Yes! You can use AI to fill out Form 01-339, Texas Sales and Use Tax Resale Certificate / Texas Sales and Use Tax Exemption Certification

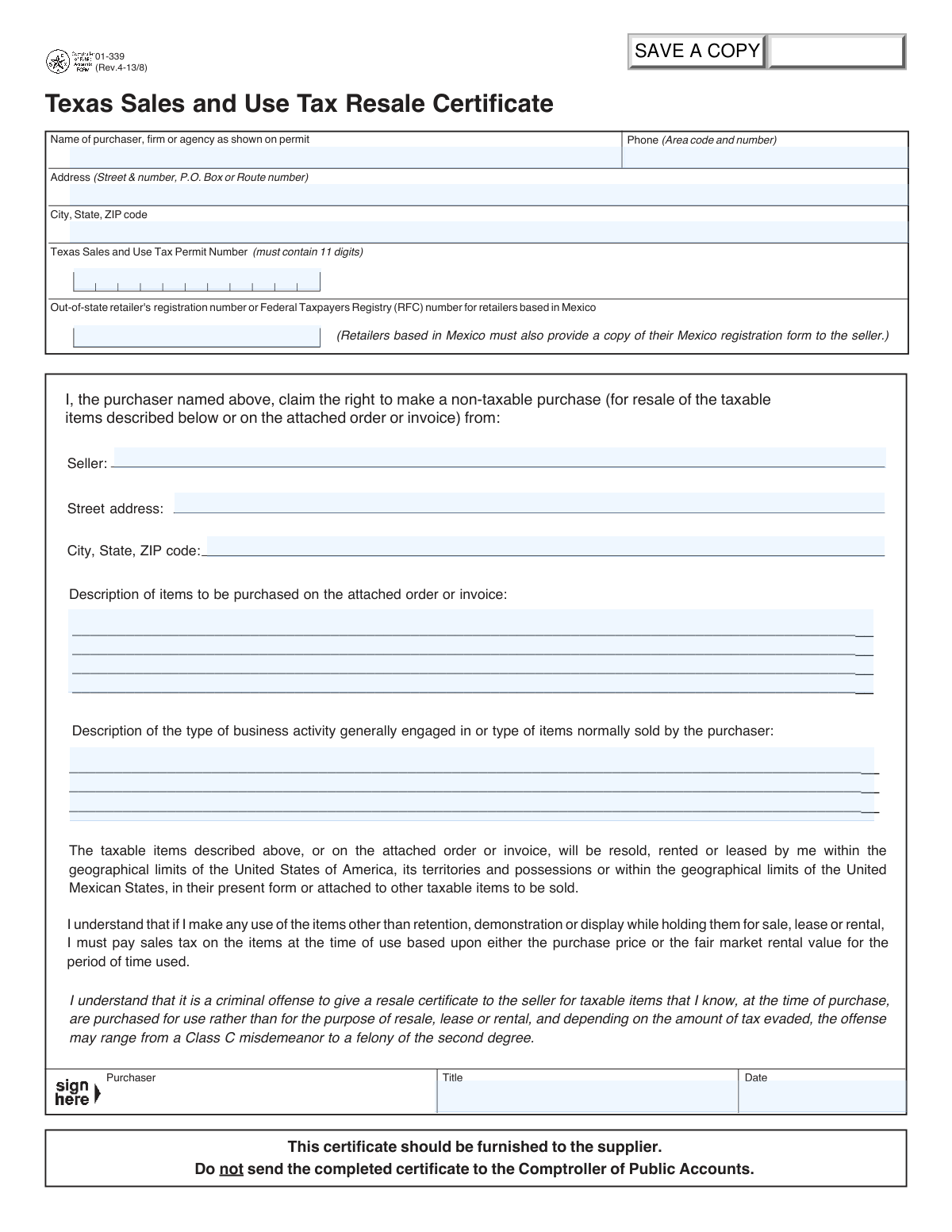

Texas Form 01-339 is a purchaser-provided certificate used to support non-taxable transactions under Texas sales and use tax rules. The front is a Resale Certificate for items bought for resale, lease, or rental, and it requires a Texas Sales and Use Tax Permit Number (or certain out-of-state/Mexico registration information). The back is an Exemption Certification used to claim a specific exemption reason and does not require an exemption number to be valid. It is important because sellers rely on it to document why tax was not collected, and misuse can create tax liability and potential criminal penalties.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Texas Form 01-339 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 01-339, Texas Sales and Use Tax Resale Certificate / Texas Sales and Use Tax Exemption Certification |

| Number of pages: | 2 |

| Language: | English |

| Categories: | Texas tax forms, sales tax forms, resale certificate forms, tax exemption forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Texas Form 01-339 Online for Free in 2026

Are you looking to fill out a TEXAS FORM 01-339 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your TEXAS FORM 01-339 form in just 37 seconds or less.

Follow these steps to fill out your TEXAS FORM 01-339 form online using Instafill.ai:

- 1 Choose the correct section to complete: Resale Certificate (for resale/lease/rental) or Exemption Certification (for a specific exemption reason).

- 2 Enter purchaser information: legal name, phone number, and full address (city, state, ZIP).

- 3 If completing the Resale Certificate, provide the 11-digit Texas Sales and Use Tax Permit Number (or the applicable out-of-state registration number / Mexico RFC, and attach Mexico registration if required).

- 4 Enter seller information: seller name, street address, and city/state/ZIP.

- 5 Describe the items being purchased (or reference/attach the related order or invoice) and, for resale, describe the purchaser’s general business activity or items normally sold; for exemption, state the exemption reason.

- 6 Review the statements regarding proper use, tax liability, and criminal penalties to ensure the purchase qualifies for resale or the claimed exemption.

- 7 Sign and date the certificate (include purchaser title), then provide it to the supplier; do not send the completed form to the Texas Comptroller of Public Accounts.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Texas Form 01-339 Form?

Speed

Complete your Texas Form 01-339 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Texas Form 01-339 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Texas Form 01-339

Form 01-339 is used to document either a tax-free purchase for resale (Resale Certificate) or a tax-exempt purchase for a specific exempt reason (Exemption Certification). It is given to the seller to support why sales tax was not charged.

Use the Resale Certificate if you are buying taxable items to resell, rent, or lease (either in the same form or incorporated into other taxable items for sale). You generally must have a Texas Sales and Use Tax Permit Number (11 digits) or a qualifying out-of-state/Mexico registration number.

Use the Exemption Certification if you are claiming a specific exemption from sales and use tax for the items being purchased. You must state the reason for the exemption on the form.

No. The form states that it should be furnished to the supplier (seller) and should not be sent to the Comptroller of Public Accounts.

You must provide the purchaser’s name, phone number, address, and Texas Sales and Use Tax Permit Number (must contain 11 digits). You also need the seller’s information, a description of items being purchased (or attach an order/invoice), your business activity/type of items sold, and a signature, title, and date.

You must provide the purchaser’s name, address, and phone number, the seller’s information, a description of items being purchased (or attach an order/invoice), the reason for the exemption, and a signature, title, and date.

No. The form explicitly states that this certificate does not require a number to be valid and that “Exemption Numbers” or “Tax Exempt” numbers do not exist.

For the Resale Certificate, the form requires a Texas permit number with 11 digits, unless you are using an out-of-state retailer registration number or a Mexico RFC number (for Mexico-based retailers). If you cannot provide the required number, the seller may not accept the resale claim.

You must provide your out-of-state retailer registration number or Federal Taxpayers Registry (RFC) number. The form also requires Mexico-based retailers to provide a copy of their Mexico registration form to the seller.

Yes. Both sides of the form allow you to describe the items on an attached order or invoice rather than writing every item in the description field.

By signing the Resale Certificate, you are certifying the items will be resold, rented, or leased within the geographic limits of the United States (including territories and possessions) or within the United Mexican States. This statement supports the non-taxable purchase for resale.

The form states that if you make any use of the items other than retention, demonstration, or display while holding them for sale/lease/rental, you must pay sales tax at the time of use. The tax is based on either the purchase price or the fair market rental value for the period used.

Yes. The form warns it is a criminal offense to give a certificate for taxable items you know are being purchased for use (or used in a way different than stated), and the offense can range from a Class C misdemeanor to a second-degree felony depending on the tax evaded.

No. The form specifically notes that the exemption certificate cannot be issued for the purchase, lease, or rental of a motor vehicle.

There is no government processing time listed because the form is not filed with the Comptroller. It is provided directly to the seller, who keeps it to document the tax-free or exempt sale.

Compliance Texas Form 01-339

Validation Checks by Instafill.ai

1

Purchaser Legal Name Present and Non-Placeholder

Validates that the 'Name of purchaser, firm or agency' field is completed with a real legal name (not blank, not 'N/A', not 'same as above', and not only initials). This matters because the certificate is only meaningful if it clearly identifies the party claiming resale/exemption. If validation fails, the submission should be rejected or routed for manual review because the certificate may be unenforceable.

2

Purchaser Phone Number Format (Area Code + Number)

Checks that the purchaser phone number includes a valid 10-digit US phone number (optionally with punctuation like (###) ###-####) and does not contain letters or too few digits. The form explicitly requests area code and number, and suppliers often need a reliable contact for audit support. If invalid, prompt the user to correct the phone number before acceptance.

3

Purchaser Address Completeness and Structure

Ensures the purchaser address includes a street number and street name or a valid P.O. Box/Route, and is not left blank. This is important for identifying the purchaser’s place of business for tax documentation and audit trails. If the address is incomplete (e.g., only a city or only a street name), the form should fail validation and require correction.

4

Purchaser City/State/ZIP Validation (US Address Rules)

Validates that city and state are present and that the state is a valid US state/territory abbreviation when a US ZIP is provided. Also checks ZIP code format as 5 digits or ZIP+4 (##### or #####-####). If the city/state/ZIP combination is malformed or missing, the submission should be blocked because the purchaser location cannot be reliably determined.

5

Texas Sales and Use Tax Permit Number Must Be 11 Digits

For the resale certificate side, verifies that the Texas Sales and Use Tax Permit Number is present and contains exactly 11 digits (numeric only, no letters, no spaces). The form explicitly states the permit number must contain 11 digits, and incorrect length undermines validity. If it fails, the system should reject the resale certificate or require the user to correct the permit number.

6

Mutual Exclusivity: Texas Permit Number vs Mexico Retailer Registration (RFC)

Checks that the user does not provide conflicting registration identifiers (e.g., both a Texas 11-digit permit number and a Mexico RFC number) unless the workflow explicitly allows dual registration. This prevents ambiguity about which jurisdictional registration supports the claim. If both are provided without an allowed reason, flag for manual review or require the user to select the correct registration type.

7

Mexico Retailer Requirement: RFC Provided and Mexico Registration Copy Acknowledged

If the purchaser indicates they are a retailer based in Mexico (or provides an RFC number), validate that an RFC/registration number is present and that an attachment/checkbox confirms a copy of the Mexico registration form is included. The form states Mexico-based retailers must provide a copy to the seller, so the submission should enforce that requirement. If missing, the certificate should be marked incomplete and not accepted as valid documentation.

8

Seller Identification Completeness (Name and Address)

Validates that the seller name and seller address (street, city, state, ZIP) are provided and not placeholders. The certificate is furnished to a supplier, and the seller identity ties the certificate to a specific transaction relationship. If seller details are missing, the system should require completion because the certificate may not be usable for the intended supplier.

9

Items Description Present or Attachment Referenced

Ensures there is a meaningful 'Description of items to be purchased' OR a clear reference to an attached order/invoice (and, if applicable, the attachment is actually provided). This is important because the certificate applies to specific taxable items and must support auditability. If neither a description nor an attachment reference is present, fail validation and request item details.

10

Business Activity / Normally Sold Items Provided (Resale Certificate)

On the resale certificate, checks that the 'type of business activity generally engaged in or type of items normally sold' field is completed with a plausible description. This helps establish that the purchase is consistent with resale activity and reduces misuse risk. If blank or clearly non-descriptive (e.g., 'none', 'N/A'), the submission should be rejected or escalated for review.

11

Purchaser Title Present and Reasonable

Validates that the purchaser title field is completed (e.g., Owner, Manager, Authorized Agent) and is not a random string. Title indicates the signer’s authority to bind the purchaser, which is important for compliance. If missing or invalid, require correction before accepting the certificate.

12

Signature/Attestation Presence (Purchaser Signed)

Checks that the purchaser has provided a signature or equivalent electronic attestation in the designated signature area. The certificate includes legal statements and criminal offense warnings, so an unsigned form is not a valid claim. If not signed, the system should not accept the submission as complete.

13

Date Format and Not in the Future

Validates that the date is present and in an acceptable format (e.g., MM/DD/YYYY or ISO YYYY-MM-DD) and is not a future date. Dating the certificate is necessary to establish when the claim was made and for audit timelines. If the date is missing, malformed, or in the future, block submission until corrected.

14

Certificate Type Consistency: Resale vs Exemption

If the system allows submitting either the Resale Certificate (front) or Exemption Certification (back), validate that the user selected one type and completed the corresponding required fields. This prevents mixing requirements (e.g., providing a Texas permit number on an exemption form where a number is not required) and reduces confusion. If both are partially completed or neither is clearly selected, require the user to choose a certificate type and complete the correct section.

15

Exemption Reason Required (Exemption Certification)

On the exemption certification, checks that 'Purchaser claims this exemption for the following reason' is completed with a specific reason (not blank or generic filler). The exemption claim must be supported by a stated basis to be defensible in an audit. If missing, the exemption certificate should fail validation and require a reason before acceptance.

16

Motor Vehicle Purchase Prohibited (Exemption Certification)

Validates that the described items (or attached invoice/order) do not indicate a motor vehicle purchase, lease, or rental when using the exemption certification, as the form explicitly prohibits it. This can be implemented via a user confirmation checkbox and/or keyword/line-item screening (e.g., VIN, 'vehicle', 'car', 'truck'). If a motor vehicle is detected or confirmed, the system should block submission and instruct the user that this certificate cannot be used for that transaction.

Common Mistakes in Completing Texas Form 01-339

People often grab the first page they see and complete a resale certificate when they actually need an exemption certification (or vice versa). This can cause the seller to reject the document, charge tax anyway, or create liability for unpaid tax if the purchase was not truly for resale. Avoid this by confirming whether the purchase is for resale/rental/lease (use the Resale Certificate) or for a specific exempt purpose (use the Exemption Certification) before filling anything out.

A very common error is providing a permit number with the wrong length, missing digits, or using a different identifier (like an EIN) in the permit field. Sellers may refuse the certificate or treat the sale as taxable if the permit number is invalid or incomplete. To avoid this, enter the Texas Sales and Use Tax Permit Number exactly as issued and verify it contains 11 digits.

Many purchasers believe they must provide an “exemption number” or “tax exempt number,” even though the form explicitly states these do not exist and no number is required for validity. This misunderstanding leads to blank fields being “filled” with random numbers, old permit numbers, or internal account IDs, which can trigger seller follow-up or rejection. Avoid this by leaving number fields off the exemption form entirely and instead clearly stating the exemption reason and completing the purchaser/seller details.

People frequently write generic descriptions (e.g., “supplies,” “inventory,” “various,” or “taxable items”) instead of describing what is actually being purchased. Vague descriptions make it hard for the seller to document why tax was not collected and can create audit risk for both parties. Avoid this by listing specific items or attaching the order/invoice and referencing it clearly (e.g., “See attached invoice #12345 dated MM/DD/YYYY”).

On the resale certificate, purchasers often skip the field describing the type of business activity or the items normally sold, assuming the permit number is enough. Missing or unclear business activity can cause the seller to question whether the purchase is legitimately for resale and may result in tax being charged. Avoid this by stating your business type and typical resale items (e.g., “Retailer of HVAC parts; normally sells compressors, thermostats, and fittings”).

It’s common to omit the seller’s name or address details, especially when the purchaser thinks the seller already “knows who they are.” Incomplete seller information can make the certificate unusable for the seller’s records and may lead to rejection or requests for a corrected form. Avoid this by fully completing the seller name and full address (street, city, state, ZIP) exactly as shown on the seller’s invoice or business listing.

A frequent mistake is using a resale certificate to buy equipment, consumables, or supplies that the business will use (e.g., office supplies, tools, fixtures) rather than resell, rent, or lease. This can create tax liability (you must pay tax at time of use) and may expose the purchaser to penalties, including criminal consequences described on the form. Avoid this by only using the resale certificate for inventory held for resale/lease/rental and paying tax on items used by the business.

On the exemption certification, people often leave the “reason” blank or write something non-specific like “tax exempt” without citing the actual basis for exemption. Sellers may reject the certificate or charge tax because the exemption claim is not documented. Avoid this by writing a specific exemption reason that matches your situation (e.g., qualifying exempt organization purchase, manufacturing exemption, agricultural exemption, etc.) and ensuring it aligns with Texas rules.

Some purchasers try to use this exemption certificate for the purchase, lease, or rental of a motor vehicle, even though the form explicitly prohibits it. This will typically be rejected and can delay the transaction or require reprocessing with the correct motor vehicle tax documentation. Avoid this by using the appropriate motor vehicle tax forms and processes instead of this certificate for any motor vehicle transaction.

People often forget to sign, omit their title, or leave the date blank—especially when submitting electronically or when multiple pages are involved. An unsigned or undated certificate may be considered invalid by the seller and provides weak support in an audit. Avoid this by ensuring the purchaser (authorized representative) signs, prints/enters their title, and dates the form before providing it to the supplier.

Despite the instruction on both forms, some filers mail or upload the completed certificate to the Texas Comptroller, assuming it must be “filed” with the state. This wastes time and can leave the seller without proper documentation, resulting in tax being charged or follow-up requests. Avoid this by furnishing the completed certificate directly to the supplier and keeping a copy for your records; do not send it to the Comptroller.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Texas Form 01-339 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-01-339-texas-sales-and-use-tax-resale-certifi forms, ensuring each field is accurate.