Form 3468, Investment Credit Completed Form Examples and Samples

Explore a detailed example of a completed Form 3468 for claiming investment credit on a solar energy system installation. Learn how to accurately fill the form with taxpayer information, project costs, and credit calculations for the 2024 tax year.

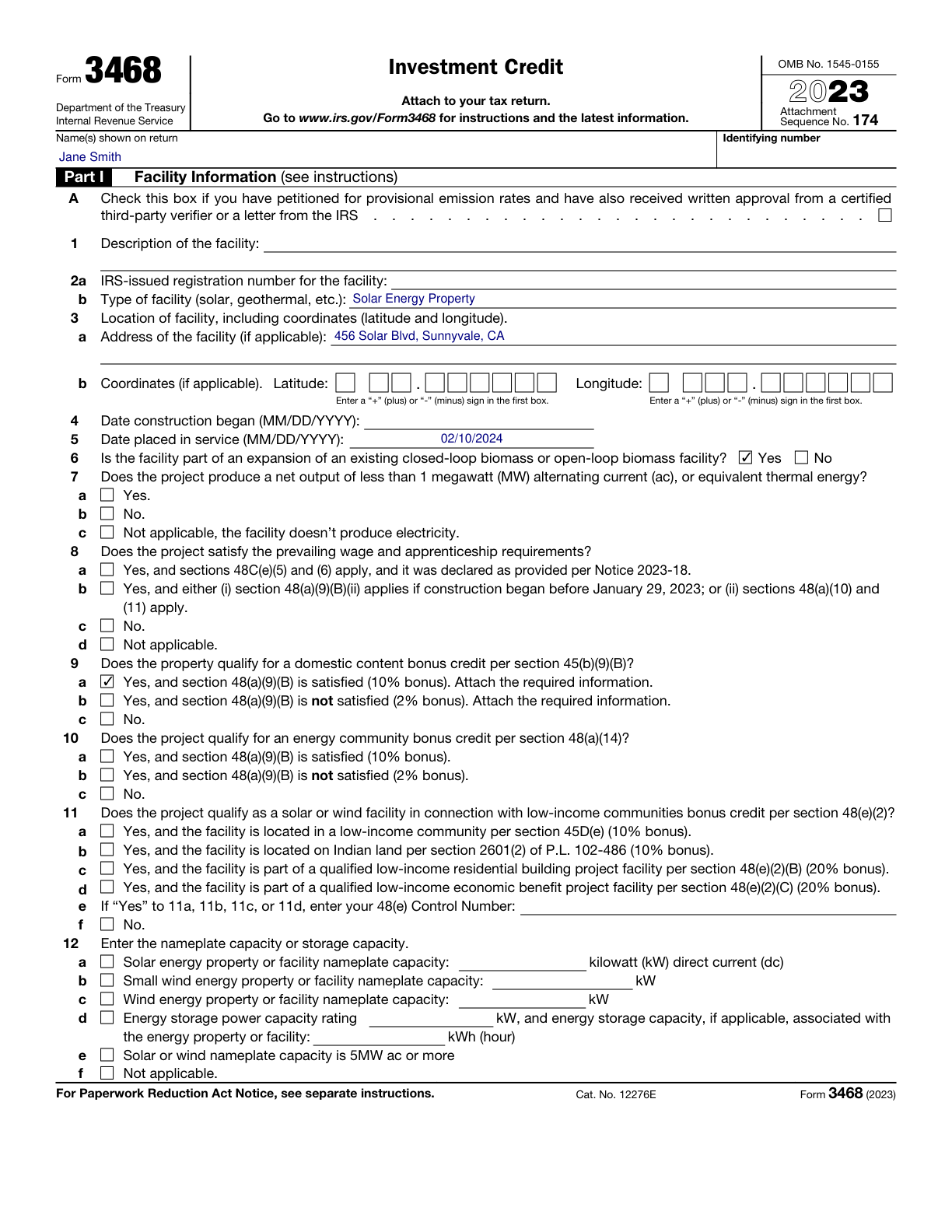

Form 3468 Example – Solar Energy System Installation

How this form was filled:

This example demonstrates how to fill out Form 3468 for claiming investment credit on a newly installed solar energy system. The form includes the taxpayer's identification, project costs, and the calculation of the allowable credit for the 2024 tax year.

Information used to fill out the document:

- Taxpayer Name: Jane Smith

- Business Name: Sunshine Enterprises

- Property Type: Solar Energy Property

- Date Placed in Service: 02/10/2024

- Project Cost: 150000

- Credit Rate: 30%

- Calculated Credit: 45000

- Address: 456 Solar Blvd, Sunnyvale, CA

- Signature: Jane Smith

- Date: 03/15/2025

What this filled form sample shows:

- Properly completed Taxpayer Identification and Business Name fields

- Accurate project cost and date placed in service

- Correct credit rate and calculated credit

- Suitable signature and submission date

Form specifications and details:

| Use Case: | Claiming investment credit for a solar energy installation in 2024 |

| Form Year: | 2024 |

| Industry: | Renewable Energy |