Form 2553 (Rev. December 2017), Election by a Small Business Corporation Completed Form Examples and Samples

View completed examples and samples of IRS Form 2553 (Rev. December 2017), Election by a Small Business Corporation. Our detailed guides show you how to correctly fill out the form to elect S Corp status, with filled-out scenarios for new corporations, late elections, and more.

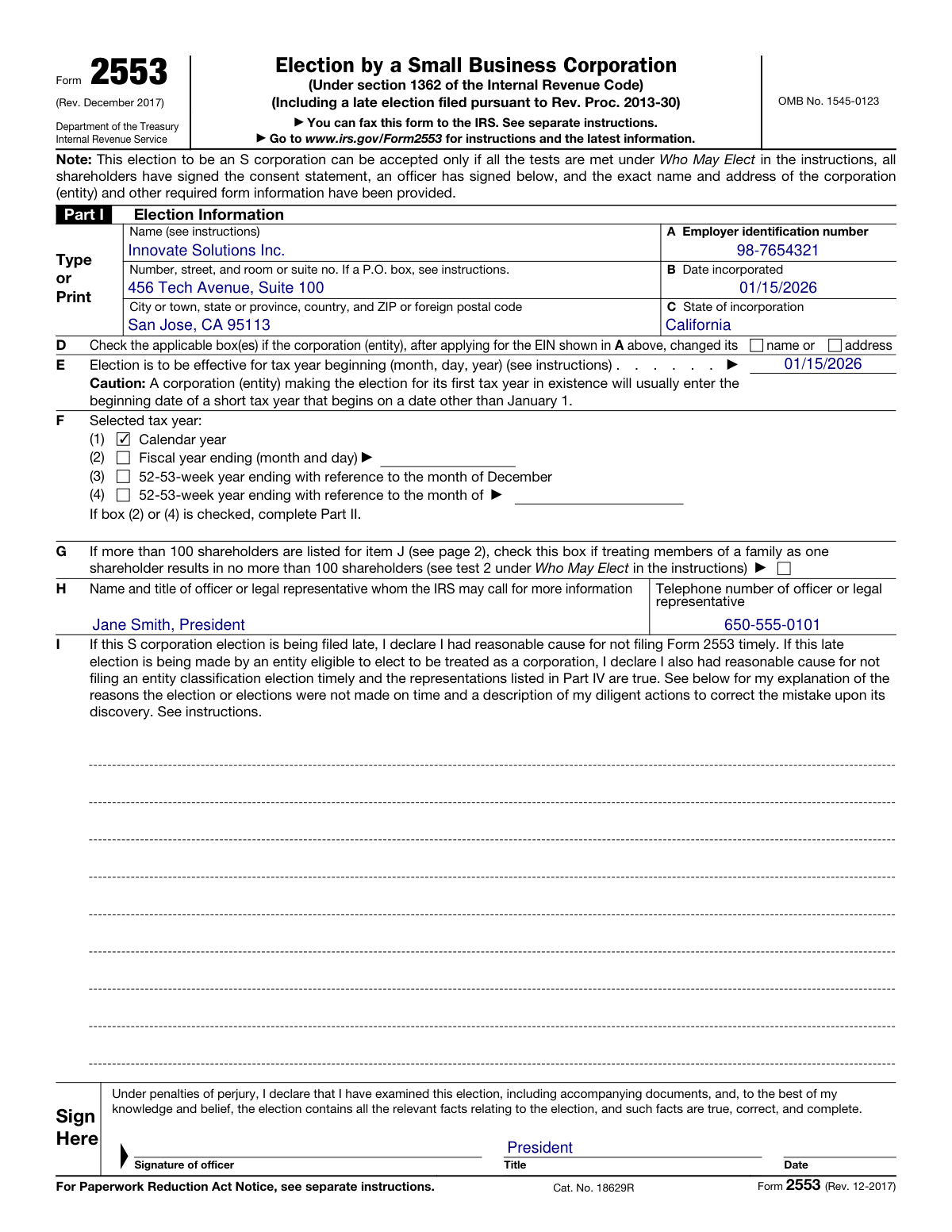

Form 2553 Example: New Corporation Electing S Corp Status

How this form was filled:

This example shows Form 2553 filed for a newly incorporated business, 'Innovate Solutions Inc.', electing to be treated as an S corporation from its date of incorporation. The election is effective January 15, 2026, and a calendar tax year is chosen. All shareholders have provided their consent, and the form is signed by a corporate officer.

Information used to fill out the document:

- Corporation Name: Innovate Solutions Inc.

- Employer Identification Number (EIN): 98-7654321

- Address: 456 Tech Avenue, Suite 100, San Jose, CA 95113

- Date Incorporated: January 15, 2026

- State of Incorporation: California

- Election Effective Date: January 15, 2026

- Selected Tax Year: Calendar year ending December 31

- Officer Name and Title: Jane Smith, President

- Officer Telephone: 650-555-0101

- Shareholder 1: Jane Smith, 500 shares, SSN: 111-22-3333, acquired 01/15/2026

- Shareholder 2: Robert Johnson, 500 shares, SSN: 444-55-6666, acquired 01/15/2026

- Total Shares Issued and Outstanding: 1,000

- Signature Date: February 20, 2026

What this filled form sample shows:

- Timely election: The form is filed within 2 months and 15 days of the desired effective date.

- Effective date from incorporation: Part I, Item E is completed with the date the business was formed.

- Calendar tax year selection: Part II, Item 1 is selected as the corporation's tax year will be a calendar year.

- Complete shareholder consent: Part I, Section K is filled out with information and consent for all shareholders.

Form specifications and details:

| Form Name: | Form 2553, Election by a Small Business Corporation |

| Form Revision: | December 2017 |

| Use Case: | New corporation electing S corp status from the date of incorporation. |

Created: February 05, 2026 09:39 PM