Dealer’s Heavy Equipment Inventory Tax Statement (Form 50-266) Completed Form Examples and Samples

View a detailed example of a completed Dealer’s Heavy Equipment Inventory Tax Statement (Form 50-266). This sample provides a clear guide for Texas heavy equipment dealers on how to calculate market value, apply tax rates, and accurately file their inventory tax statement.

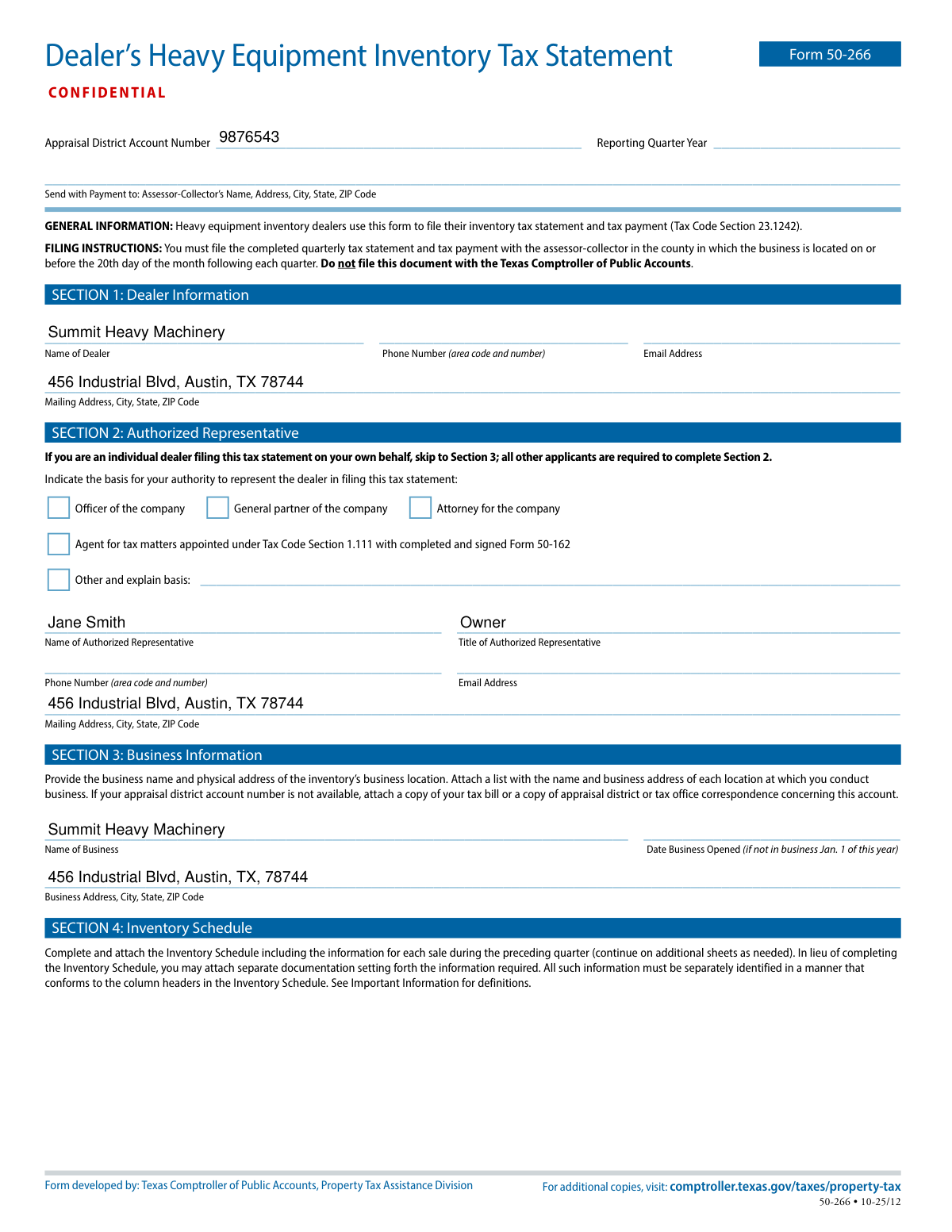

Dealer’s Heavy Equipment Inventory Tax Statement (Form 50-266) Example

How this form was filled:

This is an example of a completed Form 50-266 for the 2026 tax year. It shows how a fictional dealer, Summit Heavy Machinery, calculates its inventory's market value based on the prior year's sales and determines the total property tax due using the aggregate tax rate of all applicable taxing units.

Information used to fill out the document:

- Tax Year: 2026

- Appraisal District Name: Travis Central Appraisal District

- Appraisal District Account Number: 9876543

- Dealer Name: Summit Heavy Machinery

- Owner Name: Jane Smith

- Business Address: 456 Industrial Blvd, Austin, TX, 78744

- Dealer's GDN: P123456

- Total Sales of Heavy Equipment in 2025: $15,250,000.00

- Number of Units Sold in 2025: 50

- Market Value of Inventory (Total Sales / 12): $1,270,833.33

- Travis County Tax Rate: 0.003500

- City of Austin Tax Rate: 0.004800

- Austin ISD Tax Rate: 0.011000

- Central Health Tax Rate: 0.001000

- Austin Community College Tax Rate: 0.000900

- Aggregate Tax Rate: 0.021200

- Total Property Tax Due: $26,941.67

- Preparer Name: Jane Smith

- Preparer Title: Owner

- Date: 02/15/2026

What this filled form sample shows:

- Clearly states the tax year and relevant appraisal district information.

- Demonstrates the calculation of inventory market value based on total sales from the preceding year (Step 2).

- Provides a sample breakdown of various taxing units and their respective rates to calculate the aggregate tax rate (Step 3).

- Shows the final calculation for the total property tax due based on market value and the aggregate rate (Step 4).

- Includes correctly filled-out dealer information, signature, and date fields.

Form specifications and details:

| Form Name: | Dealer’s Heavy Equipment Inventory Tax Statement |

| Form Number: | 50-266 |

| Jurisdiction: | Texas, USA |

| Issuing Body: | Texas Comptroller of Public Accounts |

| Use Case: | Annual property tax declaration for a heavy equipment dealership. |

Created: February 04, 2026 02:09 AM