Yes! You can use AI to fill out Judicial Council of California Form DE-111, Petition for Probate (Probate—Decedents Estates)

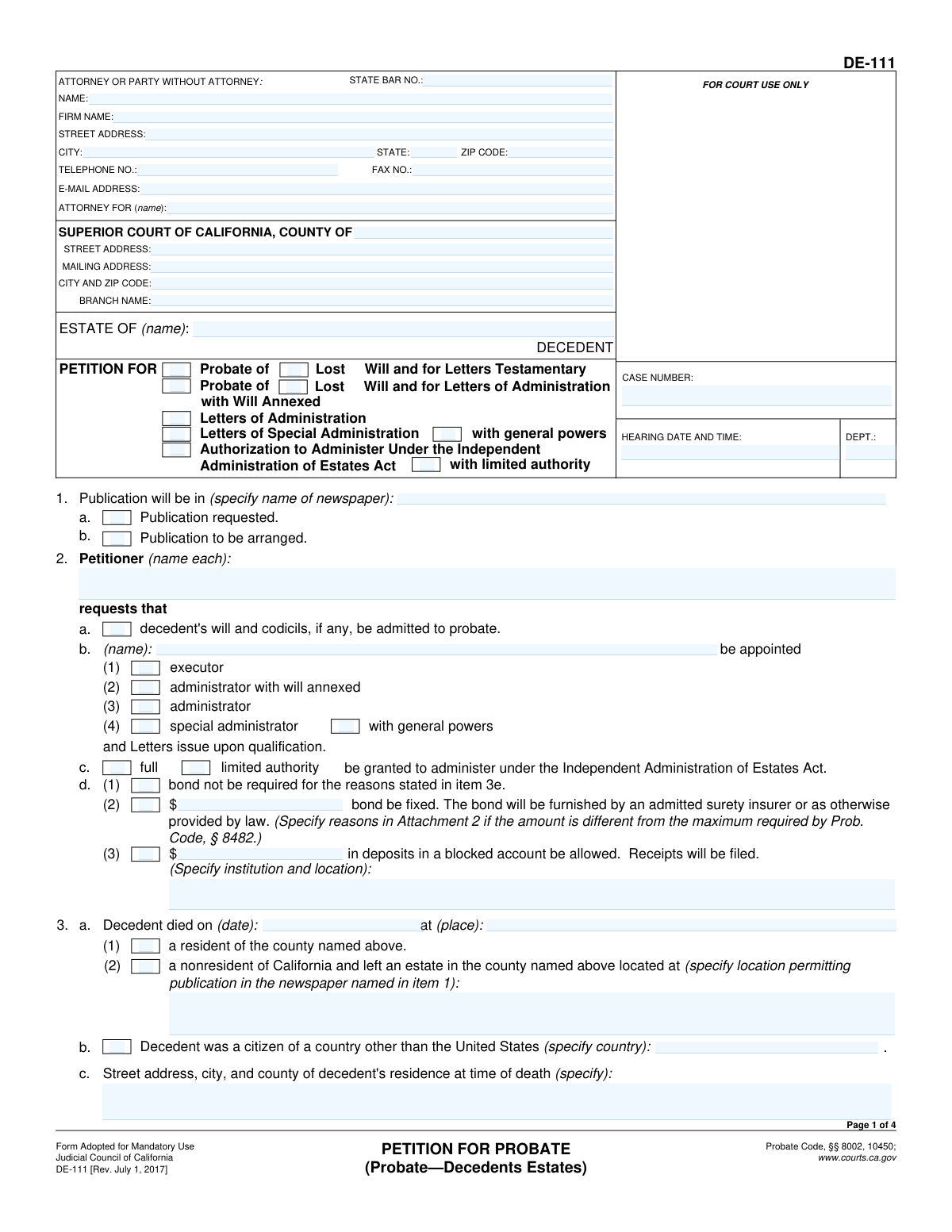

Form DE-111 is the standard California probate petition filed in Superior Court to start a formal probate proceeding for a deceased person’s estate. It tells the court key facts about the decedent (death, residence, heirs/beneficiaries), the existence and status of any will/codicils (including lost will allegations), and the estimated value of estate property. The petition also asks the court to appoint an executor/administrator (or special administrator) and to issue Letters (Testamentary/Administration/Special Administration) so the personal representative has legal authority to act. It is important because the court generally cannot appoint a personal representative or authorize estate administration without a properly completed and filed petition.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out DE-111 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Judicial Council of California Form DE-111, Petition for Probate (Probate—Decedents Estates) |

| Number of pages: | 4 |

| Filled form examples: | Form DE-111 Examples |

| Language: | English |

| Categories: | court forms, probate forms, California state forms, Judicial Council forms, estate forms, California judicial forms, California probate forms, PA state forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out DE-111 Online for Free in 2026

Are you looking to fill out a DE-111 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your DE-111 form in just 37 seconds or less.

Follow these steps to fill out your DE-111 form online using Instafill.ai:

- 1 Select the type of petition requested on DE-111 (e.g., probate of will, letters of administration, special administration, lost will) and enter the Superior Court county/branch, case caption (Estate of), and hearing information if known.

- 2 Enter petitioner and attorney/party information, then provide decedent details (date/place of death, residence, citizenship, and address at time of death) and confirm venue in the filing county.

- 3 Identify the requested personal representative (executor/administrator/special administrator), state eligibility/residency, and indicate whether the appointment is based on a will, intestacy, nomination, or priority (adding required attachments for nominations/priority explanations).

- 4 Provide will/codicil information (dates, whether self-proving, whether originals are attached, and if a will/codicil is lost include the required statement/copy and reasons rebutting the Probate Code § 6124 presumption).

- 5 Complete the estate value section by estimating personal property, real property (gross and net of encumbrances), and any annual gross income figures, then total the amounts as required by the form.

- 6 Address bond and IAEA requests: indicate whether bond is waived or should be fixed, provide reasons/waivers as attachments when required, and check whether authority under the Independent Administration of Estates Act is requested (full or limited).

- 7 List all required persons (heirs, beneficiaries, and others referenced by the form) with names/relationships/ages/addresses, attach continuation pages as needed, then sign and verify under penalty of perjury (all petitioners sign; one may verify) and generate a filing-ready PDF for court submission.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable DE-111 Form?

Speed

Complete your DE-111 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 DE-111 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form DE-111

Form DE-111 is used to ask the California Superior Court to open a probate case for a deceased person’s estate. It can request that a will be admitted to probate and that the court appoint a personal representative and issue Letters (authority to act for the estate).

A person entitled to be appointed (such as the named executor in the will, an heir, or a nominee of someone with priority) typically files this petition. If there are multiple petitioners, all petitioners must sign the petition.

DE-111 can be used to request probate of a will, Letters Testamentary, Letters of Administration (if there is no will), Letters of Administration with Will Annexed, or Letters of Special Administration (including with general powers). It can also request authorization under the Independent Administration of Estates Act (IAEA) with full or limited authority.

You must provide the decedent’s date and place of death, residence at the time of death, and whether the decedent was a resident of the county where you are filing (or a nonresident who left property in that county). The form also asks about citizenship if the decedent was a citizen of a country other than the United States.

Yes—if there is a will and/or codicils, you generally attach copies as indicated in the form (including typed copies of handwritten documents and English translations of foreign-language documents). The original will is typically lodged with the court per local filing rules, while the petition references and attaches copies as required.

Yes—the form includes options for a “Lost Will” petition. You must attach a copy of the lost will/codicil or a written statement of the testamentary words (or their substance) and explain why the presumption of revocation under Probate Code section 6124 does not apply.

If there is a will naming an executor who will serve, you request appointment of an executor. If there is no will (intestate), you request an administrator; if there is a will but no executor can or will act, you request an administrator with will annexed.

A special administrator is a temporary personal representative appointed to handle urgent estate matters before a general personal representative is appointed. If you request a special administrator, you must state the grounds and the powers requested in an attachment (as the form directs).

IAEA allows the personal representative to administer the estate with reduced court supervision. “Full authority” generally permits more actions without prior court approval (subject to notice requirements), while “limited authority” requires court approval for certain transactions; the petition asks you to request one or the other.

You must estimate the character and value of the estate, including personal property, gross fair market value of real property, encumbrances, and net value of real property. The form also asks for annual gross income from real and personal property and totals/subtotals based on the amounts you enter.

Bond may be required to protect the estate unless it is waived or not required by law. The form lists common reasons bond may be waived (for example, the will waives bond, all adult beneficiaries/heirs waive bond, or the personal representative is a corporate fiduciary or exempt government agency), and you must attach the required waivers or explanations where indicated.

A blocked account is a restricted bank account where estate funds cannot be withdrawn without a court order. If requested, you must specify the financial institution and location, and the form indicates that receipts will be filed to confirm the deposit.

In most probate cases, notice of the hearing must be published in an adjudicated newspaper. The form asks you to list the newspaper name and indicate whether publication is requested, will be arranged by the petitioner, or is to be arranged in another way (depending on local practice).

You check the boxes that match the decedent’s family situation (spouse/partner, children/issue, parents, grandparents, next of kin, etc.). Then you list names, relationships, ages, and addresses of the required persons on the next page (or on Attachment 8 if more space is needed).

You file it in the Superior Court of California in the county identified on the form (generally where the decedent lived or where property is located). You typically submit the petition, required attachments (will/codicils, nominations, bond waivers, lost-will statements, Attachment 8 heir list), and any local court forms and filing fees required by that county.

Compliance DE-111

Validation Checks by Instafill.ai

1

Court Venue Identification Completeness (County/Branch/Addresses)

Validates that the SUPERIOR COURT OF CALIFORNIA county is provided and that the branch name, street address, city, ZIP code, and mailing address fields are complete enough to identify the filing venue. This is important because probate petitions must be filed in the correct county and routed to the correct courthouse location. If missing or inconsistent, the submission should be rejected or flagged for correction because it may be filed in the wrong venue or be unprocessable by the clerk.

2

Case Number and Hearing Details Format (If Provided)

Checks that the case number (if already assigned) matches the court’s expected format and that hearing date/time and department fields are either all blank (for initial filing) or all populated with valid values. This prevents partial scheduling data that can cause miscalendaring or failed docket matching. If validation fails, the system should require correction or treat the filing as an initial petition without hearing details (per configured business rules).

3

Attorney/Party Contact Block Completeness and Formatting

Ensures the filer is identified as either an attorney or a party without attorney and that the name and address fields are present and structured (street, city, state, ZIP). Validates phone and fax numbers (if provided) are in a valid US format and that email (if provided) is syntactically valid. If invalid or incomplete, the petition may not be serviceable and the court may be unable to contact the filer; the submission should be flagged and returned for correction.

4

State Bar Number Required When Attorney Is Listed

If an attorney is named, validates that a State Bar number is present and matches a numeric pattern consistent with California bar numbers (and optionally cross-checks against a bar registry if available). This is important for attorney authentication and proper court record indexing. If missing/invalid, the system should block submission or require the filer to correct the attorney identification section.

5

Estate and Decedent Name Presence and Consistency

Validates that the 'ESTATE OF (name)' and 'DECEDENT (name)' fields are populated and consistent (e.g., the estate name should correspond to the decedent’s legal name). This prevents miscaptioned cases and indexing errors in court systems. If inconsistent or blank, the petition should be rejected or routed to manual review to avoid creating a case under the wrong party.

6

Decedent Date of Death and Place of Death Validation

Checks that the date of death is a valid date (not in the future, and not unreasonably old if system rules apply) and that the place of death is provided as a recognizable location (city/county/state or equivalent). This information is essential to establish jurisdiction and to support probate administration. If missing or invalid, the petition should be flagged because the court cannot confirm basic eligibility and venue facts.

7

Residency/Venue Logic for Decedent (Resident vs Nonresident)

Validates that exactly one residency status is selected: either the decedent was a resident of the named county or a nonresident with an estate located in the named county, and that the corresponding required details are provided. If resident is selected, the street address/city/county of residence at death must be completed; if nonresident is selected, the location of property in the county must be specified. If the logic fails (both/none selected or missing dependent fields), the submission should be rejected because venue cannot be established.

8

Citizenship Field Dependency (Non-U.S. Country Required When Indicated)

If the form indicates the decedent was a citizen of a country other than the United States, validates that a country name is provided and is not left blank. This matters for notice, consular issues, and potential international administration considerations. If the country is missing when non-U.S. citizenship is indicated, the system should require completion before acceptance.

9

Petition Type Selection (Mutually Exclusive Primary Relief Requested)

Validates that the petition selects at least one primary request (e.g., Probate of Will, Letters of Administration, Letters Testamentary, Special Administration, Lost Will options) and enforces mutual exclusivity where the form structure requires it (e.g., not selecting conflicting letter types simultaneously). This is critical because the court must know exactly what authority is being requested. If conflicting or missing, the petition should be blocked or routed for correction to prevent issuance of incorrect letters.

10

Personal Representative Appointment Section Completeness

Ensures that when appointment of a personal representative is requested, the form identifies the role (executor, administrator with will annexed, administrator, special administrator) and includes required supporting statements (e.g., named in will, nominee, successor). This prevents incomplete appointment requests that cannot be granted. If required appointment basis is not provided, the system should flag the filing and require the missing appointment justification/attachments.

11

Will/Intestacy Consistency (Will Admitted vs Intestate)

Checks logical consistency between selecting 'Decedent died intestate' and any selections indicating a will/codicil exists or is to be admitted to probate (including will dates and self-proving statements). A petition cannot simultaneously proceed as intestate while asking to admit a will unless the will is explicitly alleged lost and handled under the lost will pathway. If inconsistent, the system should require the filer to correct selections or provide the appropriate lost-will allegations and attachments.

12

Will and Codicil Date Format and Presence When Will Is Referenced

If the petition references a will and/or codicil, validates that the will date is present and in a valid date format, and that any codicil date provided is also valid. This is important for identifying the operative testamentary instrument and for resolving priority among multiple documents. If dates are missing/invalid, the petition should be flagged because the court cannot determine which instrument is being offered.

13

Lost Will Attachment Requirement and Explanation Dependency

If the petition indicates the original will/codicil has been lost, validates that Attachment 3f(3) is included with either a copy of the lost instrument or a written statement of the testamentary words/substance, plus reasons addressing the presumption under Probate Code § 6124. This is essential because lost will petitions require heightened proof and specific allegations. If the attachment or required explanation is missing, the system should block submission or mark it as legally insufficient.

14

Bond Election and Amount Validation (Including Blocked Account Deposits)

Validates that the bond section is internally consistent: either bond is waived (and a valid waiver reason is selected with required waivers attached) or bond is requested/fixed with a numeric dollar amount. If blocked account deposits are requested, validates that the deposit amount is numeric and that the institution and location are specified. If amounts are non-numeric, negative, or required supporting attachments are missing, the petition should be rejected or returned for correction because bond orders depend on accurate figures and legal basis.

15

Estate Value Arithmetic and Non-Negative Currency Checks

Checks that all monetary fields (personal property, real property gross fair market value, encumbrances, net value, subtotals, totals, and annual gross income fields) are valid currency numbers (no letters, no negative values unless explicitly allowed) and that computed totals match the stated subtotals/totals (e.g., subtotal equals sum of components; net real property equals gross minus encumbrances; total equals sum of required lines). This prevents incorrect fee calculations, bond calculations, and inaccurate court findings. If arithmetic fails, the system should flag discrepancies and require correction or auto-recalculate with user confirmation.

16

Heirship/Survivor Boxes Logical Consistency and Required Listing in Item 8

Validates that the survivor selections (spouse/partner, children/issue, parents, grandparents, next of kin, etc.) are not contradictory (e.g., selecting both 'no spouse' and 'spouse', or 'no child' and 'child') and that when the form states survivors are 'listed in item 8,' item 8 actually includes at least one corresponding person entry. This is important because notice and distribution depend on accurate heirship statements. If inconsistent or item 8 is missing required persons, the petition should be flagged for correction to avoid defective notice and potential due process issues.

17

Item 8 Person Entries Structure (Name/Relationship/Age/Address) and Age Validity

Ensures each person listed in item 8 (and any Attachment 8) includes a name, relationship to decedent, age (numeric and within a reasonable human range), and a deliverable address (not blank; includes city/state/ZIP where applicable). This is critical for statutory notice and for confirming adult waivers where claimed. If entries are incomplete or ages are invalid, the system should require correction because the court cannot rely on the list for notice and bond waiver determinations.

18

Signature, Verification, and Date Requirements (All Petitioners Sign)

Validates that the petition is signed and dated, includes the perjury declaration, and that all petitioners have signatures (or that additional petitioner signatures are present on the last attachment as indicated). If an attorney signature block is used, validates the typed/printed name accompanies the signature. If signatures/dates are missing, the submission should be rejected because an unverified petition is procedurally defective and cannot be accepted for filing.

Common Mistakes in Completing DE-111

People often skip the top caption fields (county, branch name, street/mailing address, estate name, and case number) or fill them inconsistently across pages. This happens because filers assume the clerk will “look it up” or because they copy information from another case. Missing or mismatched caption information can delay filing, cause documents to be misfiled, or require re-submission. Use the exact county/branch for the filing location, keep the “ESTATE OF (name)” and decedent name identical everywhere, and add the case number once assigned.

DE-111 contains multiple checkboxes for different relief (Probate of Will, Letters of Administration, Letters Testamentary, Special Administration, Lost Will, and IAEA authority), and filers frequently check the wrong box or check conflicting options. This usually happens when people confuse “executor” vs. “administrator,” or assume a will automatically means “letters testamentary” without confirming who is nominated and able to serve. Choosing the wrong petition type can lead to continuances, amended petitions, or issuance of the wrong letters. Confirm whether there is a valid will, whether an executor is named and willing/able to act, and whether you truly need special administration or a lost-will proceeding before checking boxes.

A common error is entering an incorrect date of death, omitting the place of death, or misunderstanding the residency question (resident of the county vs. nonresident with property in the county). This happens because filers rely on memory instead of the death certificate or do not understand that venue depends on residence or property location. Errors can create venue challenges, require amendments, or delay issuance of letters. Use the death certificate for the date/place of death and provide the full residence address at time of death; if nonresident, clearly specify the county property location that supports filing there.

People often state there is a will but forget to attach copies, omit codicils, fail to include typed copies of handwritten documents, or skip English translations for foreign-language documents. This happens because they assume the court only needs the original later or they do not realize every referenced testamentary document must be provided. Missing attachments can result in rejection, continuance, or inability to admit the will to probate. Attach copies of the will and all codicils, include typed copies of handwritten instruments, and provide certified/competent translations when required.

When the original will is missing, filers frequently check the “lost will” box but do not include a copy or a statement of the testamentary words, and they fail to explain why the presumption in Probate Code § 6124 does not apply. This happens because people think “lost” simply means “we can’t find it,” without realizing the court requires specific proof. Inadequate lost-will support can lead to denial of probate of the will and the estate proceeding as intestate. Provide the required attachment: a copy or detailed statement of the will’s contents and a clear factual explanation (with supporting declarations if available) showing the will was not revoked.

Filers often check “bond not be required” without meeting one of the listed statutory/waiver conditions, or they claim beneficiaries/heirs waived bond but do not attach the signed waivers as required (Attachments 3e(2) or 3e(3)). This happens because bond is confusing and people assume a will automatically waives bond or that verbal family agreement is enough. Incorrect bond handling can delay issuance of letters or result in the court ordering bond anyway. Only request a bond waiver if the will waives it or all required adults have signed written waivers, and attach the waivers or explain the bond amount deviation in the specified attachment.

A frequent mistake is mixing up gross fair market value and net value of real property, forgetting to subtract encumbrances, leaving subtotals blank, or entering inconsistent totals across the personal property/real property sections. This happens because people use informal estimates, confuse equity with value, or do not follow the add/subtract instructions on the form. Incorrect valuations can affect bond amounts, publication/notice expectations, and court review, and may require amended petitions. Use reasonable date-of-death estimates, list encumbrances separately, complete each subtotal line, and double-check that totals equal the sum of the referenced line items.

People often leave the publication item blank, list a newspaper that is not approved for probate notices in the county, or check both “Publication requested” and “Publication to be arranged.” This happens because filers assume any local paper works or do not realize publication is a required procedural step tied to the hearing. Errors can cause continuances if notice is defective or not timely. Confirm the court-approved adjudicated newspaper for the county, select only one publication option, and ensure publication is arranged early enough to meet statutory timing.

The survivor section requires specific combinations (e.g., check (1) or (2) and (3) or (4), etc.), and filers frequently check contradictory boxes (e.g., “no spouse” and “spouse”) or fail to complete the required set. This happens because the layout is dense and people skim, or they misunderstand terms like “issue,” “predeceased,” and “registered domestic partner.” Inconsistent heirship statements can trigger court questions, require amendments, and delay appointment. Carefully follow the “check items …” instructions, use the legal definitions, and verify family status with records (marriage/divorce, domestic partnership, birth/adoption) before selecting boxes.

Item 8 requires listing all persons mentioned in the will/codicils, all heirs identified by the earlier checkboxes, and certain trust beneficiaries when the trustee and personal representative are the same person; filers often list only “closest” relatives or omit ages/addresses. This happens because people do not know all relatives, assume unknowns can be ignored, or do not realize the court expects “reasonably ascertainable” information. Missing interested persons can lead to defective notice, objections, and continuances. List everyone required, include complete mailing addresses and ages (or best estimates), and if information is unknown, document diligent efforts and use an attachment to explain what is not reasonably ascertainable.

Filers commonly forget that all petitioners must sign, omit the verification language/date, or sign in the wrong place (attorney signature vs. petitioner signature). This happens because the form spans multiple pages and the signature instructions are easy to miss. Missing or improper signatures can cause rejection or require re-filing, delaying the hearing and issuance of letters. Ensure every petitioner signs where required, one petitioner (at minimum) properly verifies under penalty of perjury with a date and printed name, and include additional petitioner signatures after the last attachment if needed.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out DE-111 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills judicial-council-of-california-form-de-111-petitio-1 forms, ensuring each field is accurate.