Form 1120-S (2025), U.S. Income Tax Return for an S Corporation Completed Form Examples and Samples

View detailed, filled-out examples and samples of IRS Form 1120-S for the 2025 tax year. Our guide provides a clear walkthrough on how to complete the U.S. Income Tax Return for an S Corporation, covering income, deductions, and ordinary business income calculations. Perfect for small business owners and tax professionals.

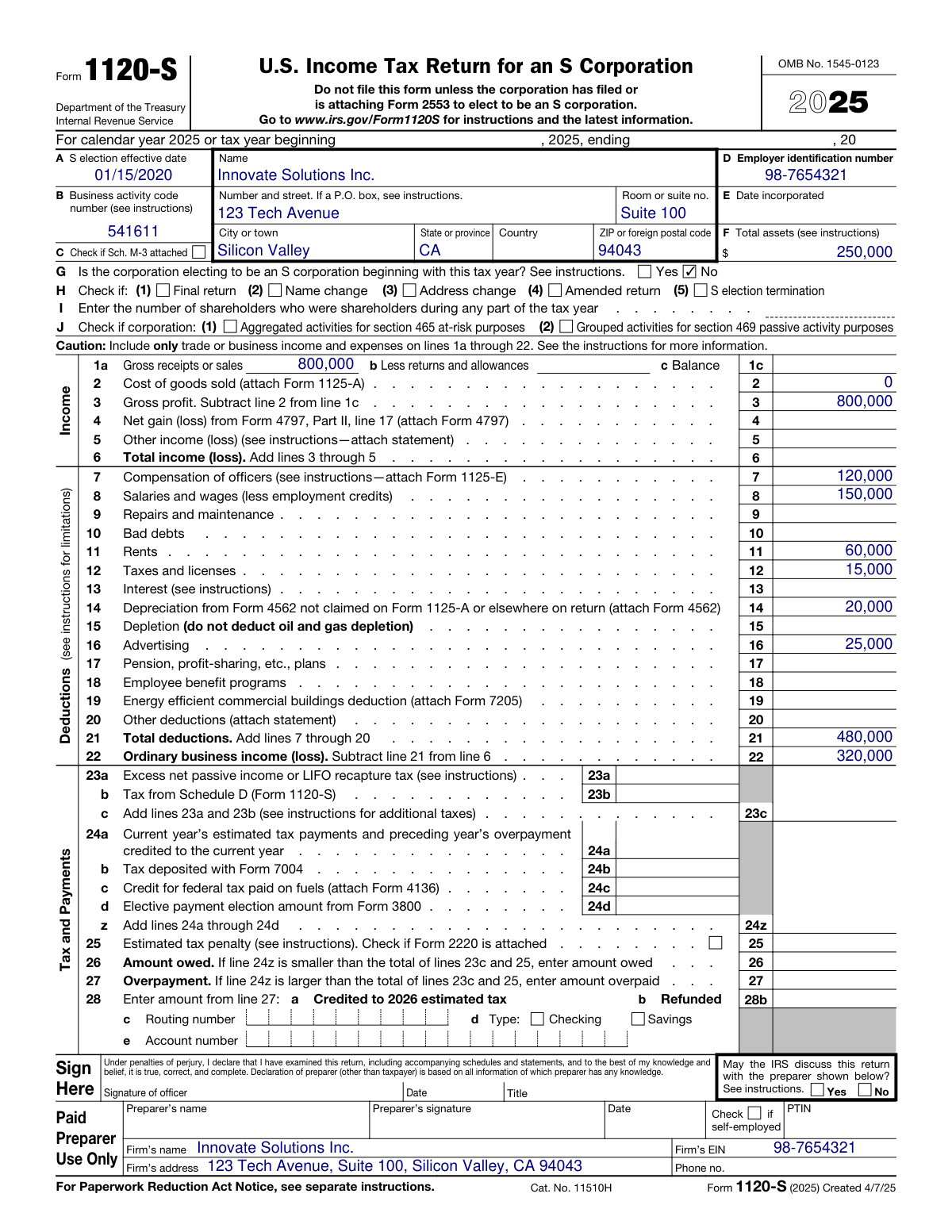

Form 1120-S (2025) Example – Consulting S Corporation

How this form was filled:

This example shows a completed Form 1120-S for a fictional consulting firm, 'Innovate Solutions Inc.' for the 2025 tax year. It details gross receipts of $800,000 and total deductions of $480,000, resulting in $320,000 of ordinary business income. Key deductions include officer compensation, salaries, and rent. This income passes through to the shareholder(s) via Schedule K-1.

Information used to fill out the document:

- Corporation Name: Innovate Solutions Inc.

- Employer Identification Number (EIN): 98-7654321

- Business Address: 123 Tech Avenue, Suite 100, Silicon Valley, CA 94043

- Date of S Corp Election: 01/15/2020

- Business Activity Code: 541611 - Management Consulting

- Total Assets: $250,000

- Gross Receipts: $800,000

- Cost of Goods Sold: $0

- Gross Profit: $800,000

- Compensation of Officers: $120,000

- Salaries and Wages: $150,000

- Rent: $60,000

- Taxes and Licenses: $15,000

- Depreciation: $20,000

- Advertising: $25,000

- Total Deductions: $480,000

- Ordinary Business Income: $320,000

- Filing Date: 03/15/2026

What this filled form sample shows:

- Demonstrates the calculation of Ordinary Business Income (Line 21) for a service-based business with no cost of goods sold.

- Includes common deductions for a small corporation, such as Officer Compensation, Salaries and Wages, and Rent.

- Shows the correct use of a Business Activity Code for a consulting firm, a critical detail for IRS classification.

- Illustrates a completed first page, providing a clear sample of how to report key financial totals for an S Corp tax return.

- The resulting income flows through to shareholders on Schedule K-1 (not shown), which is a key feature of S Corporations.

Form specifications and details:

| Form: | Form 1120-S, U.S. Income Tax Return for an S Corporation |

| Tax Year: | 2025 |

| Filing Year: | 2026 |

| Use Case: | Consulting Firm operating as a single-shareholder S Corporation |

Created: January 29, 2026 07:41 AM