Yes! You can use AI to fill out Form W-10 (Rev. October 2020), Dependent Care Provider’s Identification and Certification

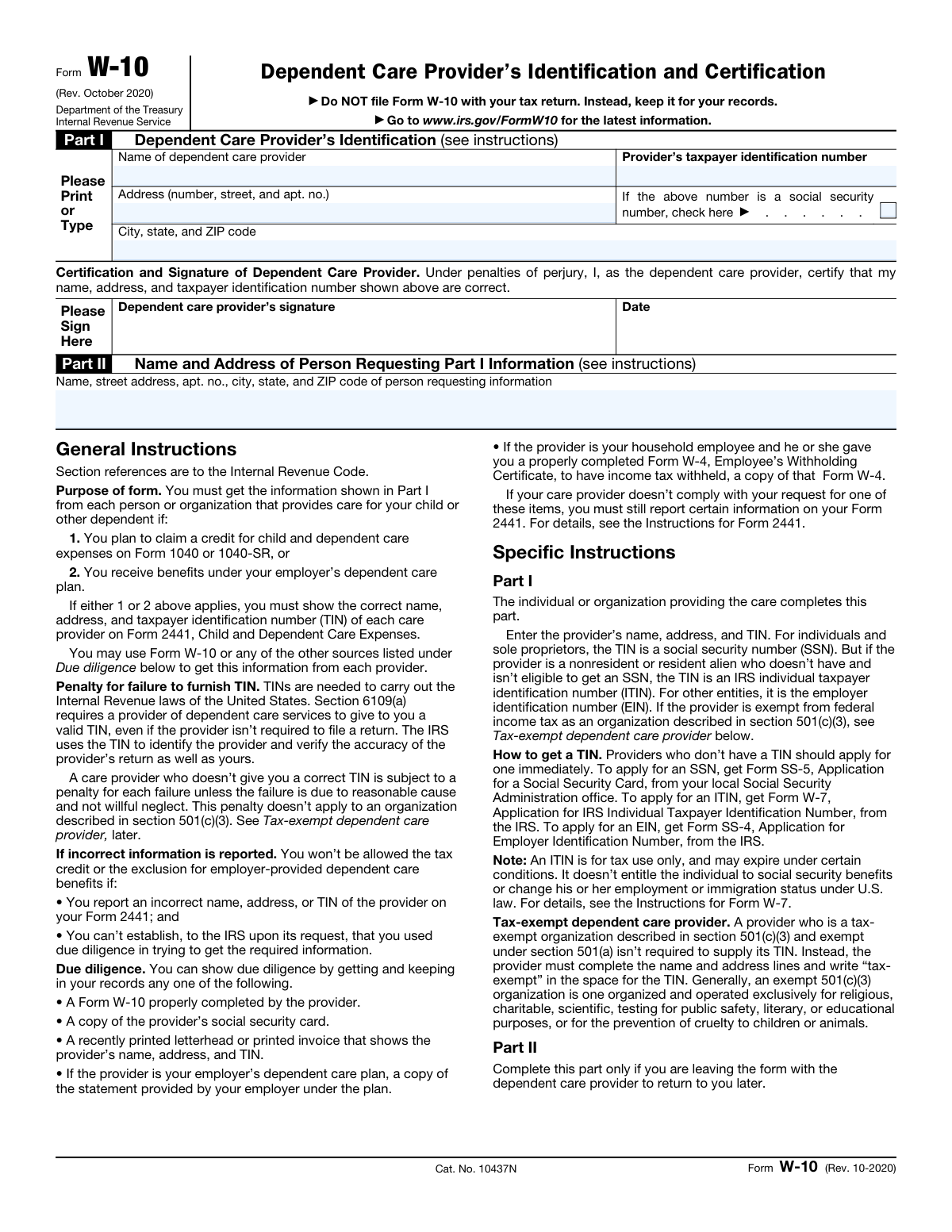

Form W-10 is an IRS recordkeeping form that a dependent care provider completes to certify their identifying information, including their name, address, and TIN (SSN, ITIN, or EIN). Taxpayers use this information to accurately complete Form 2441 (Child and Dependent Care Expenses) when claiming the child and dependent care credit on Form 1040/1040-SR or when reporting employer-provided dependent care benefits. The form is not filed with the tax return; it is kept in the taxpayer’s records as proof of due diligence in obtaining correct provider information. Having accurate provider details helps avoid denial of the credit or exclusion if the IRS requests verification.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out W-10 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form W-10 (Rev. October 2020), Dependent Care Provider’s Identification and Certification |

| Number of pages: | 1 |

| Filled form examples: | Form W-10 Examples |

| Language: | English |

| Categories: | CAR forms, identification forms, L.A. Care forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out W-10 Online for Free in 2026

Are you looking to fill out a W-10 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your W-10 form in just 37 seconds or less.

Follow these steps to fill out your W-10 form online using Instafill.ai:

- 1 Confirm you need provider information for Form 2441 (to claim the child/dependent care credit or report dependent care plan benefits).

- 2 Enter the dependent care provider’s legal name and complete address in Part I (provider section).

- 3 Enter the provider’s taxpayer identification number (SSN/ITIN/EIN) in Part I, or write “tax-exempt” if the provider is a qualifying 501(c)(3) organization.

- 4 Have the provider review the entries and sign/date the certification under penalties of perjury in Part I.

- 5 Complete Part II with the name and address of the person requesting the information if you are leaving the form with the provider to return later.

- 6 Save the completed Form W-10 securely for your records (do not attach or file it with your tax return).

- 7 Use the collected provider information to complete Form 2441 accurately when preparing your Form 1040/1040-SR.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable W-10 Form?

Speed

Complete your W-10 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 W-10 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form W-10

Form W-10 is used to collect a dependent care provider’s name, address, and taxpayer identification number (TIN). You use this information to complete Form 2441 when claiming the Child and Dependent Care Credit or reporting employer-provided dependent care benefits.

No. You do not file Form W-10 with your tax return; you keep it in your records in case the IRS asks for proof that you obtained the provider’s information.

The dependent care provider (the individual or organization that provided the care) completes Part I. They enter their name, address, and TIN and then sign the certification.

You (the person requesting the information) complete Part II only if you are leaving the form with the provider to return later. If you get the completed form back immediately, Part II is generally not necessary.

You need the provider’s information if you plan to claim the child and dependent care expenses credit on Form 1040/1040-SR or if you receive benefits under an employer dependent care plan. The provider details are reported on Form 2441.

Part I requires the provider’s name, address, and TIN. The provider must also sign and date the certification stating the information is correct.

Individuals and sole proprietors generally use an SSN. If the provider is a nonresident or resident alien not eligible for an SSN, they may use an ITIN; other entities typically use an EIN.

If the provider’s TIN entered is an SSN, the provider should check the box indicating the number is a Social Security number. This helps clarify the type of TIN being provided.

A qualifying tax-exempt 501(c)(3) provider is not required to provide a TIN on this form. They should complete the name and address and write “tax-exempt” in the TIN space.

You should still report the required information you do have on Form 2441 and follow the Form 2441 instructions for situations where the provider won’t comply. Keep records showing you tried to obtain the information.

Due diligence can be shown by keeping a completed Form W-10 or other acceptable records such as a copy of the provider’s Social Security card, a recent invoice/letterhead showing name/address/TIN, an employer plan statement, or (for a household employee) a completed Form W-4.

You may be denied the credit or the exclusion for dependent care benefits if the provider’s name, address, or TIN is incorrect and you cannot prove you used due diligence to obtain correct information. Keeping Form W-10 or other documentation helps protect you.

Yes, in general the law requires a provider of dependent care services to give you a valid TIN, even if the provider isn’t required to file a tax return. Providers who fail to furnish a correct TIN may be subject to penalties, with certain exceptions such as qualifying 501(c)(3) organizations.

They should apply for one as soon as possible: SSN using Form SS-5, ITIN using Form W-7, or EIN using Form SS-4. The form instructions note that an ITIN is for tax use only and may expire under certain conditions.

The form directs you to www.irs.gov/FormW10 for the most current information. You may also need the Instructions for Form 2441 to understand how to report provider information on your tax return.

Compliance W-10

Validation Checks by Instafill.ai

1

Provider Name Present and Non-Placeholder

Validates that the dependent care provider’s name field is completed and does not contain placeholder text (e.g., “N/A,” “unknown,” or only punctuation). This is required to identify the care provider for Form 2441 reporting and IRS matching. If missing or invalid, the submission should be rejected or flagged for correction because the requester may lose eligibility for the credit/exclusion if they cannot substantiate due diligence.

2

Provider Address Completeness (Street, City, State, ZIP)

Checks that the provider address includes street number/name (and apartment/unit if applicable), city, state, and ZIP code. A complete address is necessary for accurate identification and recordkeeping, especially if the TIN is later questioned. If any required address component is missing, the form should be flagged as incomplete and returned for completion.

3

US State/Territory Code Validation

Validates that the state field is a valid U.S. state or territory abbreviation (e.g., CA, NY, DC, PR) and not free-form text or an invalid code. Standardized state codes improve downstream processing and reduce mismatches when the information is transcribed to Form 2441. If invalid, the system should prompt the user to correct the state value.

4

ZIP Code Format Validation

Ensures the ZIP code is in a valid U.S. format: 5 digits or ZIP+4 (##### or #####-####). Correct ZIP formatting supports address normalization and reduces data quality issues. If the ZIP is not in an acceptable format, the submission should be flagged and the user asked to correct it.

5

Provider TIN Required Unless Marked Tax-Exempt

Validates that a provider TIN is supplied unless the provider is a qualifying 501(c)(3) tax-exempt organization and the TIN field contains the literal value “tax-exempt.” The form instructions explicitly allow “tax-exempt” in place of a TIN only for eligible organizations. If neither a valid TIN nor “tax-exempt” is provided, the form should be rejected as incomplete.

6

TIN Format Validation (SSN/ITIN/EIN)

Checks that the TIN matches an acceptable pattern for SSN, ITIN, or EIN (typically 9 digits, optionally formatted with hyphens such as ###-##-#### for SSN/ITIN or ##-####### for EIN). This reduces transcription errors and prevents unusable identifiers from being stored. If the TIN fails format checks, the system should block submission and request correction.

7

SSN Checkbox Consistency with TIN Type

Validates that the “If the above number is a social security number, check here” box is consistent with the TIN entered. If the checkbox is checked, the TIN should conform to SSN formatting rules; if unchecked, the TIN should plausibly be an EIN/ITIN or the field should be “tax-exempt.” If inconsistent, the system should flag the record for review and require the provider to correct either the checkbox or the TIN.

8

Disallow Invalid/Prohibited TIN Values

Rejects clearly invalid TIN entries such as all zeros, repeated digits (e.g., 111111111), or values containing letters/special characters (other than hyphens) when a numeric TIN is expected. These values commonly indicate placeholders or data entry errors and will fail IRS matching. If detected, the submission should be blocked and the user prompted to enter a valid TIN or “tax-exempt” where applicable.

9

Provider Signature Presence

Ensures the dependent care provider’s signature field is completed (wet signature captured, e-signature applied, or a valid signature indicator depending on system design). The certification is made under penalties of perjury, so the signature is essential to establish the provider attested to the accuracy of the information. If missing, the form should be considered not properly completed and should be rejected or returned for signature.

10

Signature Date Present and Valid Date Format

Validates that the signature date is provided and is a real calendar date in an accepted format (e.g., MM/DD/YYYY). A valid date supports auditability and helps confirm when the certification occurred. If the date is missing or malformed, the system should flag the submission and require correction.

11

Signature Date Logical Range Check

Checks that the signature date is not in the future and is within a reasonable historical range (e.g., not before 1900 or before the form revision date if your business rules require). Future dates or implausible dates often indicate entry mistakes and can undermine the credibility of the certification. If out of range, the system should prompt for correction or route to manual review.

12

Part II Completion Rule (Only If Leaving With Provider)

Validates that Part II (requester name and address) is completed when the workflow indicates the form is being left with the provider to return later, and allows it to be blank otherwise. This aligns with the form’s instruction that Part II is conditional. If the workflow requires Part II and it is blank, the system should block submission until completed.

13

Requester Name and Address Completeness (Part II)

When Part II is required or provided, checks that the requester’s name and full mailing address (street, city, state, ZIP) are complete and not placeholders. This information supports recordkeeping and clarifies who requested the provider’s information. If incomplete, the system should flag the form and request missing details.

14

Prevent Provider and Requester Identity Duplication (Potential Self-Provider Flag)

Compares provider name/address to requester name/address and flags cases where they are identical or highly similar. While not always invalid, it can indicate an error (e.g., requester accidentally entered their own details in Part I) or a scenario requiring extra scrutiny. If duplication is detected, the system should warn the user and route for review rather than automatically rejecting.

Common Mistakes in Completing W-10

Many people assume every IRS form must be attached to their Form 1040, so they mail or e-file Form W-10 with the return. The form explicitly says not to file it; it’s a recordkeeping document used to support the information you report elsewhere (typically Form 2441). To avoid this, keep the completed W-10 in your tax records and only enter the provider details on Form 2441 (or provide them to your employer plan as required).

A frequent mistake is the taxpayer (parent/guardian) filling out the provider’s name, address, and TIN in Part I without the provider’s certification. This happens when the provider is unavailable or the taxpayer is trying to “speed things up,” but it undermines the purpose of the form and can leave you unable to substantiate due diligence if the IRS questions the provider information. Avoid this by having the dependent care provider (individual or organization) complete Part I and sign the certification.

People often enter an EIN for an individual caregiver, or an SSN for a daycare business, because they don’t understand which identifier applies. This can lead to mismatches when the IRS verifies the provider and may jeopardize the credit/exclusion if you can’t show due diligence. Confirm the provider’s entity type: individuals/sole proprietors generally use an SSN (or ITIN if applicable), while other entities use an EIN.

Providers sometimes refuse to share a TIN, or taxpayers enter placeholders (e.g., “000-00-0000”) or partial numbers. Missing/invalid TINs can trigger IRS follow-up and may result in denial of the child and dependent care credit or employer-plan exclusion if you can’t document due diligence. To avoid this, request a properly completed W-10 or one of the acceptable substitutes (invoice/letterhead with TIN, SS card copy, etc.) and keep it with your records.

The checkbox indicating the TIN is an SSN is easy to overlook, especially when forms are completed quickly. While the number itself is most important, missing the checkbox can create confusion about whether the TIN is an SSN or another identifier and can slow down internal review or recordkeeping. Avoid this by verifying the TIN type and checking the SSN box when applicable.

Taxpayers often write “Ms. Jenny,” “Happy Kids Daycare,” or a shortened name that doesn’t match the provider’s tax records. Name/TIN mismatches are a common reason the IRS questions provider information and can put the credit at risk if you can’t prove you tried to obtain correct details. Use the provider’s legal name as it appears on their SSN card, ITIN documentation, or EIN registration/official invoices.

People frequently omit apartment/suite numbers, use an old address, or list only a city/state without a street address. An incomplete address can make it harder to substantiate the provider’s identity and may cause issues if the IRS requests clarification. Avoid this by entering the full mailing address (street, apt/suite, city, state, ZIP) exactly as shown on the provider’s current documentation.

A common oversight is collecting the form without the provider’s signature or forgetting the date, especially when the form is exchanged electronically or left to be completed later. Without the signed certification, the form is less persuasive as due diligence support and may not satisfy your recordkeeping needs if questioned. Always confirm the provider has signed and dated the certification before you file it in your records.

When the provider is a tax-exempt 501(c)(3) organization, people often still demand a TIN or leave the TIN field blank without explanation. The instructions specify that qualifying tax-exempt providers may write “tax-exempt” in the TIN space, and failing to do so can look like missing information. Avoid this by confirming the provider’s 501(c)(3) status and entering “tax-exempt” in the TIN field when appropriate.

Part II is only required if you are leaving the form with the provider to return later, but many people either complete it unnecessarily or forget it when they actually are leaving the form behind. This can cause confusion about who requested the information and can complicate follow-up if the provider returns an incomplete form. Use Part II only in the “leave-behind” scenario, and include your full name and address so the provider can return the form correctly.

Taxpayers often collect the information verbally or via text message and don’t keep a W-10 or other acceptable proof (invoice/letterhead with TIN, SS card copy, employer plan statement, etc.). If the provider information later proves incorrect, you may lose the credit/exclusion unless you can show due diligence. Avoid this by keeping a completed W-10 or one of the listed substitute documents with your tax records for the year you claim the benefit.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out W-10 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-w-10-dependent-care-provider-s-identification-and-certification forms, ensuring each field is accurate.