Fill out loan application forms

with AI.

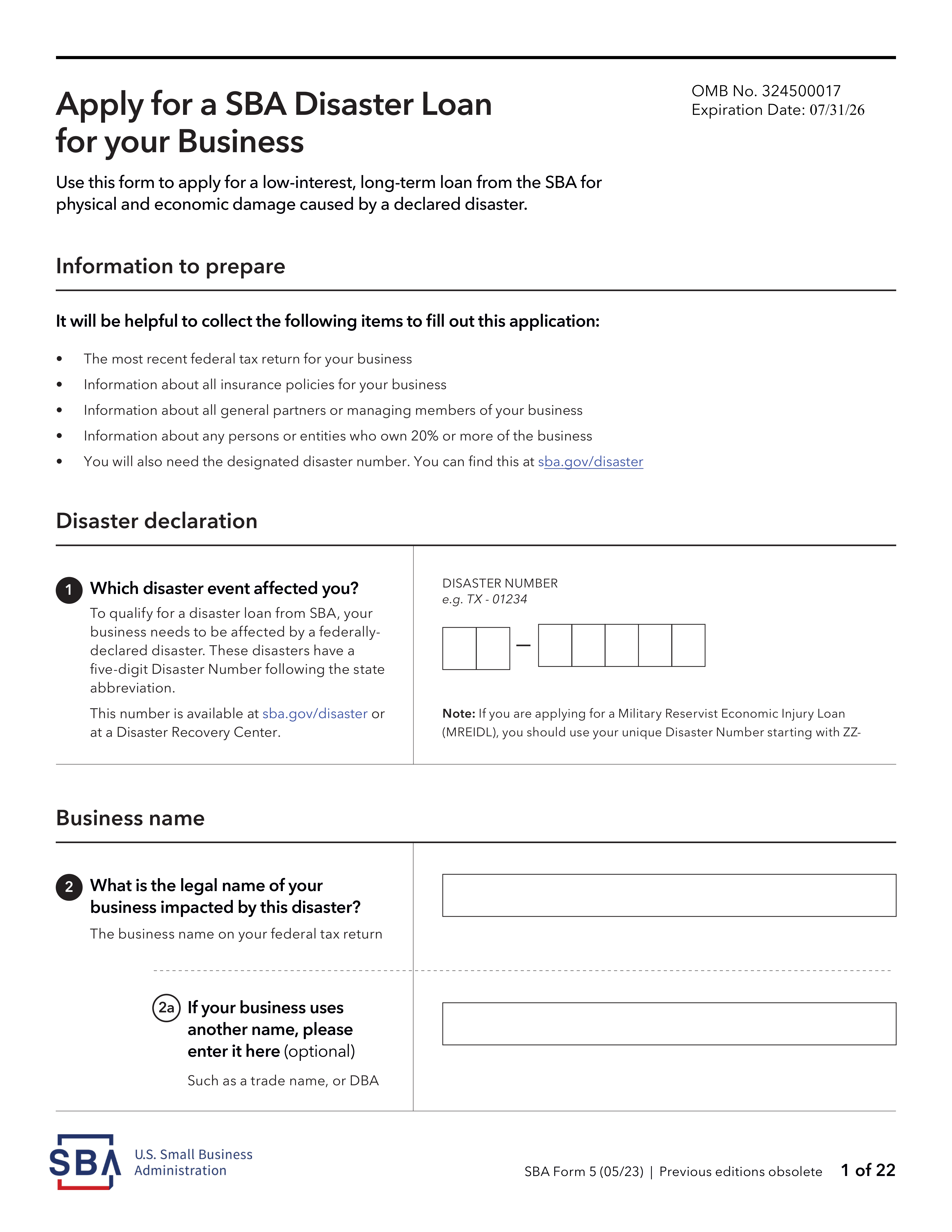

Loan application forms are the gateway to securing financing for a wide range of needs — from rebuilding a business after a natural disaster to purchasing a home or accessing credit through a local cooperative. These documents collect detailed personal, financial, and employment information that lenders use to assess creditworthiness, verify income, and ensure regulatory compliance. Getting them right matters: errors or omissions can delay approvals, trigger additional scrutiny, or result in outright rejection.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About loan application forms

The people who need these forms are just as varied as the forms themselves. A small business owner recovering from a hurricane may need to complete the SBA Disaster Loan Application, while a first-time homebuyer will likely encounter the Uniform Residential Loan Application (Fannie Mae Form 1003), the industry standard for residential mortgages. Credit union members, housing loan applicants at regional banks, and borrowers working with institutions like USTACOOP in Colombia all face similarly detailed paperwork that requires accurate, consistent information across multiple sections.

Because these forms often run several pages and ask for precise financial figures, dates, and legal declarations, filling them out carefully is essential. Tools like Instafill.ai use AI to complete these forms in under 30 seconds, handling the data accurately and securely — a practical advantage when you're navigating an already stressful financial process.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds