Form W-8BEN-E (Rev. October 2021), Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Completed Form Examples and Samples

Access filled examples and samples of IRS Form W-8BEN-E (Rev. October 2021). Learn how to complete the Certificate of Status of Beneficial Owner for foreign entities to manage U.S. tax withholding and claim treaty benefits.

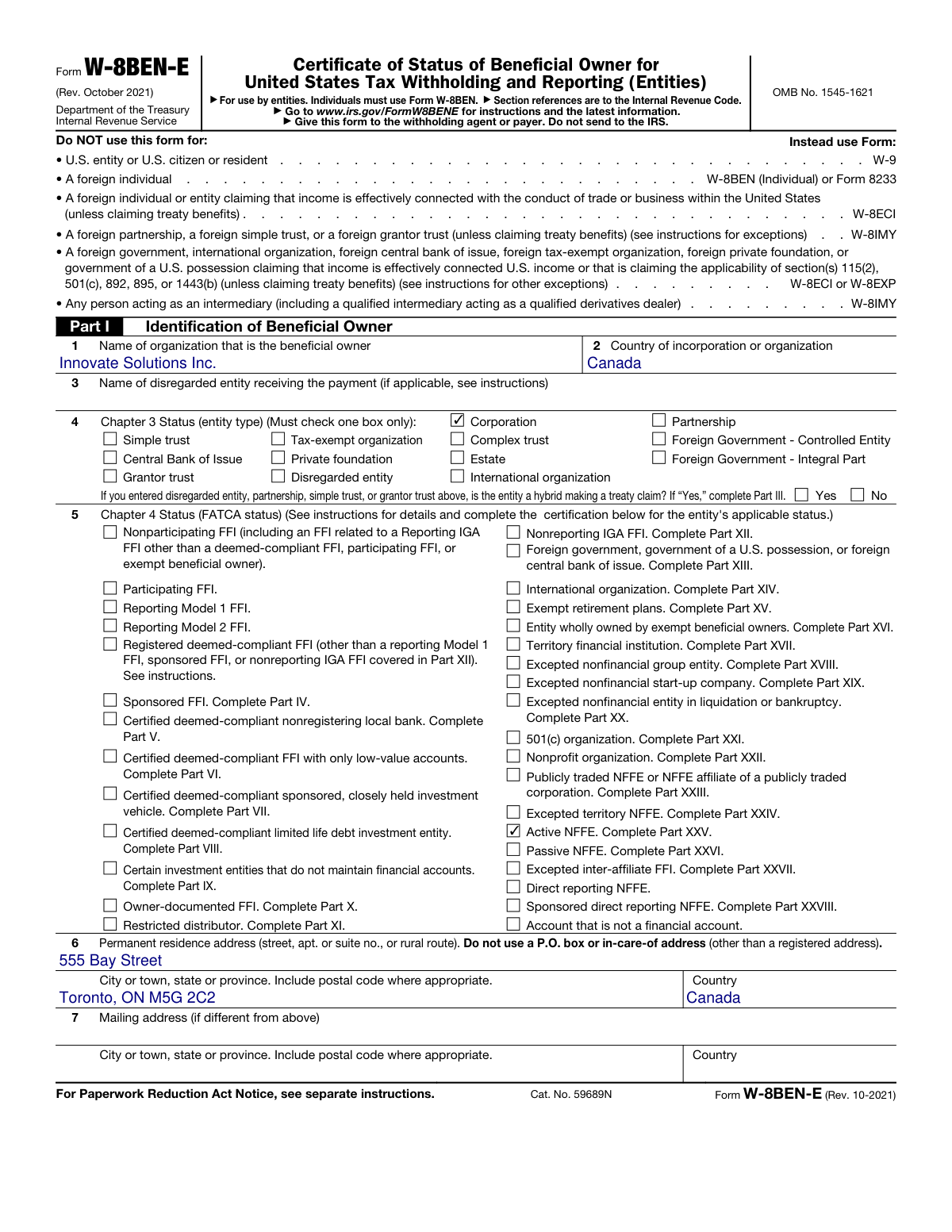

Form W-8BEN-E Example – Foreign Corporation Claiming Treaty Benefits

How this form was filled:

This is an example of a completed Form W-8BEN-E for a Canadian corporation providing services to a U.S. client. The form identifies the entity as a corporation and an 'Active Non-Financial Foreign Entity' (Active NFFE) for FATCA purposes. It correctly completes Part III to claim a 0% withholding rate on service income under Article VII of the U.S.-Canada tax treaty, asserting it does not have a permanent establishment in the U.S. The form is certified by an authorized director.

Information used to fill out the document:

- Legal Name of Entity: Innovate Solutions Inc.

- Country of Incorporation: Canada

- Entity Type: Corporation

- FATCA Status (Chapter 4): Active NFFE (Non-Financial Foreign Entity)

- Permanent Residence Address: 555 Bay Street, Toronto, ON M5G 2C2

- Country: Canada

- Mailing Address: Same as permanent residence address

- Foreign TIN: 987654321RC0001

- Reference Number: CLI-12345

- Tax Treaty Claim: Yes, under the U.S.-Canada tax treaty

- Treaty Article and Paragraph: Article VII

- Withholding Rate Claimed: 0%

- Type of Income: Services (Software Development)

- Treaty Benefit Explanation: Beneficial owner is a resident of Canada and derives business profits from services performed. The income is not attributable to a permanent establishment in the United States.

- Signatory Name: Jane Smith

- Signatory Title: Director

- Date of Signature: October 26, 2026

What this filled form sample shows:

- Identifies the entity as a Corporation in Part I, line 4.

- Specifies the Chapter 4 Status as an Active NFFE in Part I, line 5, and completes the corresponding certification in Part XXV.

- Completes Part III (Claim of Tax Treaty Benefits) to claim a reduced withholding rate under a specific U.S. tax treaty.

- Provides a clear and sufficient explanation for meeting the terms of the treaty article.

- The form is properly signed and dated by an individual with the capacity to sign for the entity.

Form specifications and details:

| Use Case: | Foreign corporation in a treaty country providing services to a U.S. payer. |

| Form Version: | Form W-8BEN-E (Rev. October 2021) |

Created: February 03, 2026 07:53 PM