Form 8283, Noncash Charitable Contributions Completed Form Examples and Samples

Explore our sample of Form 8283 completed for a noncash charitable contribution of artwork. This example provides a detailed guide on filling out the form, highlighting key sections such as property description, valuation methods, and recipient organization details. Perfect for anyone looking to document their donation for tax purposes accurately.

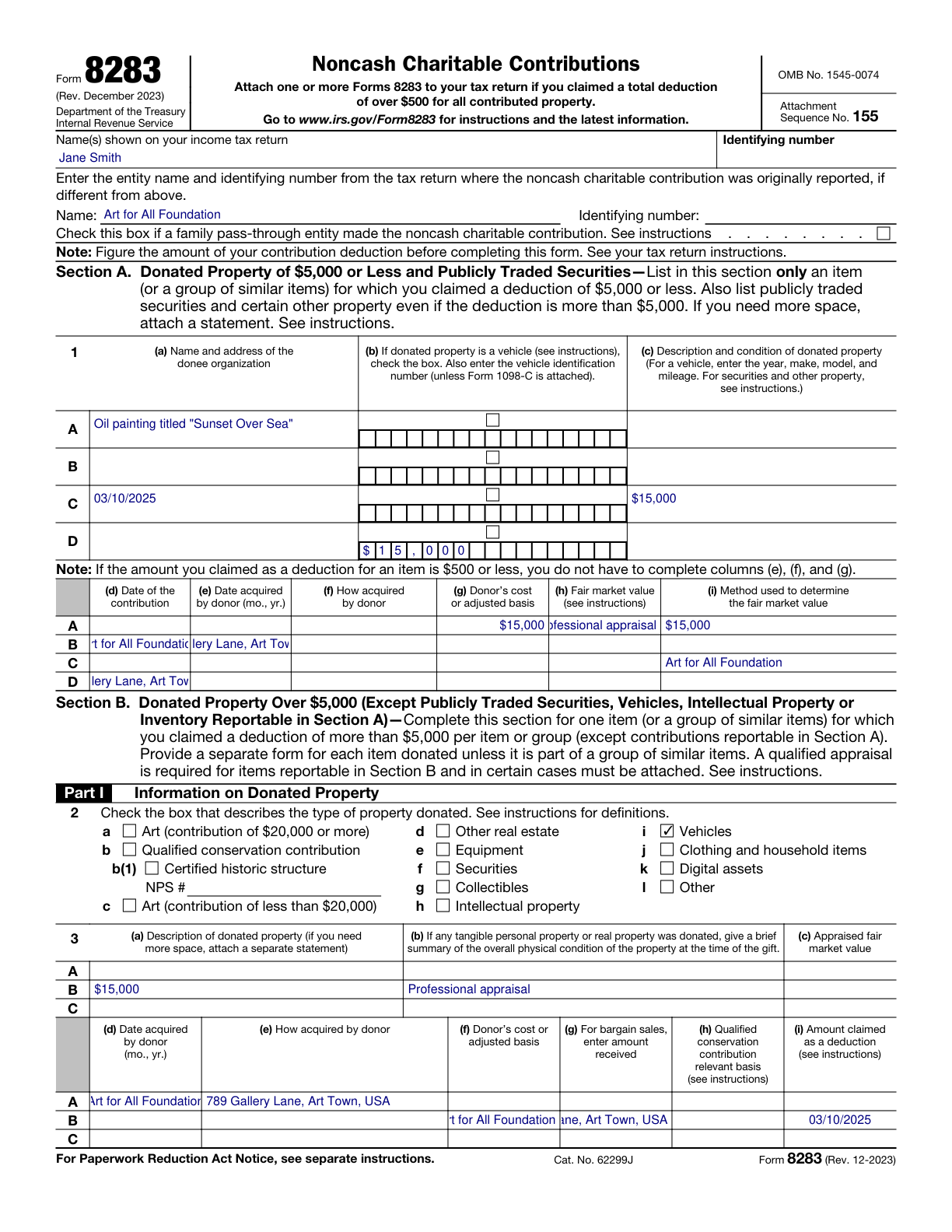

Form 8283 Example – Artwork Donation

How this form was filled:

This example demonstrates the completion of Form 8283 for a donation of artwork to a qualified organization. The form details the description of the artwork, its fair market value, and the valuation method used, along with the recipient organization's information.

Information used to fill out the document:

- Donor’s Name: Jane Smith

- Donation Year: 2025

- Type of Property: Artwork

- Description of Property: Oil painting titled "Sunset Over Sea"

- Address of Donor: 456 Ocean Drive, Capital City, USA

- Donee Organization Name: Art for All Foundation

- Donee Organization Address: 789 Gallery Lane, Art Town, USA

- Date of Contribution/Deduction: 03/10/2025

- Fair Market Value (FMV): $15,000

- Method Used to Determine FMV: Professional appraisal

- Appraiser’s Name: Art Valuers Inc.

- Appraiser’s Address: 101 Appraisal Ave, Value City, USA

- Signature of Donee Organization: John Doe

- Date Signed by Donee: 03/09/2025

What this filled form sample shows:

- Accurate description of donated property with title and type

- Correct donor and recipient details including addresses

- Comprehensive detailing of valuation method and appraiser

- Proper certification by donee organization with signatures

Form specifications and details:

| Use Case: | Donation of artwork to a qualified organization |

| Form Year: | 2025 |

| Category: | Noncash Charitable Contributions |

| Purpose: | Document donation for tax deduction |