Form 8885, Health Coverage Tax Credit Completed Form Examples and Samples

Explore a detailed example of a completed Form 8885, Health Coverage Tax Credit, showcasing how to claim the credit for the tax year 2024. This example guides you through eligibility criteria, premium payments, and credit calculations, illustrated with a scenario involving trade adjustment assistance.

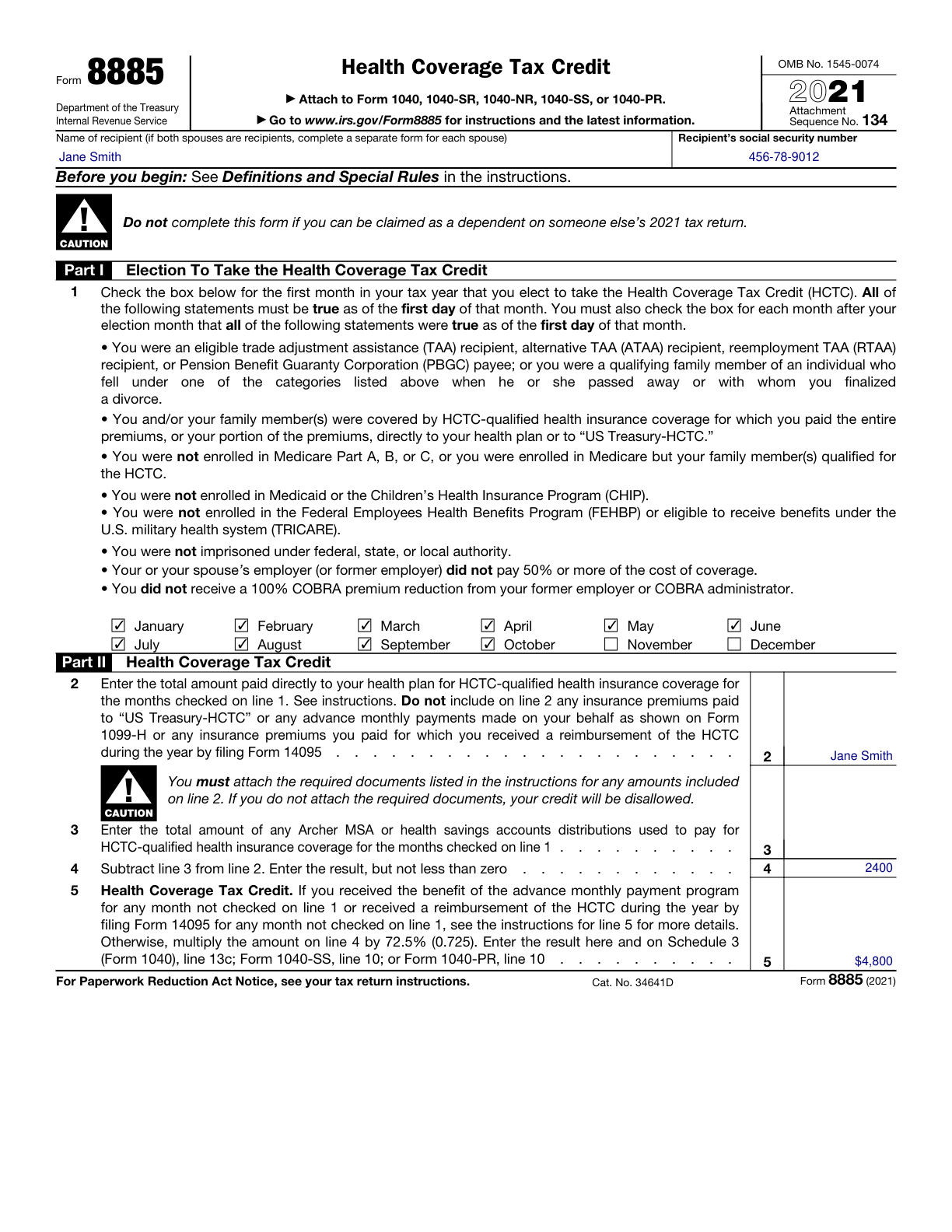

Form 8885 Example – Health Coverage Tax Credit

How this form was filled:

This example of a completed Form 8885 includes all necessary details to claim the Health Coverage Tax Credit (HCTC) for the tax year 2024. Illustrates a scenario where the taxpayer is eligible due to receiving trade adjustment assistance and has qualifying health insurance coverage.

Information used to fill out the document:

- Taxpayer Name: Jane Smith

- Taxpayer Identification Number (TIN): 456-78-9012

- Eligibility: Received Trade Adjustment Assistance

- Year of Eligibility: 2024

- Months of Coverage: January - December

- Qualified Health Insurance Coverage: Yes

- Total Premiums Paid: $4,800

- Total HCTC Claimed: $2,400

- Signature: Jane Smith

- Date: 03/12/2025

What this filled form sample shows:

- Correct recording of eligibility criteria based on receiving trade adjustment assistance

- Proper calculation of total health insurance premiums paid

- Accurate computation of Health Coverage Tax Credit amount at 50% of total premiums

- Filled signature and date fields for 2024 tax year

Form specifications and details:

| Use Case: | Claiming Health Coverage Tax Credit due to Trade Adjustment Assistance |

| Tax Year: | 2024 |

| Required Eligibility: | Received Trade Adjustment Assistance or PBGC Pension |