Yes! You can use AI to fill out State of New Mexico Workers’ Compensation Administration — Workers' Compensation Complaint (Rev. 8/22) (11.4.4.9 NMAC)

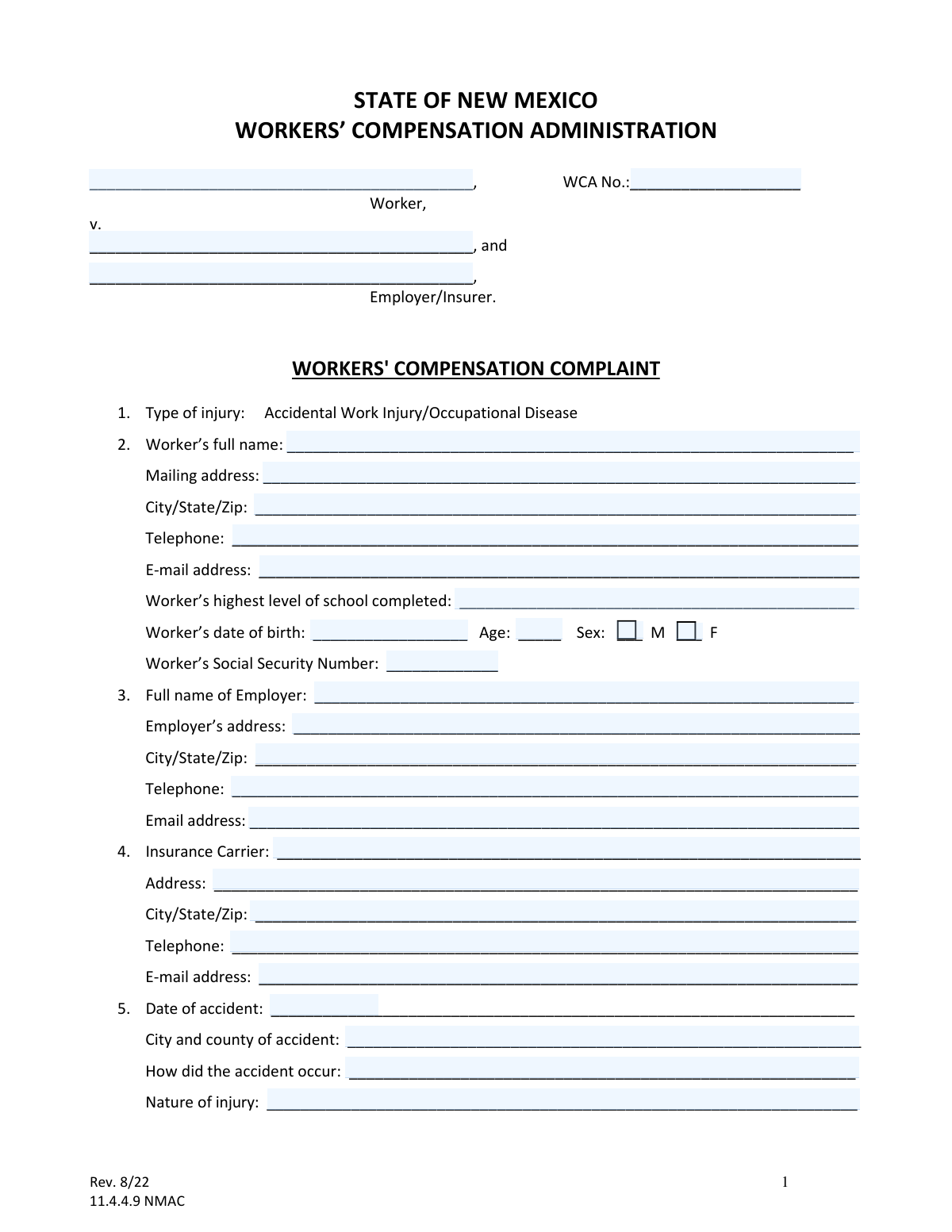

The Workers' Compensation Complaint is the official New Mexico WCA form used to start or respond to a workers’ compensation dispute by identifying the parties, the injury/occupational disease, medical treatment details, and the benefits or determinations sought. It creates the case record (including the WCA number, if assigned) and frames the issues for mediation and hearings. Completing it accurately is important because it determines what claims are being made, what relief is requested, and what information the WCA and the opposing parties will rely on during the proceeding.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out NM WCA Workers' Compensation Complaint using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | State of New Mexico Workers’ Compensation Administration — Workers' Compensation Complaint (Rev. 8/22) (11.4.4.9 NMAC) |

| Number of pages: | 4 |

| Filled form examples: | Form NM WCA Workers' Compensation Complaint Examples |

| Language: | English |

| Categories: | workers compensation forms, employment forms, legal forms, New Mexico forms, PA state forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out NM WCA Workers' Compensation Complaint Online for Free in 2026

Are you looking to fill out a NM WCA WORKERS' COMPENSATION COMPLAINT form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your NM WCA WORKERS' COMPENSATION COMPLAINT form in just 37 seconds or less.

Follow these steps to fill out your NM WCA WORKERS' COMPENSATION COMPLAINT form online using Instafill.ai:

- 1 Enter case caption details: worker name, employer/insurer names, and the WCA case number (if known/assigned).

- 2 Complete the worker information section, including contact details, education level, date of birth, sex, and Social Security Number.

- 3 Provide employer and insurance carrier information (names, addresses, phone numbers, and email addresses).

- 4 Describe the injury/occupational disease: date of accident, location (city/county), how it occurred, nature of injury, body parts affected, and first date unable to perform job duties.

- 5 Fill in employment and wage details at the time of injury (job title, average weekly wage, and weekly compensation rate, or mark as to be determined/disputed).

- 6 Add medical information: treating doctor, maximum medical improvement (MMI) doctor and date, impairment rating (if known), and work status/return-to-work dates.

- 7 Select the benefits/relief sought and any employer complaints, state the reasons supporting the complaint, answer interpreter/remote-hearing equipment questions, then sign/date and provide service contact information; attach required documents (summons for each responding party and, if the worker is filing, the Worker’s Authorization for Use and Disclosure of Health Records).

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable NM WCA Workers' Compensation Complaint Form?

Speed

Complete your NM WCA Workers' Compensation Complaint in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 NM WCA Workers' Compensation Complaint form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form NM WCA Workers' Compensation Complaint

This form starts a formal case with the New Mexico Workers’ Compensation Administration (WCA) to resolve disputes about a work injury or occupational disease, such as whether the claim is compensable or what benefits are owed.

A worker may file it to request benefits or resolve a dispute, and an employer/insurer may file it to request determinations such as compensability, reimbursement, or suspension/reduction of benefits.

The WCA No. is the case number assigned by the WCA. If you do not have one yet, you can still file; the WCA will assign a number after the complaint is received.

Yes—select the option that best matches your situation. Use “Accidental Work Injury” for a specific incident/date and “Occupational Disease” for conditions that develop over time due to work exposure.

You should provide the worker’s full name, contact information, education level, date of birth, sex, and Social Security Number. Providing complete contact details helps ensure you receive notices about mediation and hearings.

Fill in as much as you know (employer name and address are especially important). If the carrier details are unknown, you can leave them blank or note “unknown,” but providing them can speed processing and service.

List the date of accident, the city and county where it occurred, describe how it happened, and describe the nature of injury and body parts affected. Be specific and consistent with any medical records or prior reports.

You may check the “To be determined/disputed” box for the wage and/or compensation rate. This allows the case to proceed while the correct amounts are determined or resolved.

Provide your treating doctor’s information if you have it. If MMI date or impairment rating is not known, you can check “Unknown/To be determined,” since those items may be established later.

“Released back to work” means a doctor cleared you to work (with or without restrictions). “Returned to any work” means you actually worked after the accident, even if it was modified, part-time, or for a different employer.

These questions help identify Medicare eligibility and potential Medicare Secondary Payer issues. Answering accurately helps ensure medical payments and any settlement considerations are handled correctly.

You can check the boxes for the benefits you are seeking, such as temporary total disability, permanent partial disability, medical benefits, attorney fees, disfigurement, or other relief. If you are seeking medical benefits, list unpaid bills or attach them.

An employer/insurer can request determinations such as compensability/benefits, reimbursement rights, credit for overpayment, or suspension/reduction of benefits (and must state the grounds). They can also list other specific issues in dispute.

Be as specific as possible about what happened, what benefits are disputed, and why you believe you are entitled to (or not responsible for) certain benefits. You may attach additional pages if you need more space.

Yes—“A Summons for each responding party shall be filed with the Complaint,” and if the worker is filing, the worker must also complete and attach the Worker’s Authorization for Use and Disclosure of Health Records. For questions, call the Ombudsman Hotline at 505-841-6894 or 1-866-967-5667.

Compliance NM WCA Workers' Compensation Complaint

Validation Checks by Instafill.ai

1

Validates WCA Case Number format and presence when required

Checks whether the WCA No. field is provided when the submission is intended to be filed into an existing case, and validates that it matches the expected WCA numbering pattern (e.g., digits/hyphens as configured by the agency). This prevents misfiling into the wrong case or creating duplicate records. If validation fails, the system should block submission for existing-case filings or route to manual review with a clear prompt to correct the case number.

2

Ensures Worker full legal name is complete and not placeholder text

Verifies the Worker’s full name is present and contains at least a first and last name, rejecting entries like initials only, 'N/A', or blank/whitespace. Accurate identification is essential for matching to prior claims, medical records authorizations, and service of process. If validation fails, the form should be rejected as incomplete and the filer prompted to enter the Worker’s full legal name.

3

Validates Worker mailing address completeness (street, city, state, ZIP)

Checks that the Worker mailing address includes a street address (or PO Box), city, state, and ZIP code, and that the state is a valid US state/territory abbreviation and ZIP is 5 digits (or ZIP+4). This is required for notices, service, and jurisdictional correspondence. If validation fails, the system should require correction before submission or flag for manual follow-up if the filer indicates homelessness/unknown address (if supported).

4

Validates phone number format for Worker, Employer, Insurer, and Doctors

Ensures each provided telephone number conforms to a valid US format (10 digits, allowing punctuation and optional country code) and is not obviously invalid (e.g., 000-000-0000). Reliable phone numbers are critical for mediation scheduling, hearing logistics, and medical/provider coordination. If validation fails, the system should prompt for correction and allow omission only where the field is not required.

5

Validates email address format and service email presence for filing party/attorney

Checks that any entered email address is syntactically valid (e.g., [email protected]) and specifically requires the 'e-mail address for service' for the filing party/attorney if electronic service is used by the program. Incorrect emails can cause failed service and missed deadlines. If validation fails, the system should block submission or require an alternate service method to be selected (if available).

6

Validates Worker date of birth format and logical age consistency

Ensures the date of birth is a valid date (MM/DD/YYYY or configured format), not in the future, and that the stated Age (if provided) matches the DOB within an acceptable tolerance (e.g., ±1 year depending on whether birthday has occurred this year). This reduces identity errors and supports Medicare/benefits coordination. If validation fails, the system should prompt to correct DOB/age and flag potential identity mismatch.

7

Validates Sex selection is exactly one option when required

Checks that the Sex field has exactly one selection (M or F) if the form requires it, and prevents both or neither from being selected. Consistent demographic data supports record matching and reporting. If validation fails, the system should require the filer to select one option or allow 'unspecified' only if the form/system supports it.

8

Validates Social Security Number format and disallows known invalid patterns

Ensures the Worker’s SSN is 9 digits (optionally formatted as XXX-XX-XXXX) and rejects invalid patterns such as all zeros in any group, 123-45-6789, or 000-00-0000. SSN accuracy is important for identity verification and coordination with benefits systems. If validation fails, the system should require correction and apply masking/encryption rules for storage and display.

9

Ensures Employer and Insurer identification fields are complete and distinct

Validates that the Employer full name and the Employer/Insurer party fields are provided, and that Employer and Insurance Carrier are not accidentally duplicated unless the insurer is legitimately self-insured (if that option exists). Correct party identification is essential for proper service and liability determination. If validation fails, the system should prompt for missing party details and flag potential self-insured scenarios for confirmation.

10

Validates accident date and related timeline fields for logical order

Checks that the Date of accident is a valid date and not in the future, and that the 'First date Worker was unable to perform job duties' is on or after the accident date (or otherwise requires an explanation if earlier due to occupational disease). It also validates that return-to-work and release-to-work dates (if provided) are not before the accident date. If validation fails, the system should require correction or an explanatory note depending on injury type.

11

Validates injury type selection and requires supporting narrative fields

Ensures the filer selects either Accidental Work Injury or Occupational Disease (and not both unless the form allows), and requires 'How did the accident occur' and 'Nature of injury' to be non-empty and sufficiently descriptive (e.g., minimum character count). These fields are necessary to evaluate compensability and route the claim appropriately. If validation fails, the system should block submission and prompt for a clearer description.

12

Validates location of accident includes city and county

Checks that 'City and county of accident' includes both components (e.g., contains a county name and a city/municipality) and is not left blank. Location is important for jurisdiction, investigation, and hearing venue considerations. If validation fails, the system should require completion or allow 'unknown' only with a reason if the system supports that exception.

13

Validates wage and compensation rate fields including 'To be determined/disputed' logic

Ensures that Worker’s average weekly wage and weekly compensation rate are numeric currency values when provided (non-negative, reasonable upper bounds), and enforces mutual exclusivity with the 'To be determined/disputed' checkbox (i.e., you cannot provide a number and also mark TBD/disputed). This prevents contradictory benefit calculations and downstream payment errors. If validation fails, the system should require the filer to either provide a value or mark TBD/disputed, not both.

14

Validates Maximum Medical Improvement (MMI) and impairment rating dependencies

Checks that if a doctor who set MMI is provided, then either an MMI date is provided or 'Unknown/To be determined' is checked, and that impairment rating entries are numeric percentages within an acceptable range (e.g., 0–100) with a valid 'Date assessed' or 'Unknown/To be determined' selected. These fields affect permanency benefits and dispute scope. If validation fails, the system should prompt for missing dates/flags and reject out-of-range impairment values.

15

Validates Yes/No questions enforce required follow-up dates

Ensures that when 'Has Worker been released back to work by a Doctor?' is Yes, a release date is provided, and when 'Has Worker returned to any work since the accident?' is Yes, a return-to-work date is provided. This prevents incomplete work-status information that impacts benefit eligibility and mediation issues. If validation fails, the system should require the corresponding date or require the user to change the answer to No.

16

Validates interpreter and remote-hearing equipment responses and conditional fields

Checks that interpreter needed is answered Yes/No, and if Yes, a language is specified; also checks that equipment availability is answered Yes/No, and if No, exactly one closest WCA office is selected. These validations ensure accessibility accommodations and proper scheduling/logistics. If validation fails, the system should prompt for the missing conditional information and prevent submission until resolved.

Common Mistakes in Completing NM WCA Workers' Compensation Complaint

People often don’t know what the WCA number is or assume it’s the same as a claim number from the insurer, so they leave it blank or enter an unrelated identifier. This can delay filing, misroute the complaint, or cause it to be associated with the wrong case. If you already have a WCA number from prior filings, copy it exactly; if you do not, confirm whether the WCA will assign one and avoid substituting an insurer claim number unless the form explicitly asks for it.

A frequent error is listing only the employer but not the insurer, using a trade name instead of the legal entity, or leaving one of the caption lines blank. This can lead to improper service, disputes about the correct responding party, and delays in scheduling mediation/hearings. Use the employer’s full legal name (as on paystubs/W-2 or business registration) and list the insurance carrier exactly as shown on the workers’ compensation policy/claim correspondence.

Many filers check a box without understanding the distinction, especially when symptoms developed over time (repetitive stress) or when there was a single incident with later complications. Choosing the wrong type can create confusion about dates, causation, and required proof. If the condition arose from a specific event, select accidental injury; if it developed from exposure or repetitive work over time, select occupational disease, and explain the timeline in the accident description.

People sometimes omit apartment numbers, use a temporary mailing address, or provide an email they rarely check, then miss notices and deadlines. Missed communications can result in default outcomes, missed hearings, or delayed benefits. Provide a stable mailing address, a working phone number, and an email you monitor daily; update the WCA promptly if any contact information changes.

Common mistakes include using the report date instead of the accident date, mixing month/day order, or giving dates that conflict (e.g., unable-to-work date before the accident). Inconsistent timelines can undermine credibility and complicate benefit calculations and medical causation. Use MM/DD/YYYY consistently, verify dates against medical notes and employer records, and if a date is unknown, mark it as unknown/to be determined where the form allows.

Filers often write short statements like “hurt back at work” without describing what happened, where, and what body parts were affected. Vague descriptions can lead to disputes about compensability, mechanism of injury, and whether the condition is work-related. Describe the event or exposure clearly (task, equipment, location, immediate symptoms), list the nature of injury (sprain, fracture, burn, etc.), and specify all affected body parts.

People frequently guess their average weekly wage, confuse gross vs. net pay, or leave the field blank without checking the “to be determined/disputed” option. Incorrect wage data can cause benefit miscalculations and later disputes that slow resolution. Use gross wages and verify with paystubs; if you don’t have accurate numbers, check the “to be determined/disputed” box rather than entering an estimate.

A common issue is listing a clinic name without a specific provider, omitting addresses/phone numbers, or putting the treating doctor in the “doctor who set maximum medical improvement” field. This can delay record requests, impairment rating verification, and scheduling of evaluations. List the treating provider’s full name and contact details, and separately identify the provider who declared MMI and the date/rating; if unknown, use the form’s “unknown/to be determined” option.

Filers often check “Yes” to being released or returning to work but forget to provide the date, or they confuse “released to work” with “actually returned to work.” Missing or inconsistent work-status information affects temporary disability eligibility and can trigger disputes. Answer both questions, provide the exact dates, and if you returned with restrictions or to different duties/hours, clarify that in the reasons section.

People sometimes leave Medicare/SSDI/ESRD questions blank because they seem unrelated, or they answer based on assumptions (e.g., thinking SSDI is the same as Social Security retirement). Incorrect Medicare-related information can create compliance issues and delay settlement or payment processing. Answer each item carefully, and if you applied for SSDI within the past 5 years (even if denied), mark “Yes” and be prepared to provide details if requested.

Filers often check boxes but leave required supporting details blank, such as the safety device name, whether mental impairment is primary/secondary, or the list of unpaid medical bills. This can lead to requests for clarification, incomplete claims, or denial of specific relief due to lack of notice. When a line asks for details, fill it in (attach unpaid bills if needed) and use the “reasons supporting this complaint” section to explain what you want and why.

Many people file only the complaint and miss the instruction that a Summons is required for each responding party, and that workers must attach the Worker’s Authorization for Use and Disclosure of Health Records. Missing these items can prevent proper service and stall the case from moving forward. Before filing, prepare a separate Summons for each employer/insurer respondent and attach the signed health records authorization if the worker is the filing party.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out NM WCA Workers' Compensation Complaint with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills state-of-new-mexico-workers-compensation-administr forms, ensuring each field is accurate.