Form 7206 (2025), Self-Employed Health Insurance Deduction Completed Form Examples and Samples

Explore clear examples and filled-out samples of IRS Form 7206 (2025), Self-Employed Health Insurance Deduction. Learn how to correctly calculate your deduction with our step-by-step guides for freelancers (Schedule C), partners, and S corp shareholders for the 2025 tax year.

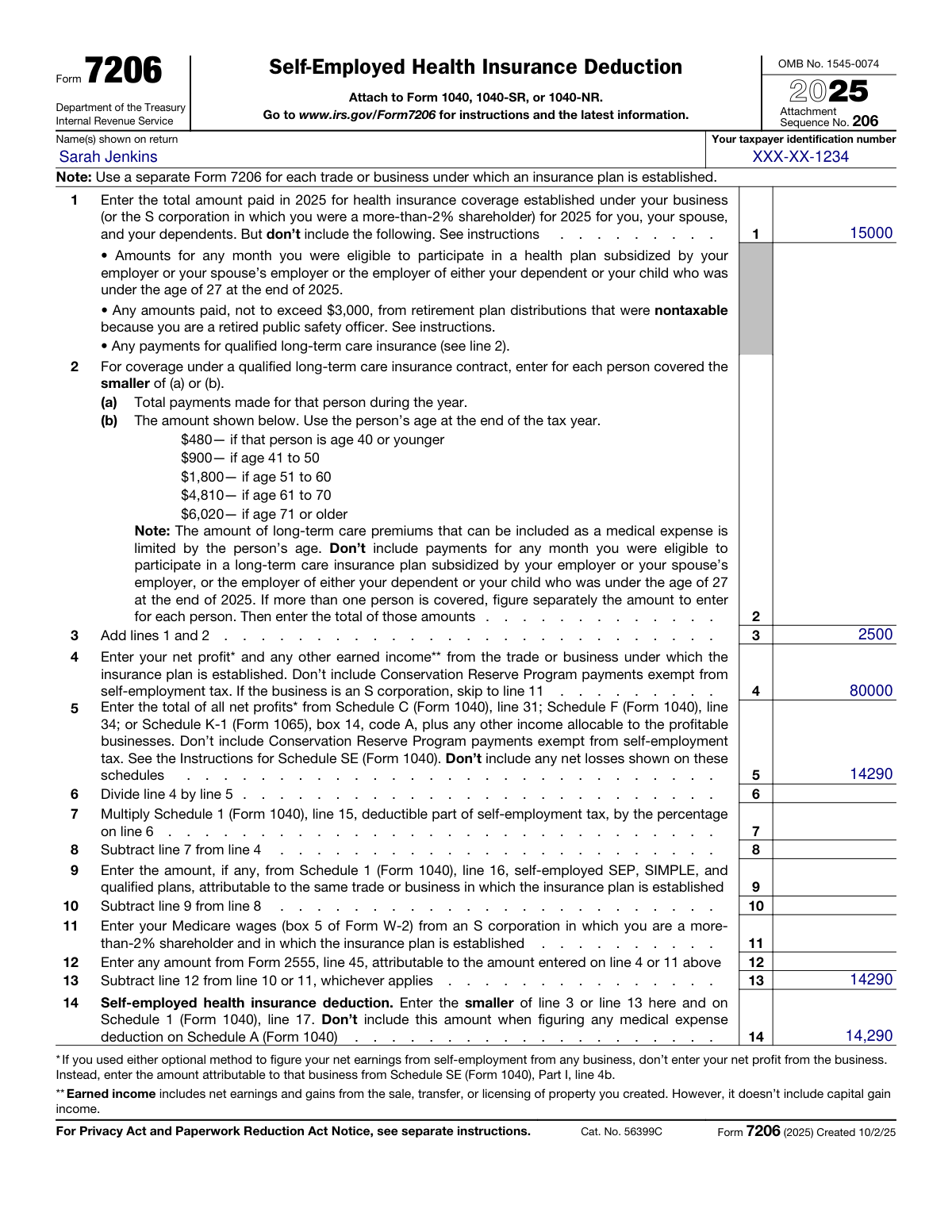

Form 7206 (2025) Example: Self-Employed Graphic Designer

How this form was filled:

This sample shows Form 7206 completed for a freelance graphic designer who files a Schedule C. The example demonstrates how to report health insurance premiums purchased through the Marketplace (Form 1095-A), apply the age-based limit for long-term care premiums, and account for Advance Premium Tax Credits (APTC) to accurately calculate the final deduction amount.

Information used to fill out the document:

- Filer's Name: Sarah Jenkins

- Social Security Number: XXX-XX-1234

- Business Type: Freelance Graphic Designer (filing Schedule C)

- Net Profit from Business (Schedule C, line 31): $80,000

- Marketplace Health Insurance Premiums (Form 1095-A): $18,000

- Advance Premium Tax Credit Received (APTC): $3,000

- Included Long-Term Care (LTC) Premiums: $2,500

- Filer's Age: 45

- Applicable LTC Premium Limit (Age 41-50): $1,790

- Final Calculated Deduction: $14,290

- Form Filing Year: 2025

- Date Signed: April 10, 2026

What this filled form sample shows:

- Calculation of the deduction based on **net profit from a Schedule C** business.

- Correct application of **age-based limits for long-term care insurance premiums**.

- Adjustment for **Advance Premium Tax Credit (APTC)** received through the Health Insurance Marketplace.

- Demonstrates how to use figures from **Form 1095-A** to complete Form 7206.

- Clear example of the final deduction limited by either the net premiums paid or the business's earned income.

Form specifications and details:

| Form: | 7206 |

| Year: | 2025 |

| Title: | Self-Employed Health Insurance Deduction |

| Use Case: | Freelancer with Marketplace insurance, Advance Premium Tax Credits, and Long-Term Care coverage. |

Created: February 02, 2026 10:59 PM