders. Neglecting to do so can lead to application rejection or delays. To avoid this mistake, carefully read and follow all instructions provided in the application form and related documents. Additionally, consult with a tax professional or legal advisor if you have any doubts or questions about the requirements.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out SBA Form 5 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills sba-5 forms, ensuring each field is accurate.