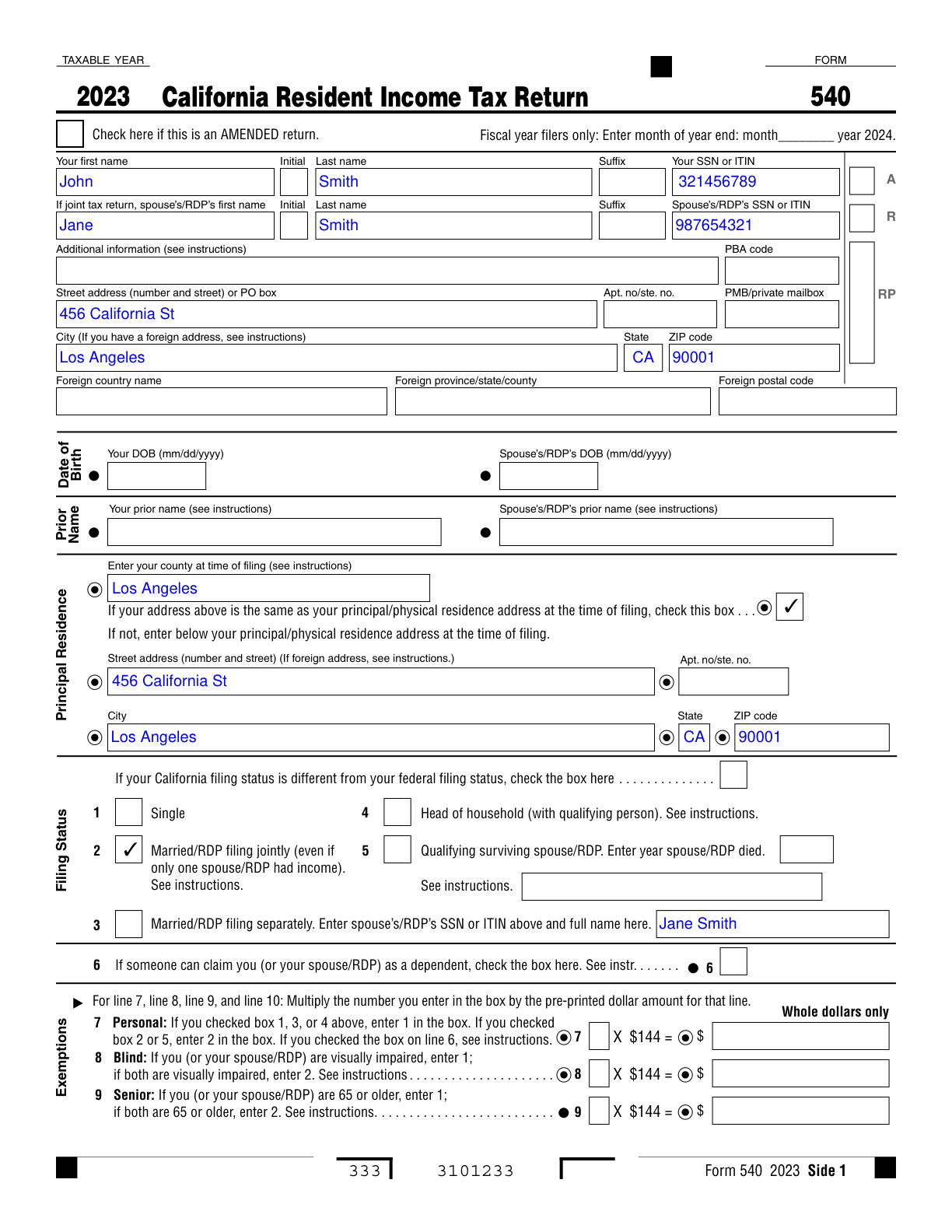

Form 540, California Resident Income Tax Return Completed Form Examples and Samples

Explore a detailed example of Form 540, California Resident Income Tax Return. This completed form demonstrates how residents like John and Jane Smith file jointly, including crucial details such as income, deductions, and credits specific to California tax laws.

Form 540 Example – California Resident Tax Return

How this form was filled:

John and Jane Smith, California residents, file jointly using Form 540. Key fields include personal information, income details, deductions, and credits specific to California tax laws.

Information used to fill out the document:

- Taxpayer's Name: John Smith

- Spouse's Name: Jane Smith

- Filing Status: Married/RDP filling jointly

- Social Security Numbers: 321-45-6789, 987-65-4321

- Address: 456 California St, Los Angeles, CA 90001

- Tax Year: 2024

- Total Income: $85,000

- California Adjustments: $5,000

- Itemized Deductions: $10,000

- Tax Due: $1,200

- Credits: $800

- Total Tax: $400

- Refund Amount: $0

- Signature: John Smith, Jane Smith

- Date: 04/15/2025

What this filled form sample shows:

- Accurate entry of filing status, with both spouses' names and social security numbers.

- Inclusion of California-specific income adjustments and deductions.

- Computation of taxable income and credits relevant to the state.

- Correctly signed and dated by both filers.

Form specifications and details:

| Use Case: | California Residents Filing Jointly in Tax Year 2024 |

| Form Type: | Individual Income Tax Return |