Yes! You can use AI to fill out Form 7206 (2025), Self-Employed Health Insurance Deduction

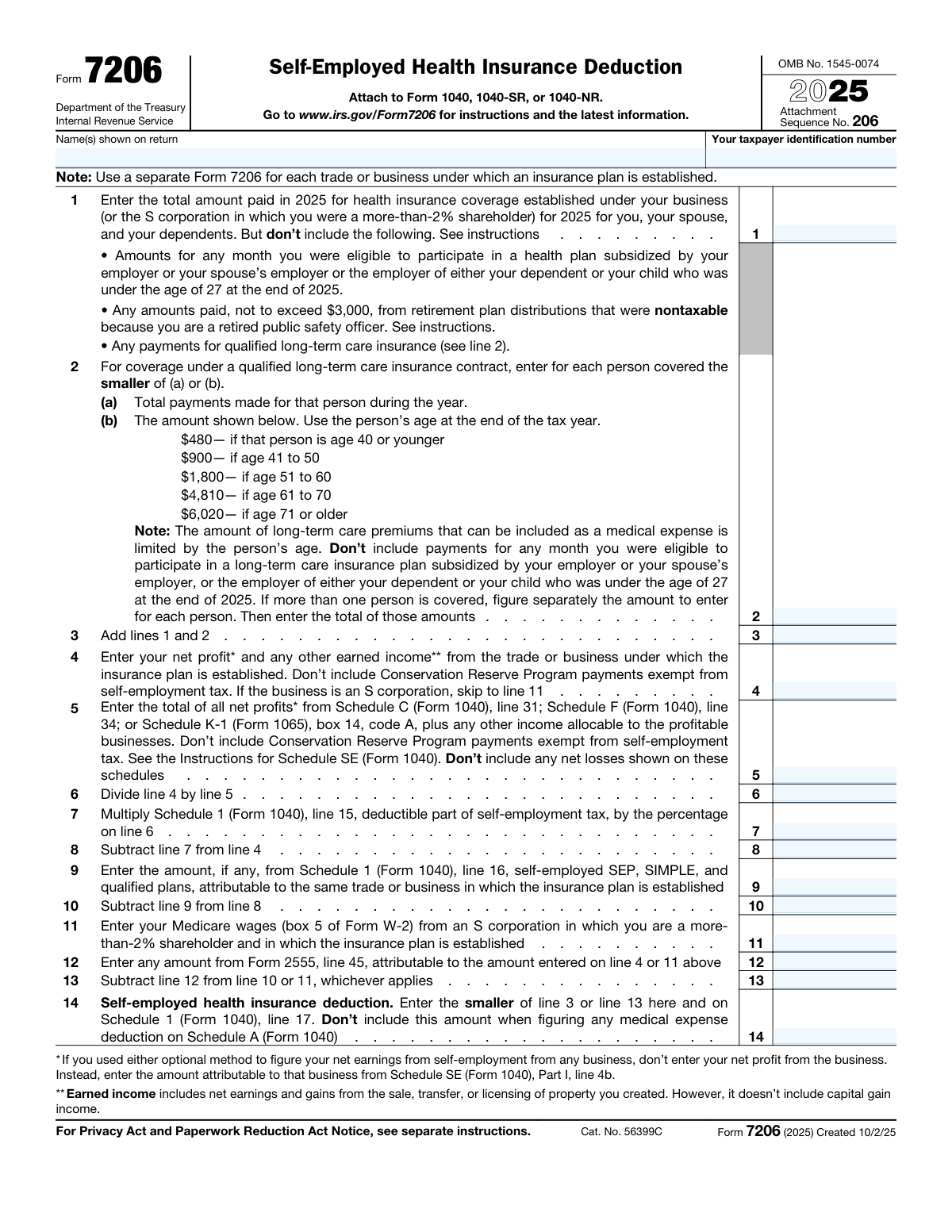

Form 7206 is an IRS attachment used by self-employed individuals (and certain more-than-2% S corporation shareholders) to compute the deductible amount of health insurance premiums paid under a business-established plan. The form walks you through eligible premium amounts (including limited qualified long-term care premiums) and applies income-based limits tied to the specific trade or business. It is important because the deduction is limited by earned income from the business and must be calculated correctly to avoid overstating deductions and to ensure the amount is properly reported on Schedule 1 (Form 1040), line 17. A separate Form 7206 is required for each trade or business under which an insurance plan is established.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 7206 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 7206 (2025), Self-Employed Health Insurance Deduction |

| Number of pages: | 1 |

| Filled form examples: | Form Form 7206 Examples |

| Language: | English |

| Categories: | insurance forms, health insurance forms, self-employed forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 7206 Online for Free in 2026

Are you looking to fill out a FORM 7206 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your FORM 7206 form in just 37 seconds or less.

Follow these steps to fill out your FORM 7206 form online using Instafill.ai:

- 1 Enter taxpayer identifying information and confirm whether you need separate Form 7206 filings for multiple trades or businesses with separate insurance plans.

- 2 Report total 2025 health insurance premiums paid under the business-established plan on line 1, excluding months you were eligible for subsidized employer coverage and other disallowed amounts described in the instructions.

- 3 Calculate allowable qualified long-term care premiums on line 2 using the age-based limits for each covered person, then total the allowed amounts.

- 4 Add lines 1 and 2 to get total potentially deductible premiums on line 3.

- 5 Compute the earned-income limitation for the specific business: enter net profit/earned income on line 4, total net profits from all profitable businesses on line 5, and complete lines 6–10 to allocate the deductible part of self-employment tax and subtract any SEP/SIMPLE/qualified plan deductions attributable to the same business.

- 6 If applicable, complete the S corporation path (lines 11–13) using Medicare wages from the S corporation and subtract any Form 2555 amounts attributable to that income.

- 7 Determine the final deduction on line 14 as the smaller of line 3 or line 13, then transfer it to Schedule 1 (Form 1040), line 17, and ensure it is not also included as a medical expense on Schedule A.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 7206 Form?

Speed

Complete your Form 7206 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Form 7206 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 7206

Form 7206 is used to figure your self-employed health insurance deduction for 2025. You attach it to Form 1040, 1040-SR, or 1040-NR and then enter the final deduction on Schedule 1 (Form 1040), line 17.

You generally file Form 7206 if you are self-employed (for example, you have Schedule C or Schedule F income, or partnership self-employment income) and you paid for health insurance established under your business. More-than-2% S corporation shareholders also use it for coverage established under the S corporation.

Yes. The form states you must use a separate Form 7206 for each trade or business under which an insurance plan is established.

Line 1 includes the total amount you paid in 2025 for health insurance coverage established under your business (or qualifying S corporation) for you, your spouse, and your dependents. Do not include months you were eligible for an employer-subsidized health plan (yours, your spouse’s, or certain dependents/children under 27), qualified long-term care premiums (those go on line 2), or certain nontaxable retired public safety officer distribution amounts (up to $3,000).

If you were eligible for a subsidized employer plan for any month (even if you didn’t enroll), you generally can’t include premiums for that month on line 1. The same restriction applies if your spouse’s employer (or certain dependents’/children’s employers) offered subsidized coverage.

You report qualified long-term care insurance on line 2, and you must calculate it separately for each covered person. For each person, enter the smaller of (a) the premiums paid for that person or (b) the age-based limit shown on the form, then total all covered persons’ allowed amounts.

Use the person’s age at the end of 2025 and apply the limit: $480 (age 40 or younger), $900 (41–50), $1,800 (51–60), $4,810 (61–70), or $6,020 (71 or older). You can only include up to the applicable limit per person.

Line 4 is your net profit and any other earned income from the specific trade or business under which the insurance plan is established. If you used an optional method to figure net earnings from self-employment, don’t enter net profit—enter the amount attributable to that business from Schedule SE (Form 1040), Part I, line 4b.

Line 5 totals all net profits from your profitable businesses (from Schedule C, Schedule F, or partnership K-1 self-employment amounts) plus other income allocable to profitable businesses. Net losses are excluded because the form uses line 5 to allocate certain deductions proportionally across profitable businesses.

Line 6 is a percentage (line 4 divided by line 5) that represents how much of your total profitable business income comes from the business tied to the insurance plan. Line 7 uses that percentage to allocate the deductible part of self-employment tax (Schedule 1, line 15) to that business.

These lines reduce the income available to support the health insurance deduction by subtracting retirement plan deductions attributable to the same business. You enter the relevant amount from Schedule 1 (Form 1040), line 16 on line 9, then subtract it on line 10.

If the business is an S corporation, the form instructs you to skip line 4 and go to line 11. On line 11, you enter your Medicare wages (Form W-2, box 5) from the S corporation in which you are a more-than-2% shareholder and under which the insurance plan is established.

Line 12 subtracts any amount from Form 2555, line 45 that is attributable to the income entered on line 4 or line 11. This adjustment affects the maximum self-employed health insurance deduction you can claim.

Line 14 is the smaller of line 3 (total eligible premiums from lines 1 and 2) or line 13 (the income-based limit after adjustments). You enter that amount on Schedule 1 (Form 1040), line 17.

No. The form specifically says not to include the amount from line 14 when figuring any medical expense deduction on Schedule A (Form 1040).

Compliance Form 7206

Validation Checks by Instafill.ai

1

Tax Year Must Be 2025 for Form 7206 (2025)

Validate that the submission is for tax year 2025 and that all entered amounts correspond to payments and income for calendar year 2025. This matters because the line instructions and long-term care premium limits are year-specific and can change by year. If the tax year is not 2025, the form should be rejected or routed to the correct year’s Form 7206 version to prevent applying incorrect limits and calculations.

2

Taxpayer Name and TIN Presence and Format

Ensure the taxpayer name(s) shown on the return and the taxpayer identification number are present and the TIN matches an allowed format (SSN: 9 digits, ITIN: 9 digits starting with 9, or EIN where applicable for the filing context). This is critical for matching the attachment to the correct Form 1040/1040-SR/1040-NR and preventing misapplied deductions. If missing or malformed, the submission should fail validation and require correction before filing.

3

Separate Form per Trade or Business Indicator

Check that the filer indicates which trade or business the insurance plan is established under, and that only one trade/business is represented per Form 7206. The form explicitly requires a separate Form 7206 for each trade or business, and mixing businesses can distort the earned-income limitation calculation. If multiple businesses are detected (e.g., multiple Schedule C/F/K-1 sources without a clear single business attribution), the system should flag the return and require separate forms or clear allocation.

4

All Monetary Fields Must Be Non-Negative Currency Values

Validate that lines 1–14 accept only numeric currency amounts (no text), with appropriate precision (typically whole dollars or two decimals depending on system rules), and that no line contains a negative value. These lines represent payments, income, and computed limits that should not be negative on this form. If a negative or non-numeric value is entered, the form should error because downstream calculations and IRS e-file schemas generally disallow such values.

5

Line 3 Must Equal Line 1 Plus Line 2

Verify that line 3 is exactly the sum of line 1 and line 2. This is a core arithmetic dependency used later to cap the deduction on line 14. If the sum does not match, the system should either auto-calculate line 3 or reject the submission to prevent an incorrect deduction amount.

6

Qualified Long-Term Care Premium Limits by Age (Line 2)

For each covered person included in line 2, validate that the amount counted is the smaller of (a) total payments for that person and (b) the age-based limit ($480, $900, $1,800, $4,810, or $6,020 based on age at end of 2025). This is required by statute and prevents overstating deductible long-term care premiums. If ages are missing, inconsistent, or the total exceeds the allowed per-person caps, the system should fail validation or require per-person detail to compute the correct total.

7

Age Determination Must Use Age at End of 2025

If the system collects date of birth or age for long-term care coverage, validate that the age used corresponds to the person’s age as of 12/31/2025. Using the wrong reference date can place a person in the wrong premium limit bracket and change the allowable amount. If the age cannot be substantiated (e.g., missing DOB) or is computed incorrectly, the form should be flagged and line 2 recalculated or blocked.

8

S Corporation Path vs Self-Employed Business Path Consistency

Validate that the filer follows the correct computation path: if the business is an S corporation, line 4 should be skipped and line 11 should be used; otherwise, line 11 should generally be blank and lines 4–10 should be completed. This matters because the earned-income limitation differs for S corporation more-than-2% shareholders versus sole proprietors/partners. If both paths are populated or neither path is properly completed, the system should require correction to avoid an invalid limitation calculation.

9

Line 5 Must Be Positive When Line 6 Is Computed (No Division by Zero)

Ensure line 5 is greater than zero whenever line 6 is present, since line 6 is line 4 divided by line 5. Line 5 represents total net profits from profitable businesses (excluding losses), and a zero value would make the percentage undefined. If line 5 is zero or missing while line 6 is needed, the submission should fail and prompt the filer to correct the underlying profit totals or remove the computation.

10

Line 6 Percentage Range Validation (0 to 1, Inclusive)

Validate that line 6 (line 4 ÷ line 5) is a decimal percentage between 0 and 1 inclusive, and that it is consistent with the provided line 4 and line 5 values. This percentage is used to allocate the deductible part of self-employment tax to the relevant business. If line 6 is outside the allowed range or does not match the computed ratio within rounding tolerance, the system should recalculate or reject to prevent misallocation.

11

Line 7 Must Equal Schedule 1 Line 15 × Line 6 (With Rounding Rules)

Check that line 7 equals the deductible part of self-employment tax from Schedule 1 (Form 1040), line 15 multiplied by the percentage on line 6, applying consistent rounding rules. This ensures the correct reduction of earned income for the business when computing the health insurance deduction limit. If Schedule 1 line 15 is missing, or the multiplication result does not match line 7, the form should be flagged and line 7 recalculated.

12

Line 8 Must Equal Line 4 Minus Line 7 and Cannot Be Negative

Validate the arithmetic on line 8 (line 4 − line 7) and ensure the result is not negative. Line 8 represents earned income after reducing for the deductible part of self-employment tax attributable to the business. If line 8 is negative or does not match the computed value, the system should reject or recompute because it directly affects the maximum allowable deduction.

13

Line 10 Must Equal Line 8 Minus Line 9 and Cannot Be Negative

Verify that line 10 equals line 8 minus line 9, and that it is not negative. Line 9 is the amount from Schedule 1 line 16 (SEP/SIMPLE/qualified plans) attributable to the same trade or business, which reduces the income limit for the deduction. If line 10 is negative or inconsistent, the system should flag the entry and require correction or proper attribution of retirement plan amounts.

14

Form 2555 Amount (Line 12) Must Not Exceed Related Earned Income Base

Validate that line 12 (Form 2555, line 45 amount attributable to line 4 or 11) is present only when Form 2555 is included and does not exceed the relevant earned income amount it is reducing. This prevents subtracting more foreign earned income exclusion than the income base used for the limitation. If Form 2555 is not attached or line 12 exceeds line 10/11 context, the submission should fail validation.

15

Line 13 Must Equal Applicable Base Minus Line 12 (Correct Base Selection)

Ensure line 13 is computed as line 10 minus line 12 for non–S corporation cases, or line 11 minus line 12 for S corporation cases, and that the correct base is selected based on which path applies. This is essential because line 13 is the earned-income limitation used to cap the deduction. If the wrong base is used or the subtraction is incorrect, the system should recalculate and block filing until corrected.

16

Line 14 Deduction Must Be the Smaller of Line 3 or Line 13 and Must Match Schedule 1 Line 17

Validate that line 14 equals the smaller of line 3 and line 13, and that the same amount is carried to Schedule 1 (Form 1040), line 17. This is the final allowable self-employed health insurance deduction and must be capped by earned income. If line 14 exceeds either limit or does not match the Schedule 1 carryover, the return should be rejected or corrected to prevent overstating the deduction.

Common Mistakes in Completing Form 7206

People often have multiple Schedule C/F activities (or multiple businesses) and mistakenly combine all health insurance premiums on one Form 7206. This can misstate the limitation calculations because the deduction is tied to the specific trade or business under which the plan is established. Use a separate Form 7206 for each trade or business (and each S corporation situation) and keep premiums and income/limits matched to the correct business.

A very common error is deducting premiums for months when the taxpayer (or spouse/dependent/child under 27) was eligible to participate in an employer-subsidized health plan, even if they didn’t enroll. The form explicitly disallows those months, and including them can overstate the deduction and trigger IRS correspondence or adjustment. Review each month of 2025 for eligibility (not just enrollment) for any subsidized employer plan and exclude those months’ premiums from line 1 (and similarly for long-term care on line 2).

Taxpayers frequently lump all “health insurance” payments together and enter qualified long-term care premiums on line 1. Long-term care premiums must be handled on line 2 and are subject to age-based annual limits per covered person. Separate long-term care amounts from other health coverage premiums and apply the per-person cap before totaling line 2.

Line 2 requires calculating, for each covered person, the smaller of actual payments or the age-based limit using the person’s age at the end of the tax year. People often apply one limit to the whole family, use the wrong age, or forget to compute separately for each person. This can inflate the deduction and lead to disallowance. Compute each person’s allowable amount separately using their year-end age, then add those allowable amounts to arrive at the line 2 total.

When taxpayers use an optional method on Schedule SE, they often still enter Schedule C/F “net profit” on line 4, even though the form instructs them to use the amount from Schedule SE Part I, line 4b attributable to that business. This mismatch can distort the earned-income limitation and produce an incorrect deduction. Confirm whether an optional SE method was used and, if so, pull the correct attributable amount from Schedule SE rather than the schedule’s net profit line.

Line 5 specifically says not to include any net losses shown on the referenced schedules, but many filers net losses from one business against profits from another. That changes the line 4/line 5 ratio and can incorrectly reduce or increase the allocated self-employment tax adjustment on line 7. Follow the instruction: include only net profits from profitable businesses on line 5, and do not subtract losses.

Because line 7 requires multiplying Schedule 1, line 15 by the percentage on line 6, people often just enter the full Schedule 1, line 15 amount. This over-allocates the SE tax deduction to the business tied to the insurance plan and can reduce the allowable health insurance deduction incorrectly. Always compute line 6 (line 4 ÷ line 5) and apply that percentage to Schedule 1, line 15 to get the correct allocated amount for line 7.

Taxpayers commonly overlook that SEP, SIMPLE, and qualified plan deductions attributable to the same trade or business reduce the income available for the health insurance deduction. If line 9 is left blank when contributions exist, line 10 (and therefore the maximum deduction) may be overstated. Identify retirement plan deductions on Schedule 1, line 16 and allocate the portion attributable to the same business as the insurance plan before completing line 9.

More-than-2% S corporation shareholders often incorrectly complete lines 4–10 instead of skipping to line 11, or they enter the wrong W-2 amount (using box 1 or box 3 instead of Medicare wages in box 5). This can materially change the limitation and lead to an incorrect deduction. If the business is an S corporation for this purpose, follow the instruction to skip to line 11 and use W-2 box 5 Medicare wages from the correct S corporation.

Filers with foreign earned income exclusions sometimes miss that Form 2555, line 45 amounts attributable to the same income must reduce the limitation. Omitting line 12 can overstate line 13 and allow too large a deduction. If Form 2555 is filed, determine the portion attributable to the income used on line 4 or line 11 and enter it on line 12 before computing line 13.

A frequent misunderstanding is claiming the self-employed health insurance deduction on Schedule 1 and also including the same premiums as medical expenses on Schedule A. The form explicitly prohibits including the line 14 amount when figuring any medical expense deduction, and double-counting can cause an IRS adjustment. Track which premiums are used for the above-the-line deduction and exclude those amounts from Schedule A medical expenses.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 7206 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-7206-2025-self-employed-health-insurance-dedu forms, ensuring each field is accurate.