Form W-10 (Rev. October 2020), Dependent Care Provider’s Identification and Certification Completed Form Examples and Samples

Browse a filled Form W-10 (Rev. October 2020) example for Dependent Care Provider’s Identification and Certification. See a realistic W-10 sample with daycare provider name, address, EIN, certification signature, and date—useful for parents requesting provider tax ID details for the Child and Dependent Care Credit.

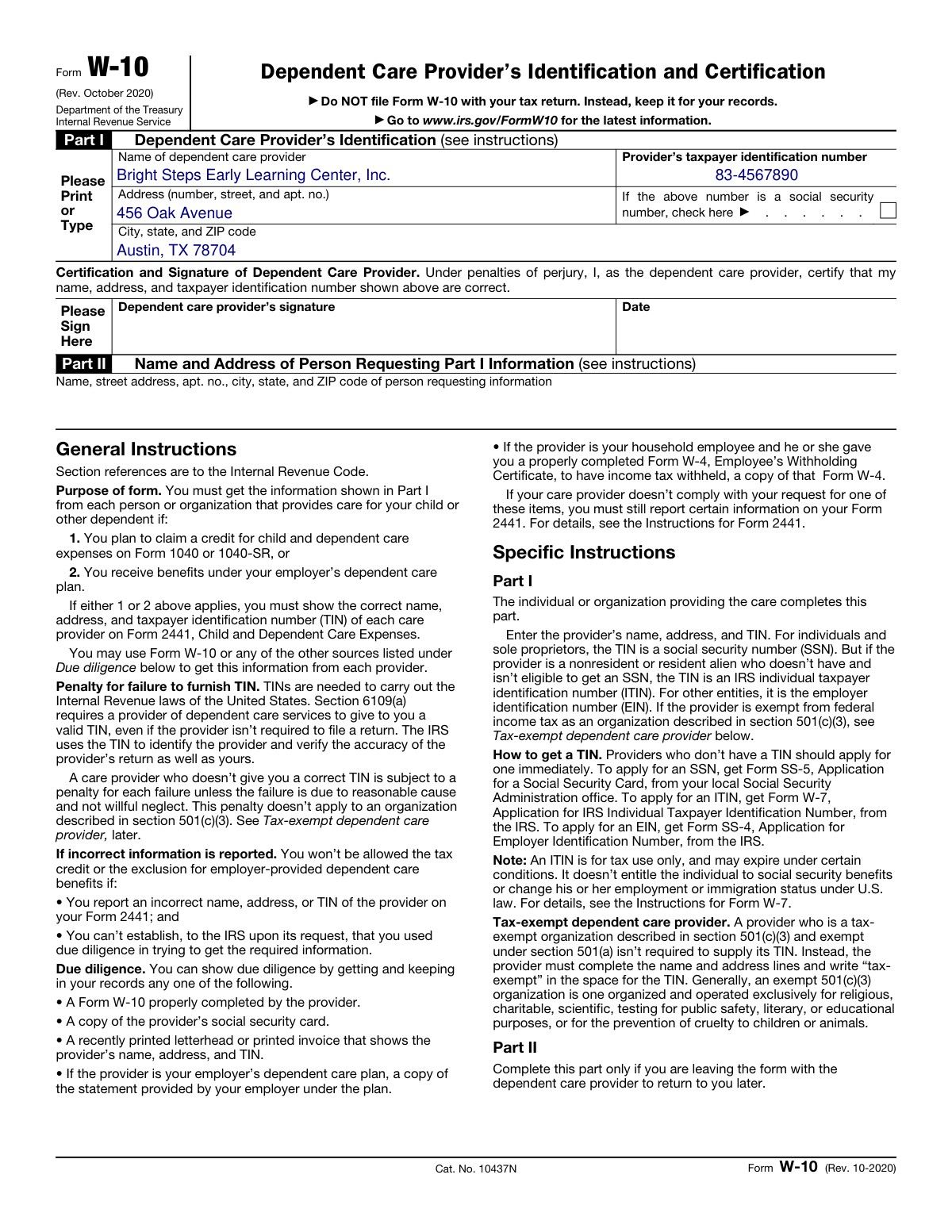

Form W-10 Example (Rev. October 2020) – Daycare Center Provider Certification

How this form was filled:

This Form W-10 (Rev. October 2020) sample shows a common scenario where parents request their daycare provider’s tax identification details for the Child and Dependent Care Credit. The provider lists the daycare business name and address, supplies an EIN, indicates they are a daycare center (not a household employee), and signs and dates the certification in early 2026.

Information used to fill out the document:

- Form Name: Form W-10 (Rev. October 2020), Dependent Care Provider’s Identification and Certification

- Tax Year Context: 2025 dependent care expenses reported on a 2026 tax return

- Requesting Taxpayer (Parent) Name: Taylor Morgan

- Requesting Taxpayer (Parent) SSN/ITIN: 123-45-6789

- Dependent Care Provider Legal Name: Bright Steps Early Learning Center, Inc.

- Dependent Care Provider Business Name (if different): Bright Steps Early Learning Center

- Provider Address (Street): 456 Oak Avenue

- Provider Address (City, State, ZIP): Austin, TX 78704

- Provider Telephone: (512) 555-0184

- Provider Taxpayer Identification Number (TIN) Type: EIN

- Provider EIN: 83-4567890

- Provider SSN (if applicable):

- Provider ITIN (if applicable):

- Type of Care: Daycare center (not household employee)

- Certification Statement: Provider certifies TIN and name are correct and provided for dependent care reporting

- Provider Signature (Printed Name): Avery Chen

- Provider Title: Director

- Signature Date: 01/12/2026

- Notes for Rendering: Show EIN in ##-####### format; leave SSN/ITIN blank; include parent name and SSN in payer section

What this filled form sample shows:

- SEO-focused Form W-10 (Rev. October 2020) example and sample for a daycare center provider

- Includes realistic provider legal name, business name, address, and telephone fields

- Uses a properly formatted EIN (and leaves SSN/ITIN blank, as typical for a center)

- Shows a standard certification with provider signature, title, and a 2026 date close to the current year

- Clearly indicates the provider is not a household employee, aligning with a common W-10 use case

Form specifications and details:

| Form: | Form W-10 (Rev. October 2020) |

| IRS Purpose: | Dependent Care Provider’s Identification and Certification for Child and Dependent Care Credit reporting |

| Use Case: | Parents request daycare provider identification details to complete Form 2441 / dependent care credit information |

| Example Provider Type: | Daycare center (business entity) |

| TIN Provided: | EIN |

| Signature Included: | Yes |

| Example Date: | 01/12/2026 |

| Output Intent: | Filled PDF form rendered as a web page (example/sample for demonstration) |

Created: January 16, 2026 07:25 AM