Form 1120 (2025), U.S. Corporation Income Tax Return Completed Form Examples and Samples

Find clear and accurate Form 1120 (2025) examples. Our filled samples of the U.S. Corporation Income Tax Return show you how to complete each section, from gross receipts to final tax calculation. Ideal for small businesses and C corporations.

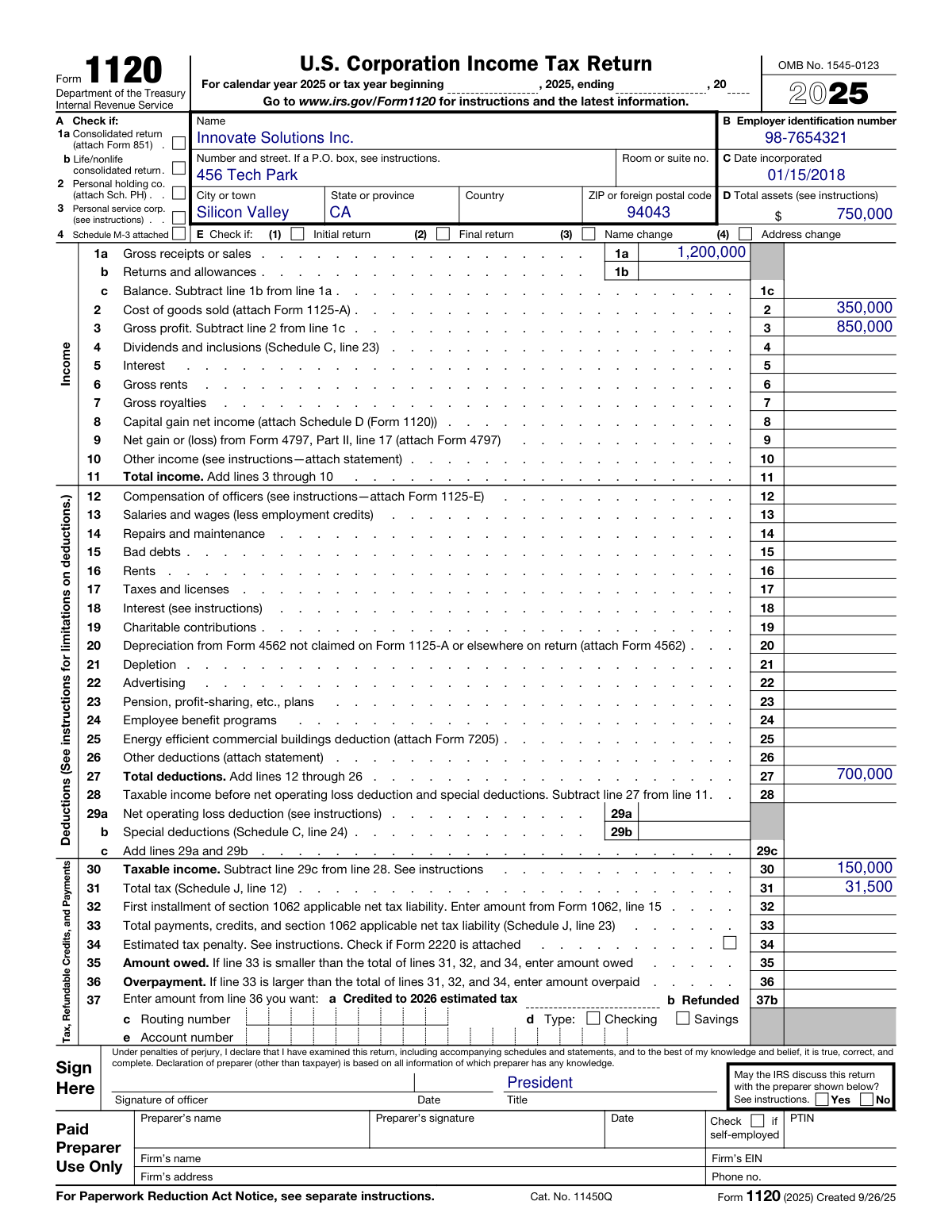

Form 1120 (2025) Example – Small Technology Corporation

How this form was filled:

This is a completed 2025 Form 1120 example for a small, profitable C corporation in the technology consulting sector. The sample demonstrates how to report gross receipts, itemize common business deductions (such as salaries, rent, and depreciation), calculate the taxable income, and determine the final tax liability using the 21% corporate tax rate.

Information used to fill out the document:

- Corporation Name: Innovate Solutions Inc.

- Employer Identification Number (EIN): 98-7654321

- Address: 456 Tech Park, Silicon Valley, CA 94043

- Date Incorporated: 01-15-2018

- Business Activity Code: 541510 (Computer Systems Design Services)

- Total Assets: $750,000

- Gross Receipts or Sales: $1,200,000

- Cost of Goods Sold: $350,000

- Gross Profit: $850,000

- Total Deductions: $700,000

- Taxable Income (Line 30): $150,000

- Total Tax (Line 31): $31,500

- Signing Officer: Jane Smith, President

- Date Signed: March 10, 2026

What this filled form sample shows:

- Accurate reporting of income and deductions for a service-based technology business.

- Correct calculation of taxable income and final tax liability based on the 21% corporate rate.

- Inclusion of common deductions like salaries, wages, rent, taxes, and depreciation.

- Properly filled out entity information, including EIN, address, and business activity code.

- Shows a clear path from gross receipts to final tax, making it a useful Form 1120 sample.

Form specifications and details:

| Form: | Form 1120 |

| Tax Year: | 2025 |

| Filing For: | U.S. Corporation Income Tax Return |

| Use Case: | Small Profitable Technology C Corporation |

Created: February 04, 2026 02:15 AM