Fill out tax exemption forms

with AI.

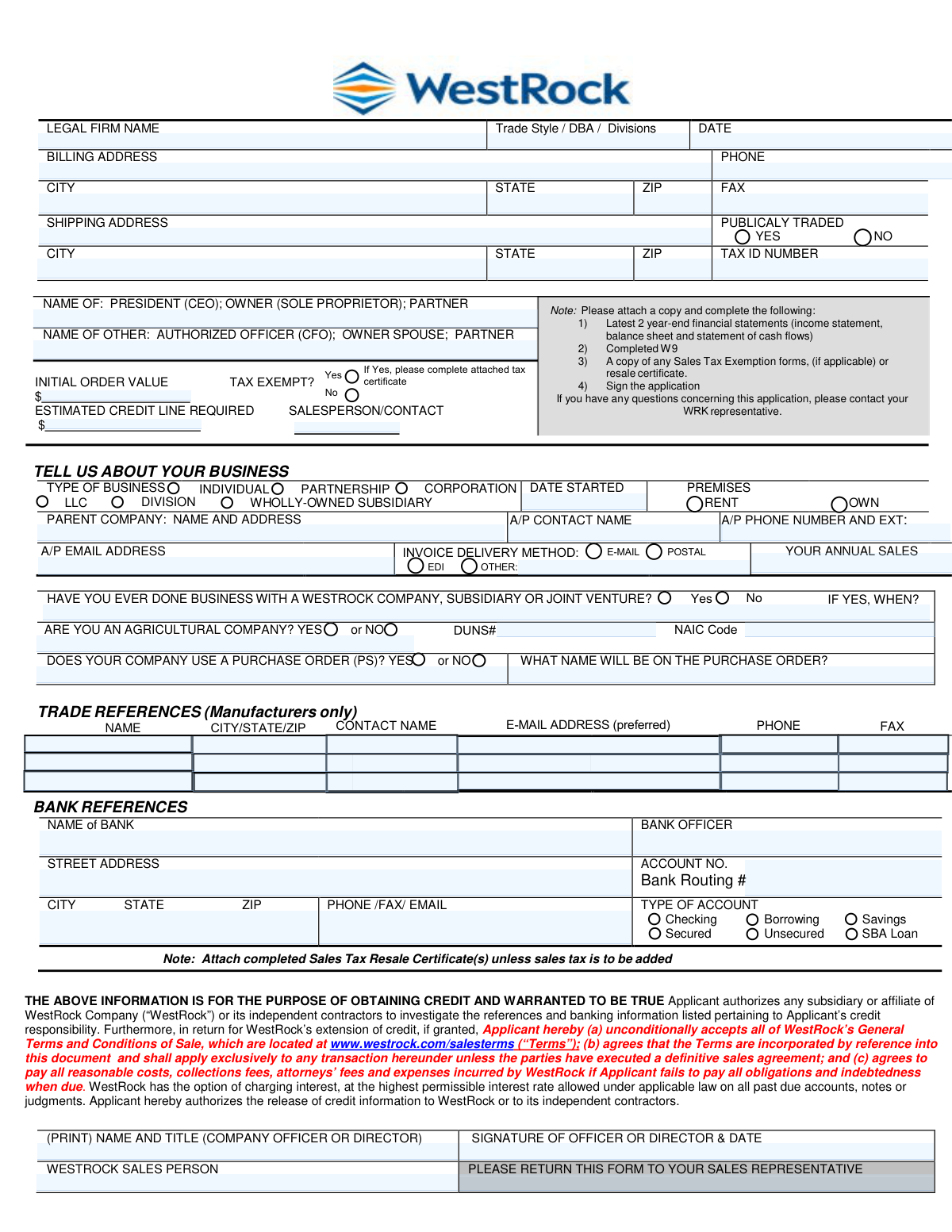

Tax exemption forms are official documents that allow individuals, businesses, and organizations to legally avoid paying certain taxes — or to document why a tax was not collected on a transaction. This category covers a range of forms, from sales and use tax exemption certificates used by businesses purchasing goods for resale, to income tax schedules that help individuals claim dependent exemptions and earned income credits. Getting these forms right matters: errors or omissions can lead to unexpected tax liability, compliance issues, or delayed credit approvals.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About tax exemption forms

These forms are typically needed by business owners applying for trade credit and sales tax exemptions across multiple states, retailers and purchasers documenting tax-free transactions (such as Texas Form 01-339), and individual taxpayers filing state income tax returns who need to claim dependents or credits like the Illinois Earned Income Tax Credit. The situations vary widely, but the common thread is that accuracy and completeness are essential — a missing permit number or an incorrect exemption reason can create real legal and financial consequences.

Because these forms often require pulling together information from multiple sources — business registration numbers, federal tax figures, bank references — they can be time-consuming to complete manually. Tools like Instafill.ai use AI to fill these forms in under 30 seconds, handling the data accurately and securely so you can focus on what actually needs your attention.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds