Yes! You can use AI to fill out Uniform Residential Loan Application (Freddie Mac Form 65 / Fannie Mae Form 1003)

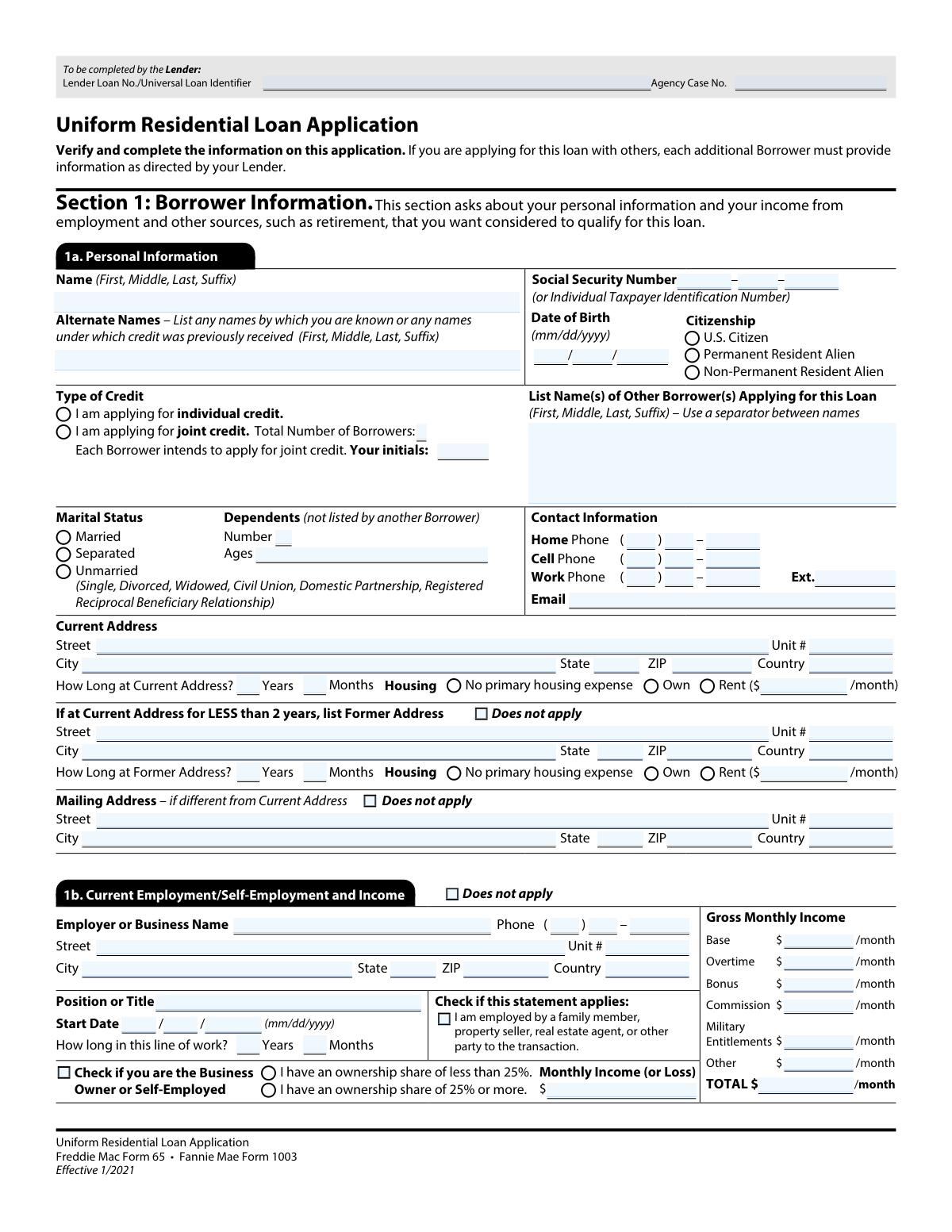

The Uniform Residential Loan Application (URLA), also known as Fannie Mae Form 1003 and Freddie Mac Form 65, is the industry-standard form used to apply for a residential mortgage. It gathers a borrower’s identity, employment and income, assets, debts, real estate owned, and details about the loan and subject property, along with required declarations and acknowledgments. Lenders use the information to evaluate creditworthiness, calculate qualifying income and debt-to-income ratios, and meet federal and investor compliance requirements (including demographic monitoring). Providing complete and accurate information is critical because the borrower certifies the statements and authorizes verification (credit, employment, and tax/financial documentation).

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out URLA (Form 1003/65) using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Uniform Residential Loan Application (Freddie Mac Form 65 / Fannie Mae Form 1003) |

| Number of pages: | 9 |

| Language: | English |

| Categories: | real estate forms, loan application forms, mortgage forms, Fannie Mae forms, Freddie Mac forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out URLA (Form 1003/65) Online for Free in 2026

Are you looking to fill out a URLA (FORM 1003/65) form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your URLA (FORM 1003/65) form in just 37 seconds or less.

Follow these steps to fill out your URLA (FORM 1003/65) form online using Instafill.ai:

- 1 Enter borrower personal details in Section 1 (name, SSN/ITIN, DOB, citizenship, marital status, dependents, contact info, and address history).

- 2 Add employment and income information in Sections 1b–1e (current/previous jobs, self-employment indicators, and other income sources you want considered).

- 3 List financial accounts and funds in Section 2 (bank/retirement accounts, other assets/credits) and disclose monthly liabilities and other expenses.

- 4 Provide real estate information in Section 3 (properties owned, values, mortgage details, occupancy, and rental income where applicable).

- 5 Complete loan and subject property details in Section 4 (loan purpose, loan amount, property address/units/value, other financing, rental income, and gifts/grants).

- 6 Answer all required declarations and acknowledgments in Sections 5–6 (occupancy, undisclosed borrowing/credit, legal/credit events, and sign/date authorizations).

- 7 Finish remaining sections as applicable (Sections 7–9: military service, optional demographic information, and loan originator details) and review for accuracy before submitting.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable URLA (Form 1003/65) Form?

Speed

Complete your URLA (Form 1003/65) in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 URLA (Form 1003/65) form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form URLA (Form 1003/65)

This is the standard application used by most lenders to apply for a residential mortgage (purchase or refinance). It collects your personal, income, asset, debt, property, and loan details so the lender can evaluate and underwrite your loan.

Each borrower applying for the loan must provide their information as directed by the lender. If you are applying jointly, you’ll indicate joint credit and list the other borrower(s), and each borrower may need to complete their own borrower sections and sign.

Individual credit means you are applying alone; joint credit means you are applying with one or more co-borrowers. “Total Number of Borrowers” should reflect everyone who will be on the loan, and joint applicants typically initial to confirm the intent to apply together.

You’ll provide your legal name, any alternate names used for credit, Social Security Number (or ITIN), date of birth, citizenship status, marital status, dependents, and contact information. You’ll also list your current address and housing status (own/rent/no primary housing expense) and monthly housing payment if applicable.

Yes—if you have been at your current address for less than 2 years, you should list your former address and how long you lived there. If it does not apply, you can mark “Does not apply” as shown on the form.

List your current employer (or business if self-employed), position, start date, time in line of work, and your gross monthly income broken out by type (base, overtime, bonus, commission, etc.). You must generally provide at least 2 years of current and previous employment history, so include additional/previous employment if needed.

Check the box indicating you are a business owner or self-employed and indicate whether your ownership share is less than 25% or 25% or more. Provide the business name, address, and your monthly income (or loss) as requested by the lender.

No—those income types should be disclosed only if you want them considered to qualify for the loan. If you choose to include them, list the income source and the monthly amount.

List bank accounts and investment/retirement accounts (checking, savings, 401(k), IRA, stocks, etc.) with the financial institution, account number, and cash/market value. You should also list other assets/credits such as earnest money, gift funds, proceeds from a sale, or employer assistance if they will be used for the transaction.

Include credit cards, installment loans (auto/student/personal), leases (non-real estate), and other debts—even if payments are deferred. Also include other obligations like alimony, child support, separate maintenance, job-related expenses, or other recurring expenses not already listed.

You must list each property you own, its address, estimated value, whether it will be sold/pending/retained, intended occupancy, and monthly insurance/taxes/dues if not included in the mortgage payment. You’ll also list the mortgage loan(s) on each property, including creditor, payment, unpaid balance, payoff status, and loan type (FHA/VA/Conventional/USDA-RD/Other).

You can check the box indicating “I do not own any real estate.” If that is accurate, you generally do not need to complete the property ownership tables in Section 3.

You’ll enter the loan amount, select the loan purpose (purchase/refinance/other), and provide the property address, number of units, estimated value, and occupancy type. For purchases, complete the rental income section only if it’s a 2–4 unit primary residence or an investment property, and list any gifts/grants you will use for the loan if applicable.

These are required yes/no questions about occupancy, relationships with the seller, undisclosed borrowed funds, new credit, liens, co-signed debts, judgments, federal debt delinquency, lawsuits, foreclosure/short sale history, and bankruptcy. Your answers affect eligibility and underwriting, so answer truthfully and provide details when the form asks for them.

No—you are not required to provide ethnicity, sex, or race information, but you are encouraged to do so for fair lending monitoring. If you apply in person and choose not to provide it, the lender may be required to complete it based on visual observation or surname.

Compliance URLA (Form 1003/65)

Validation Checks by Instafill.ai

1

Borrower Full Legal Name Completeness and Character Validation

Validate that the Borrower Name (first, last; middle/suffix if provided) is present and contains only allowed characters (letters, spaces, hyphens, apostrophes) and does not include numeric-only or placeholder text (e.g., 'N/A'). This is important for identity verification, credit pulls, and document matching across disclosures and closing documents. If validation fails, the submission should be rejected or routed for manual review with a request to correct the name fields.

2

Alternate Names Required When Indicated and Properly Formatted

If the applicant provides any indication of prior names (or the lender workflow flags a mismatch with credit/ID), require at least one Alternate Name entry and validate it uses the same name rules as the primary name. Alternate names are critical for accurate credit history retrieval and fraud prevention. If missing or malformed, the system should block credit ordering and prompt the applicant to add/correct alternate names.

3

SSN/ITIN Format and Mutual Exclusivity Validation

Validate that the Social Security Number is exactly 9 digits (optionally formatted as XXX-XX-XXXX) or that an ITIN is 9 digits with valid ITIN patterns, and ensure only one identifier type is captured per borrower record. This prevents failed credit bureau requests and reduces identity errors. If validation fails, the application should not proceed to underwriting/credit pull and must request a corrected identifier.

4

Date Fields Format and Realistic Range Checks (DOB, Employment Dates, Signatures)

Validate all dates are in mm/dd/yyyy format and represent real calendar dates (no 02/30, etc.). Apply reasonableness rules: DOB cannot be in the future and should indicate an adult borrower per program rules; employment start/end dates cannot be in the future (except projected military expiration) and end date must be after start date; signature dates cannot be in the future. If any date fails, the system should flag the specific field and prevent submission until corrected.

5

Citizenship Selection Required and Single-Choice Enforcement

Require exactly one citizenship status selection (U.S. Citizen, Permanent Resident Alien, or Non-Permanent Resident Alien). Citizenship impacts eligibility, documentation requirements, and compliance reporting. If none or multiple are selected, the application should be considered incomplete and blocked from submission.

6

Credit Type and Borrower Count Consistency (Individual vs Joint)

If 'joint credit' is selected, require Total Number of Borrowers to be a positive integer (>=2), require initials for the joint credit intent statement, and require at least one other borrower name listed using the specified separator rules. If 'individual credit' is selected, ensure Total Number of Borrowers is blank or equals 1 and that no other borrower names are provided. If inconsistent, the system should stop processing because it affects disclosures, liability, and underwriting.

7

Marital Status Required and Valid Value Set Enforcement

Validate that marital status is selected from the allowed set (Married, Separated, Unmarried) and is not left blank. Marital status can affect vesting, community property considerations, and certain underwriting calculations. If missing or invalid, the submission should be flagged as incomplete and require correction before proceeding.

8

Dependents Count/Ages Logical Validation

If a dependents number is provided, require ages to be provided for each dependent (or a count-matching list) and validate ages are non-negative integers within a reasonable range (e.g., 0–120). If dependents number is zero, ages must be blank. This ensures accurate household and expense considerations and prevents data-entry errors. If validation fails, prompt the applicant to correct the count/ages mismatch.

9

Phone Number and Email Format Validation (Including Extension Rules)

Validate phone numbers (home/cell/work) follow a consistent format (e.g., 10 digits with optional punctuation) and that extensions are numeric and only allowed when a work phone is provided. Validate email addresses using standard syntax rules and reject obvious placeholders. Correct contact data is required for disclosures, verification, and closing coordination. If invalid, the system should require correction or at minimum flag for follow-up before disclosures are issued.

10

Current Address Completeness and Residency Duration Validation

Require current address components (street, city, state, ZIP, country) and validate ZIP/state consistency (e.g., US ZIP is 5 digits or ZIP+4; state required for US addresses). Validate 'How long at current address' years/months are non-negative and months are 0–11. If the duration is less than 2 years, require former address details unless 'Does not apply' is explicitly selected. If any part fails, the application should be blocked as incomplete because address history is required for underwriting and fraud checks.

11

Housing Expense and Tenure Consistency (Own/Rent/No Expense)

Validate that exactly one housing status is selected (Own, Rent, or No primary housing expense). If Rent is selected, require a monthly rent amount > 0; if Own or No expense is selected, rent amount must be blank or zero per system rules. This prevents incorrect DTI calculations and underwriting misrepresentation. If inconsistent, the system should flag the housing section and prevent submission until corrected.

12

Employment Section Completeness When Not Marked 'Does Not Apply'

If current employment is not marked 'Does not apply', require employer/business name, employer phone, employer address, position/title, start date, and at least one income component or total monthly income. Validate employer phone format and that start date is not after today. Employment data is essential for income qualification and verification. If missing/invalid, the system should not allow the application to proceed to underwriting.

13

Self-Employment and Ownership Share Selection Rules

If 'Business Owner or Self-Employed' is checked, require exactly one ownership share option (<25% or >=25%) and ensure it is not selected when self-employment is unchecked. Ownership share affects documentation requirements and income analysis methodology. If the ownership share is missing or contradictory, the system should flag the employment record and require correction before submission.

14

Income Totals Arithmetic Validation (Employment and Other Income)

Validate that the TOTAL gross monthly income equals the sum of the provided components (base, overtime, bonus, commission, military entitlements, other) within a defined rounding tolerance. For 'Income from Other Sources', require each line to have both a valid source from the allowed list and a numeric monthly amount, and validate the provided total equals the sum of line items. Accurate totals are critical for DTI and eligibility decisions. If totals do not reconcile, the system should either auto-recalculate and display the corrected total or block submission until corrected (per business policy).

15

Assets/Liabilities Numeric and Account Identifier Validation

Validate that all monetary fields (cash/market value, unpaid balance, monthly payment, credit limit) are numeric, non-negative, and within reasonable upper bounds, and that account numbers meet minimum length/character rules (e.g., 4–20 alphanumeric) without illegal characters. Require an account type from the allowed list for each asset/liability row that is populated, and ensure section totals equal the sum of rows when totals are provided. This prevents calculation errors and improves downstream verification and auditability. If validation fails, the system should flag the specific row/field and prevent submission or require manual review depending on severity.

Common Mistakes in Completing URLA (Form 1003/65)

Applicants often enter a shortened legal name (e.g., “Mike” vs. “Michael”), omit a suffix (Jr., III), or skip “Alternate Names” used on prior credit. This can cause credit report retrieval issues, identity verification delays, and requests for additional documentation. Use your full legal name exactly as it appears on your ID and include any prior/maiden/other names that appear on credit accounts or legal records.

A common error is transposing digits, using an expired/incorrect ITIN, or assuming the lender can “pull it later,” especially for additional borrowers. This can prevent the lender from ordering credit, verifying identity, and underwriting on time. Double-check the number against your Social Security card/IRS letter and ensure every borrower listed for joint credit provides their own SSN/ITIN.

People frequently enter dates in dd/mm/yyyy format, omit leading zeros, or provide start/end dates that don’t align with the “How long in this line of work” fields. Inconsistent dates trigger underwriting questions and can require written explanations or employment re-verification. Always use mm/dd/yyyy, confirm start/end dates from pay stubs/W-2s, and make sure the “years/months” duration matches the dates provided.

Borrowers sometimes check “joint credit” without listing all other borrowers, forget the total number of borrowers, or miss the initials confirming joint intent. This can create compliance issues and force the lender to re-disclose or re-collect signatures/initials. Confirm whether you are truly applying jointly, list every co-borrower exactly as they will appear on the loan, and provide the required initials where indicated.

Applicants often forget to provide a former address when they’ve lived at the current address for under two years, or they omit unit numbers, ZIP+4, or country (especially for prior foreign addresses). Gaps can delay verification and raise fraud-prevention flags. Provide a continuous 2-year address history, include unit/apartment numbers, and ensure city/state/ZIP/country are complete and consistent with official mail and IDs.

A frequent issue is checking “Own” while still paying rent, entering a weekly amount instead of monthly, or leaving the rent/mortgage amount blank. Incorrect housing expense data affects debt-to-income calculations and can lead to inaccurate pre-approval or underwriting conditions. Select the correct housing status and enter the full monthly payment amount (including required fields like “$/month”) based on your lease statement or mortgage statement.

Some applicants mistakenly check “Does not apply” for current/previous employment, or they only list the current job without covering a full two-year timeline (including gaps, school, or self-employment). Underwriters must document a complete employment history, so omissions lead to follow-up requests and delays. Provide all current employment, any additional jobs, and enough previous employment to cover at least two years, including accurate start/end dates.

Borrowers often fail to check “Business Owner or Self-Employed,” misunderstand what counts as self-employment (1099, side business, LLC), or select the wrong ownership share (<25% vs. 25%+). This can change required documentation (e.g., business tax returns) and may cause underwriting to rework income calculations. If you receive 1099 income, own a business, or have an ownership stake, disclose it and choose the correct ownership percentage based on actual equity/operating agreement.

Applicants commonly enter take-home pay instead of gross, double-count income across Base/Bonus/Overtime, or leave the TOTAL blank or inconsistent with the line items. This leads to incorrect qualifying income and can result in a denial or last-minute conditions when documents don’t match. Use gross monthly amounts from pay stubs, separate income types correctly, and ensure the TOTAL equals the sum of the components (or clearly explain “Other”).

People either forget to list eligible income (retirement, Social Security, disability, interest/dividends) or mistakenly believe they must disclose alimony/child support even if they don’t want it considered. Missing income can reduce qualifying power, while incorrect disclosure can create documentation requirements and privacy concerns. List all income you want used to qualify, choose the correct source from the provided list, and only include alimony/child support/separate maintenance if you want it considered.

Applicants often provide partial account numbers, outdated balances, or omit liabilities like deferred student loans, credit cards with zero balance but open payment obligations, co-signed loans, or vehicle leases. Incomplete data can cause underwriting discrepancies when credit and bank statements are reviewed, leading to rework and delays. Use current statements, include all required fields (institution, account number, cash/market value), and list all debts and leases—even if payments are deferred or someone else “usually pays.”

A common mistake is answering “No” to questions about undisclosed borrowed funds, pending new credit, or other property ownership because the borrower assumes it’s not finalized or “doesn’t count.” Incorrect declarations can trigger serious underwriting issues, including loan denial, re-disclosure, or fraud concerns if later discovered. Answer each Yes/No carefully, disclose any side loans/gifts/credits, planned new credit before closing, and accurately report occupancy intent and recent ownership interests.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out URLA (Form 1003/65) with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills uniform-residential-loan-application-freddie-mac-f forms, ensuring each field is accurate.